The secret route of Western countries’ money and assets towards the Indian Stock Exchanges and Indian Central Bank

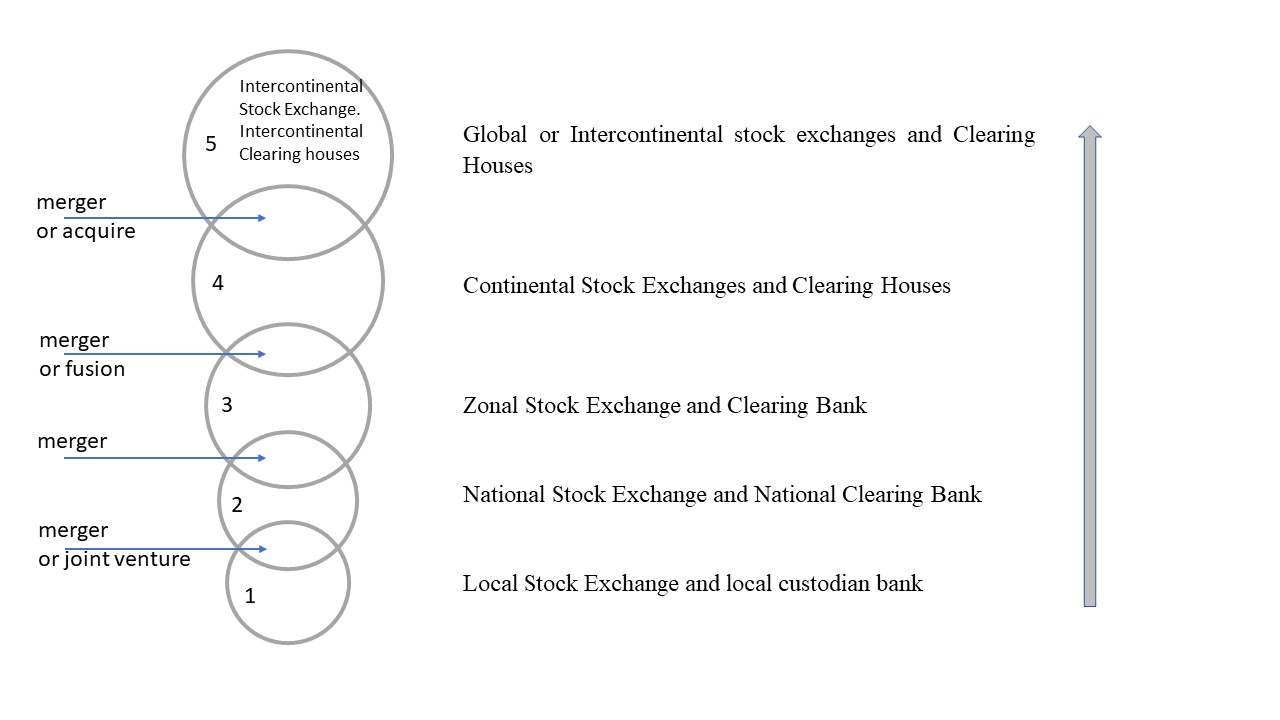

- The Clearing Banks and the Stock Exchanges have different dimensions and different financial force and play a bigger and more important role, depending on the dimension of the geographical area where the assets come from including

The bigger the area, the more important the Clearing Banks and Stock Exchanges are.

Stock Exchanges and Clearing divisions attached to these Stock Exchanges:

a – locals – that cover a particular area from a country

b – the ones that can cover a whole country

c – regional, that trade securities, equities from more countries

d – continental clearing banks and stock exchanges that have access to all the assets from one continent

e – intercontinental and global clearing houses trading treasuries, equities and O.T.C. products all across the globe.

As a scheme, stock exchanges and clearing banks that are attached to these stock exchanges can be drawn as follows:

These Stock Exchanges and Clearing Houses and founded, financed and coordinated in secret by Iran and its ally, India.

If Iran had purchased all the stock exchanges in the world, this would have been considered a monopoly and would have been unmasked very easily. So, they would not manage to keep it secret, but Tehran manages to control these stock markets without owning them 100%.

This way, they succeeded to remain invisible during the centuries, hiding behind the other (white men) shareholders and co-owners. The main idea in the management of these Stock Exchange and Clearing Banks attached to these Stock Exchanges is that they are interconnected between each other, two by two.

So, they become a chain network of Clearing Banks institutions extended all over the planet, in order to become a global Clearing Bank network.

The Stock Exchanges and the Clearing Houses are founded as companies with share capital.

The Interconnection is realized through their shareholders.

The shareholders of a Stock Exchange or Clearing Bank – attached to the Stock Exchange – are represented by members of the managing board. In the case of the Clearing Bank, the managing board members are, in fact, the founding members of the hedge fund = asset manager that manages the clearing bank. The asset manager is a different name for the Clearing Bank or the Clearing House. The asset manager (Clearing Bank) is a hedge fund (closed fund, joint stock company = anonymous company).

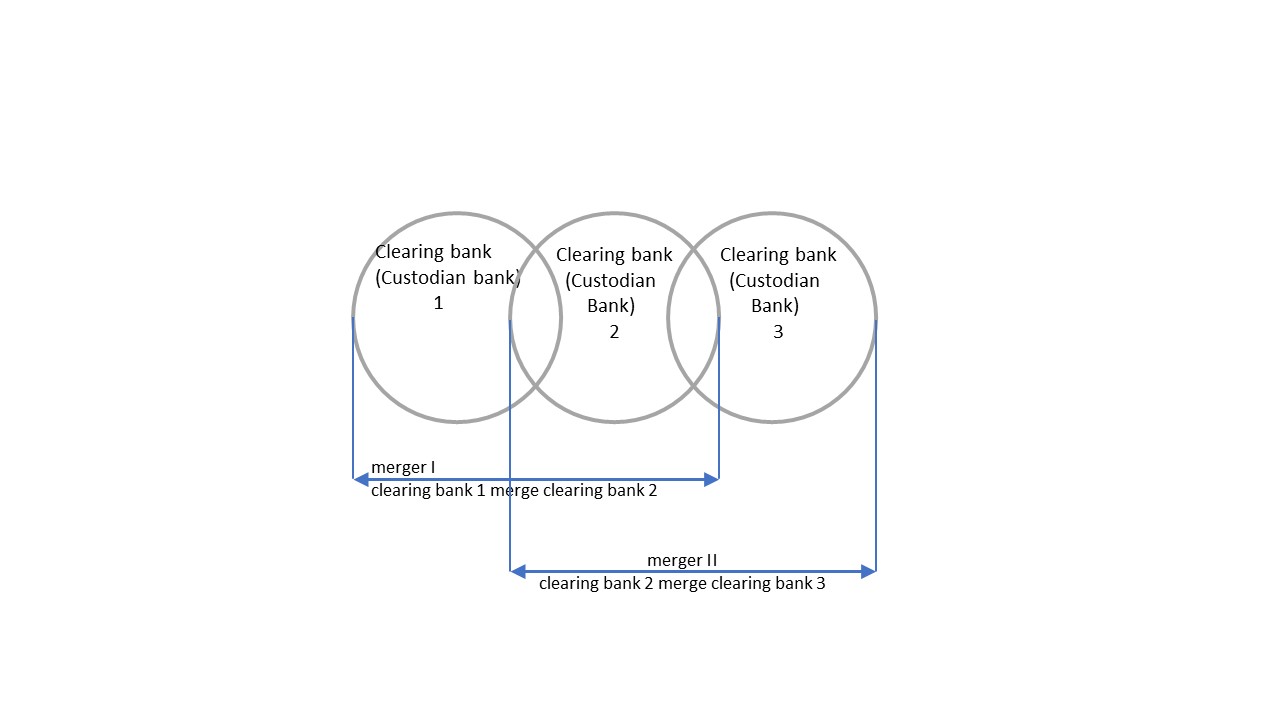

The interconnection between two Clearing Banks is done by merger of the two Clearing Banks. This means they put together all the assets. After the merge, the number of shares is recalculated according to the cumulated assets of the two clearing banks and redistributed to the total number of shareholders.

Clearing houses are some type of Clearing Banks that make clearing and cash settlements for OTC super-complex, super-sophisticated contracts (super-derivatives).

The function of the two Clearing Banks does not change. They keep on working almost independently one of each other.

An almost similar effect can be obtained when the two hedge funds administrators of the two Clearing Banks create a joint venture.

Following, we show the way two Custodian Banks (it is the same with Clearing Banks) merger (fusion). The same way is used for the Stock Exchanges.

Example of fusion

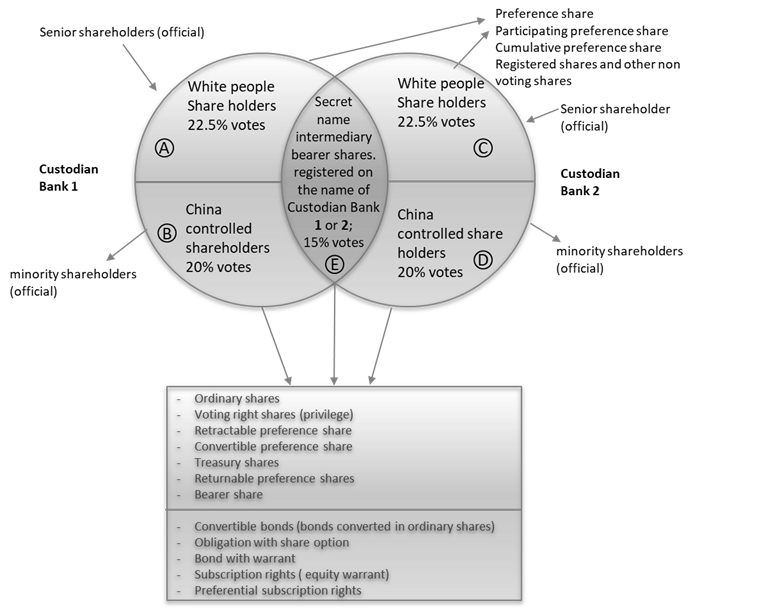

Let’s pretend that after the merger, the shares owned before the fusion will be distributed to the 5 Shareholders, as it follows:

Custodian Bank 1:

- A bank, white men shareholders 22,5% voting shares; voting power = voting interest = 22,5%

Economic interest = 30% (preference shares + voting shares)

- B bank – 20% voting shares; voting power = 20%.

This bank is known by the regulators, but due to the minority shareholding, it is not important for them. Bank B or the Group of Banks B is indirectly owned by the secret Iranian Financial Trust.

Custodian Bank 2:

- Bank C, white men shareholders own 22,5% voting shares; voting power = voting interest = 22,5%

Economic interest may be, for example, 30% (preference shares = non-voting shares + voting shares)

- Bank D, 20% voting shares (voting power = 20%). Also this bank is indirectly owned by the secret Iranian Financial Trust.

Due to its minority shareholding, it does not attract the attention of the Government Financial Regulators (for example, Monopolies and Merge Commission).

The Intermediary Bank: E

- Bank E (or banks) voting shares = 15% (voting power = 15%)

Also this entity is owned by the secret Iranian Financial Trust. It is not observed by the Government Financial Regulators because it can be dissimulated in several companies. Usually can be used more then 10 companies, each owning around 1.5% of the voting shares. For the voting process they use Voting Trust Certificate. In many cases this Voting Trust Certificate, are illegally modified or falsified.

The banks B, D and E own together 55% of the voting shares (20% + 20% + 15%)

These banks have a secret agreement to vote together in the shareholder meeting and to make the appointment of the managing board.

These banks are owned indirectly, in secret, by Goldman Sachs and City Group and controlled directly from Tehran and New Delhi.

The way the Clearing Banks (Clearing Houses) fusion 2 by 2 can be observed in the following picture:

Officially, there is no controlling shareholder.

In reality, Controlling Shareholders are: B + E + D = 55% voting power.

After this merger, the Custodian Bank (Clearing Bank) 2 can merge in the same way with another Custodian Bank: Custodian Bank 3 (see bellow picture):

As one can observe, by the merger of the Clearing Banks 2 by 2, a Clearing Banks’ chain network can be created that can lead from a local Clearing Bank to the top of the Western Countries Clearing Houses: Intercontinental Exchange (ICE) – Clearing Houses.

ICE Clearing Houses are:

ICE Clear USA

ICE Clear Europe

ICE Clear Singapore

ICE Clear Credit

ICE Clear Netherlands

ICE Clear NGX

The Clearing Banks and Stock Exchange network is represented in drawings: 3, 4, 5, 6, 7, 8, 9 – Chapter III..

E share holders (secret name) has the following particularities:

1. It is a hedge fund involved in unregulated OTC market transactions .

2. It is a closed corporation

It is a company whose shares are owned by a small group and are not for sale to the public.

The closed corporation can be managed by a managing board based upon its own rules and they can buy back their own shares after a certain time.

3. The hedge fund (closed corporation) is a joint stock company (anonymous society). The owners of this fund remain anonymous for Monopolies and Merger Commission, and for the rest of the shareholders.

4. In order to vote in the General Assembly of shareholders, the E shareholder issues a “Voting Trust Certificate”. This is an empowering given by the secret shares owner to another shareholder or to an institution, in order to exercise the right to vote in his absence.

5. The Hedge Funds (closed corporations) are off balance sheet companies with the location in offshores/ free zones (in the islands), in order not to be controlled by the Government Regulators.

6. The Hedge Funds have the particularity of being unregulated financial institutions (on OTC unregulated market transactions).

Very important – The way the E shareholder takes the possession of the right to vote shares

The shares owned by the E shareholder by the new created Clearing Bank (by the merger) are bearer type shares.

The bearer shares are specially printed in order to avoid falsification.

The names of the bearer shareholders are not registered (cannot be traced).

The right to vote goes to the one who hold the shares. The shares the E shareholder owns to the new merger created Clearing Bank are not registered on his name, but on the Custodian Bank’s name (street name) where the E shareholder keeps in custody his shares, treasuries and OTC products accounts.

These OTC products can be option contracts having underling assets as: stocks and bonds, convertible bonds, equity warrants, obligations with share options, bond with warrant, preferential subscription rights.

The E shareholder can take the possession of the voting shares using the following assets:

a. Convertible bonds – bonds that can be transformed into ordinary shares at the owner’s request.

Officially, this happens when the interest of the bonds is less than the dividends of the shares or when the stock market value of the shares rises.

In reality, the E shareholders converts his convertible bonds in ordinary shares in the eve of the general assembly of the Clearing Bank elections, just to increase the amount of voting shares. (1 ordinary share = 1 vote)

b. Obligation with share option – this is a combination between a usual bond that has extra rights. These rights allow the owner to buy later, shares at the obligation issuer company, at a previously assigned price.

This way, also the E shareholder hedge fund can take the possession of ordinary shares or voting right shares (privileged shares).

Ordinary shares – one share = one vote

Voting right share – one share = two votes (or more)

c. Equity warrant (= subscription rights) – are sold on the market as part of an obligation

It is an asset that gives the owner the right to buy shares or convertible bonds at the “equity warrant” issuing company at a certain price and at a certain time.

In reality, the E shareholder trades the equity warrant to buy ordinary shares (with right to vote) and convertible bonds that can be converted in ordinary shares (voting shares).

d. Preferential subscription rights

If the shareholders exercise their preferential subscription rights, they have the privilege to subscribe for new shares purchase. These new shares are issued due to the increase of the registered capital (share capital) and have a special smaller price than the issuing price or the market price.

e. Bond with warrant – is an obligation with removable certificate attached, that gives the owner the right to buy ordinary shares or convertible bonds from the issuing company. The later are voting shares or can become voting shares (ordinary shares).

All these assets are traded on the OTC market.

Using option trades, the Market Maker Broker Dealer (who is involved in proprietary trading) can lead the price of the bonds to a certain fake market value. This leads further to a decrease of the interest rate of the Clearing Bank issued bonds. This way, they make it look like the investors convert the Clearing Bank bonds into the same Clearing Bank shares, due to the shares’ dividends is higher than the bond interest rate.

This is the illusion they want to create for the other market participants and for the government regulating agencies. But, in reality, the companies led by Iran and India desire to secretly get in possession of the voting shares of the Clearing Bank (by converting the bonds), simulating they want to make profit. Something that looks natural.

The types of shares designed by the China Tibet Financial engineers

Some shares have financial profit and are attractive to the Western white people. Others are voting shares, but with low dividend and are hunted by the Chinese Financial Trust.

Very important!

In order to hold a very strict record of the voting shares, the non-voting shares, as well as of many types of bonds that can be converted in voting shares, the securities account of the E intermediary is kept right in that Custodian Bank (Clearing Bank) that merger.

This way, the Secret Trust is able to know the number of voting shares needed to accumulate in order to reach 55% voting shares. By the merging of 2 Clearing Banks, a secret voting power majority in the new created Clearing Bank is realized. This will allow it to appoint a majority of members in the managing board.

The Government Financial regulators are very vigilant to identify the monopoly created by Stock Exchanges and Clearing Banks. In order to avoid the identification, by the Government Regulatory Agencies, of all the shareholders and the number of shares they own, the shares are not hold by the real owners, but on some intermediaries (Shadow Banks) that hand over the shares to be registered on another intermediary name: Custodian Bank.

So, the shareholding structure must be impossible to determine at the time when the General Assembly of shareholders chooses members from the managing board.

For this purpose, many types of shares have been invented, each of them with different characteristics.

There are shares that combine features of more share types. For instance, “cumulative preference share” can be, in the same time, “participating preference share”. If a mix of this kind of shares is created and belongs to more shareholders, then their right to vote is very difficult to identify.

The fact that the shares, the bonds and the other financial instruments (warrant bonds etc) connected to shares, held by the E intermediary, are not recorded in the name of the E company, but in the name of the Custodian Bank (the other intermediary) – where E company holds his accounts – manages to efficiently cover the identity of the real E company’s owners.

The confusion is fuelled by the speed of the shares’ circulation on the Stock Exchange and by moving the shares from one account to another.

They are transferred from the bonds and warrants account into the shares account, by conversion.

Using this big amount of tricks, the Iranians appoint the majority of members in the managing boards of all the Stock Exchanges and their Clearing Divisions. These members are Indian or white people from LGBT minority. LGBT minority is financed, managed, protected (and also blackmailed) in secret by Iran, in all the countries.

Some Stock Exchanges and Clearing Banks attached to the exchanges are:

Paris Bourse

Marché à Terme International de France

Marché des Options Négociables de Paris

Berlin Börse

Frankfurt Börse

Deutsche Börse

London Stock Exchange; London Traded Options Market

Euronext – Liffe

Milan Stock Exchange

Borsa Italiana

Cassa de Compensazione e Garanzia

Mercato dei Titoli di Stato

Brussel Exchange

Amsterdam Exchange

Lisbone Exchange

Zurich Börse

Tokyo Stock Exchange

New York Stock Exchange

Chicago Mercantile Exchange Group

Philadelphia Stock Exchange

Boston Options Exchange

Nasdaq Amex Market Group

Intercontinental Exchange – it is in the top of white people Western countries clearing banks:

Depository Trust & Clearing Corporation

Depository Trust Company

Global Trade Repository

DTCC Data Repository

DTCC Deriv/ Serv LLC

Derivative Repository PLC

Fixed Income Clearing Corporation

National Securities Clearing Corporation

Other Stock Exchanges, part of the evil Clearing Banks chain:

Indian Stock Exchanges

Indian Clearing Banks

Singapore Stock Exchange

Hong Kong Stock Exchange

Hong Kong Custodian Banks (for Qualified Foreign Institutional Investor)

Types of shares:

Ordinary shares (common stock)

The owner of the ordinary share has one vote for each ordinary share.

The law allows the company with share capital to set its own way of distributing the dividends.

So, basically, one can notice the Clearing Banks do not usually pay dividends for the ordinary shares. The dividends for the ordinary shares are paid after the dividends for the preference shares have been paid.

Voting right shares (privileged) – these are a different type of ordinary shares that provide the owner with two or more rights to vote (one share = two votes; one share = three votes) for each voting right share.

Preference shares – these are shares that provide the owner with certain advantages when he cases in the dividends, but has no right to vote in the general assembly of shareholders (one share = zero votes).

These preference shares have a priority dividend that is paid before the ordinary shares dividends.

For instance, one preference share brings a fixed income of 7% to 10% (per year) from the nominal value of the share to the owner. If the profit of the issuing corporation is lower for one, two or three years, then only the preference shares will receive the dividends. In the years when a higher profit is recorded, the ordinary share will receive dividends as well (if there is enough profit)

Retractable preference share (re-purchasable preference share)

The issuer of the shares can state a repurchase clause for the shares, with a high dividend rate. If the issuing company considers a drop in the bond market yields (interest rates) followed by the drop in the dividend offered in the general market, then it appears the opportunity to attract capital at a lower dividend rate. (this is the official explanation)

For this, the corporation uses the repurchase clause, in order to withdraw these shares at a certain moment, at a certain price.

In reality, the retractable preference shares are non-voting shares that can be re-purchased by the issuing corporation after some years and turned into treasury shares and then, after a month, sold back in the market to private Iranian investors, as ordinary share (voting share).

Basically, this is a trick to transform the non-voting shares into voting shares and to make them available to the Tehran coordinated intermediaries.

Cumulative preference shares

If during one year the Clearing Bank that issues cumulative preference shares makes no profit, then the cumulative preference shareholders receive no dividends. The annual percentage dividend is accumulated during the years with losses and after the first year the corporation makes profit, the dividends will be paid with priority (comparing with ordinary shares).

If the preference shares owned by the Western white people investors at the Clearing Banks (Stock Exchanges) would be non-cumulative preference share and during one year the Clearing Bank does not make profit, then the dividends corresponding to that year would be permanently lost. For instance, considering cumulative preference share give a fix income of 9% per year and during 3 years the Clearing Bank (Stock Exchange) makes zero profit, but in the 4th year it makes enough profit, then the corporation will pay 36% (9% x 4 years) from the nominal value of the shares corresponding to the 4 years.

This way, the Western white people shareholders are tempted to hold the cumulative preference shares in their portfolio also for the 4th year (the year the general assembly of the shareholders votes the managing board members). They have not the right to vote, but it insures them the recovery of the dividends during the 3 years without profit.

For the supreme leader in Tehran, the purpose is to avoid the majority of the voting shares of the white people (occidental people) at the time when the general assembly of shareholders votes the managing board members of the Stock Exchange (Clearing Bank).

For the financial regulators, it seams the votes are divided to many shareholders and apparently no one holds the control over the members of the managing board.

The majority of the votes will be in the hands of the private companies, coordinated by Iran, that will appoint secret agents as members in the managing board. These agents can be Indian or LGBT white people that are financed and blackmailed by China. The later are also part of the Masonry.

The Masonry (the fraternities) was created, financed and coordinated by China from old times.

The Clearing Bank (Stock Exchange) profit is artificially balanced every year by the Market Maker Broker Dealer and the Asset Manager of the Clearing Bank. This Asset Manager is counter party (buyer and seller) in all the trades including the OTC ones. This way, they artificially balanced all the assets’ prices and make zero profit when they need it.

Convertible preference shares

These are shares that allow the preference shares owners (non-voting shares) to convert them into ordinary shares (voting shares).

If the conversion rate is 2:1, then each convertible preference share (zero votes shares) is converted into 2 ordinary shares (equivalent of 2 votes).

The convertible preference shares that are in the private companies’ (that belong to the Tibet China Financial Trust) possession are changed into ordinary shares with the right to vote in order to enhance the voting power during the voting time in the general assembly of shareholders.

Treasury stocks – these are shares that are sold and then repurchased by the issuing company. The buy-back is done on the stock exchange or using retractable preference shares.

For these shares, no dividends are paid and have no right to vote during the time they are in the issuer’s treasury. The official purpose of the repurchase (the withdraw from the market) is that the paid dividend is very high compared to the dividends or the bonds’ interest rate in the market.

In reality, these retractable preference shares (non-voting shares) are repurchased by the issuer only to sell them back in the market, after one month as voting right share (privileged). One voting right share = 2 votes.

This is another trick used to change the non-voting shares into voting shares. These voting shares are sold to the banks of the Chinese Secret Financial Trust.

Participating preference shares – The owners of these shares receive the pre-set dividend rate plus an extra dividend, according to the realized profit.

These shares are kept in the American-European-British-Japanese shareholders’ portfolio because they have an attractive profit (but don’t have the right to vote).

These shares can be also bearer shares (printed, in a material form).

Restricted shares – The investors have the right to receive the dividends, but no full right to vote.

Registered share – This is a share linked to the name of the shareholder and it is written into the Trade Register.

These shares are owned by white people shareholders whose names (the beneficial name) are known by the Government Financial Regulators.

Bearer share – The owner is the holder of the shares. This owner is kept secret because the shares are not connected to the name of the owner.

The bearer shares are held by an intermediary – the shadow bank that endorses the shares on behalf of another intermediary – a custodian bank. In order to vote in the shareholders meeting, the intermediary can use a voting trust certificate. This is an empowering given by the secret shares owners to an institution in order to exercise the right to vote in his absence.

The custodian bank (clearing bank) does also the register operations. It transfers the shares on the account of the new owner, following the Exchange trading session. This way, the dividends and coupons (in the case of the bonds) are cashed-in by the owner. The same happens to the right to vote – is assigned to the new owner.

The bearer shares are registered in the name of the custodian bank (the street name) for the following purposes:

a. The identity of the new owner not to be revealed.

b. The fact that the real owners hold the majority (the monopoly) of the voting shares at the world’s clearing banks, must not be revealed.

The voting shares owned by the Secret Financial Trust from China is masked by the Custodian Banks (where the private shareholders keep their financial assets accounts) by a combination of more types of bearer voting shares (as described above). These bearer (voting) shares pass from one account to another with a high frequency, as a result of a very big number of artificially created trades, with no real economic purpose.

The bearer shares are specially printed to avoid falsification.

All these traps from the regulations and statutes are especially invented by Tehran Financial Sect and allow the preference shares (the non-voting shares) to gather mostly into the white people portfolio (Western people), and the ordinary shares (one share=one vote), the voting right shares (one share = two votes) and the convertible preference share (for conversion rate 2:1 – one convertible preference share = two ordinary shares = two votes) to concentrate in the hands of the Tibet China Secret Financial Trust.

The Clearing Banks and the Clearing Houses of the world are controlled by several very big investment banks that are organized, at their turn, in financial holdings (Financial Holding Company – FHC).

These financial holdings that together create the secret Tibetan Financial Trust are:

- Goldman Sachs

- Citigroup

- Bank of America

- J.P. Morgan

- Morgan Stanley

- Bear Stern

- Wells Fargo

- Merril Lynch

- Deutsche Bank

Each of these 9 financial holdings are made, at their turn, of:

- Commercial Bank – regulated companies

- Investment Bank – regulated and unregulated

- Broker – regulated

- Broker dealer – regulated

- Market maker broker dealer – unregulated and regulated

- Money market mutual Fund (shadow bank, unregulated)

- Asset manager (clearing house – hedge fund) – unregulated and regulated

- Hedge Fund (shadow bank) – unregulated

- Traders (OTC products dealer – shadow banks) – unregulated

- Dealers (shadow banks) – regulated and unregulated companies

- Insurance (re-insurance) companies

The regulated banks (Commercial Banks) from these holdings have access to the Federal Reserve Funds and they transfer them, in secret, to Unregulated Shadow Banks from the same financial holdings.

All these 9 investment banks are also secret shareholders (members) of the 12 Federal Reserve Banks.

The Federal Reserve Banks are private institutions. They are a special type of Company with share capital. The share capital is subscribed by the 9 banks mentioned earlier that are also called members’ bank.

Goldman Sachs completely controls the other 8 banks mentioned earlier. Goldman Sachs is secretly controlled from Lasa or Beijing.

Citigroup is technically managed from New Delhi (the technical details of OTC products) and from a hierarchic standpoint is run from China (Tehran and India subordinates to China).

The same 9 banks receive funds by new money emission from the Federal Reserve Banks (where they are shareholders) by the following means:

- Open market operations (money market mutual funds; example: PIMCO)

- Window discount (overnight loans backed by T-bills) – only commercial banks have access

- Bills of exchange (draft, and other commercial papers), discounting (only commercial banks have access)

- Lombard credit – revolving type of credit (by investment banks)

- Quantitative easing (investment banks). Can be discount of financial bills of exchange.

- Repurchase agreement and others

This way, the local, national, regional, continental and the global (intercontinental) clearing banks are interconnected.

2. The advantages of the members of the Stock Exchange and the members of the Clearing Banks

The Stock Exchange is a private institution that is self-regulated and self-governed.

The Stock Exchange has the right to establish its own way of function and management by elaborating its own statute and regulations.

The statute or the rule act of the Stock Exchange is adopted by the Stock Exchange members (the Stock Exchange shareholders).

So, the Stock Exchange and the Clearing Bank shareholders (members) execute the management, the internal organisation of the stock market and its principles of functioning.

The stock market and clearing house members decide:

- the way the financial titles transactions are done

- the trading systems that are used

- only the member has password access to the trading systems

- the types of operations executed in the stock exchange

- the way the stock markets receive and execute orders

- the contract execution done through the stock exchange

- the way the information is distributed inside the stock exchange

- the way the transactions are reported

- the way the transactions are cleared and cash settled

The stock exchange and clearing bank members are allowed to be involved in proprietary trading. They are counterpart in transactions.

Also the members of the stock exchange and clearing banks (and clearing house for derivative products) have supplied the stock exchanges with electronic equipment and particular software that are specially configurated to be able to secretly allow the access of the market makers broker dealers to the traditional Stock Exchanges outright transactions, as well as to the regulated derivative products stock markets, and the O.T.C. super sophisticated transaction platforms (that are not allowed at regulated markets). So, the unregulated O.T.C. products trading systems are attached to the regulated Stock Exchange trading system.

The electronic equipment has certain operational and security requirements.

The trading platforms can be commuted (connected) in secret from the usual regulated markets to the regulated markets for derivative products (futures, options) and on the unregulated markets over the counter (OTC) products. This connection can be done only by the members of those exchanges and clearing banks because they are the only ones with the privilege to have the keyword (password) to access the necessary systems.

Nasdaq exchange that has a fully electronical O.T.C. trading system can be connected to the regulated derivative market and has the capacity to receive information and trade secretly with many more clearing banks.

Through their complex system and through – “Instinet” – Electronic Communication Network (ECN), Nasdaq takes over the futures and options regulated contracts from the regulated markets, gets them structured and transfers them to the O.T.C. (bilateral cleared|) markets by using Intercontinental Exchange or Global Trade Repository (G.T.R.); DTCC deriv/ serv LLC; DTCC Institutional Traded Processing (ITP). Intercontinental Exchange (ICE) and GTR (DTCC) are, in reality, made by some Banking institutions (or complementary), but they have different names.

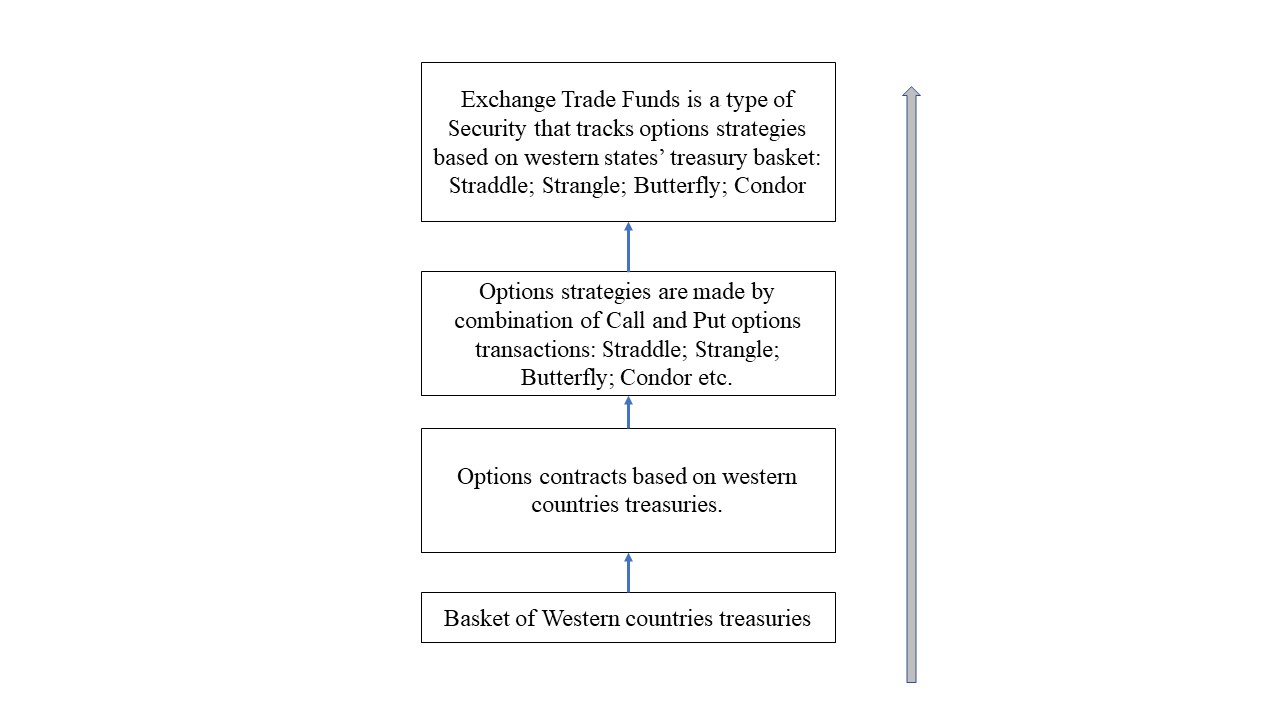

3. How treasuries-based Exchange Traded Funds (ETFs) are made

a. The members that are brokers, broker dealers, Market Maker broker dealers (it is a hierarchy) have the role to gather the Western states treasuries from the local Stock Exchange (and Custodian Banks), National Stock Exchange and Clearing Banks, Continental Stock Exchanges (and clearing houses) and Intercontinental (Global) regulated Stock Exchanges and Clearing houses.

b. All these members use these treasuries baskets as underlying asset for the futures and options contracts at regulated derivative contracts Stock Exchanges.

c. During this third phase, the stock exchanges and clearing banks, for regulated derivative products Members, deliver, in secret, these option contracts (en gros) to the unregulated trading systems (shadow bank markets). These systems execute trades on the over-the-counter markets. These trades are bilateral cleared. Nobody else knows the details of the trades.

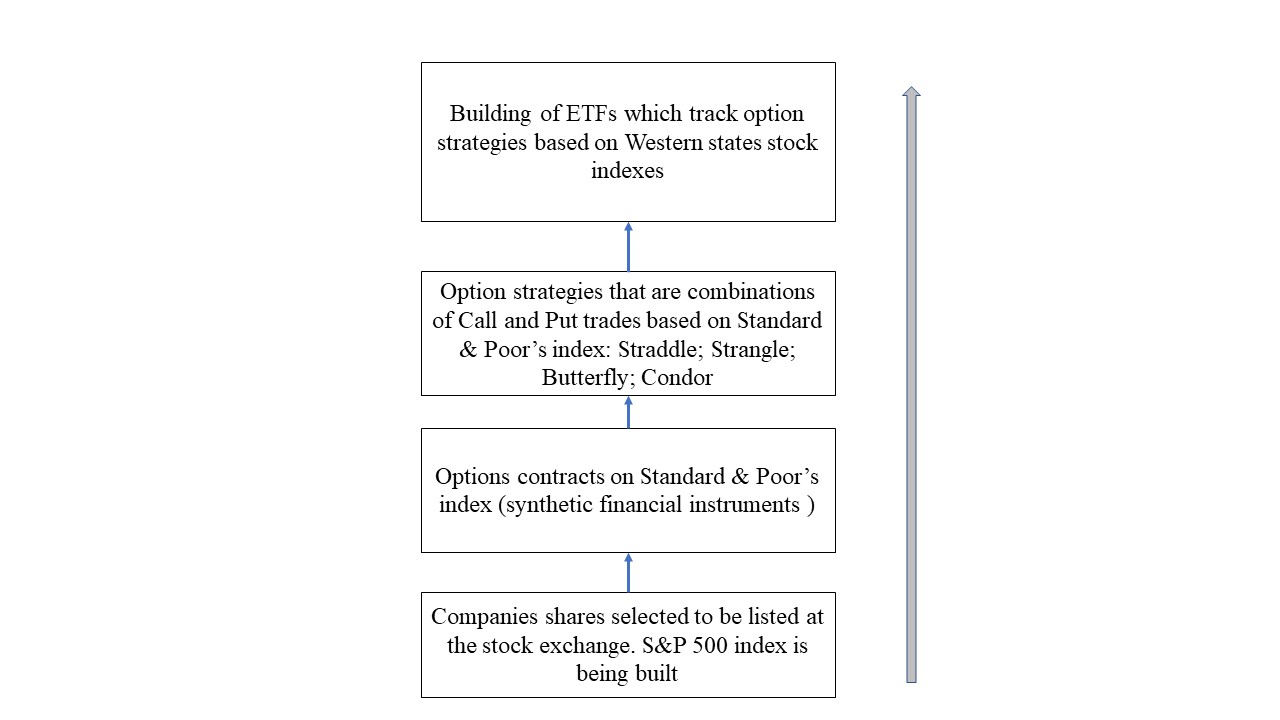

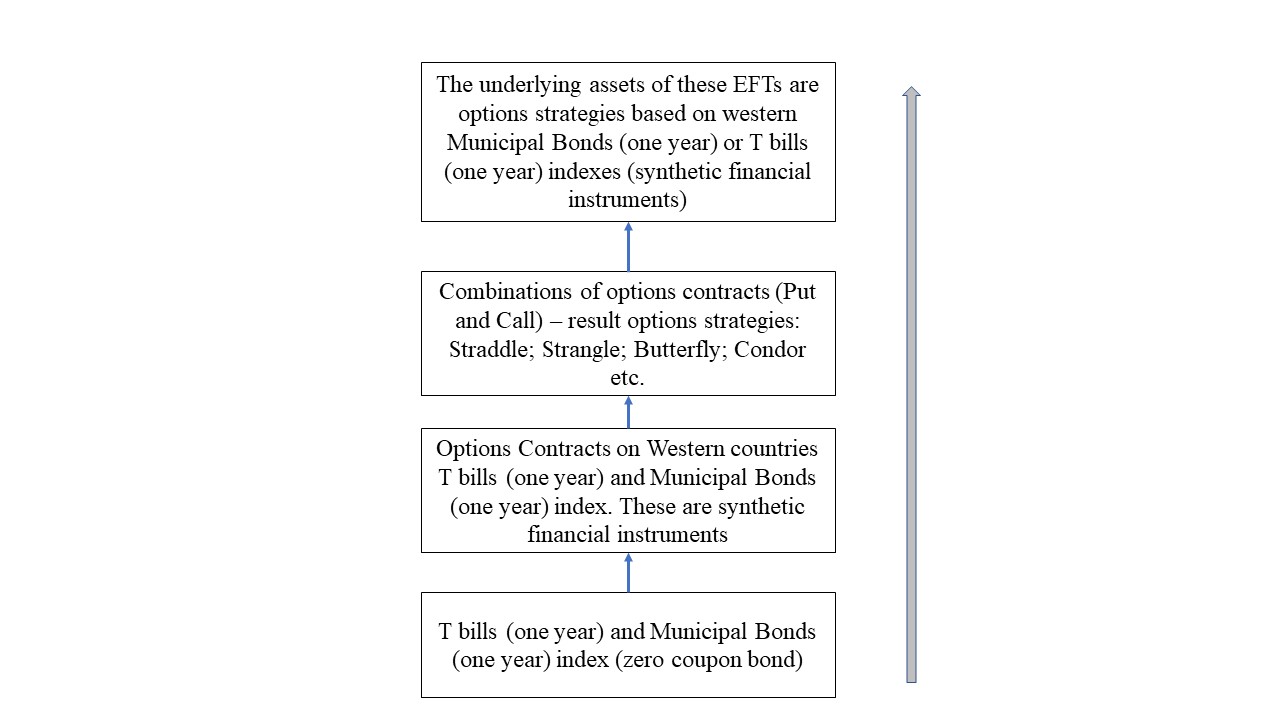

Here, the options contracts are combined in certain ways that lead to the so-called options strategies: Straddle; Strangle; Butterfly; Condor.

Also, here the guaranteed deposits are made by Market Maker Broker Dealer and Asset Manager (legal requirements). These guarantee (collateral) deposits are calculated using the sensitivity coefficient method: Delta, Gamma, Vega, Theta, Rho.

d. In this last phase, Exchange Trade Funds (ETFs) which use treasury options strategies as underling assets are built.

These ETFs have the market price very hard to be evaluated at the expiry of the options contracts.

The building stages of the ETFs based on the Occidental countries’ treasury baskets are presented in the next figure:

All the options strategies contracts on which ETFs are constructed are traded and cleared (by the actual transfer of the treasuries, or equivalent value in money) by secret CROSS transactions. The illegal CROSS transactions are executed out of the stock exchange (bilaterally) and remains invisible because these transactions are not reported (illegal) to the Stock Exchanges.

4. How the exchange traded funds built on underlying Occidental Stock Indexes and Occidental Treasury Indexes are made

a. For instance, Standard & Poor’s company has founded a mutual fund that has a similar portfolio with the S&P 500 Index portfolio.

The mutual fund unit, that has the same structure with the index portfolio, is traded on the market.

S&P index is used as support for the options contracts. The index options are contracts that have a stock index as support base. These are synthetic products (artificially created).

All the options contracts on stock market index are cleared and settled by clearing houses and the cash settlements have the same results that would be obtained by delivering of all the stocks contained by the index (but following the percentage of every company the Index is made of).

At the expiry date, the stock market index contract is offset only by paying a certain amount of money without possibility to receive the equities the index is made of.

For the stock market indexes options contracts, the brokers, the traders and asset managers have to guarantee these contracts with collateral deposits.

These collateral deposits can be affected by the sensitivity coefficients: Delta, Gamma, Vega, Theta, Rho.

Example 1:

The warranty deposit of the stock market member that sells 20.000 call contracts on TOPIX at 1860 with a premium of 40 is calculated as follows:

(P + 0,2 TOPIX exerc) x M x N = (40 + 0,2 x 1860) x 10.000 x 20.000 = 82,4 billion Yen (approx. 750 mil USD)

P = the exercise premium (in index points number = 40)

Topix exerc = the exercise value of a Topix index option = 1860

M = 10.000 Yen (Japan market multiplicator)

N = the number of contracts = approx. 20.000 contracts – are done in CROSS transactions not operated through the Stock Exchange (during the next 35 seconds after trading program is closed). This remains unreported to the Stock Exchange.

This Stock Exchange software is specially conceived, so it does not allow the report of the trade after the closing of trading hours.

Example 2: the purchase of a call option on Topix index: if a trader bets on Topix index rising, he can win an amount calculated as follows:

S = (Topix – Topix exerc – p) x N x M

Topix = the current value of topix index = 2000

Topix exerc = the exercise value of the index option = 1860

N = the number of contracts = 20.000 (unreported CROSS transactions)

M = Japan market multiplicator = 10.000

P = the option premium expressed in Index points = 40

S = (2000 – 1840 – 40) x 20.000 x 10.000 = 24 billion Yen (approx. 218 mil USD)

At the exercise of the option, the buyer of the call receives the cash amount as per formula:

S = (Topix – Topix exerc) x N x M

S = (2000 – 1840) x 20.000 x 10.000 = 32 billion Yen (approx. 290 million USD)

This is because the trader has already paid the premium at the time of the purchase of the call options.

The multiplicator for the American Stock Market is 500 USD for one index point.

For London Market, it is 25 GBP for one index point.

For the Swiss Market, the multiplicator is 5 CHF for one index point.

For Japan Market, the multiplicator is 10.000 Yen for one index point.

On the market, there are exchange trade funds (ETF) like S&P 500 ETF, which tracks the S&P 500 Index.

In the same time, Exchange Traded Funds is a type of security that tracks option contracts on diverse other international indexes, such as:

- Solomon brothers – Frank Russel global equity index

- Standard & Poor’s global 1200 index

- Financial Times – Actuaries world index; FTSE 100 Index

- Morgan Stanley Capital International Indexes

- Nasdaq 100 Index (QQQ ETFs tracks this index), and others

The way a stock market index-based ETF is built is reproduced in the next figure:

Standard and Poor’s has founded a mutual fund managed also by the company Standard and Poor’s that has a structural identical portfolio with the S&P 500 index portfolio.

The shares of the S&P 500 mutual fund that are owned by the shareholders contain a specific number of shares from all the 500 companies from S&P500 index. Each of these shares has a subsequent percentage like S&P 500 index.

Let’s suppose that a market maker broker dealer who trades in his own name (proprietary trading) or an asset manager – clearing house (that is counterpart in all the OTC trades) buys a big quantity of shares of the mutual fund S&P 500 from a dealer with whom has a secret agreement. This is equivalent to the purchase of a quantity of each of the 500 shares from the index, proportional with the corresponding percentage in the index.

This thing has as result the rising price of each of the 500 shares, simultaneously, with the same percentage.

So, the index value will rise with the same proportion.

This way, the index market price can be manipulated pushing the index to the desired artificial value.

In the same context, the ETFs index will have a bigger or a lower value, depending on the value of the underling index.

It is to be reminded that the amount of money paid in bilateral trades with options strategies (ETFs based) depend on: the current value of the index, the options’ contract price, the market multiplicator and the number of options contacts. This is the procedure conceived by China that the values of the intentional loses from the regulated markets trader to the shadow bank dealer to be very precise.

The same thing is valid in the case of S&P Global 1200 index.

b. In the same way, ETFs which tracks options strategies based on Western countries treasuries and municipal bonds (one year) indexes are built.

This contract can be liquidated at the expiry, only by payment of the amount of money.

In the USA the largest ETFs issuers are:

- Black Rock 39% market share

- Vanguard 25% market share

- State Street Global 16% market share

Total: 80%

5. All these financial instruments have been invented by Chinese and Indian financial engineers, in order to intentionally donate big amounts of money to the trading partner (shadow bank), giving the false impression to the Occidental people that the purpose is to make profit through financial speculations

This intentional loss of money from a trader in the favour of his trading partner is camouflaged in the shape of an investment bet on the over-the-counter (OTC) market.

The options contracts strategies (on which ETFs are based) on equity and treasury indexes are executed and cash settled by secret CROSS transactions.

The CROSS transactions are invisible and unreported to the stock exchange. So, CROSS transactions are invisible to the other participants in the market (especially for the white people from the Western countries).

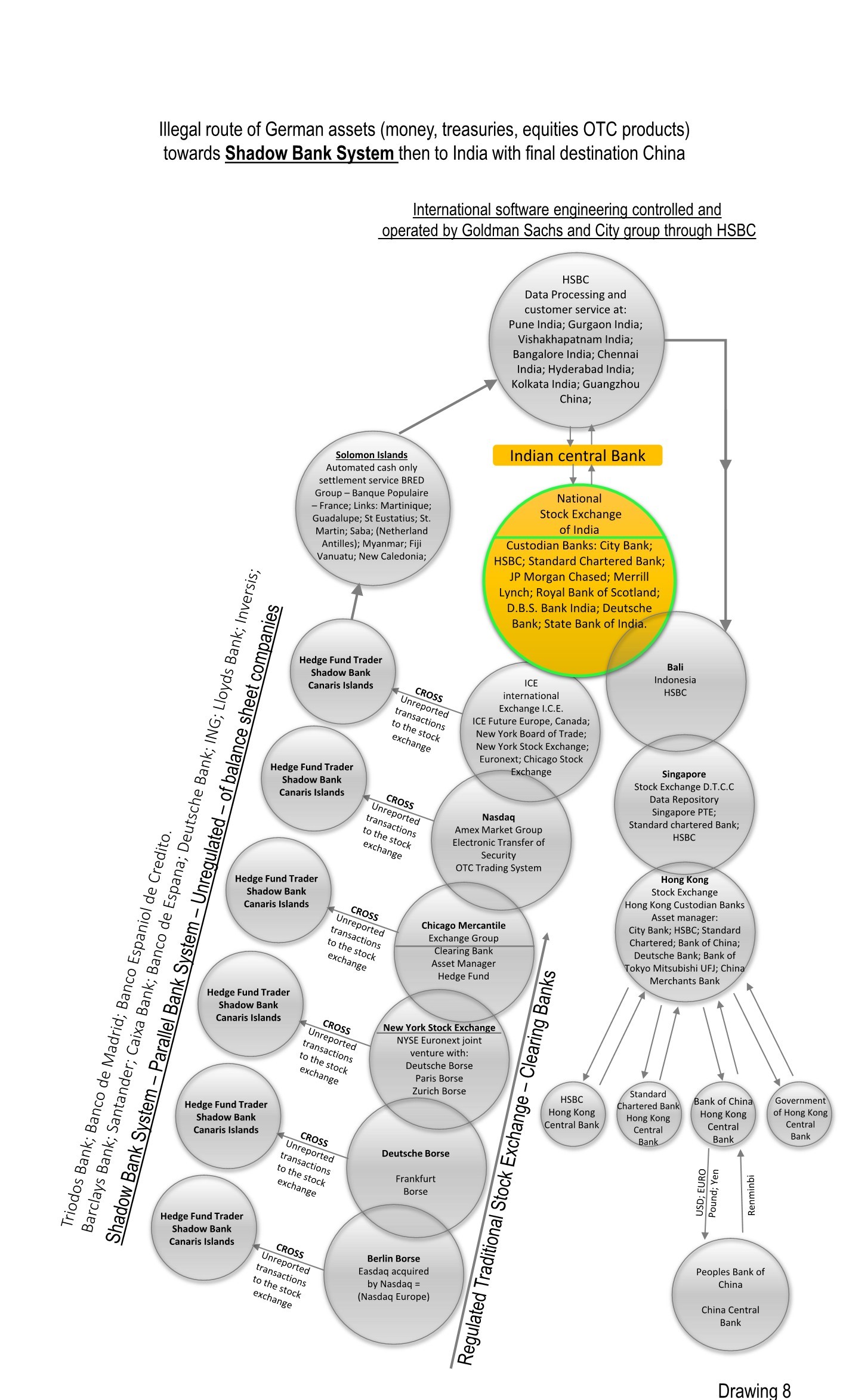

The members of the regulated stock exchanges and clearing banks are part of the same financial holdings with the offshore (tax heaven) shadow banks from Canaris Islands.

In this way, the shadow banks that have the role of dealers or traders with the location in Canaris Islands (that create the parallel bank system) have the possibility to access all the stock exchanges and clearing banks, in order to do the transactions. In this way the ETFs financial products are created. These EFTs have Western countries treasuries and equities as underlying assets.

The access is allowed because members of stock exchange and clearing houses have delivered to the shadow banks from Canaris Islands, secretly and illegally, the secret access codes in all the stock exchanges and clearing banks.

This way, CROSS trading (operated outside of the market and not reported to the stock exchange) between regulated stock exchanges and unregulated (and uncontrolled by financial authorities) shadow banks can be done.

Under the pretext of eliminating the risk in trades clearing, the custodian banks attached to the biggest stock exchanges of the world have the right to do clearing operations (they become clearing banks). This is something that in the usual custodian banks is forbidden.

Besides the codes, the dealers (shadow banks) from the tax heavens have been provided with terminals (computers) that are connected to the trading platform and communication systems of all the regulated stock exchanges and clearing houses.

This way, “off balance sheet” companies that are so-called shadow banks or parallel banks can do secret CROSS trades with the stock exchanges from Europe, USA, Canada, UK, Japan, by secretly buying treasuries and creating portfolio of treasuries from these Occidental states.

Summary:

Parallel to the official chain of regulated stock exchanges and clearing banks, there is a chain of unknown and unregulated dealers and traders (hedge funds) that are not visible and have the location in tax heaven.

These dealers and traders are cooperating closely to the stock exchange and clearing banks owners (members) that are officially regulated financial institutions. Because they are part of the same financial holding.

These offshore banks are also called Shadow Banks, which work in parallel with the traditional stock exchanges and benefit of all the information, the technology and the connection network that belong to the whole regulated stock exchanges and clearing banks system.

This system was conceived by Iran, in order to transfer through CROSS trades, in secret, the Occidental assets from the traditional banking system to the parallel banking system (shadow banks). See Drawing 8 and 9 – Chapter III.

During the second phase, the parallel banking system will transfer the Occidental assets to the Indian Central Bank at half price and finally to China Central Bank.

5. THE CROSS TRANSACTIONS

The CROSS transactions are the ones where the market maker receives two limit orders. One limit order at maximum purchase price and one limit order at minimum sales price, that can be executed one through the other.

The regulation states that these CROSS transactions can be executed by the broker outside of the stock exchange, but they have to be reported to the stock exchange.

The regulation (issued by the stock exchange members) also reads that after a standard (or a smaller) lot trade is reported of a financial asset, the market maker has one minute (60 seconds) in order to list another quotation.

If, for instance, the stock exchange program states:

Closing auction 16:30 – 16:35, then the broker can close a trade with a very small lot at 16:34 and 35 seconds and from that moment on, according to the regulation, has one minute (60 seconds) available, in order to display another quotation for another trade. In that moment, the market maker does the CROSS trade between him and the shadow bank dealer from the tax heaven. The transactions are not executed through Stock Exchange.

Because the minute that he has available out takes the hours 16:35 and 35 seconds, respectively, the software will not allow the trade to be reported to the exchange because the auction is closed at 16:35:00. This way, the trade remains unreported to the Stock Exchange!!!

For this CROSS trade, the market maker broker dealer from the same terminal disconnects from the regulated exchange trading platform and connects to the Electronic Communication Network (ECN) and executes a huge amount of option contracts (tens of thousands) through Electronic Funds Transfer, during 35 seconds, to the shadow banks from the OTC unregulated market.

This transfer of option contracts on Occidental treasury basket and option contracts on equity and treasury indexes (as underlying benchmark), are not known by anybody else. Only the members have the password to connect to these systems.

This method used by Iran where treasuries options strategies ETFs and occidental indexes options strategies ETFs reach the shadow bank systems from Canaris Islands. Here, they are again packed and structured. Following these procedures, they are transferred to Indian Stock Exchanges, Indian Clearing Houses, Indian Central Bank and finally to China Central Bank.

For instance, London Stock Exchange schedule:

- Trade Reporting, 7:15 – 7:50

- Opening Auction, 7:50 – 8:00

- Continuous Trading, 8:00 – 16:30

- Closing Auction, 16:30 – 16:35

- Order Maintenance, 16:35 – 17:00

- Trade reported, 17:00 – 17:15

Normal trading sessions on the main order book (SETS) are from 8:00 – 16:30.

Stock Exchange Trading Sessions – (SETS)

Auction periods (SETSqx)

SETSqx (Stock Exchange Electronic Trading Service – quotes and CROSSES) is a trading service for securities less liquid than those traded on SETS.

Less liquid securities are just a pretext.

In reality, the broker and clearing house asset manager (Members) has a secret password for access in the Stock Exchange Electronic Trading Service – quotes and CROSSES. This way, they CROSS trade and cash settle a very big amount of OTC contracts (20.000 – 30.000) between 16:35 – 16:35 and 35 seconds, outside the working program (closing auction).

The last legal transaction before the CROSS trades must end at 16:34 and 35 seconds.

From this moment on, according to the regulation, the trader has one minute (60 seconds) available to display a new quotation. This minute lasts from 16:34 and 35 seconds to 16:35 and 35 seconds.

These CROSS trades (20.000 – 30.000 option contracts in 35 seconds) invisible to the stock exchange became secret for the following reasons:

a. The CROSS trades are not displayed in the stock exchange monitor, according to the trading regulation;

b. The CROSS trades are illegally done outside the trading program – “closing auction” in the first 35 seconds after “closing auction” is closed.

c. The CROSS trades remain illegal and on purpose unreported to the stock exchange;

d. The CROSS trades done through the Stock Exchange Electronic Trading Service – quotes and CROSSES – are accessible and executed (based on secret password) only by the members (shareholders) of the stock exchange and asset manager (member) of the clearing house.

The illegal CROSS transactions are done with:

- ETFs backed on option strategies on Western states treasuries portfolio.

- ETFs which tracks option strategies on Western state indexes. Following these ETFs trades, the clearing house (asset manager) that is a counterpart in all (very sophisticated) OTC contracts and market maker broker dealer (proprietary trading) intentionally lose very big amounts of Western assets.

By cash settlement operations and clearing operations that follow these CROSS transactions, big amounts of Western money and treasuries are secretly transferred from the regulated stock exchanges to shadow banks from the Canaris Islands.

From Canaries Islands and Solomon Islands, the Western countries money and treasuries are transferred through shadow bank system to Indian Stock Exchanges and Indian Central Bank. Finally, these Western assets will be donated to People’s Bank of China.

7. These Western states treasuries (T bills one year Municipal bonds-zero coupon bonds) are organized in treasury portfolios (basket) that have the following features:

a. The value of a basket of treasuries to be equivalent to about 100 million USD

b. Each Western states treasury weight in the basket must be according to each state currency percentage in the SPECIAL DRAWING RIGHTS (SDR).

For instance, in 2010, the percentage in the treasury basket was:

- USA treasuries 44%

- European treasuries 34%

- Japan treasuries 11%

- UK treasuries 11%

For the European countries, the basket contains treasuries of all European countries, proportionally to each country participation to the EU (plus Swiss, Sweeden, Norway) GDP.

The same procedure is applied for stock Index ETFs and treasury Index ETFs for which the contract settlement is done only by money transfer.

The following mix is created:

- option strategies based on American indexes – cash settled in USD 44%

- option strategies based on European indexes – cash settled in EURO 34%

- option strategies based on Japan indexes – cash settled in Yen 11%

- option strategies based on UK indexes – cash settled in GBP 11%

These treasury portfolios from which 50% of the value is given as a gift to China must have a tolerable value for each Western country, proportional to the GDP of each country.

The principle set by Tehran is that the annual donation to China from the Western states to be proportional to the economic power of each Western state.

For instance, in the year 2020, the Western states have donated unwillingly and without to know 30 billion USD per day or 7.8 trillion USD per year to China.

These amounts were made by treasury basket baked ETFs, stock index ETFs, treasury index ETFs, gold ETFs and a mix of such ETFs.

Also, cryptocurrencies secret transfers were used.

c. All the Western states treasuries (T bills one-year, Municipal Bonds – one year, zero coupon bond) that form a treasury basket must have the same maturity date. Only this way they will be presented as payment for HSBC, Standard Chartered, Bank of China, Central Banks of Hong Kong commercial bills of exchange portfolios.

Those baskets of bills of exchange will also have the same deadline (tenor) date with the Western countries’ treasuries portfolio.

This type of payment is, in reality, a BARTER of financial products (as presented in Chapter II).

d. The occidental treasuries must be zero coupon bonds (with discount).

To be remembered that these treasuries baskets represent the underlying assets of some option strategies that, at their turn, form the underlying assets for some OTC products named Exchange Traded Funds (ETFs).

The Exchange Traded Funds product and the option strategies they are based on are secretly transferred (through unreported CROSS trades to the regulated stock exchange) to shadow bank system and then to Indian Stock Exchanges and finally to People’s Bank of China.

ETFs have a very complex structure whose value CAN NOT be determined, but only by Iranian and Indian financial engineers that have invented them. The American specialists (and Western ones) do not have the necessary knowledge to evaluate the ETFs products.

Shadow banks will sell (on purpose) to Indian Stock Exchanges ETFs based on Western assets at a 2 times lower value (half price) against Indian rupees than the value that would be obtained from the official USD/ Indian rupee exchange rate.

This is the method used by Iran and its ally, India, to avoid the American financial specialists to observe that for one USD was not paid, for instance 56 rupees – that is the official rate – but 28 rupees (half price).

This way, Central Bank of India got the possession of very big foreign reserves (western assets and western money).

In this way, Indian rupee is Anchored by the USD (and other Western currencies).

For the Iranians, it is very important that the rate of exchange USD to Rupees (1 USD = 28 rupees) not to be written on any of the financial instruments as an evidence (proof) of the fraud.

In this stage, all the Western assets accumulated by the Indian Central Bank will be transferred through the Indian rupee to the Hong Kong Stock Exchange. This way, Hong Kong Dollar is Anchored to the US Dollar.