The secret route of Western countries’ money and treasuries from Indian Central Bank, Indian Stock Exchanges and Indian Clearing Banks towards the People’s Bank of China

The method used by China and its ally, Iran & India, to donate Western countries money to China

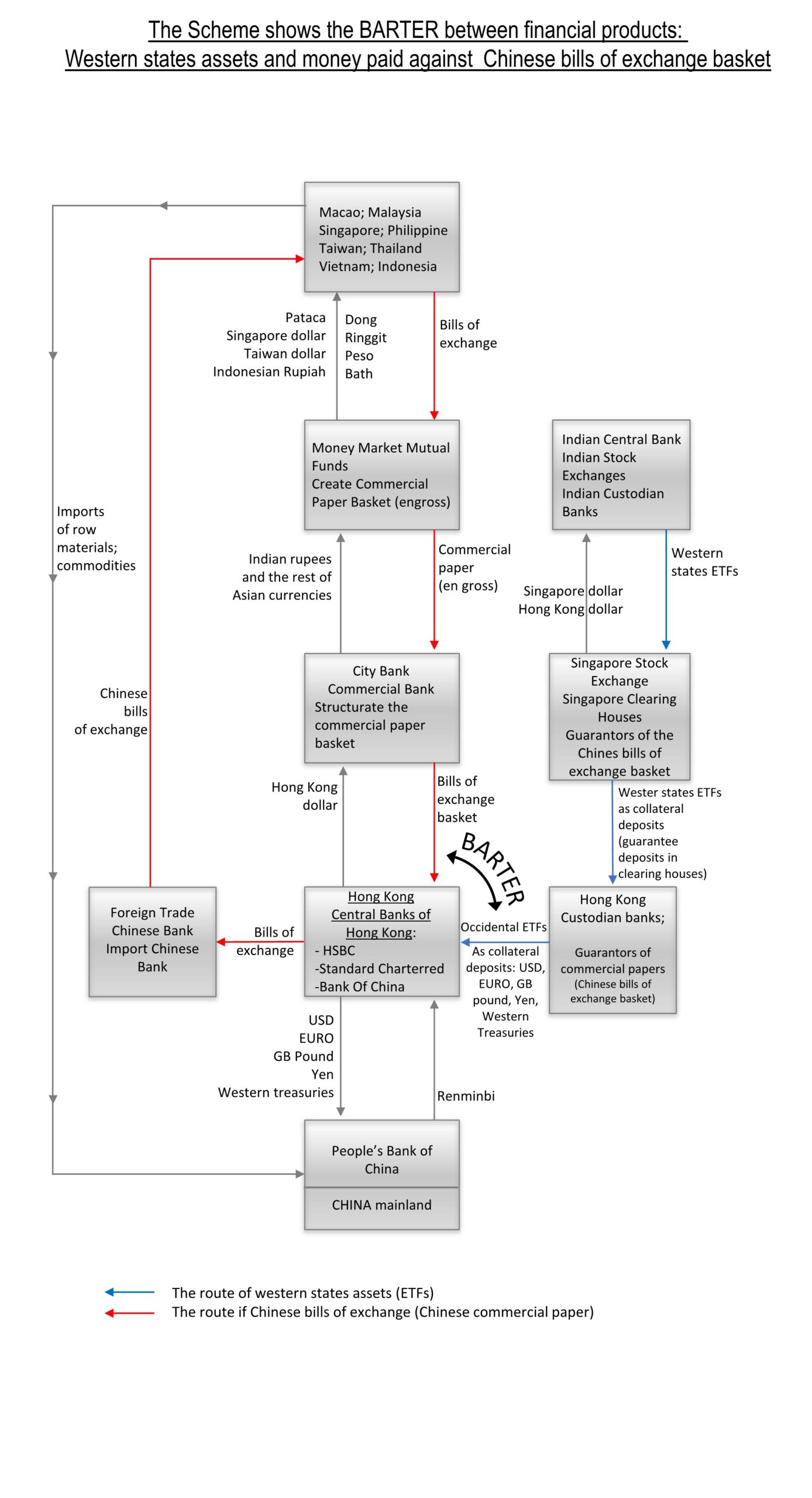

The barter trading between Western States Exchange Traded Funds (ETFs) and Chinese commercial paper basket

China imports the raw materials from the Asian area countries against a currency, Renminbi, that is twice stronger than the official Yuan/ USD exchange rate.

China has two currencies: the Yuan, used in mainland China, and also used in the Chinese products exports. The exchange rate with the USD (in 2012, for instance) was 6,3 CNY/ 1USD. The second currency of China, that cannot be used inside China but only outside China, in Hong Kong, is Renminbi (it is also called off-shore Renminbi).

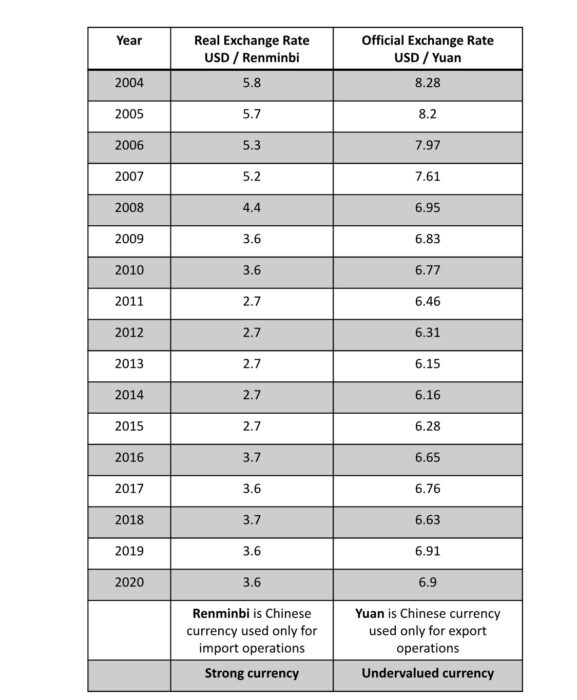

Although it is officially known that the two currencies had identical exchange rate, Renminbi is in general more than twice stronger against USD than CNY.

So, in reality, the exchange rate of 1 USD is 2,7 Renminbi (in 2012). So, China has a currency for export, the Yuan (CNY) and another currency for imports, the Renminbi (more than twice stronger). In order for the Chinese products to be more competitive on the external markets, they are sold in the cheap currency (against the USD), the Yuan (1 USD = 6,3 CNY).

But for the imports, one week currency against the USD can not be used, because with the same amount too little merchandise can be purchased.

Thus, for the raw material imports from the Asian area, Renminbi is used. 1 USD in reality (in 2012, for instance) equals 2,7 Renminbi. With this currency, a more than double quantity of goods can be purchased, compared to the Yuan (mainland currency).

What is the secret financial mechanism elaborated by Chinese and Indian financial engineers?

1. First step. The Foreign Trade Chines Bank issues invoices in order to buy commodities and other raw materials for the Chinese industry. This bank pays for these invoices with bills of exchange (and other commercial papers) denominated in the respective country currency. China’s main suppliers of raw materials are 8 countries from the Asian region.

It pays to each exporting company against the national currency of each corresponding country.

The corresponding countries’ currencies are:

- Macao – Pataca

- Singapore – Singapore Dollar

- Taiwan – Taiwan Dollar

- Vietnam – Dong

- Malaysia – Ringgit

- Philippines – Peso

- Thailand – Bath

- Indonesia – Rupiah

2. Money Market Mutual Funds (MMMF) that trade these bills of exchange and commercial papers, (or checks) buy the bills of exchange from exporting companies from these Asian countries before the deadline (tenor).

The Money Market Mutual Funds pay to the exporters of the eight countries against the respective country currency the amounts written on the bills of exchange (commercial paper) less the commission.

The expiry term for the bills of exchange is 90 days.

These bills of exchange (commercial paper, promissory notes), that go through more financial institutions, are discounted by central banks from the commercial banks. Usually, the bills of exchange (commercial paper) exit the national borders and move towards central banks that have the lowest discount rate.

The intermediaries (Money Market Mutual Funds) managed by Tibet-Chinaare collecting (en-gross) these bills of exchange and create a commercial papers’ basket with the following features:

a. The expiry date is in the same day

b. The value of each bill of exchange not to exceed an equivalent of 10.000 USD. This way, the monitoring of the bills of exchange by the Trade Report and Compliance Engine (TRACE) is avoided

c. The number of commercial papers (bills of exchange) from the basket is about 5000. The value of one bills of exchange basket is equivalent to about 50 mil USD at the official exchange rate (5000 x 10,000 USD = 50 mil USD).

3. The commercial papers (bills of exchange) are repeatedly endorsed on behalf of a different beneficiary ending up that the beneficiary of all these bills of exchange to be Citibank. Citibank has paid to the intermediaries Money Market Mutual Funds (that are also brokers/ dealers) that have built (created) the bills of exchange basket, the equivalent amount of the 8 Asian currencies in Indian Rupees.

Finally, the bills of exchange basket are discounted by Citibank to the following 3 Central Banks of Hong Kong: Standard Chartered, HSBC, Bank of China. This Central Banks of Hong Kong has the discount rate zero. Standard Chartered, HSBC and Bank of China Central Banks of Hong Kong pay to Citibank the amounts written on the bills of exchange (in the 8 currencies) converted in Hong Kong dollars. At the expiry of the bills of exchange, these three central banks should cash in the amounts written on the bills of exchange.

4. But the bills of exchange basket is guaranteed by six guarantors that are business partners to the bills of exchange issuer (Import Bank of China) and of the intermediaries Money Market Mutual Funds and asset managers from various clearing houses

These clearing houses that are attached to Singapore Stock Exchange have created and structured the Chinese bills of exchange basket.

So the guarantors will pay at the expiry date instead of the issuer of the bills of exchange. The issuer is Import Bank of China. The guarantors guarantee deposit (collateral deposit) should be in Indian Rupees and is managed by clearing banks (asset manager) from Singapore Stock Exchange and Hong Kong Stock Exchange.

The asset manager that manages the clearing houses executes the guarantees of the guarantors (the shadow banks).

The guarantor companies can be hedge funds (shadow banks), market makers broker dealer (proprietary trading), asset manager (these ones are counterpart for any OTC transaction) intentionally keep Western states ETFs in the clearing houses guarantee account.

Instead of Indian Rupees, the guarantors will therefore pay with Occidental countries’ ETFs.

The bills of exchange guarantors will all refuse (non-acceptance) the total payment, instead they will agree to pay a partial amount of about 15-20% from the total amount. This way, the percentage each of the six guarantors pay to amount 100% in total (meaning the total amount) written on the bills of exchange (contained in the basket). For example, six guarantors each paying (from six different clearing houses) a partial amount of 16,6% will result 100% (16.6 % x 6 = 100%).

5. The Barter

These guarantors pay to HSBC, Standard Chartered, Bank of China Hong Kong Central Banks the corresponding amounts in Over-the-Counter Financial portfolios instead in Indian Rupees. The OTC products are very complex. The OTC market is unregulated and is not monitored by the authorities. The OTC products are specially designed by Tibet-China and Iran, so that nobody can evaluate them.

The six guarantors can guarantee the commercial papers portfolios from six different clearing banks masked under the shape of guarantee deposits of dealers/ traders, market maker broker dealers and asset managers.

The financial OTC products paid by the guarantors are called Exchange Traded Funds (ETFs).

So, a BARTER trading of financial products is done: the ETFs underlying assets (Western treasuries portfolios, Western countries indexes option strategies, Wester countries money) are exchanged against commercial papers basket.

The USD/ Hong Kong dollar exchange rate must not appear written on any financial contract. In reality, the exchange rate is 3.9 Hong Kong Dollar/ 1 USD (half price compared to the official exchange rate 7,8 Hong Kong dollar/ 1 USD). So, the Hong Kong dollar is pegged by USD, because in Central Banks of Hong Kong enter twice as many Western assets for one Hong Kong dollar than it should according to the official rate.

6. ETFs have different categories:

a. Index ETFs – Most ETFs are index funds that attempt to replicate the performance of diverse indexes.

The index may be based on the value of equities, treasuries, currencies and others.

Some funds track US Stock Market Indexes (for example, Vanguard Total Stock Market ETF).

ETFs that track the Standard & Poors 500 Index are issued by Vanguard Group.

Other funds track International Stock Indexes. For example, Vanguard Total International Stock Index tracks the Morgan Stanley All Countries World, ex USA Investable Market Index Morgan Stanley CI EAFE Index.

b. Inverse ETF – are constructed by using various derivatives for the purpose of profiting from decline in the value of the underlying index. This type of investment uses a combination of advanced investments strategies to make profit from the falling price. The inverse ETF are based on some strategies with option contracts on the Western countries’ treasury basket.

c. Leverage ETFs

Leverage Inverse Exchange Traded Fund (ETF) may achieve double or triple loss on the market. These losses on the guarantor are done on purpose and in favour of HSBC, Standard Chartered Bank, Bank of China – Hong Kong Central Banks. To have these results, the issuer of ETFs uses various financial engineering techniques including equity swaps, derivative strategies with option contracts (straddle, strangle, butterfly, condor) and rebalancing. By the rebalancing technique, the asset manager that controls the clearing bank can suffer intentionally very big losses.

Most ETFs are index funds that hold the same securities in the same proportions, as a certain stock market index or bond market index. ETFs in US replicate the Standard & Poor’s 500 Index, the Total Market Index, NASDAQ – 100 index.

d. Actively managed ETFs – a very important part of them are not transparent. They are very secret and very difficult to evaluate.

e. Bond ETFs

Their income distribution depends on the performance of underling bonds. They might include Western states government and municipal bonds.

7. The basket of commercial paper-bills of exchange (cheques or promissory notes) are transferred as an electronic bill of exchange that provides the same information as a written bill of exchange. In other words, there are electronic bills of exchange image (or electronic cheques image).

For this purpose, automated clearing houses have been created, that effectuate Electronic Fund Transfer (EFT).

Electronic Fund Transfer is used also for option contracts basket transfers from regulated derivative markets (and clearing houses) to unregulated derivative market (shadow banks) in order to build options strategies. These, at their turn, are used to build ETFs.

The clearing and the cash settlements of ETFs trades are done in the favour to the one that has the possession of the ETFs, in this case Bank of China, HSBC, Standard Chartered Central Banks of Hong Kong. These ETFs have been paid (delivered) by the guarantors of the bills of exchange (commercial paper) basket.

The clearing is done by the actual delivery (Electronic Funds Transfer) of the portfolio made of the underlying assets of the options strategies, the ETF is built on. The delivery is done to Bank of China, HSBC, Standard Chartered Bank, Central Banks of Hong Kong.

The based assets are the Western states treasuries portfolios.

The clearing can also be done by cashing in the value in money of the occidental states’ treasuries. These amounts are paid in the following currencies USD, EURO, Japan Yen, GBP, Canadian Dollar.

For the ETFs used on synthetic financial products – Occidental stock market indexes (on equities and treasuries) options strategies, the settlement towards HSBC, Standard Chartered Bank, Bank of China, Hong Kong Central Banks is done only in cash – USD, Euro, Japan Yen, GBP, Canadian Dollar.

In other words, at the expiry of the commercial paper basket that by repeated endorsements reached the 3 Central Banks of Hong Kong, these banks receive from the guarantors of the bills of exchange instead of the amounts written on the bills of exchange various ETFs mixes. These ETFs mixes are paid through a series of clearing houses, by a number of guarantors.

The underlying assets of these ETFs (treasuries portfolio) intentionally worth a double amount of money expressed in Occidental currencies at the date of payment (tenor) than the amount written on the bills of exchange.

If the bills of exchange basket worth equivalent of 50 mil USD, then the treasuries portfolio worth 100 mil USD.

Western states treasuries portfolio and the Chinese commercial paper basket must have the same maturity date in order for the barter to be possible.

This arrangement that the Occidental assets that the ETFs is based to worth double is done by manipulating the price of the Western countries’ indexes by the mutual funds (Standard and Poor’s Mutual Fund) by dealers and traders and by asset manager (clearing house owner). The later is counterpart in all the sophisticated futures contracts. This way, the treasuries price, the stock index value, the treasury index and the OTC products prices will be manipulated (artificially made) at the date of payment of the bills of exchange basket.

This way, at a certain value of the T bills portfolio or indexes, the intentional loss of the option strategies traders to be maximum.

The Western assets (ETFs) that get in through Central Banks of Hong Kong, HSBC, Standard Chartered Bank and the Bank of China (via bills of exchange barter) have the role to peg the Hong Kong dollar to the USD.

This way, Bank of China, Hong Kong Central Bank can exchange big amounts of Renminbi into Hong Kong Dollar and then, from Hong Kong Dollars into USD.

So, Bank of China, Hong Kong Central Bank can exchange Renminbi into USD (at an exchange rate twice stronger than the official one – 1 USD = 2,7-3,7 Renminbi (2009-2020).

Bank of China is a commercial banking group in Hong Kong and is also one (of the three) of the Hong Kong Central Banks.

Bank of China has been the designated clearing bank for transactions involving Renminbi in Hong Kong. This means that Bank of China Hong Kong acts as a settlement agent for Renminbi funds is Hong Kong and an intermediary between the banks in Hong Kong and the Peoples’ Bank of China.

Officially, it is known that the mechanism of pegging the Hong Kong dollar to the US dollar is supported by the Federal Reserve.

In reality, the amounts the Federal Reserve uses to officially support the Hong Kong dollar are extremely little compared to the illegal and secret amounts used by Tehran controlled banks to supply the Hong Kong foreign (occidental) reserves using occult financial engineering. Only this way it is possible for the Hong Kong to be pegged at the official exchanged rate 1 USD = 7.8 Hong Kong dollar.

One can observe that first, Hong Kong dollar was pegged to the Indian Rupee and then through Indian Rupee the Hong Kong dollar is pegged to US dollar.

In the last stage, the Chinese Renminbi is exchanged into USD through the Hong Kong dollar.

The real exchange rate USD/ Renminbi was the following:

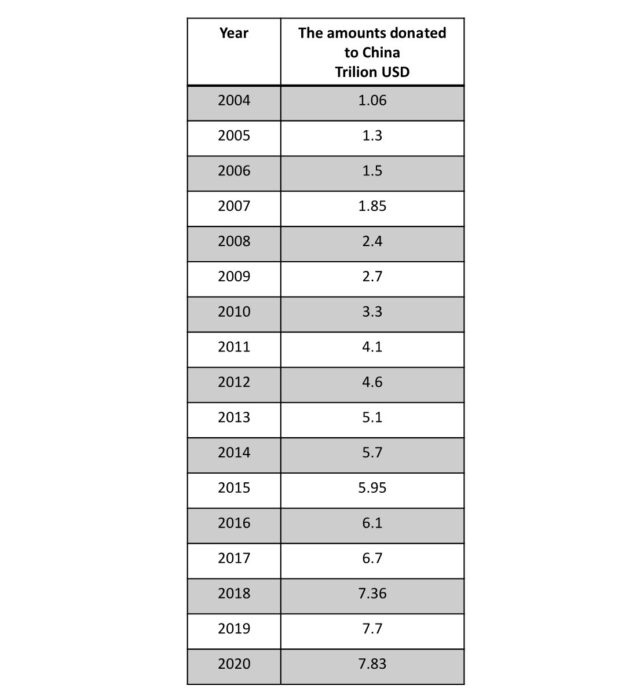

The amounts in Western currencies USD equivalent donated (for free) to China in secret (clandestine) by China, are the following:

In 2020 the daily amount illegally transferred to China was approx. 30 billion USD/day, (7830 billion USD = 7.83 trillion USD / year)

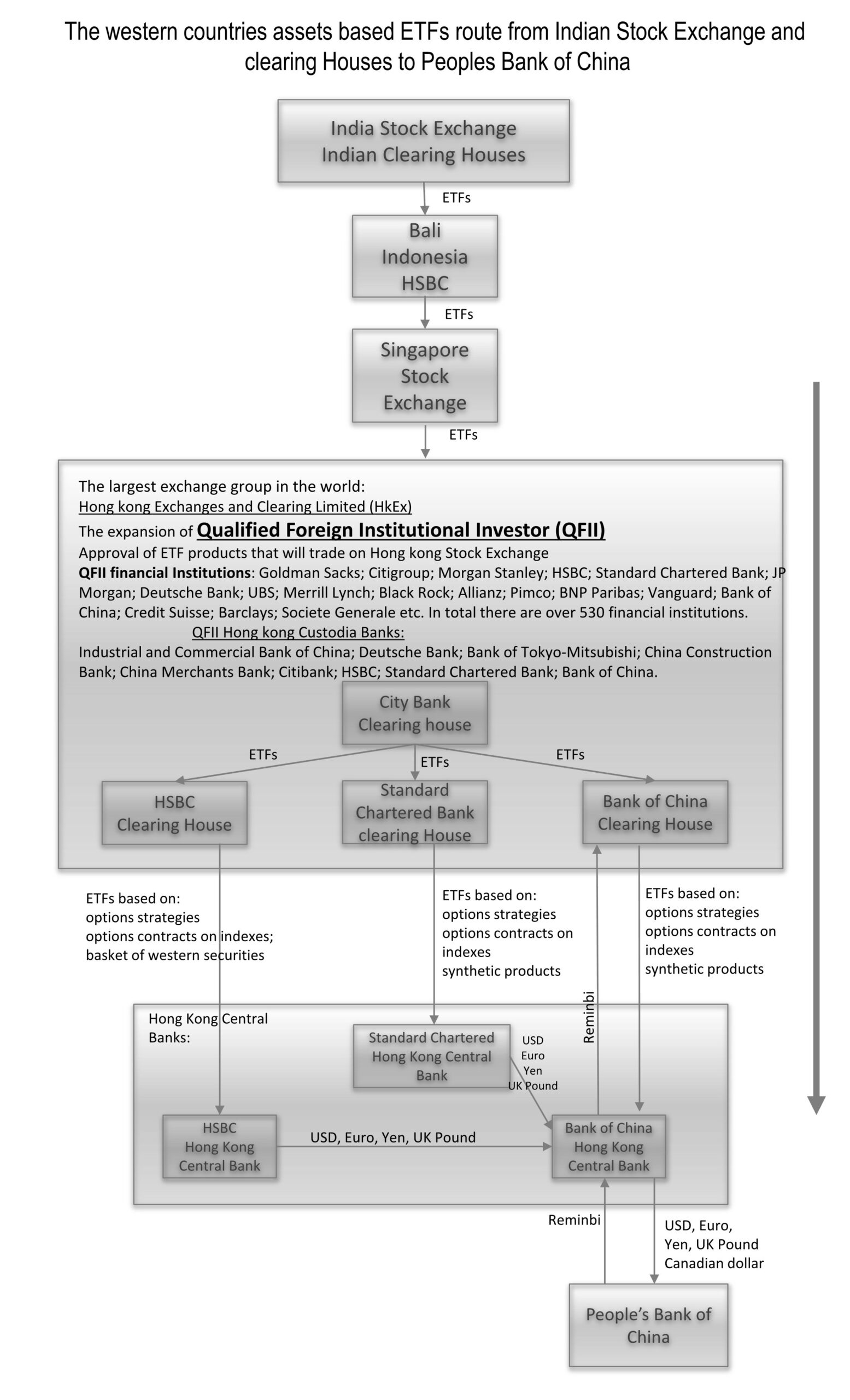

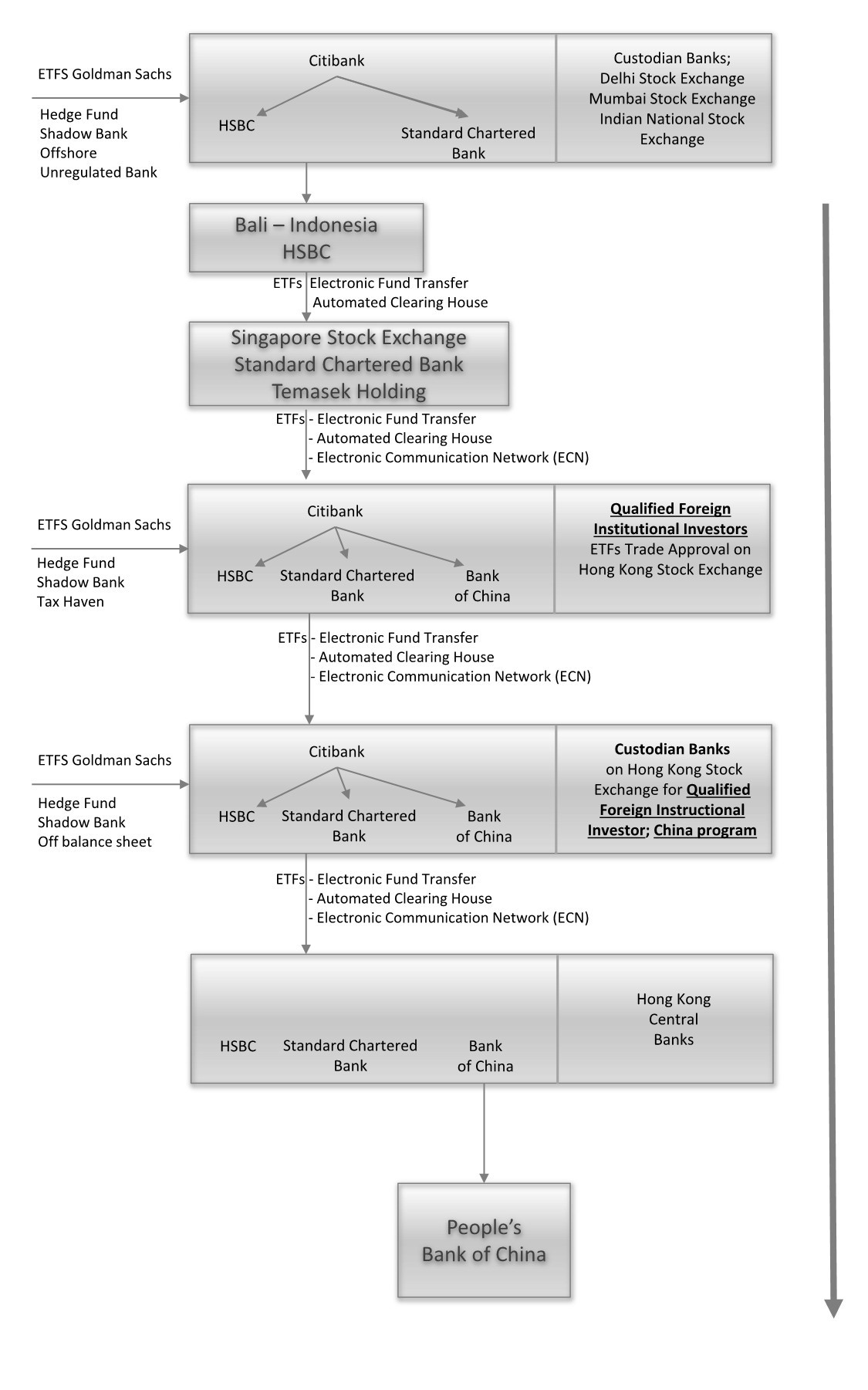

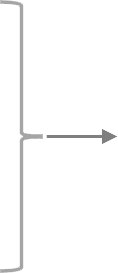

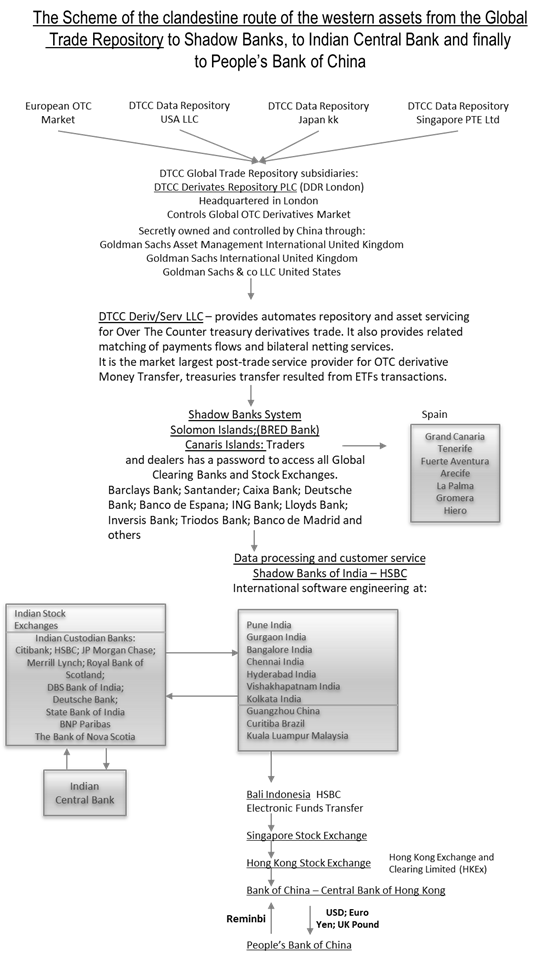

The following diagrams show the key role played by three banks: HSBC, Standard Chartered Bank and Bank of China.

ETFs based on Western assets after are passing through many intermediary (558 financial companies from Qualified Foreign Institutional Investor – QFII program) enter in China via 3 banks being supplied by Goldman Sachs through Citibank.

Scheme no. 1

Scheme no. 2

8. Tibet China has created a Global Clearing Banks and Clearing House Network for this purpose (for derivative, OTC products).

All the Clearing Banks and Automated Clearing Houses are connected to each other through the electronic communication network (ECN).

Using this ECN, Electronic Funds Transfer is realized.

We remind you that Asset Manager (Hedge Fund) that is shareholder and member of Clearing House takes part to all the OTC trades (regulated and non-regulated) as counterpart to all the sellers and buyers of OTC contracts.

The Asset Manager that manages the Clearing Houses and Clearing Banks is a buyer for all the options contracts and ETFs sellers and a seller for all the options contracts and ETFs buyers.

All Asset Managers from the Clearing Houses network, intentionally donate to their partners, the Hedge Funds (from the same Financial Holdings) and Shadow Banks from offshore, very big amounts of money on the following route:

USA

CANADA

EUROPE

UK

JAPAN

CHINA through Indian Stock Exchanges and Clearing Houses

Here, in Indian Stock Exchanges (New Delhi and Mumbai), as well as in the Clearing Banks attached to these Stock Exchanges, all the Western assets are collected and are getting structured before they leave further, to China.

As described before, all the Western countries treasuries and Western countries stock market indexes synthetic products secretly reach the Indian Clearing Banks through secret and illegal cross transactions.

The cross transactions, their clearing and the cash settlement are not executed through the stock exchanges and are not reported to the Stock Exchanges (as stated in the exchange regulations).

The architecture of the Global Clearing Banks and Clearing Houses Network, conceived and coordinated by Tibet-China

a. Depositary Trust and Clearing Corporation (DTCC)

b. National Securities Clearing Corporation (NSCC) – is a subsidiary of DTCC and provides:

- Clearing, settlement, risk management

- Central counterparty services

- Guarantee administration

for transactions involving:

- Equities (synthetic derivative products on equity indexes)

- Municipal debts

- Exchange Traded Funds (ETF)

c. The Depositary Trust Company – DTC – is a subsidiary of DTCC and:

- Keeps in custody securities valued at USD 54 trillion (2017) – from 131 countries;

- Provides securities transfer for NSCC – money and treasuries transfer between custodian banks and brokers/ dealers

The members (shareholders – owners of Clearing Banks) daily execute illegal and unreported (to the Stock Exchange) cross transfers of money and treasury baskets during the first 35 seconds after the trading program is closed.

Other illegal and unreported cross transactions take place once a week and some others once a month (depending on the treasuries maturity date or the term of the treasuries).

VERY IMPORTANT! The Depositary Trust Company (DTC) is a member of US Federal Reserve Banks. It is a Custody Bank and also a registered Clearing Agency.

The secret members, shareholders (owners) of the Federal Reserve Banks are the following banks:

- Goldman Sachs

- Citigroup

- Bank of America

- JP Morgan

- Bear Stearns

- Morgan Stanley

- Wells Fargo

- Deutsche Bank

- Merrill Lynch

These shareholder Members of the Federal Reserve Banks are also Members shareholders in Clearing Houses and Clearing Banks of Depository Trust Company (DTC).

The same big investment Banks (Members) are also primary dealers. They represent the treasuries primary market.

d. Fixed Income Clearing Corporation (FICC)

The securities transactions processed by FICC’s Government Securities Division (GSD) include: T-bills, Tnotes, zero coupon government bonds, Government Agencies Securities.

Services include:

- Real Time trade management

- Automated Funds Only (cash only) Settlements

This system is used to transfer the US treasuries portfolios towards shadow banks, using options illegal cross trades (unreported to the exchange).

Also, through Automated Cash Only Settlements Service system, the cash equivalent of the US treasuries portfolio is secretly transferred, if the market maker (falsely) claims that he does not own the options contract strategies underlying treasuries.

e. DTCC Global Trade Repository (GTR):

- Controls the Global OTC derivatives market

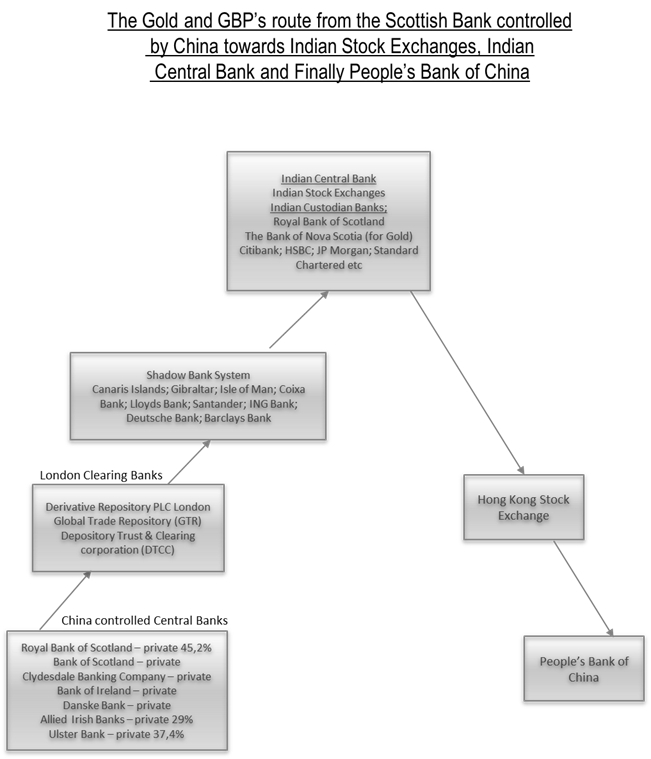

Following, there is the scheme showing the clandestine route of the money and the Western countries treasuries from Global Trade Repository towards the Shadow Bank system followed by their accumulation in the Indian Central Bank.

Finally, these Western assets are donated by India to People’s Bank of China under Iran’s coordination.

In 2020 DTCC’s Subsidiaries processed securities transactions valued at more then US $2.3 quadrillion (US $2300 Trillion). Its depository provides custody and asset servicing for security issued from 170 countries valued at US $73.5 trillion

A different way to present the route of the money from the Federal Reserve Banks (members) towards the regulated banks, then towards the Shadow Bank system, further to the Indian Stock Exchanges (and Custodian Banks) and finally to China

For instance, the Commercial Banks have the right to take credit from Fed through Window discount or through discounting of bills of exchange.

Their explanation would be (they say) that these banks must not be left short of liquidities because they work with the people’s deposits. But the Commercial Banks secretly transfer these funds towards the asset manager (clearing house) to market makers and further towards shadow banks that are part of the same financial holding as the Commercial Bank.

The Federal Reserve also supplies the Chinese Banks through:

- Open market operations

- Repurchase agreements (repos)

- Lombard credits (overdraft) – bronze bills of exchange – revolving type credits (long term credit – gold collateral is requested)

- Quantitative easing (long term – gold collateral)

The Clearing Houses are counterpart in all the OTC products invented by themselves and they need very big amounts of money (from the FED), in order to lose them on purpose in favour of its OTC trading partners – Shadow Banks. This money will follow their route to India and finally to China.

The Asset Manager is a counterparty for the OTC transactions. The transactions related to the regulated market are done in Cross and they are not reported to the regulated exchanges. They are not seen by the other market participants. The transactions, the payment and the transfer of treasuries are done simultaneously.

VERY IMPORTANT: The Depository Trust Company (DTC) is a member of US Federal Reserve System. It is a Custody Bank and also a registered Clearing Agency.

In order to donate to China big amounts of money, illegally transferred through Cross transactions during the last minute of the trading program, they must take this money from somewhere.

The Clearing Bank is, in fact, the owner of the USA Central Banks, the Federal Reserve (a shareholder with a statute of member in the Fed’s board of governors). The members, owners of the Federal Reserve, have the self-invested privilege to take credits from their own money printing machine.

These credits are called Lombard Credits (overdraft; promissory notes; financial bill of exchange) and are revolving types credit. They are completed with the window discount credit (one day); commercial bills of exchange discount (90 days); open market operations; repurchase agreement (repos); quantitative easing (similar with Lombard Credit).

The revolving credits are those credits where the amounts spent from the credit account are automatically filled back by the FED without any approval needed.

These credits are rolled-over with shorter term credits (from the window discount). The amounts are permanently kept to the member bank that took the credit.

This new issued Western money due to be transferred for free to China are coming back to the West because the Chinese imports of modern machines and high technology from the Western countries.

The American money go back to the USA also through the USD Chinese credits lent to the United States’ government.

This new money issued by the Western states and spent by China on the Western states’ markets create inflation for the respective markets. The conclusion is that the new issued money by the Western Central Banks that are transferred for free to China (through the Iranian scheme) are coming from the devaluation (inflation) of the American, European, Japanese, English and Canadian people’s money.

The official inflation announced by the Fed is 2% whistle the real secret inflation is 7-10% per year.

We remind you that the real owner of the Federal Reserve Banks is the Chinese Financial Sect from Tehran.

The Tibetans has created and controlled the central banks of all the empires and countries of the world, for many centuries.

The way of managing the world’s financial system and the way it hides behind the intermediaries and LGBT minority is very elaborated.

The same thing happens at the European Central Bank, where the same Chinese Financial Sect (Oculta) from Tehran is the secret owner.

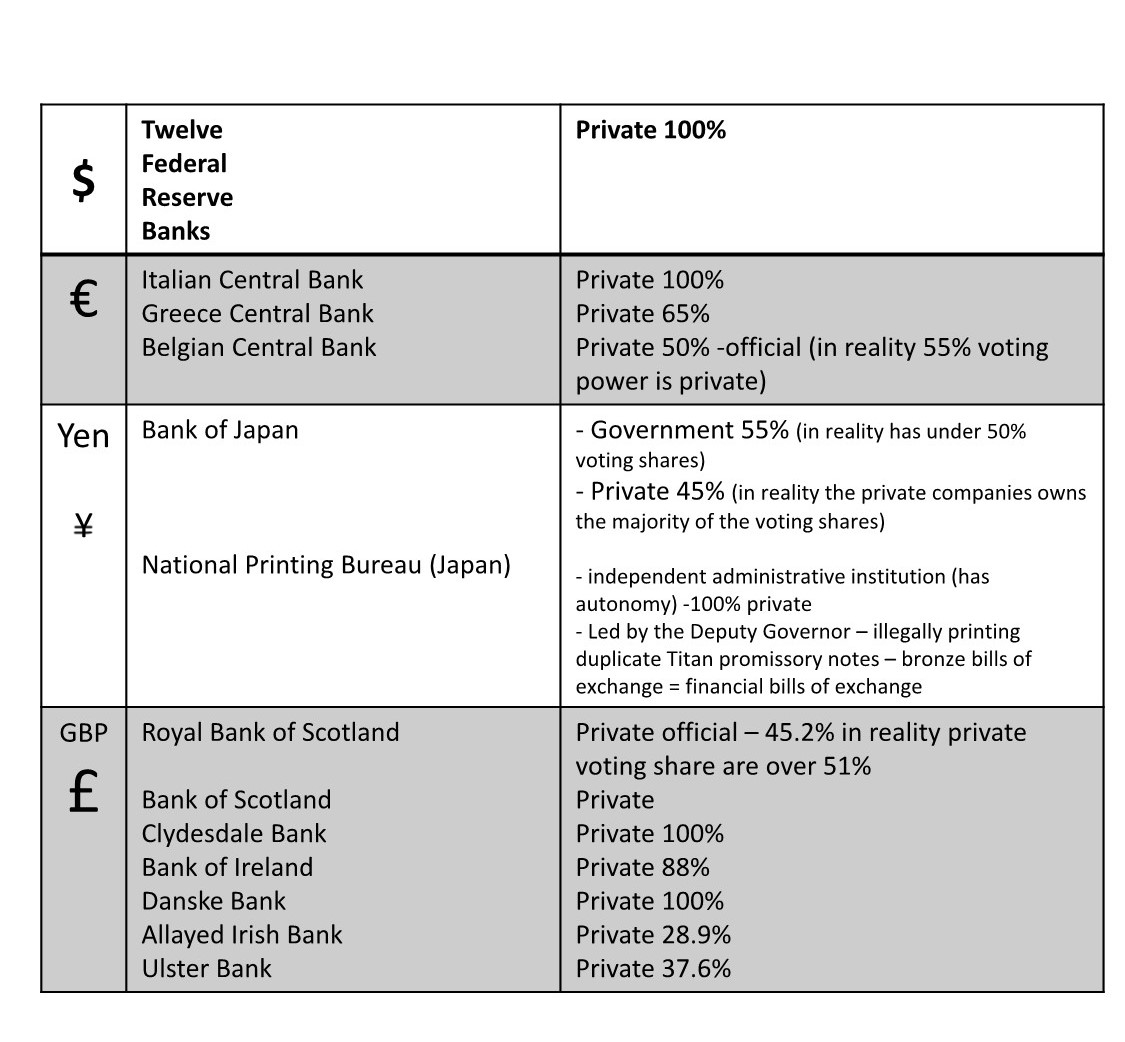

The central banks from where the biggest amount of Euro flows towards the Iran controlled private banks are:

- The Central Bank of Italy – 100% private

- The Central Bank of Greece – 65% private

- The Central Bank of Belgium – 50% private (in reality, 55% voting share)

The other central banks of the countries from Euro zone are state owned, but are controlled by Iran who controls the LGBT minority whose members have been promoted as presidents of the central banks.

The LGBT minority is controlled (through protection and blackmail) in secret by the Chinese from ancient history.

The way Tibet controls the GBP printing

Bank of England has the monopoly of banknotes issuance in England, but the trick is that 3 banks in Scotland and 4 banks in Northern Ireland are permitted to issue their own currency.

The law requires these issuing banks must hold a sum of Bank of England bank-notes (or gold) equivalent to the total value of the note issued.

The Scottish and North Ireland bank-notes are, in fact, promissory notes used for Lombard credits (overdraft, or financial bill of exchange – bronze bill of exchange). These credits are issued in favour of the Clearing Banks.

The trick continue as follows:

The Scottish notes (in reality, financial bills of exchange) issuing bank’s branches situated in England dispense bank of England notes. This means that there is no need for Scotish notes issuing banks to hold an amount of Bank of England bank-notes equivalent to the total value of issued notes.

Instead, a 5-10% gold guarantee is required from the total value of the issued promissory notes (financial bills of exchange).

Usually, only the Clearing Banks and the traders take promissory notes as credits from the Scottish notes issuing banks (the Scottish notes issuing banks are, in fact, Central Banks). The bank-notes issued by the Northern Ireland Banks have the same legal status as the Scottish bank-notes. In fact, they are promissory notes issued in GBP and may be used for cash transactions anywhere in the United Kingdom.

The Scottish bank-notes (promissory notes) are denominated in Pounds Sterling and have exactly the same value as the Bank of England notes.

The Banks which are permitted to issue currency in Scotland:

1. Bank of Scotland – shareholders – private (Lloyd Bank Group is the major shareholder)

2. Royal Bank of Scotland:

- 45,2% private shareholders (in reality, 51% voting power)

- 54,8% Government investments (2008)

3. Clydesdale Banking Company: 100% private

The bank-notes issuing banks in Northern Ireland:

4. Bank of Ireland – private

5. Danske Bank – private (majors: Maersk, Black Rock, Mutual Funds – 33%)

6. Allied Irish Banks (Northern Ireland)

- 71,1% Government of Ireland

- 28,9% Private

7. Ulster Bank:

- 62,4% UK Government Investments

- 37,6% Private

The private shareholders of the 7 Scottish and Northern Ireland Banks have the majority of voting power in general assembly of the (voting) shareholders. So, the private banks will appoint Indians or LGBT British minority in the board of governors.

Even the Government representatives from the general assembly of the shareholders are high ranking masons (Scottish Trinitar Great, Great Scottish of Saint Andrew– the Scottish Rite Ancient and Accepted – Great Souverain – General Inspector).

The members issue credits in new issued GBP in the favour of Clearing Banks or traders from unregulated OTC markets, that are part of the Secret Global Financial Trust, controlled by China and India.

For instance, the Lombard (promissory notes) credits in favour of JP Morgan, Citibank, Morgan Stanley, Standard Chartered Bank, HSBC – Clearing Banks (Asset Manager) are used for Over the Counter (OTC) markets transactions.

These Clearing Houses are counterpart in the OTC transactions.

These money are intentionally lost in the OTC transactions, sometimes as guarantee deposits to the Shadow Bank System (especially Goldman Sachs, Lloyd Bank, Santander Caixa Bank). These Shadow Banks are located in Solomon’s Islands’, Canaries Islands, Gibraltar, Isle of Man, The Netherlands Antilles.

From the Shadow Bank System, the Sterling Pounds reach the Indian Stock Exchanges and Indian Central Bank with final destination the People’s Bank of China.

The promissory notes issued by the Royal Bank of Scotland (and the other six banks) have the value starting from 100 mil GBP up to one billion GBP and are issued in big numbers. This is a strict secret operation.

So, the GBP donation to China, organized by Iran and India comes from the inflation of the Great Britain’s People currency.

The 5-10% gold guarantee the Clearing Banks must deposit against the promissory notes is taken from the gold deposits they have at the companies NM Rothschild; Sharp Pixley; Mocatta & Goldsmid; Jonson Mathey Bank; Samuel Montagu from London.

These companies represent the London Gold Market, the biggest Fine Gold Exchange in the world. Also, in London, the 10% gold guarantees from the value of the world states international credits taken from international lenders are being kept under custody.

Rothschild Bank has secret access to these gold deposits as well.

China secretly owns and indirectly controls

the following western Central Banks

As one can see in the previous table, the following Central Banks are 100% private or mostly private.

Federal Reserve Banks

Central Bank of Italy

The Central Bank of Greece

Bank of Scotland

Clydesdale Bank

Bank of Ireland

Danske Bank

National Printing Bureau (Japan)

The other banks are apparently owned by the respective countries’ governments.

Belgium Central Bank, 50% Government; 50% private

Bank of Japan, 55% Government

Allied Irish Bank, 71,1% Government

Ulster Bank, 62,4% Government

In reality, in the eve of the General Assembly of shareholders’ elections, the distribution of the votes is:

- Private banks – over 50% voting shares

- Government – under 50% voting shares

The way China controls the currency issuing at the Central Banks with public and private shareholdings (Bank of Japan, Belgium Central Bank, Allied Irish Bank, Ulster Bank) where apparently the Government has the majority of shares.

The above Central Banks are organized as a share capital company.

The statute mechanism and the types of sophisticated shares of these share capital companies are specially designed to very precisely and unnoticed change the phase where the Government has the majority of the voting power to the phase (situation) when the private banks have the majority of voting power.

The private shareholders (over 50%) of these Central Banks are banks and other financial institutions secretly controlled indirectly by China.

The financial engineers from Tibet China have conceived more types of shares to harden the calculations of the number of votes and to create confusion in the shareholders’ meeting.

Ordinary shares (common stock)

The owner of ordinary shares has one right to vote for each share. The law allows the share capital company to set its own way of sharing the dividends. Usually, the Central Banks do not pay dividends for the ordinary shares.

Voting rights share (privileged shares)

These are different type of ordinary shares that give the owner the right for 2 or more votes for each share.

Preference shares – these are shares that give the owner certain advantages when he cashes in dividends, but have no right to vote in the General Assembly of the shareholders.

These preference shares have a priority dividend that is paid before the ordinary shares dividends.

For instance, one preference share brings a fixed income of 7-10% from the share’s nominal value to the owner.

If the corporation profit is lower for one, two or three years, then the dividends will be paid with priority only for preference shares, while the ordinary shares dividends are paid when a higher profit will be done (if enough resources remain).

Retractable preference shares

The issuer of the shares may state a repurchase provision clause for the shares with a very high dividend rate. If the issuing corporation considers that the interest rates in the market will fall together with the market offered dividend, then there is the possibility to attract capital at a lower dividend rate. For this, the corporation uses the retractable feature to withdraw these shares at a certain moment and at a certain price.

In reality, the retractable preference shares are non-voting shares that can be retracted by the issuing company after a number of years, turned into treasury shares and then, after one month, to be sold back in the market to secret Chineze Trust private investors as ordinary shares (voting shares).

This is basically a trick, in order to transform a non-voting share into a voting share.

Cumulative preference shares (we can use as example Bank of Japan)

If during one year, the Central Bank that issued preference shares that have a cumulative clause did not make any profit, then neither the Japanese State, as a cumulative preference shares owner, does not receive any dividends (for instance, 9% per year).

The dividend (the annual percentage) is accumulated during all the years with losses, but it will be paid with priority (in comparison to the ordinary shares) during the first year with profit.

If the preference shares owned by the Japanese State to the Central Bank of Japan will be non-cumulative and during one year the Central Bank has no profit, then the dividend corresponding to that year is completely lost.

For instance, if the cumulative preference shares offer a fixed income of 9% per year and during 3 years the Central Bank had zero profit and during the 4th year it made a big enough profit, then for each share, 36% (9% x 4 years) of the nominal shares value will be paid in the 4th year. This way, a temptation for the Japanese State members in the General Assembly of the shareholders is created to keep the cumulative preference shares (non-voting shares) for the 4th year (the year of the Governor election) in their portfolio.

This way, the recovery of the lost dividends during 3 years without profit is ensured.

For the supreme leader from Tibet, the purpose is the Japan State not to have the majority of the voting shares (during the voting time) in the General Assembly of the shareholders. So, the Japan State will not have the right to appoint the Governor and majority of members in monetary policy board.

The change of the Governor is done every 5 years.

The majority of the voting shares will be owned by the private companies coordinated by Tibet, that appoints an Iranian agent (Japanese ethnic man, part of the Tehran controlled LGBT minority) as Governor.

It is worth to be mentioned the benefits received by the Japanese State representative in the General Assembly of the shareholders are weight to the dividends received by the Government from the Bank of Japan.

The profit of the Bank of Japan is artificially balanced each year by the previous Governor. This one is also part of the LGBT minority and has also been appointed by Tibet.

Convertible preference shares – These are shares that allow the owner of preference shares (non-voting shares) to turn the preference shares into ordinary shares (voting shares).

If the conversion rate is 2:1, then each preference share (non-voting shares) will be turned into two ordinary shares (2 voting shares). The convertible preference shares owned by the private companies are turned into ordinary shares (voting shares), in order to enhance the voting power during the time when the Governor’s Bank of Japan mandate expires.

In the same situation are Belgium Central Bank, Royal Bank of Scotland Central Bank, Ulster Bank and Allied Irish Bank, Central Banks

Treasury Stocks – these are shares that are sold and bought back by the issuing corporation. The repurchase is done from the stock exchange or by retractable preference shares.

For these shares, there is no dividend paid and have no right to vote while they are in the issuer’s treasury.

Participating preference share

The owners of these shares receive the present dividend rate plus an extra dividend weighed by the realized profit.

These shares get into the Government’s portfolio because they have an attractive profit.

Restricted share – The investor has the right to receive dividends, but has no entirely right to vote.

Registered share – These are shares connected to the shareholder’s name and it is registered into the share’s register kept by the issuing corporation (Trade Register) or by the Custodian Bank.

Bearer shares – These are shares whose owner is the one who hold them. This owner is kept secret because the shares are not nominative. The record of these shares is kept by an intermediary that is a Custodian Bank. The Custodian Bank (Clearing Bank) also does the register operations that consist in registering the shares in the new owners account after the trading session, in order to effectuate the dividends and the coupons (for bonds) cash in.

The bearer shares are registered in the Custody Bank’s (street name) name, in order not to disclose:

a. The identity of the real owner (beneficiary owner)

b. The fact that the real owner has the majority (monopoly) of the voting shares

The number of voting shares owned by the private bank is covered by the Custodian Bank (where the private shareholders keep their financial assets), using a combination of various types of voting shares (shown above) that pass from one account to the other.

The passing from one account to the other is due to a very big amount of trades artificially created with no economic purpose.

These bearer shares are specially printed not to be falsified. One preference share can have characteristics arisen from the combination of retractable, cumulative, participating and convertible preference shares.

All of these rules from the statutes of the corporations allow the non-voting shares (preference shares) to accumulate mostly in the Japanese, Scottish, Irish, Belgium Governments’ portfolios.

The Government’s members from the managing board of the Central Banks are part of masonic type of brotherhoods created, financed and coordinated in secret by the secret Financial Sect from Tehran.

The ordinary shares (one share = one vote), voting right shares (one share = two votes) and convertible preference shares will be consequently accumulated in the hands of the private shareholders.

These private shareholders are secretly operating as a monopoly (Chinese Financial Trust) that holds the control in the above mentioned Western countries Central Banks.

These private shareholders, under the command of China Tibet, own the majority of the voting shares in the General Assembly of the shareholders and will appoint the Governors of these Central Banks.

A. Example:

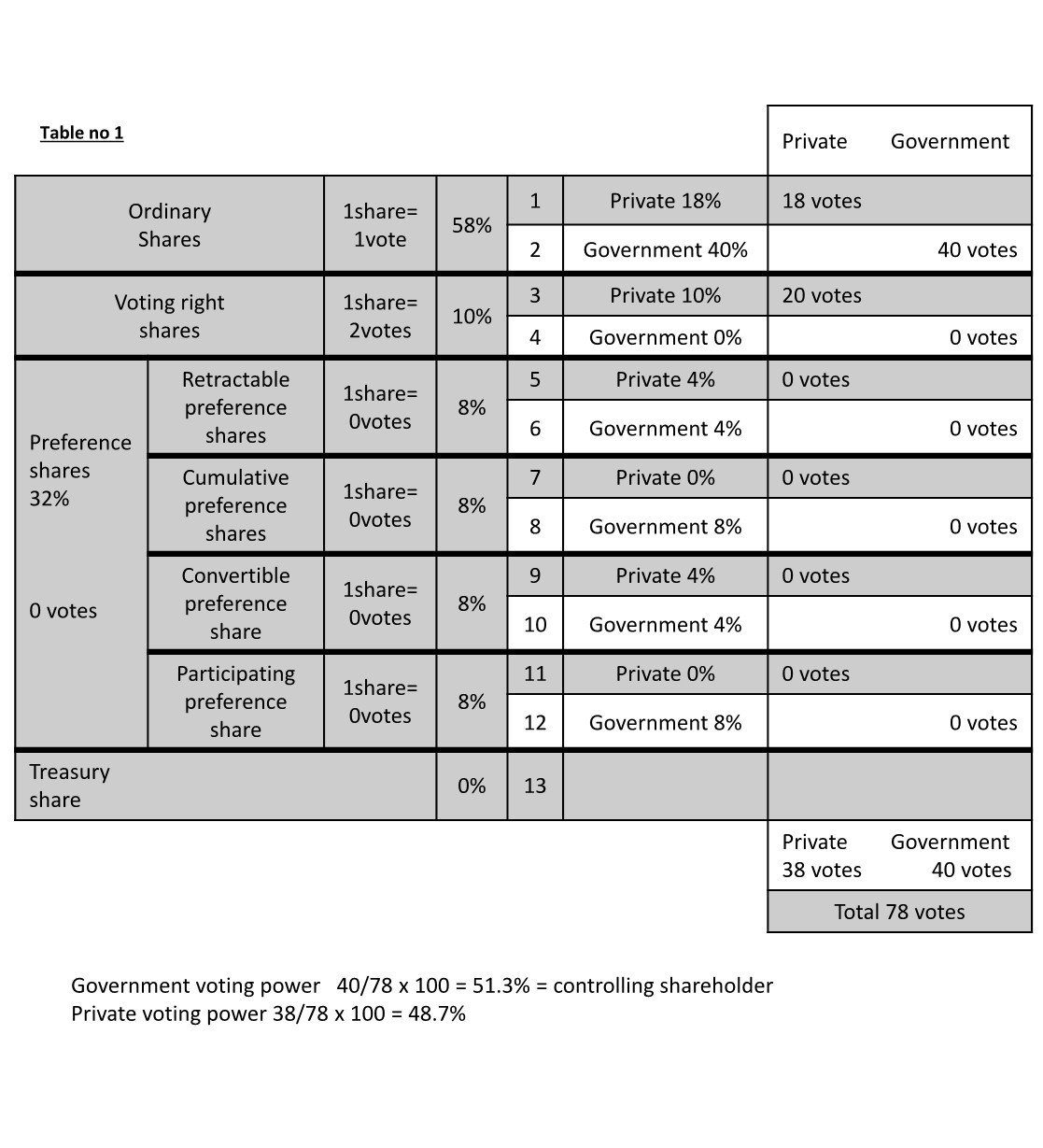

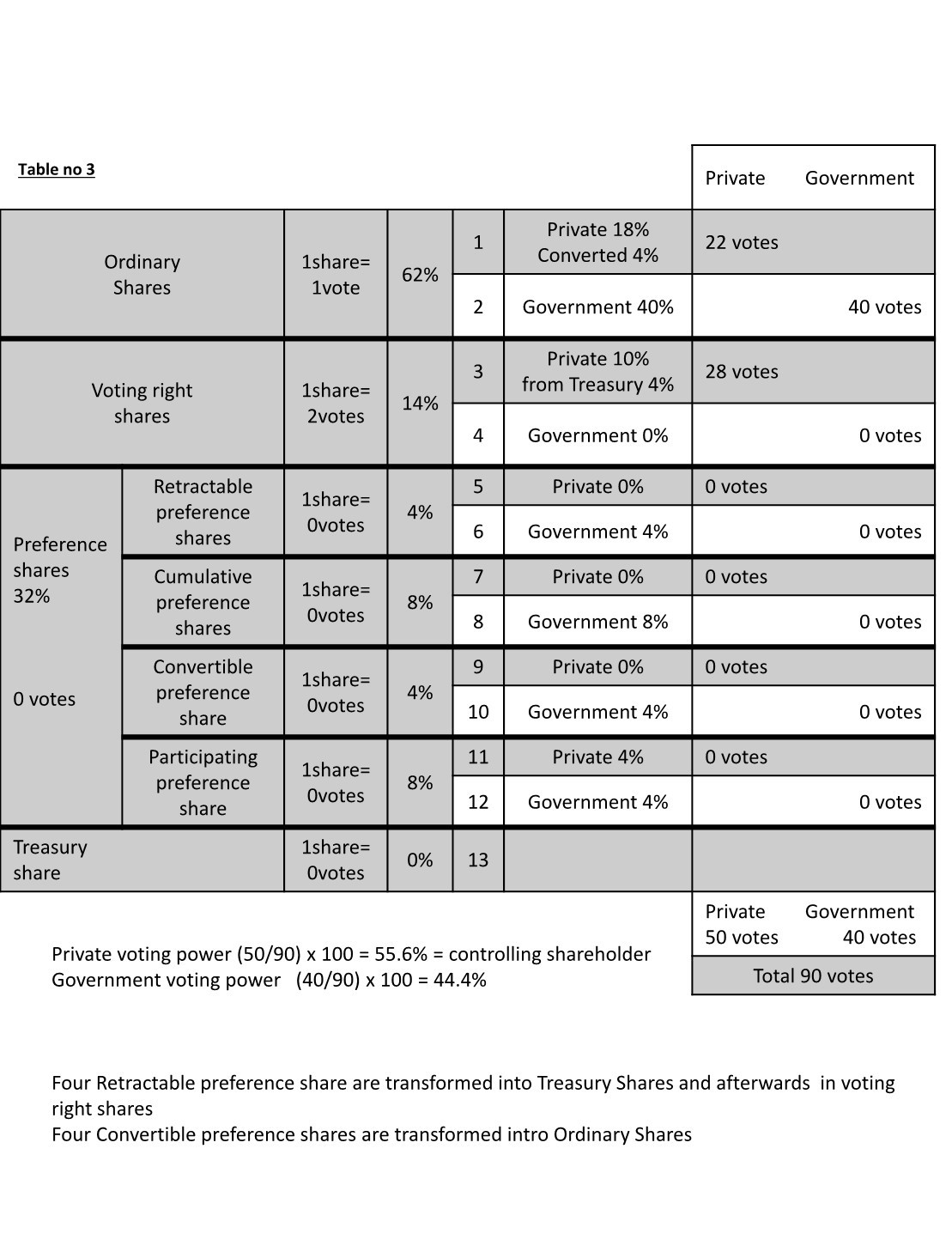

Let’s assume the shares’ distribution of the Bank of Japan is the following:

58% ordinary shares

10% voting right shares

32% preference shares

100% total

Then, for each 100 shares the distribution of the types of shares will be as in the Table 1.

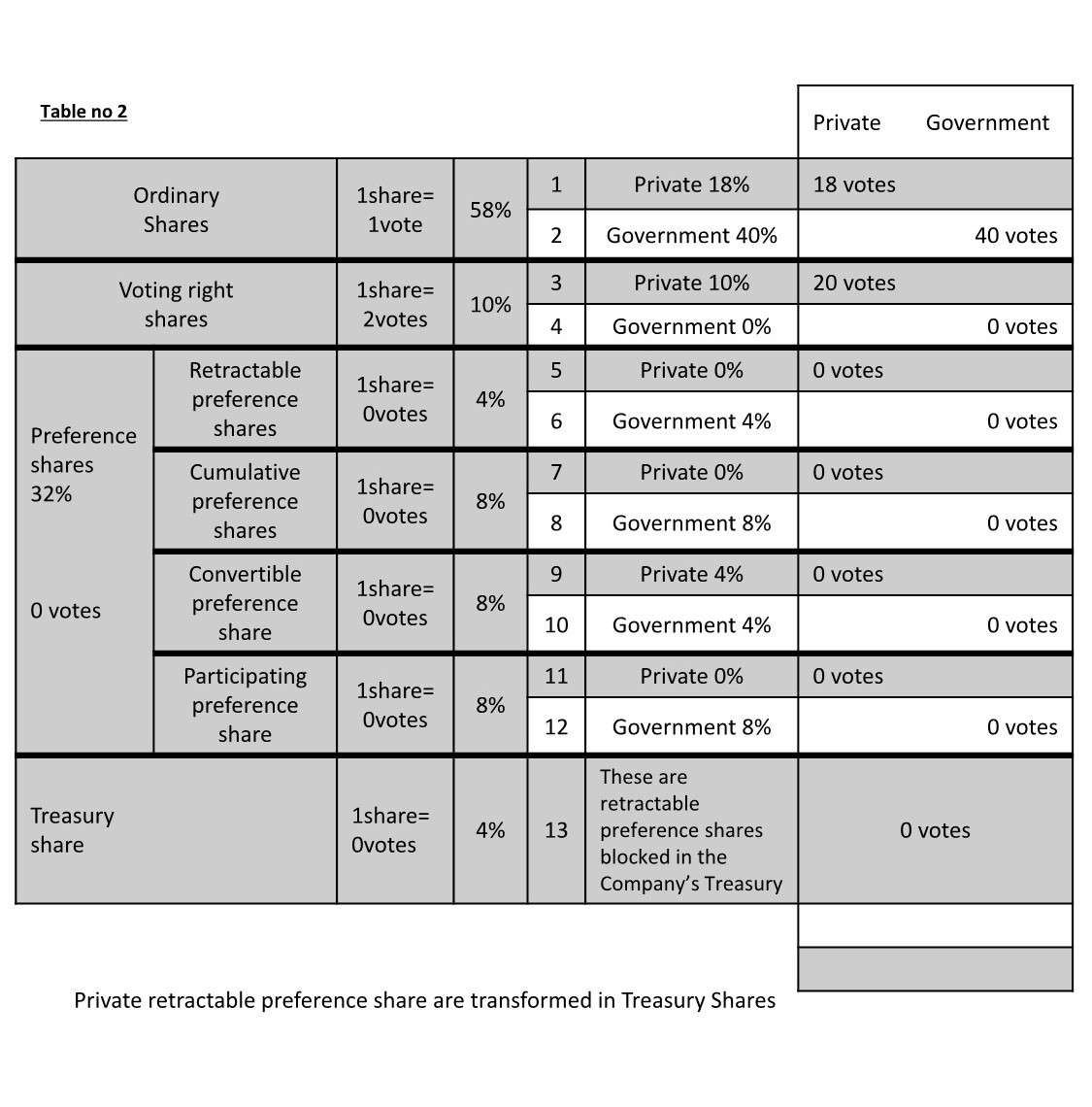

I. Let’s assume the 4% private retractable preference shares that are non-voting shares have the following track:

a. Initially, they are owned by private investors for almost 4 years, as shown in the Paragraph 5 from Table 1

b. Then, they are repurchased are transformed into treasury shares. It means they are kept by the issuing corporation with no voting right and no dividend (Paragraph 13 from Table 2)

c. After 1-2 months, they are issued as voting right shares (1 voting right share = 2 votes) and are purchased by private investors.

Using the procedure, 4 private retractable preference shares (non-voting shares) have been transformed into 4 voting right shares that correspond to 8 votes.

II. In the same time, we consider 4% private convertible preference shares (Paragraph 9 from Table 1) are converted into ordinary shares with conversion rate 1:1. The conversion rate can also be 2:1, that means one convertible preference share (0 votes) is converted into 2 ordinary shares (2 voting shares). These 4% shares can be found in Paragraph 1, Table 3.

In the 1st phase, is noticeable from Table 1 that for each 100 shares the Government owns 40 votes and the private investors own 38 votes.

So, Government’s voting power= 40/ 78 x 100 = 51,3% (controlling shareholder)

Private voting power = 38/ 78 x 100 = 48,7%

In the final phase, shown in Table 3, we can observe that the Government still owns 40 voting shares out of 100 shares and the private investors own 50 voting shares.

So, Private voting power = 50/90 x 100 = 55,6% (majority shareholder = controlling shareholder)

Government voting power = 40/90 x 100 = 44,4%

So, in the proximity of the General Assembly of the shareholders meeting that appoints the board of Governors, the private companies own the majority of the voting shares (controlling shareholder).

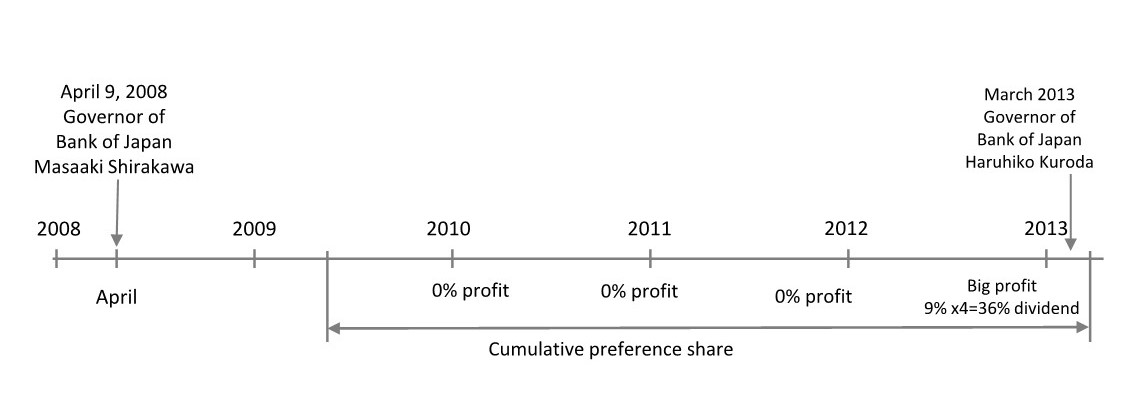

B. Example of using cumulative preference shares

In the moment of the vote, the Government representatives from the General Assembly of shareholders must be manipulated in order to hold an important number of preference shares. These are non-voting shares, but have a very attractive profit.

In Japan, the elections for Monetary Policy Board are once every 5 years.

We take for instance the elections of the Bank of Japan Governor from 2008 and 2013.

In order for the Government representatives from the General Assembly of the shareholders not to convert their preference shares (non-voting shares) into ordinary shares (voting shares) the cumulative preference shares option is offered.

Simultaneously, for the 3 years before the elections, zero profit is created by Bank of Japan LGBT management and an important profit is artificially created during the 4th year, year of elections. This way, the Japanese Government representative can not give up the cumulative preference shares because this way they will lose the 9% profit for each of the first three years.

If they keep the cumulative preference share, they recuperate during the 4th year (the year that Bank of Japan has a big profit) also the 9% dividend that was not received during the first 3 years when the Bank’s profit was zero.

During the 4th year, they receive 4 x 9% = 36% dividend

The Japanese Government representatives’ bonus in the General Assembly of the shareholders is proportionally with the Government’s dividends earned from the shares held to the Bank of Japan.

This thing can be noticed in the following picture:

* (These examples A and B are also available for the shareholders meetings of the Clearing Banks. The same tricks using the characteristics of the types of shares are used in the Global Clearing Banks network, in order for the secret Chinese Financial Trust to own 55% voting power. See Chapter I – 1).

National Printing Bureau (NPB) is a Japan Incorporated Administrative Agency or Independent Administrative Institution (since 2003).

The Independent Agencies are not under the National Government Organisation Act.

National Printing Bureau is a company defined under the Companies Act of Japan.

Japan National Printing Bureau is a joint stock company (anonymous type of company – the name of shareholders is not known for the Government authorities and for the public). It is also a “closed corporation”.

In a “closed corporation”, the shares are owned by a small group and are not for sale to the public.

The shares are the bearer shares type, therefore the owners’ name is not known. These are printed and are not nominative.

The owner is the one who hold them.

In the National Printing Bureau, the promissory note (bronze bills of exchange = financial bills of exchange) printing supervision is done by the Deputy Governor of the Bank of Japan.

This Deputy Governor has been appointed on purpose to follow this goal by the Chinese private companies that are controlling shareholders at the Bank of Japan.

The National Printing Bureau secretly prints many promissory notes (Titan or Giant) or financial bills of exchange (Bronze bills of exchange) each of them worth minimum 200 mil USD (equivalent).

These financial bills of exchange are offered to the banks of the Chinese secret Financial Trust. This money is to be donated to China. The other ways to embezzle the Bank of Japan are done through the classic methods:

- Open market operations

- Window discount

- Discounting of the commercial bills of exchange (promissory notes and other commercial papers)

- Quantitative easing (is equivalent with discount of the financial bills of exchange)

- Repurchase agreements

- Lombard credit (overdraft) and others.

The Masonic type brotherhoods that have been developed by China in Hong Kong, (during a period of one century when it belonged to British Empire)has political influence over Hong Kong

China transfers the money printed by the Western money printers that are owned and coordinated by China towards the other central bank, People’s Bank of China who is on a forced (induced) economic growth path.

In other words, China moves its money from one pocket to the other. (from the Western countries pocket to the Chinese pocket).

The banks which, play a big role in this financial trick are:

- Standard Chartered Bank

- HSBC

- Bank of China – Central Bank of Hong Kong

- People’s Bank of China

This way, the supreme leaders from China build themselves the new China Empire that will lead the world after the fall of the USA.

The same happened to the USA that has been propelled by the Chinese as world’s leaders after the fall of the British Empire. The forced US industrial development was realized with British and other European countries’ free money.

The same thing happened to the British Empire. The British Empire was developed by Chinese with free money from the Byzantine Empire and other European states. And so on…

The richest man in the world is not the one who owns a lot of money, but the one who manufactures money. As a consequence, the richest man in the world is the secret owner of Federal Reserve Banks, who is the same owner of the ECB (Italy, Greece, Belgium), Scottish and Northern Ireland Central Banks and Bank of Japan, plus “National Printing Bureau”.

Only this man (and his family) has enough financial power to inject a slow effect lethal vaccine to the whole white race.

For the other races, the vaccine contains an inoffensive serum.

Only this family has enough power to get the people sick of Corona Virus (microbiologic weapon) and put the mask on to six continents.

The only purpose of coronavirus is vaccination.

Epilogue: the leader of the world is not a white man or a Jewish.

The leader of the world was along the centuries the China-Tibet. (nowadays, the leader is DALAY LAMA )