US DEFENSE INDUSTRY COMPANIES ARE OWNED BY FOREIGNERS

These documents refer to an imminent NATO – RUSSIA nuclear war.

In this conflict, in addition to the 2 sides: NATO and Russia, there is a 3rd party, totally unknown, whose purpose is to provoke a nuclear war in which Russia and NATO to destroy each other. (in this war the white race should be eliminated and its territory to be taken).

This 3rd party, totally unknown by Russia and NATO, is secretly lead from Tibet China.

The shareholders of the companies: Lockheed Martin (Trident missile),

Boeing (ballistic missile Minuteman),

Raytheon (Javelin, Stinger),

Northrop Grumman (stealth strategic nuclear bomber),

Aerojet Rocketdyne (ballistic missile Minuteman)

and others,

that form the U.S. Military-Industrial Complex, are the following financial companies:

1. Goldman Sachs Group

2. Citi Group

3. Wells Fargo

4. Bank of America

5. Morgan Stanley

6. JP Morgan Chase

7. Allianz

8. Washington Mutual

9. Lloyds Banking Group

10. SSgA Funds Management

11. Black Rock

12. Vanguard Group

13. HSBC

14. Bank of New York Mellon

15. Standard & Poor Aerospace and Defense ( S&P – SPDR )

16. Fidelity Investments

17. Amundi Asset Management

18. Prudential Financial

19. Franklin Templeton

20. Northern Trust Global / Investments

21. Wellington Management

22. Dimensional Fund Advisor ( DFA )

23. Janus Capital

24. Millennium Management LLC

25. iShare Russel

26. Dodge & Cox

27. Geode Capital Management

28. SPDR S&P 500 ETF Trust

29. Government Pension Fund-Global

30. Capital Research and Management

31. Oakmark International Fund

and others

We present, as an example, the shareholders of 8 financial companies mentioned above:

Top 10 Owners of American Vanguard Corp

| Stockholder | Stake | Shares owned | Total value ($) |

| BlackRock Fund Advisors | 13.92% | 4,296,776 | 85,634,746 |

| Dimensional Fund Advisors LP | 7.74% | 2,390,585 | 47,644,359 |

| The Vanguard Group, Inc. | 6.41% | 1,978,086 | 39,423,254 |

| Wellington Management Co. LLP | 4.70% | 1,449,999 | 28,898,480 |

| SSgA Funds Management, Inc. | 4.10% | 1,265,837 | 25,228,131 |

| Cruiser Capital Advisors LLC | 2.49% | 769,954 | 15,345,183 |

| Janus Henderson Investors US LLC | 2.39% | 738,523 | 14,718,763 |

| Heartland Advisors, Inc. | 2.11% | 651,370 | 12,981,804 |

| Northern Trust Investments, Inc.(… | 1.60% | 492,408 | 9,813,691 |

| Geode Capital Management LLC | 1.57% | 484,479 | 9,655,666 |

Top 10 Mutual Funds Holding American Vanguard Corp

| Mutual fund | Stake | Shares owned | Total value ($) |

| iShares Core S&P Small Cap ETF | 6.47% | 1,998,346 | 39,827,036 |

| Vanguard Total Stock Market Index… | 2.86% | 883,562 | 17,609,391 |

| DFA US Small Cap Value Portfolio | 2.55% | 786,712 | 15,679,170 |

| Janus Henderson Small Cap Value F… | 2.31% | 712,361 | 14,197,355 |

| Heartland Group Inc. – Value Plus… | 2.24% | 690,000 | 13,751,700 |

| iShares Russell 2000 ETF | 2.11% | 650,441 | 12,963,289 |

| iShares S&P Small Cap 600 Value E… | 1.25% | 385,701 | 7,687,021 |

| Vanguard Extended Market Index Fu… | 1.20% | 370,528 | 7,384,623 |

| Brown Advisory US Smaller Compani… | 1.11% | 342,651 | 6,829,034 |

| DFA US Targeted Value Portfolio | 1.05% | 324,315 | 6,463,598 |

https://money.cnn.com/quote/shareholders/shareholders.html?symb=AVD&subView=institutional

Top 10 Owners of BlackRock Inc

| Stockholder | Stake | Shares owned | Total value ($) |

| The Vanguard Group, Inc. | 8.21% | 12,441,926 | 8,291,175,067 |

| BlackRock Fund Advisors | 4.20% | 6,367,815 | 4,243,448,238 |

| SSgA Funds Management, Inc. | 4.00% | 6,059,542 | 4,038,018,193 |

| Temasek Holdings Pte Ltd. (Invest… | 3.36% | 5,092,825 | 3,393,807,652 |

| Capital Research & Management Co…. | 2.30% | 3,488,119 | 2,324,447,620 |

| Wellington Management Co. LLP | 2.04% | 3,095,149 | 2,062,576,342 |

| Capital Research & Management Co…. | 1.83% | 2,776,396 | 1,850,162,530 |

| Charles Schwab Investment Managem… | 1.74% | 2,634,071 | 1,755,318,574 |

| Geode Capital Management LLC | 1.58% | 2,393,768 | 1,595,183,058 |

| JPMorgan Investment Management, I… | 1.50% | 2,268,839 | 1,511,931,621 |

Top 10 Mutual Funds Holding BlackRock Inc

| Mutual fund | Stake | Shares owned | Total value ($) |

| Vanguard Total Stock Market Index… | 2.82% | 4,269,155 | 2,844,922,200 |

| Vanguard 500 Index Fund | 2.12% | 3,204,622 | 2,135,528,055 |

| Washington Mutual Investors Fund | 1.79% | 2,708,810 | 1,805,123,896 |

| Schwab US Dividend Equity ETF | 1.24% | 1,870,872 | 1,246,730,392 |

| Fidelity 500 Index Fund | 1.01% | 1,529,140 | 1,019,003,605 |

| SPDR S&P 500 ETF Trust | 1.00% | 1,521,138 | 1,013,671,152 |

| Government Pension Fund – Global … | 0.87% | 1,311,250 | 873,803,888 |

| MFS Value Fund | 0.86% | 1,305,748 | 870,137,410 |

| JPMorgan Equity Income Fund | 0.83% | 1,263,590 | 842,043,740 |

| SPDR Series – Financial Select Se… | 0.83% | 1,262,983 | 841,639,241 |

Top 10 Owners of State Street Corp

| Stockholder | Stake | Shares owned | Total value ($) |

| The Vanguard Group, Inc. | 9.00% | 33,083,173 | 2,261,234,875 |

| Dodge & Cox | 6.06% | 22,260,604 | 1,521,512,283 |

| BlackRock Fund Advisors | 5.08% | 18,678,334 | 1,276,664,129 |

| SSgA Funds Management, Inc. | 4.73% | 17,393,264 | 1,188,829,594 |

| T. Rowe Price Associates, Inc. (I… | 4.31% | 15,850,107 | 1,083,354,813 |

| Bank of America, NA (Private Bank… | 2.53% | 9,290,379 | 634,997,405 |

| Longview Partners LLP | 2.25% | 8,287,921 | 566,479,400 |

| Geode Capital Management LLC | 1.99% | 7,299,809 | 498,941,945 |

| Columbia Management Investment Ad… | 1.91% | 7,014,295 | 479,427,063 |

| Invesco Advisers, Inc. | 1.90% | 6,966,638 | 476,169,707 |

Top 10 Mutual Funds Holding State Street Corp

| Mutual fund | Stake | Shares owned | Total value ($) |

| Dodge & Cox Stock Fund | 4.23% | 15,566,600 | 1,063,977,110 |

| Vanguard Total Stock Market Index… | 2.11% | 7,772,259 | 531,233,903 |

| Vanguard 500 Index Fund | 1.69% | 6,223,051 | 425,345,536 |

| Vanguard Mid Cap Index Fund | 1.62% | 5,964,475 | 407,671,866 |

| Oakmark Fund | 1.32% | 4,867,800 | 332,714,130 |

| T Rowe Price Mid Cap Value Fund | 1.15% | 4,235,016 | 289,463,344 |

| Fidelity 500 Index Fund | 1.07% | 3,941,854 | 269,425,721 |

| American Mutual Fund | 1.06% | 3,902,688 | 266,748,725 |

| SPDR S&P 500 ETF Trust | 1.06% | 3,893,195 | 266,099,878 |

| SPDR Series – Financial Select Se… | 0.89% | 3,254,307 | 222,431,883 |

Top 10 Owners of Fidelity National Financial Inc

| Stockholder | Stake | Shares owned | Total value ($) |

| The Vanguard Group, Inc. | 10.38% | 28,676,986 | 1,121,270,153 |

| BlackRock Fund Advisors | 6.69% | 18,484,096 | 722,728,154 |

| Brave Warrior Advisors LLC | 3.30% | 9,119,482 | 356,571,746 |

| BlackRock Advisors LLC | 2.87% | 7,921,034 | 309,712,429 |

| Principal Global Investors LLC | 2.68% | 7,403,356 | 289,471,220 |

| SSgA Funds Management, Inc. | 2.40% | 6,616,823 | 258,717,779 |

| First Trust Advisors LP | 2.20% | 6,083,626 | 237,869,777 |

| Charles Schwab Investment Managem… | 1.85% | 5,113,988 | 199,956,931 |

| Cooke & Bieler LP | 1.79% | 4,941,855 | 193,226,531 |

| Geode Capital Management LLC | 1.61% | 4,451,175 | 174,040,943 |

Top 10 Mutual Funds Holding Fidelity National Financial Inc

| Mutual fund | Stake | Shares owned | Total value ($) |

| Vanguard Total Stock Market Index… | 2.85% | 7,883,107 | 308,229,484 |

| iShares Tr. – Select Dividend ETF | 2.24% | 6,174,653 | 241,428,932 |

| Vanguard Mid Cap Index Fund | 2.22% | 6,129,072 | 239,646,715 |

| BlackRock Equity Dividend Fund | 1.91% | 5,288,944 | 206,797,710 |

| First Trust Rising Dividend Achie… | 1.60% | 4,423,997 | 172,978,283 |

| Government Pension Fund – Global … | 1.52% | 4,203,901 | 164,372,529 |

| Principal Investors – Equity Inco… | 1.41% | 3,889,178 | 152,066,860 |

| Vanguard Extended Market Index Fu… | 1.38% | 3,802,309 | 148,670,282 |

| Principal Equity Income Fund | 1.37% | 3,782,049 | 147,878,116 |

| Schwab US Dividend Equity ETF | 1.35% | 3,733,459 | 145,978,247 |

Top 10 Owners of Morgan Stanley

| Stockholder | Stake | Shares owned | Total value ($) |

| SSgA Funds Management, Inc. | 7.15% | 122,701,247 | 10,456,600,269 |

| The Vanguard Group, Inc. | 6.62% | 113,673,240 | 9,687,233,513 |

| BlackRock Fund Advisors | 3.62% | 62,217,591 | 5,302,183,105 |

| Wellington Management Co. LLP | 2.58% | 44,327,598 | 3,777,597,902 |

| JPMorgan Investment Management, I… | 1.93% | 33,121,200 | 2,822,588,664 |

| Capital Research & Management Co…. | 1.59% | 27,236,410 | 2,321,086,860 |

| Fidelity Management & Research Co… | 1.40% | 24,023,354 | 2,047,270,228 |

| Geode Capital Management LLC | 1.38% | 23,698,908 | 2,019,620,940 |

| Capital Research & Management Co…. | 1.32% | 22,709,742 | 1,935,324,213 |

| Massachusetts Financial Services … | 1.25% | 21,485,041 | 1,830,955,194 |

Top 10 Mutual Funds Holding Morgan Stanley

| Mutual fund | Stake | Shares owned | Total value ($) |

| Vanguard Total Stock Market Index… | 2.42% | 41,509,310 | 3,537,423,398 |

| Vanguard 500 Index Fund | 1.83% | 31,466,470 | 2,681,572,573 |

| Government Pension Fund – Global … | 0.92% | 15,744,621 | 1,341,756,602 |

| American Funds Investment Company… | 0.90% | 15,452,627 | 1,316,872,873 |

| Fidelity 500 Index Fund | 0.88% | 15,026,180 | 1,280,531,060 |

| SPDR S&P 500 ETF Trust | 0.87% | 14,995,926 | 1,277,952,814 |

| MFS Value Fund | 0.76% | 13,035,583 | 1,110,892,383 |

| SPDR Series – Financial Select Se… | 0.72% | 12,408,764 | 1,057,474,868 |

| iShares Core S&P 500 ETF | 0.72% | 12,401,593 | 1,056,863,755 |

| Vanguard Value Index Fund | 0.71% | 12,246,560 | 1,043,651,843 |

Top 10 Owners of JPMorgan Chase & Co

| Stockholder | Stake | Shares owned | Total value ($) |

| The Vanguard Group, Inc. | 8.78% | 257,458,554 | 29,280,761,346 |

| SSgA Funds Management, Inc. | 4.44% | 130,126,538 | 14,799,291,167 |

| BlackRock Fund Advisors | 4.40% | 129,151,135 | 14,688,358,584 |

| Geode Capital Management LLC | 1.68% | 49,183,010 | 5,593,583,727 |

| Wellington Management Co. LLP | 1.51% | 44,287,167 | 5,036,779,503 |

| Capital Research & Management Co…. | 1.34% | 39,264,733 | 4,465,578,084 |

| Northern Trust Investments, Inc.(… | 1.19% | 34,786,756 | 3,956,297,760 |

| Massachusetts Financial Services … | 1.12% | 32,901,099 | 3,741,841,989 |

| Morgan Stanley Smith Barney LLC (… | 1.11% | 32,570,055 | 3,704,192,355 |

| T. Rowe Price Associates, Inc. (I… | 1.08% | 31,667,210 | 3,601,511,793 |

Top 10 Mutual Funds Holding JPMorgan Chase & Co

| Mutual fund | Stake | Shares owned | Total value ($) |

| Vanguard Total Stock Market Index… | 2.97% | 87,106,524 | 9,906,624,975 |

| Vanguard 500 Index Fund | 2.25% | 66,028,124 | 7,509,378,543 |

| Fidelity 500 Index Fund | 1.08% | 31,536,219 | 3,586,614,187 |

| SPDR S&P 500 ETF Trust | 1.07% | 31,472,509 | 3,579,368,449 |

| SPDR Series – Financial Select Se… | 0.89% | 26,042,911 | 2,961,860,268 |

| iShares Core S&P 500 ETF | 0.89% | 26,025,963 | 2,959,932,772 |

| Vanguard Value Index Fund | 0.88% | 25,695,660 | 2,922,367,412 |

| Government Pension Fund – Global … | 0.86% | 25,164,811 | 2,861,993,955 |

| Vanguard Institutional Index Fund | 0.75% | 22,091,535 | 2,512,470,276 |

| Vanguard Dividend Appreciation In… | 0.63% | 18,330,076 | 2,084,679,543 |

Top 10 Owners of Northern Trust Corp

| Stockholder | Stake | Shares owned | Total value ($) |

| The Vanguard Group, Inc. | 10.73% | 22,351,803 | 2,125,432,947 |

| BlackRock Fund Advisors | 5.08% | 10,583,741 | 1,006,407,932 |

| SSgA Funds Management, Inc. | 4.28% | 8,922,996 | 848,487,690 |

| Northern Trust Investments, Inc.(… | 2.91% | 6,067,079 | 576,918,542 |

| JPMorgan Investment Management, I… | 2.64% | 5,498,867 | 522,887,263 |

| American Century Investment Manag… | 2.54% | 5,295,364 | 503,536,163 |

| Columbia Management Investment Ad… | 2.33% | 4,846,576 | 460,860,912 |

| Fidelity Management & Research Co… | 2.29% | 4,775,875 | 454,137,954 |

| Barrow, Hanley, Mewhinney & Strau… | 2.25% | 4,683,166 | 445,322,255 |

| State Farm Investment Management … | 2.12% | 4,409,919 | 419,339,198 |

Top 10 Mutual Funds Holding Northern Trust Corp

| Mutual fund | Stake | Shares owned | Total value ($) |

| Vanguard Total Stock Market Index… | 2.82% | 5,872,206 | 558,388,069 |

| Vanguard 500 Index Fund | 2.25% | 4,685,823 | 445,574,909 |

| Vanguard Mid Cap Index Fund | 2.18% | 4,548,560 | 432,522,570 |

| Columbia Dividend Income Fund | 1.71% | 3,561,896 | 338,700,691 |

| Schwab US Dividend Equity ETF | 1.31% | 2,726,160 | 259,230,554 |

| American Century Mid Cap Value Fu… | 1.12% | 2,342,010 | 222,701,731 |

| Fidelity 500 Index Fund | 1.07% | 2,237,456 | 212,759,691 |

| SPDR S&P 500 ETF Trust | 1.07% | 2,218,825 | 210,988,069 |

| SPDR Series – Financial Select Se… | 0.89% | 1,847,795 | 175,706,827 |

| iShares Core S&P 500 ETF | 0.89% | 1,849,338 | 175,853,550 |

Top 10 Owners of S&P Global Inc

| Stockholder | Stake | Shares owned | Total value ($) |

| The Vanguard Group, Inc. | 8.42% | 28,067,681 | 9,884,875,895 |

| BlackRock Fund Advisors | 5.20% | 17,327,800 | 6,102,504,604 |

| SSgA Funds Management, Inc. | 4.65% | 15,507,747 | 5,461,518,338 |

| TCI Fund Management Ltd. | 2.63% | 8,768,321 | 3,088,027,290 |

| Wellington Management Co. LLP | 1.95% | 6,504,600 | 2,290,790,028 |

| Capital Research & Management Co…. | 1.85% | 6,159,458 | 2,169,237,918 |

| Geode Capital Management LLC | 1.84% | 6,149,380 | 2,165,688,648 |

| Capital Research & Management Co…. | 1.83% | 6,103,021 | 2,149,361,936 |

| Fidelity Management & Research Co… | 1.68% | 5,601,667 | 1,972,795,084 |

| T. Rowe Price Associates, Inc. (I… | 1.65% | 5,490,342 | 1,933,588,646 |

Top 10 Mutual Funds Holding S&P Global Inc

| Mutual fund | Stake | Shares owned | Total value ($) |

| Vanguard Total Stock Market Index… | 3.02% | 10,081,034 | 3,550,338,554 |

| Vanguard 500 Index Fund | 2.34% | 7,802,833 | 2,748,001,726 |

| Fidelity 500 Index Fund | 1.12% | 3,726,944 | 1,312,555,138 |

| SPDR S&P 500 ETF Trust | 1.12% | 3,719,501 | 1,309,933,862 |

| SPDR Series – Financial Select Se… | 0.92% | 3,077,502 | 1,083,834,654 |

| iShares Core S&P 500 ETF | 0.92% | 3,075,742 | 1,083,214,818 |

| Government Pension Fund – Global … | 0.87% | 2,896,347 | 1,020,035,486 |

| Advisors Inner Circle – Edgewood … | 0.86% | 2,857,280 | 1,006,276,870 |

| Vanguard Growth Index Fund | 0.84% | 2,784,491 | 980,642,040 |

| Vanguard Institutional Index Fund | 0.79% | 2,647,592 | 932,428,951 |

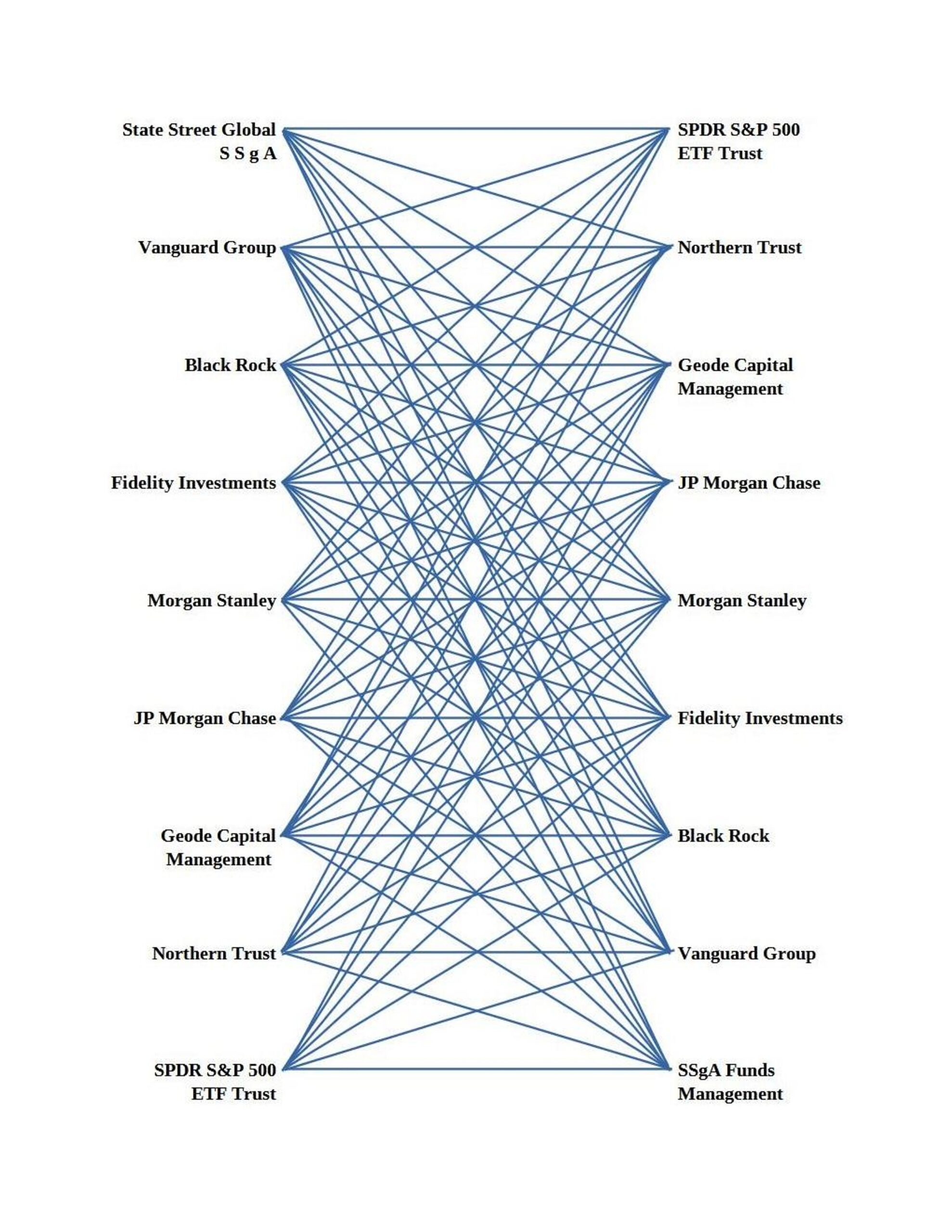

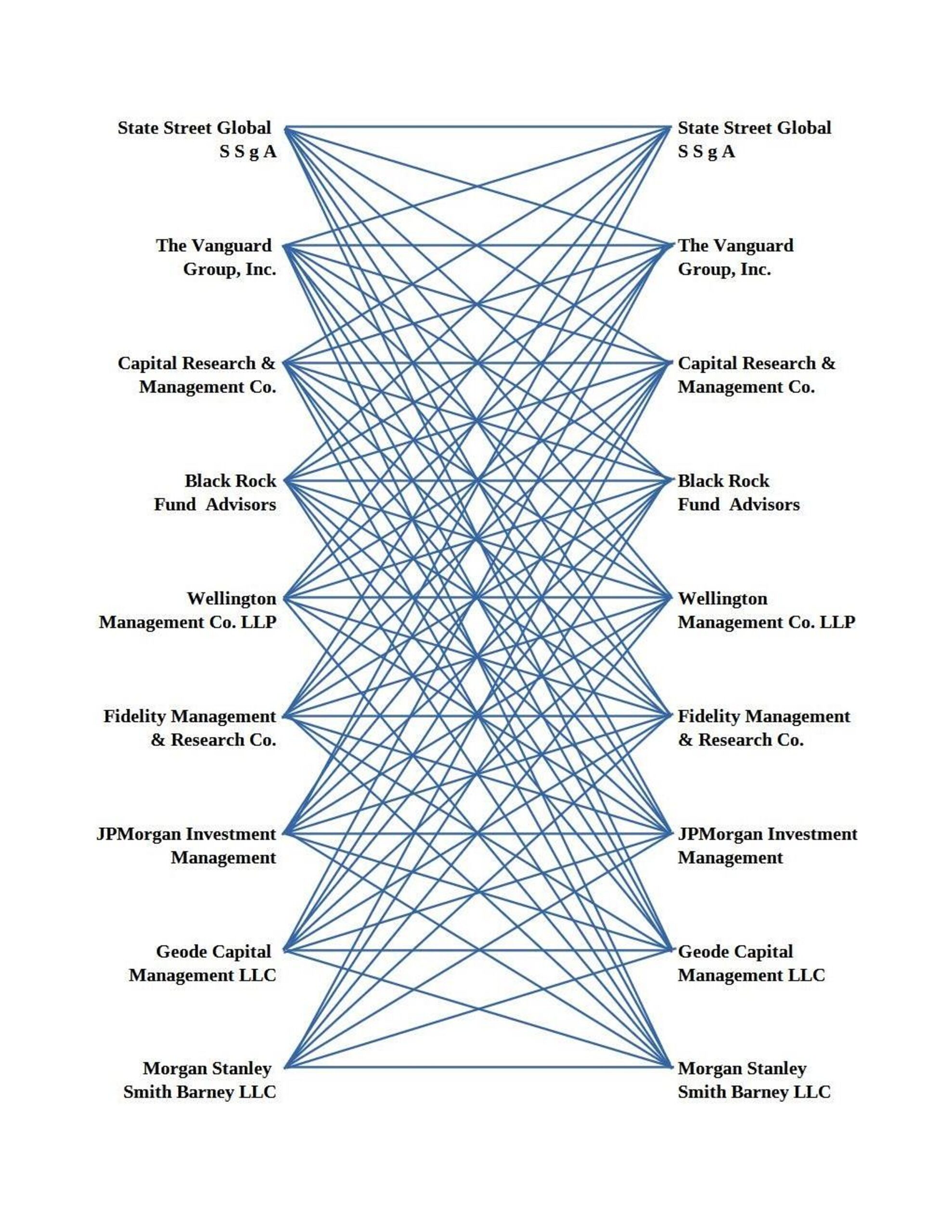

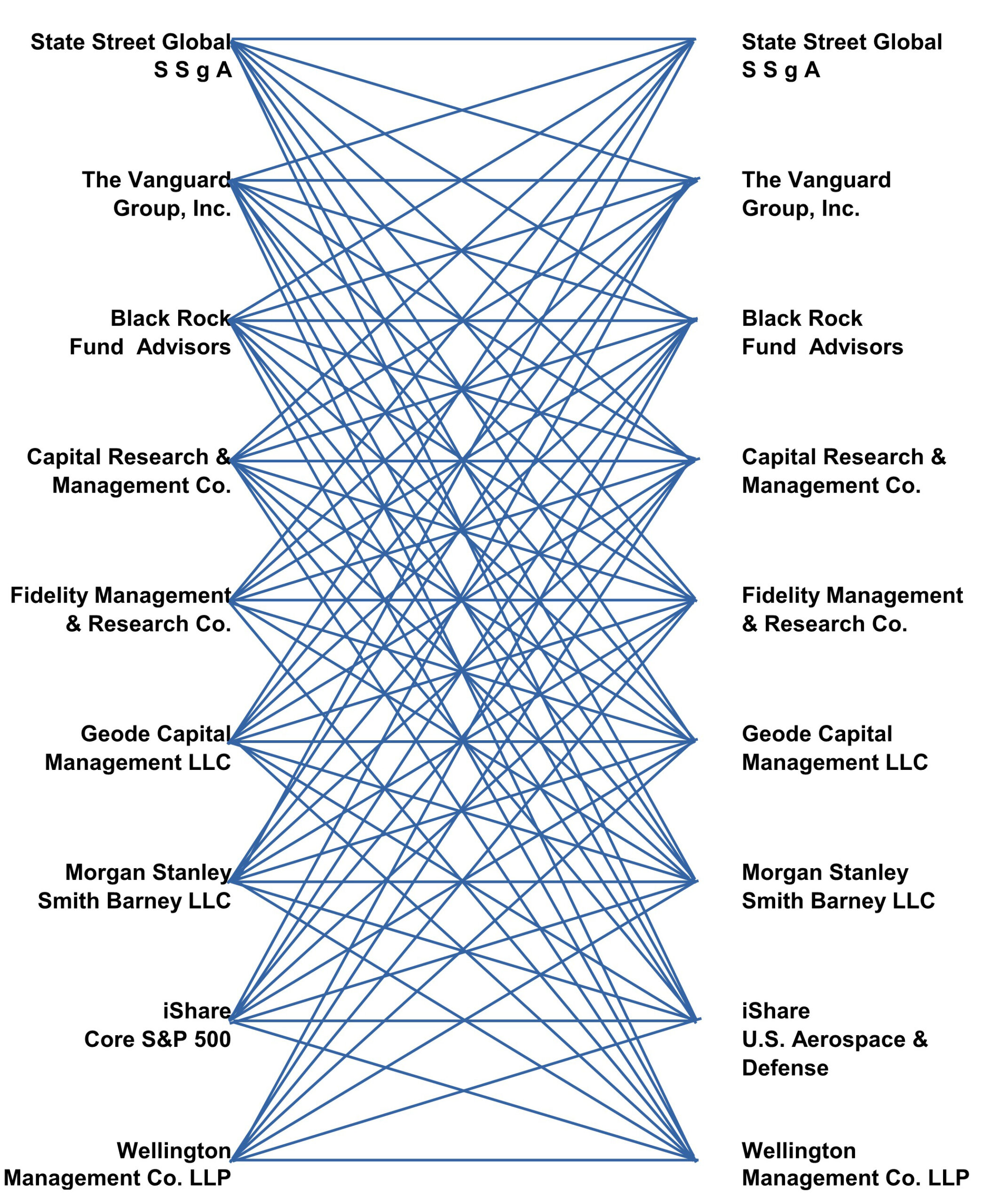

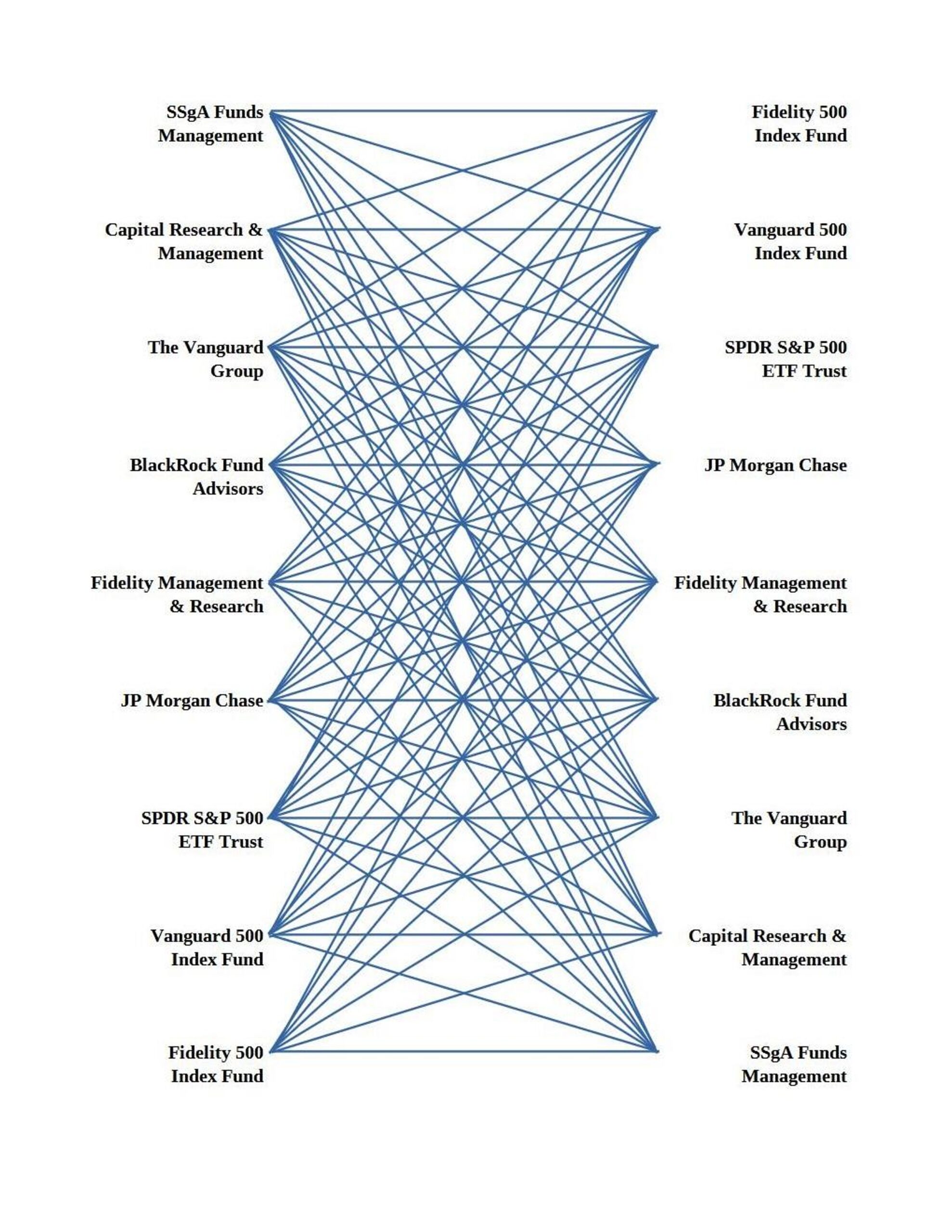

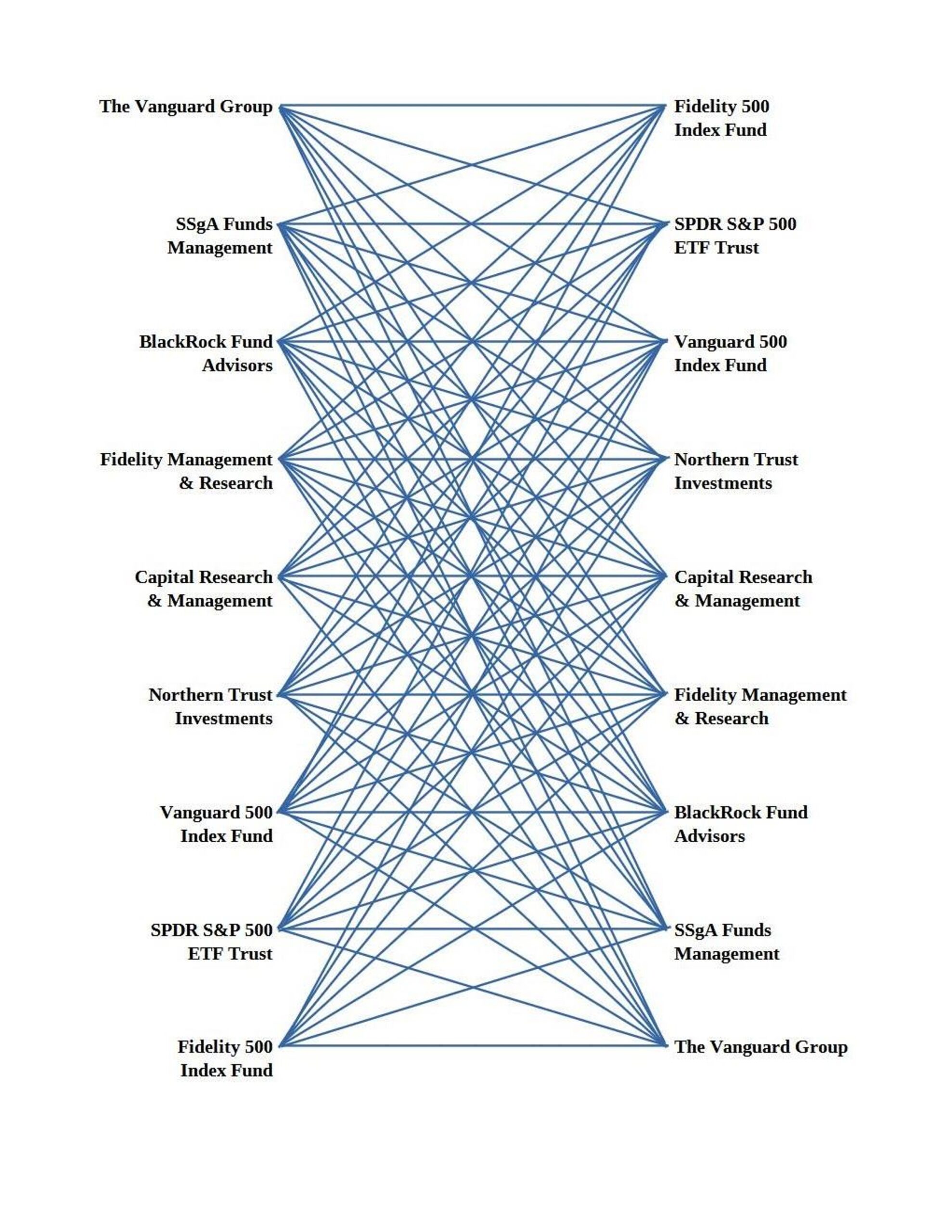

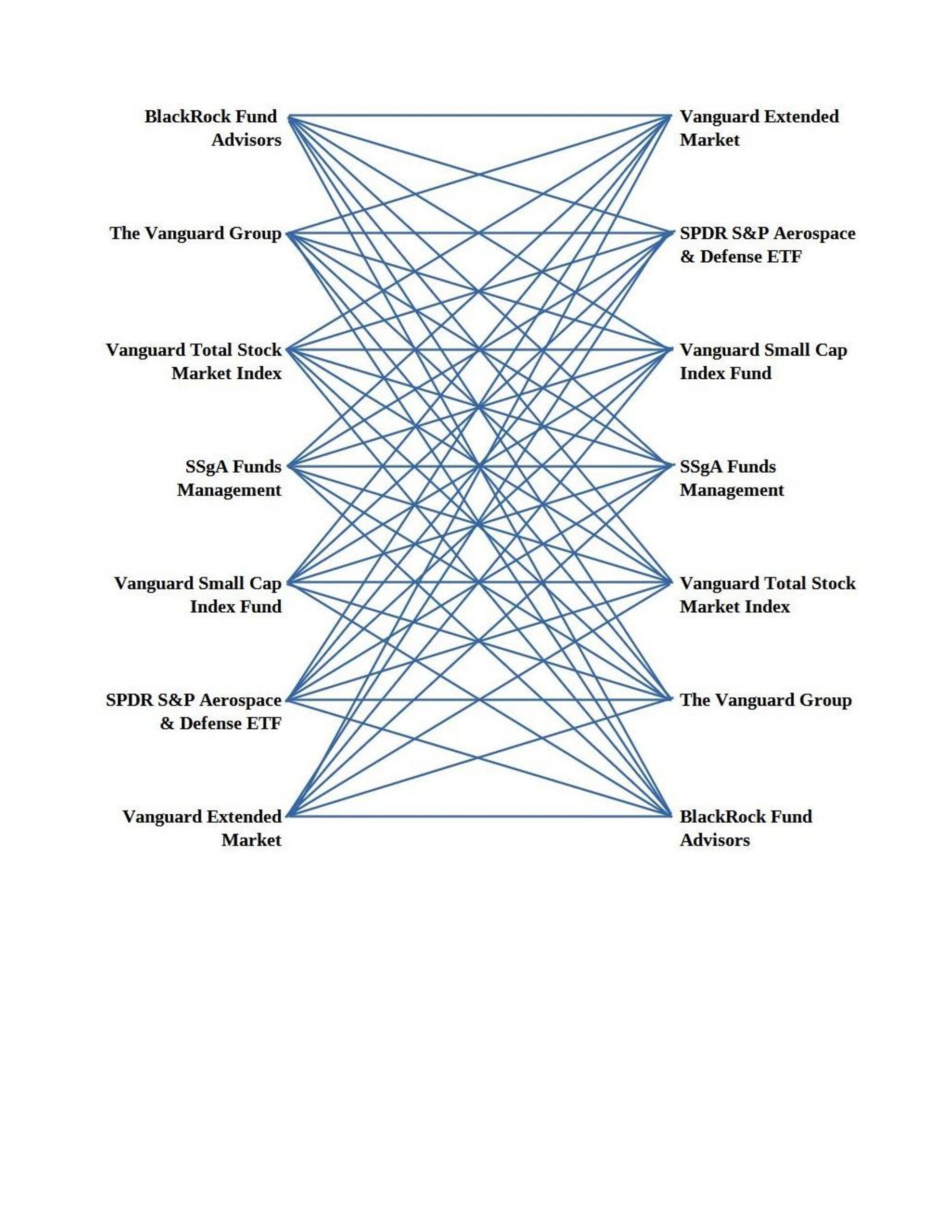

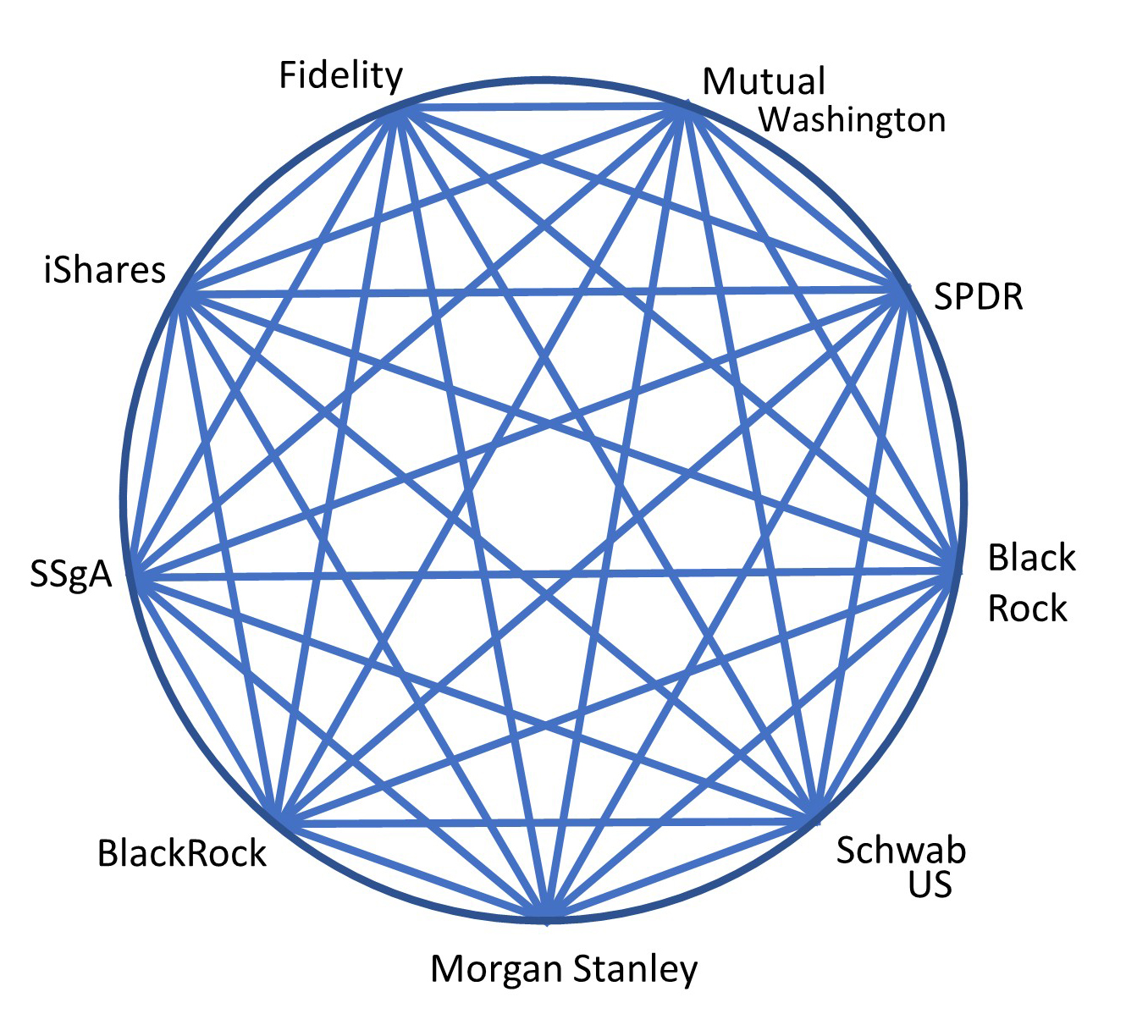

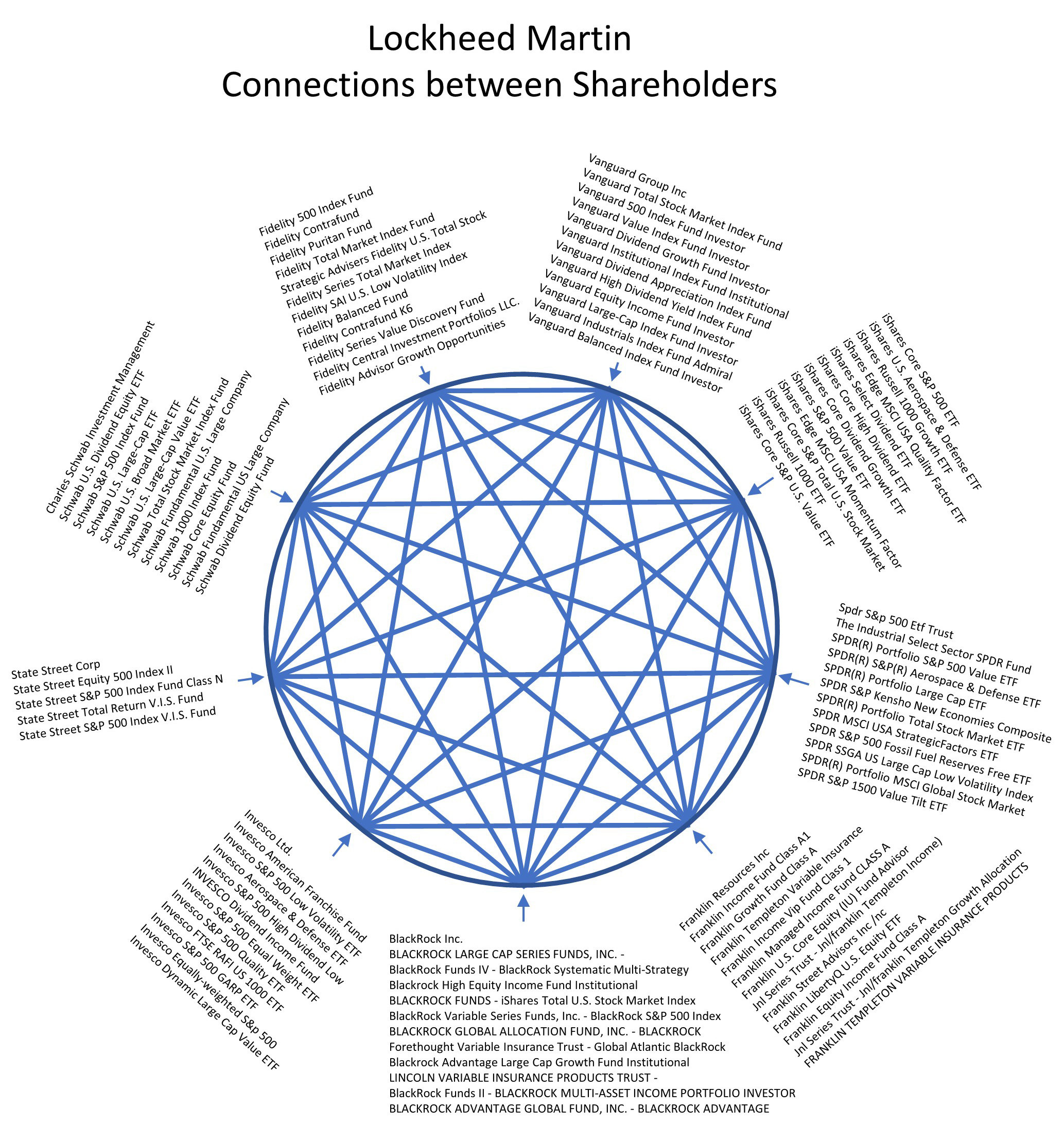

We present the connections between the companies that secretly form the Chinese Financial Trust:

In the above figure we only presented a part of the financial companies that form the Tibet China Financial Trust.

As the figure shows, every and each financial company is a shareholder to the others financial companies from the Tibet Financial Trust.

Even though they appear to be independent companies, they are actually only parts that form together a single Secret Financial Trust led from China.

Over the centuries, the Tibet China Empire financially led in secret, the others Empires of the world.

In the following we present the shareholders and the links between the shareholders for the Raytheon company:

Top 10 Owners of Raytheon Technologies Corp

| Stockholder | Stake | Shares owned | Total value ($) |

| SSgA Funds Management, Inc. | 8.77% | 129,549,992 | 11,627,111,782 |

| The Vanguard Group, Inc. | 7.89% | 116,527,712 | 10,458,362,152 |

| Capital Research & Management Co…. | 5.07% | 74,865,457 | 6,719,174,766 |

| BlackRock Fund Advisors | 4.97% | 73,379,240 | 6,585,786,790 |

| Wellington Management Co. LLP | 3.16% | 46,701,977 | 4,191,502,436 |

| Capital Research & Management Co…. | 2.96% | 43,728,084 | 3,924,595,539 |

| Dodge & Cox | 2.48% | 36,558,387 | 3,281,115,233 |

| JPMorgan Investment Management, I… | 1.68% | 24,841,384 | 2,229,514,214 |

| Geode Capital Management LLC | 1.68% | 24,841,857 | 2,229,556,666 |

| Morgan Stanley Smith Barney LLC (… | 1.49% | 22,032,156 | 1,977,386,001 |

Top 10 Mutual Funds Holding Raytheon Technologies Corp

| Mutual fund | Stake | Shares owned | Total value ($) |

| Vanguard Total Stock Market Index… | 2.99% | 44,089,109 | 3,956,997,533 |

| Vanguard 500 Index Fund | 2.26% | 33,426,788 | 3,000,054,223 |

| American Funds Investment Company… | 1.66% | 24,510,413 | 2,199,809,567 |

| Dodge & Cox Stock Fund | 1.61% | 23,704,800 | 2,127,505,800 |

| American Mutual Fund | 1.47% | 21,696,553 | 1,947,265,632 |

| Capital Income Builder | 1.32% | 19,516,883 | 1,751,640,249 |

| Fidelity 500 Index Fund | 1.08% | 15,968,790 | 1,433,198,903 |

| SPDR S&P 500 ETF Trust | 1.08% | 15,953,221 | 1,431,801,585 |

| Government Pension Fund – Global … | 0.98% | 14,493,310 | 1,300,774,573 |

| Vanguard Dividend Growth Fund | 0.93% | 13,730,740 | 1,232,333,915 |

The links between the shareholders of Raytheon Technologies:

In the following figures we present the shareholders and links between the shareholders for Lockheed Martin:

Top 10 Owners of Lockheed Martin Corp

| Stockholder | Stake | Shares owned | Total value ($) |

| SSgA Funds Management, Inc. | 14.52% | 38,494,398 | 16,171,881,544 |

| The Vanguard Group, Inc. | 8.16% | 21,625,793 | 9,085,211,897 |

| BlackRock Fund Advisors | 5.16% | 13,679,766 | 5,747,006,494 |

| Capital Research & Management Co…. | 5.13% | 13,597,055 | 5,712,258,776 |

| Charles Schwab Investment Managem… | 1.94% | 5,146,227 | 2,161,981,425 |

| Fidelity Management & Research Co… | 1.85% | 4,892,084 | 2,055,213,409 |

| Geode Capital Management LLC | 1.63% | 4,310,104 | 1,810,717,791 |

| Morgan Stanley Smith Barney LLC (… | 1.46% | 3,869,798 | 1,625,740,838 |

| Capital Research & Management Co…. | 1.39% | 3,677,032 | 1,544,757,914 |

| Wellington Management Co. LLP | 1.23% | 3,271,390 | 1,374,343,653 |

Top 10 Mutual Funds Holding Lockheed Martin Corp

| Mutual fund | Stake | Shares owned | Total value ($) |

| Vanguard Total Stock Market Index… | 2.98% | 7,894,942 | 3,316,744,084 |

| Vanguard 500 Index Fund | 2.01% | 5,321,220 | 2,235,497,734 |

| American Funds Income Fund of Ame… | 1.65% | 4,373,742 | 1,837,452,752 |

| Washington Mutual Investors Fund | 1.62% | 4,285,283 | 1,800,290,241 |

| Schwab US Dividend Equity ETF | 1.20% | 3,180,222 | 1,336,043,064 |

| American Balanced Fund | 1.04% | 2,768,614 | 1,163,122,428 |

| Fidelity 500 Index Fund | 0.96% | 2,542,990 | 1,068,335,529 |

| SPDR S&P 500 ETF Trust | 0.96% | 2,537,884 | 1,066,190,447 |

| Vanguard Value Index Fund | 0.88% | 2,328,311 | 978,146,734 |

| iShares Core S&P 500 ETF | 0.79% | 2,099,855 | 882,170,084 |

The links between the shareholders of Lockheed Martin:

In the following figures we present the shareholders and links between the shareholders for Northroop Grumman:

Top 10 Owners of NORTHROP GRUMMAN CORP

| Stockholder | Stake | Shares owned | Total value ($) |

| SSgA Funds Management, Inc. | 9.21% | 14,243,422 | 6,808,213,282 |

| Capital Research & Management Co…. | 7.94% | 12,280,616 | 5,870,011,642 |

| The Vanguard Group, Inc. | 7.41% | 11,467,635 | 5,481,414,854 |

| Wellington Management Co. LLP | 5.15% | 7,974,522 | 3,811,741,771 |

| BlackRock Fund Advisors | 4.27% | 6,601,980 | 3,155,680,420 |

| Fidelity Management & Research Co… | 3.63% | 5,607,954 | 2,680,545,932 |

| Massachusetts Financial Services … | 3.51% | 5,434,390 | 2,597,584,076 |

| JPMorgan Investment Management, I… | 2.20% | 3,408,159 | 1,629,065,920 |

| Sanders Capital LLC | 2.03% | 3,134,834 | 1,498,419,304 |

| Geode Capital Management LLC | 1.73% | 2,668,711 | 1,275,617,171 |

Top 10 Mutual Funds Holding NORTHROP GRUMMAN CORP

| Mutual fund | Stake | Shares owned | Total value ($) |

| Washington Mutual Investors Fund | 3.35% | 5,177,097 | 2,474,600,595 |

| Vanguard Total Stock Market Index… | 2.68% | 4,152,196 | 1,984,708,166 |

| Vanguard Dividend Growth Fund | 2.37% | 3,666,984 | 1,752,781,682 |

| MFS Value Fund | 2.19% | 3,392,401 | 1,621,533,754 |

| Vanguard 500 Index Fund | 2.12% | 3,282,493 | 1,568,998,829 |

| American Balanced Fund | 1.60% | 2,470,885 | 1,181,058,321 |

| American Mutual Fund | 1.11% | 1,721,036 | 822,637,998 |

| Fidelity 500 Index Fund | 1.01% | 1,568,928 | 749,931,895 |

| SPDR S&P 500 ETF Trust | 1.01% | 1,568,169 | 749,569,100 |

| American Funds Investment Company… | 0.98% | 1,523,090 | 728,021,789 |

The links between the shareholders of Northroop Grumman:

In the following figures we present the shareholders and links between the shareholders for Boeing:

Top 10 Owners of Boeing Co

| Stockholder | Stake | Shares owned | Total value ($) |

| Newport Trust Co. | 7.52% | 44,678,806 | 7,159,778,662 |

| The Vanguard Group, Inc. | 7.14% | 42,393,198 | 6,793,509,980 |

| SSgA Funds Management, Inc. | 4.42% | 26,255,730 | 4,207,480,733 |

| BlackRock Fund Advisors | 4.02% | 23,888,317 | 3,828,102,799 |

| Loomis, Sayles & Co. LP | 2.30% | 13,655,099 | 2,188,229,615 |

| Fidelity Management & Research Co… | 2.28% | 13,545,792 | 2,170,713,168 |

| Geode Capital Management LLC | 1.55% | 9,193,200 | 1,473,210,300 |

| Capital Research & Management Co…. | 1.51% | 8,964,720 | 1,436,596,380 |

| Northern Trust Investments, Inc.(… | 0.86% | 5,082,330 | 814,443,383 |

| T. Rowe Price Associates, Inc. (I… | 0.76% | 4,505,452 | 721,998,683 |

Top 10 Mutual Funds Holding Boeing Co

| Mutual fund | Stake | Shares owned | Total value ($) |

| Vanguard Total Stock Market Index… | 2.96% | 17,558,263 | 2,813,711,646 |

| Vanguard 500 Index Fund | 2.11% | 12,514,526 | 2,005,452,792 |

| Fidelity 500 Index Fund | 1.01% | 5,971,463 | 956,926,946 |

| SPDR S&P 500 ETF Trust | 1.00% | 5,959,371 | 954,989,203 |

| SPDR Dow Jones Industrial Average… | 0.97% | 5,735,859 | 919,171,405 |

| iShares Core S&P 500 ETF | 0.83% | 4,932,431 | 790,422,068 |

| Vanguard Growth Index Fund | 0.82% | 4,847,124 | 776,751,621 |

| Vanguard Institutional Index Fund | 0.70% | 4,129,498 | 661,752,055 |

| Loomis Sayles Growth Fund | 0.61% | 3,619,108 | 579,962,057 |

| American Funds Fundamental Invest… | 0.46% | 2,740,500 | 439,165,125 |

The links between the shareholders of Boeing:

In the following figures we present the shareholders and links between the shareholders for Aerojet Rocketdyne:

Top 10 Owners of Aerojet Rocketdyne Holdings Inc

| Stockholder | Stake | Shares owned | Total value ($) |

| BlackRock Fund Advisors | 15.33% | 12,332,437 | 531,158,062 |

| The Vanguard Group, Inc. | 10.06% | 8,089,511 | 348,415,239 |

| Millennium Management LLC | 4.75% | 3,821,322 | 164,584,339 |

| SSgA Funds Management, Inc. | 4.71% | 3,790,642 | 163,262,951 |

| Elliott Investment Management LP | 3.73% | 3,000,000 | 129,210,000 |

| GAMCO Asset Management, Inc. | 3.60% | 2,898,429 | 124,835,337 |

| Nuance Investments LLC | 2.70% | 2,170,638 | 93,489,379 |

| Gabelli Funds LLC | 2.33% | 1,873,699 | 80,700,216 |

| Dimensional Fund Advisors LP | 2.14% | 1,719,316 | 74,050,940 |

| Reinhart Partners, Inc. | 1.74% | 1,396,238 | 60,135,971 |

Top 10 Mutual Funds Holding Aerojet Rocketdyne Holdings Inc

| Mutual fund | Stake | Shares owned | Total value ($) |

| iShares Core S&P Small Cap ETF | 6.88% | 5,534,102 | 238,353,773 |

| Vanguard Total Stock Market Index… | 2.82% | 2,266,019 | 97,597,438 |

| Vanguard Small Cap Index Fund | 2.41% | 1,939,270 | 83,524,359 |

| iShares Russell 2000 ETF | 2.18% | 1,756,815 | 75,666,022 |

| 1290 VT GAMCO Small Company Value… | 1.85% | 1,490,000 | 64,174,300 |

| Franklin Small Cap Value Fund | 1.76% | 1,414,094 | 60,905,029 |

| Vanguard Small Cap Growth Index F… | 1.43% | 1,149,812 | 49,522,403 |

| SPDR S&P Aerospace & Defense ETF | 1.37% | 1,104,801 | 47,583,779 |

| Vanguard Extended Market Index Fu… | 1.24% | 1,000,127 | 43,075,470 |

| Nuance Mid Cap Value Fund | 1.23% | 985,353 | 42,439,154 |

The links between the shareholders of Aerojet Rocketdyne:

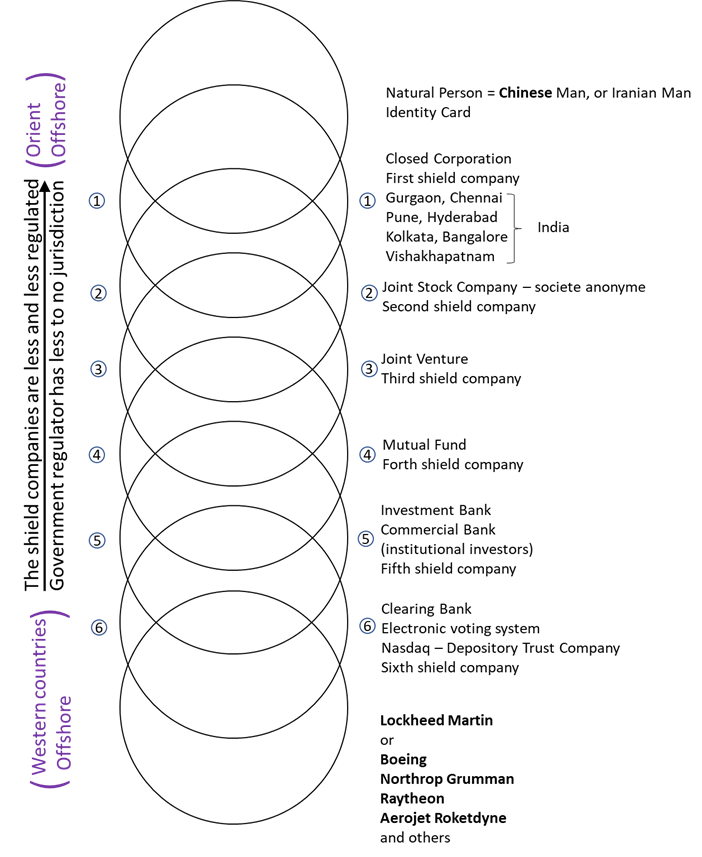

Chapter 6 b

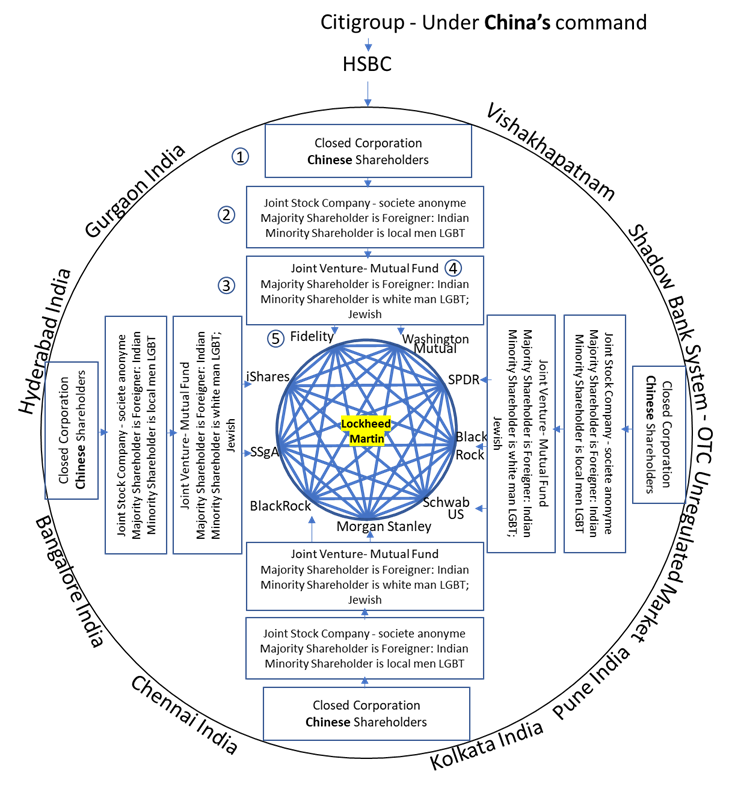

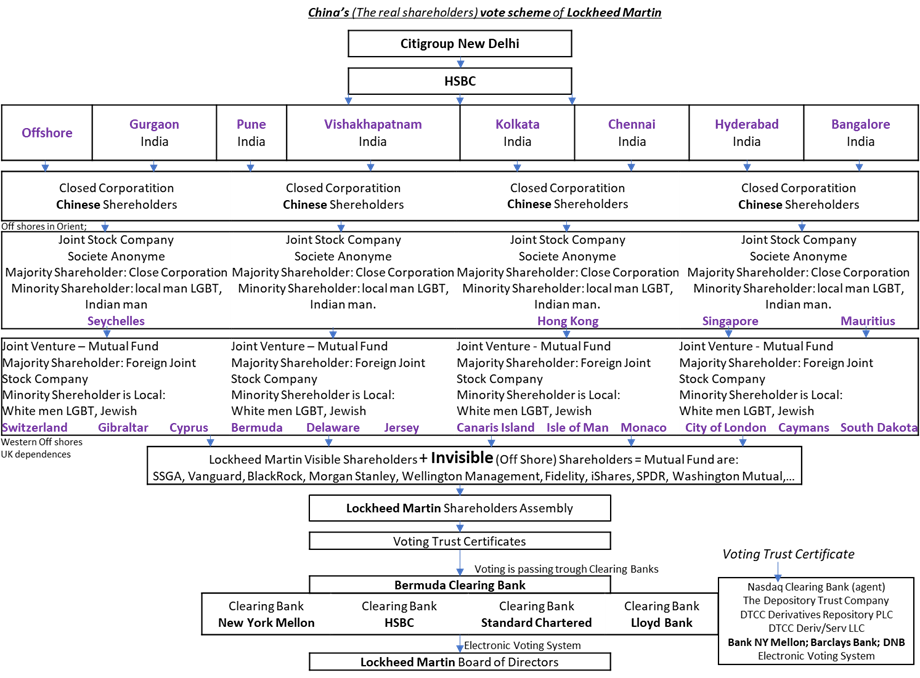

This chain of shield companies shows that the majority shareholders of Lockheed Martin (at the bottom of the figure), is the Iranian Man, at the Tibet orders (at the top of the figure).

In this figure we can see that natural person Chinese, is the majority shareholder of the first shield company.

First shield company is the majority shareholder for the second shield company.

Second shield company is the majority shareholder for the third shield company.

Third shield company is the majority shareholder for the fourth shield company.

Forth shield company is the majority shareholder for the fifth shield company.

Fifth shield company give the voting trust certificate tot the sixth shield company. (clearing bank)

Sixth shield company – Clearing bank give the votes to the Lockheed Martin board of directors

1. First shield companies are Indian companies and are located as follows: Gurgaon, Kenai, Pune, Hyderabad, Kolkata, Bangalore, Vishakhapatnam.

These companies have the following characteristics:

- Are offshore – Phantom companies

- Are closed corporations (company whose shares are owned by a small group of people and are not for sale to the public)

- Belong to HSBC group ( Hong Kong & Shanghai Banking Corporation)

- Shareholder anonymity is protected by banking secrecy and anonymity low.

- Shareholders are Chinese.(or Chinese representants: Iranian, Indians)

2. Second shield are located in the following Oriental locations:

Mauritius, Singapore, Hong Kong, Seychelles, Vanuatu, Samoa, and others.

These companies are the following characteristics:

- Are joint stock companies (societe anonyme)

- Are offshore – Phantom Companies

- Majority of the shareholder are Indians

- Minority shareholders are local LGBT man

3. Third shield companies are located nearby wester countries in islands, British dependencies overseas, etc.

The locations are: Gibraltar, Cyprus, Canaries Islands, Isle of Man, City of London, Switzerland, Jersey, Monaco, Cayman, Delaware, Marshal Islands, Panama, Sought Dakota and others.

These companies have the following characteristics:

- Are Joint Venture companies = Financial Entity having the nationality of the country where it has the Registered Office. It is funded with the participation of other foreign companies from various other countries.

- Are offshore – Phantom Companies

- Majority of the shareholder are one or more oriental offshore Joint stock companies (see point 2 – Second shield)

- Minority shareholders are white man LGBT or Jewish.

- These Joint Venture companies (Principal) issue Voting Trust Certificate to the Mutual Fund (agent) or to Clearing Banks (also agent). The agent can exercise the right to vote in the Principal (secret Joint Venture) absence.

4. Forth shield companies are Mutual Funds located in western countries offshore or offshores from western countries islands.

Those Mutual Funds have the mission not to unveil the identity of the majority shareholders (Joint Ventures = 3 ) nor his location. The Mutual Fund vote each other so they end up being all shareholders to the others Mutual Funds. This way every Mutual Fund votes for the Board of Directors of all the other Mutual Funds.

The Mutual Funds and the Exchanged Trade Funds complete the votes from Institutional Investors in order to get the majority of the votes in the General Shareholder Assembly.

This is because the Institutional Investors do not afford to hold the majority of the votes in all the other Institutional Investors. That would create an obvious monopole.

The Mutual Funds (Principal) issues a Voting Trust Certificate on behalf of the Clearing Bank = Custodian Bank (Agent) in order for this to vote (through Electronic Voting System) for the Board of Directors.

The Voting Trust Certificate it is used to hide the real voting company from the governmental regulator, and swap it with the Agent name.

5. Fifth shield companies = Institutional Investor. Each of these companies is a shareholder at all the other ones.

Each of the Institutional Investors plus Mutual Funds (plus Joint Venture, see point 3 – Third Shield companies) are shareholders at the other Institutional Investors. All the Institutional shareholders issue Voting Trust Certificate on behalf the Clearing Banks in order to vote for Board of Directors of the other Institutional companies. All the US Institutional Investors vote one another.

6. Sixth shield companies are Clearing Banks or Custodian Banks or Depository Banks. They illegally hold a secret record of all types of voting share and non-voting shares.

All types of shares are invented by financial engineers from Tibet China just to transform on various ways the nonvoting shares into voting shares, owned by a variety of financial entities (Investment Banks, Commercial Banks, Mutual Funds, Hedge Funds, ETFs, Insurance Companies) controlled by China.

This voting shares are used for voting the Board of Directors at another Bank or Military Corporation. The Clearing Bank also holds a secret and illegal record of the derivative products: warrants, rights, convertible bonds, that can be transformed in voting shares at the time of the election for the Board of Directors. If, for instance, 80 voting financial entities are needed to illegally meet the majority of 41%, then 4 (or 5) Clearing Banks from different continents could be used. (20 voting financial entities for every Clearing Bank)

The bank where they need to meet 41% of the voting shares, is listed on multiple stock exchanges, across, 2 or more continents. For example, HSBC has dual primary listing on:

– Hon Kong Stock Exchange (offshore)

– London Stock Exchange

and the secondary listing on:

– New York Stock Exchange

– Euronext Paris

– Bermuda Stock Exchange (offshore)

Each of this Exchanges has attached, it’s on Clearing Banks.

This way, the trace of the companies who own shares at the respective banks is lost.

In order to achieve this, Tibet China must build a secret and illegal voting process collaboration between the Clearing Banks and the Financial entities that vote through this Clearing Banks.

The Government regulators do not know the secret agreements between the financial entities who vote and the Clearing Banks (based on Polyalphabetic ciphers). This makes the voting process very opaque so the financial monopole is not detected by Western Governments

In order not to drawn attention to the anti-monopole regulators, the shares are distributed to a big number of mutual funds who accumulate in total 7% to 10% of the US armament producing companies.

For instance, 30 institutional shareholder (big investment banks, commercial banks, investment funds) hold 35% voting share at the Lockheed Martin, (or Boeing, Raytheon, Northrop Grumman, Aerojet Rocketdyne and others).

Then other (supposedly) 100 mutual funds may accumulate 6% in order to meet together with institutional shareholders a majority of 41% voting shares of the total of 80% voting shares.

(We presumed that 20% of the total shares are non voting shares)

So, 35% + 6% = 41% voting shares

35% – institutional shareholders

6% – 100 Mutual funds x 0.06% each

———————————————-

41% = Total – the majority of the voting share ( from a total of 80% voting shares.)

Total shares, 100% = 80% voting shares + 20% nonvoting shares

Clearing Banks, Depository Banks and Custodian Banks, give the access the financial companies to various assets including:

- Equities and equity-related instruments ( warrants, rights, convertible bonds and others)

- Exchange Trade Funds

The type of shares and share-related instruments processed by clearing banks are:

1 Ordinary Shares (common stock), one share = 1 vote

2 Voting Right Shares (privileged), one share = 2 votes (3 votes, or more . . votes)

3 Preference Shares, one share = 0 votes

4 Retractable Preference Shares, one share = 0 votes. Can be

transformed in ordinary shares

5 Cumulative Preference Shares, one share = 0 votes

6 Convertible Preference Shares, one share = 0 votes

7 Participating Preference Shares, one share = 0 votes

8 Restricted Shares, one share = 0 votes,

or one share = 1 vote

9 Treasury Stock,

10 Registered Shares,

11 Bearer Shares,

The shares-related instruments (assets) are:

- Convertible bonds – can be transformed in voting shares.

- Obligation with share option – can buy shares at a previously assigned price.

- Equity with warrant – Can be traded to buy ordinary shares (voting shares).

- Preferential subscription rights – have the privilege to subscribe for new voting shares purchase.

- Bond with warrant – gives the owner the right to buy ordinary shares ( voting shares) or convertible bonds (can be converted in voting shares)

- Script issue – (stock dividend; attribution d’actions). This consist in:

- The shares are provided as a replacement for the dividends.

- Ordinary shares for free (voting shares) handed to shareholders as a result of share capital (registered capital) increase.

See details on page 17-23, page 64-72 and 135-137.

These are financial assets and can be sold on the stock market.

So, they can be sold by some shareholders in order to be accumulated in the hands of certain mutual funds that are controlled by China Tibet in order to participate at the voting process.

These types of share and shares-related instruments have the role to transform themselves into voting shares at the time of the shareholder’s meeting. This way a majority of voting shares is created by companies that have the right to vote. These companies are controlled by China Tibet.

For this purpose, the offshore Joint Ventures, release a Voting Trust Certificate to another shareholder that can be a mutual fund.

This is done in order for those Joint Ventures (and Joint Venture’s shareholders) to remain anonymous.

Further on, the Mutual Fund release (at their turn) a Voting Trust Certificate to a Clearing Bank, so it can vote on behalf of the Mutual Fund.

This voting empowerment contains the name of the candidates of the Board of Directors and the number of the votes for each candidate.

Voting Trust Certificate is an empowering given by a secret shareowner (principal) to another shareowner (agent) or an institution (Clearing Bank – also agent) in order to exercise the right to vote in his absence.

The Clearing Bank executes the voting process through the Electronic Vote System. The Clearing Bank is used as a Shield Company in a secret and illegal voting process. At the voting process participate more Clearing Banks (4 or 5), each of them keeping in custody shares of the same Financial or Military Company (who is the subject of voting process).

The Clearing Bank enable the distribution of the Voting Share towards the 50 to 100 Mutual Funds. This Mutual Funds have a secret agreement with the Clearing Banks to form a majority).

The big number of Mutual Funds have the role to obtain a small shareholding percentage for each. (not to be investigate by the Governmental Regulators).

This is the empowering process for Clearing Banks in order to vote certain person for the Board of Directors.

The Clearing Banks (Custodian Banks) have a strict record of the all the shareholders shares as well as all the OTC (Over The Counter) products, Warrants, rights, convertible bonds that can be turned into voting shares.

These type of share and OTC product that are turned into voting share are strictly recorded for every Voting Company encoded with a password (keyword) and a Polyalphabetic Table. This encoding method, imposed by China Tibet is called “Polyalphabetic ciphers”.

Antimonopoly regulators are:

- Security Exchange Commission (SEC) USA

- Financial Conduct Authority (FCA) UK (private)

- Prudential Regulation Authority UK (part of the England Central Bank)

- Financial Policy Committee

- European Securities and Market Authority (ESMA)

These regulators cannot achieve their purposes to break the monopole for the following reasons:

- Financial companies are established on offshore (in islands, in UK dependencies, overseas) where regulation have no jurisdictions

- Bank secrecy laws

In June 2000 IMF (international Monetary Fund) Listed three major attribute of the Offshore Financial Canters (OFCs).

The third one stipulates: More popularity Centers which provide the following services:

- Low or zero taxation

- Moderate or light financial regulation

- Banking secrecy and anonymity

So many Offshore Financial Centers (OFCs) such as Switzerland had bank secrecy laws protecting the identity of the owners for the offshore companies.

3)Clearing Banks are processing very laborious type of shares and OTC products linked with the shares.

Clearing Banks are secretly working together with the Institutional shareholders and with the Mutual Funds in order to build a very opaque voting system.

4) LGBT white man minority shareholders in offshore keep silent about majority shareholders identity (Chinese, Iranian and Indian)

LGBT man is protected and also blackmailed by Tibet leading Families, for centuries, in order to accomplish their purpose. Tibet controls all LGBT communities in all countries

Example:

Nasdaq requires companies on the exchange to report on the diversity of their Board of Directors. Also it would require most boards of directors to have at least two diverse directors including at least one who self identifies as female and one who self identifies as LGBTQ+ minority.

The Links Between Shareholders at Financial Companies

Reciprocal Shareholders

Reciprocal Voting

Reciprocal Shareholders

Reciprocal Voting

Another diagram to see the interconnections between the offshore companies in order to make invisible majority Chinese shareholder at Lockheed Martin.

In the following tables are presented some military companies owners:

Lockheed Martin. Total shares = 293,280,291

| File Date | Investors for Lockheed Martin – All Institutional Owners | Current Shares | Change | Prev Value ($K) | Current Value ($K) | Change (%) | Total % |

| 2022-08-15 | State Street Corp | 38,494,398 | -288,870 | 17,118,934 | 16,551,051 | -3.32 | 13.1255 |

| 2022-08-12 | Vanguard Group Inc | 22,596,755 | 16,904 | 9,966,746 | 9,715,701 | -2.52 | 7.7048 |

| 2022-08-12 | BlackRock Inc. | 17,940,791 | 140,226 | 7,857,169 | 7,713,820 | -1.82 | 6.1173 |

| 2022-08-15 | Capital World Investors | 13,597,055 | -2,424,359 | 7,071,954 | 5,845,932 | -17.34 | 4.6362 |

| 2022-08-29 | VTSMX – Vanguard Total Stock Market Index Fund Investor Shares | 7,837,167 | -21,492 | 3,468,812 | 3,369,668 | -2.86 | 2.6722 |

| 2022-08-12 | Fmr Llc | 5,966,076 | 1,701,615 | 1,882,333 | 2,565,175 | 36.28 | 2.0343 |

| 2022-08-15 | Morgan Stanley | 5,252,928 | 1,209,042 | 1,784,972 | 2,258,551 | 26.53 | 1.7911 |

| 2022-08-29 | VFINX – Vanguard 500 Index Fund Investor Shares | 5,241,947 | -61,726 | 2,341,041 | 2,253,828 | -3.73 | 1.7874 |

| 2022-08-15 | Charles Schwab Investment Management Inc | 5,146,227 | -109,842 | 2,320,030 | 2,212,672 | -4.63 | 1.7547 |

| 2022-09-27 | AMECX – INCOME FUND OF AMERICA Class A | 4,373,742 | -649,500 | 2,170,643 | 1,809,898 | -16.62 | 1.4913 |

| 2022-08-12 | Geode Capital Management, Llc | 4,310,104 | 118,272 | 1,845,874 | 1,850,197 | 0.23 | 1.4696 |

| 2022-09-28 | AWSHX – WASHINGTON MUTUAL INVESTORS FUND Class A | 4,285,283 | -909,840 | 2,244,916 | 1,773,293 | -21.01 | 1.4612 |

| 2022-08-15 | Capital Research Global Investors | 3,677,032 | 194,263 | 1,537,294 | 1,580,976 | 2.84 | 1.2538 |

| 2022-08-12 | Bank Of America Corp /de/ | 3,560,153 | 34,412 | 1,556,262 | 1,530,723 | -1.64 | 1.2139 |

| 2022-08-15 | Wellington Management Group Llp | 3,271,390 | -1,033,463 | 1,900,162 | 1,406,565 | -25.98 | 1.1154 |

| 2022-07-25 | SCHD – Schwab U.S. Dividend Equity ETF | 2,931,854 | 68,980 | 1,241,914 | 1,290,338 | 3.9 | 0.9997 |

| 2022-08-26 | ABALX – AMERICAN BALANCED FUND Class A | 2,768,614 | -490,640 | 1,438,634 | 1,190,393 | -17.26 | 0.9440 |

| 2022-08-15 | Bank of New York Mellon Corp | 2,703,674 | 35,218 | 1,177,856 | 1,162,473 | -1.31 | 0.9219 |

| 2022-08-12 | Wells Fargo & Company/mn | 2,660,279 | -68,144 | 1,204,326 | 1,143,813 | -5.02 | 0.9071 |

| 2022-08-26 | Spdr S&p 500 Etf Trust | 2,571,204 | -68,190 | 1,165,028 | 1,105,515 | -5.11 | 0.8767 |

| 2022-07-29 | FXAIX – Fidelity 500 Index Fund | 2,555,318 | 41,720 | 1,090,398 | 1,124,621 | 3.14 | 0.8713 |

| 2022-08-12 | Northern Trust Corp | 2,451,041 | -24,705 | 1,092,794 | 1,053,850 | -3.56 | 0.8357 |

| 2022-08-11 | Franklin Resources Inc | 2,448,118 | 69,906 | 1,049,742 | 1,052,592 | 0.27 | 0.8347 |

| 2022-08-15 | Ameriprise Financial Inc | 2,310,100 | 206,473 | 927,942 | 987,615 | 6.43 | 0.7877 |

| 2022-08-29 | VIVAX – Vanguard Value Index Fund Investor Shares | 2,302,020 | 43,898 | 996,735 | 989,777 | -0.7 | 0.7849 |

| 2022-08-15 | Royal Bank Of Canada | 2,136,455 | -62,099 | 970,441 | 918,591 | -5.34 | 0.7285 |

| 2022-08-25 | IVV – iShares Core S&P 500 ETF | 2,060,099 | -39,868 | 926,925 | 885,760 | -4.44 | 0.7024 |

| 2022-08-15 | GQG Partners LLC | 2,040,934 | 311,513 | 763,213 | 877,886 | 15.03 | 0.6959 |

| 2022-09-29 | VDIGX – Vanguard Dividend Growth Fund Investor Shares | 1,823,908 | -210,277 | 879,012 | 754,751 | -14.14 | 0.6219 |

| 2022-08-29 | VINIX – Vanguard Institutional Index Fund Institutional Shares | 1,754,599 | -62,044 | 801,866 | 754,407 | -5.92 | 0.5983 |

| 2022-08-15 | Citadel Advisors Llc | 1,649,100 | -232,000 | 830,318 | 709,047 | -14.61 | 0.5623 |

| 2022-08-10 | UBS Group AG | 1,549,433 | -48,803 | 705,462 | 666,195 | -5.57 | 0.5283 |

| 2022-07-28 | CWGIX – CAPITAL WORLD GROWTH & INCOME FUND Class A | 1,518,276 | 42,230 | 640,308 | 668,208 | 4.36 | 0.5177 |

| 2022-08-23 | FKINX – Franklin Income Fund Class A1 | 1,500,000 | 0 | 662,100 | 644,940 | -2.59 | 0.5115 |

| 2022-08-15 | Invesco Ltd. | 1,499,016 | -359,491 | 820,347 | 644,516 | -21.43 | 0.5111 |

| 2022-09-29 | VIG – Vanguard Dividend Appreciation Index Fund ETF Shares | 1,487,977 | -15,277 | 649,586 | 615,740 | -5.21 | 0.5074 |

| 2022-08-25 | ITA – iShares U.S. Aerospace & Defense ETF | 1,429,780 | 148,383 | 565,608 | 614,748 | 8.69 | 0.4875 |

| 2022-08-22 | Legal & General Group Plc | 1,369,062 | -8,281 | 607,959 | 588,643 | -3.18 | 0.4668 |

| 2022-08-15 | Susquehanna International Group, Llp | 1,276,600 | -691,000 | 868,499 | 548,887 | -36.8 | 0.4353 |

| 2022-09-27 | AMRMX – AMERICAN MUTUAL FUND Class A | 1,252,256 | 0 | 541,124 | 518,196 | -4.24 | 0.4270 |

| 2022-09-28 | CAIBX – CAPITAL INCOME BUILDER Class A | 1,217,324 | 0 | 526,030 | 503,741 | -4.24 | 0.4151 |

| 2022-08-26 | XLI – The Industrial Select Sector SPDR Fund | 1,213,609 | -85,737 | 573,531 | 521,803 | -9.02 | 0.4138 |

| 2022-08-15 | Stifel Financial Corp | 1,207,388 | 10,545 | 528,314 | 519,168 | -1.73 | 0.4117 |

| 2022-08-10 | California Public Employees Retirement System | 1,123,453 | -18,272 | 503,957 | 483,040 | -4.15 | 0.3831 |

| 2022-09-29 | VYM – Vanguard High Dividend Yield Index Fund ETF Shares | 991,375 | 37,757 | 412,077 | 410,241 | -0.45 | 0.3380 |

| 2022-08-12 | Dimensional Fund Advisors Lp | 978,138 | 32,737 | 417,300 | 420,561 | 0.78 | 0.3335 |

| 2022-08-18 | Goldman Sachs Group Inc | 946,148 | -63,653 | 445,725 | 406,806 | -8.73 | 0.3226 |

| 2022-07-25 | LBSAX – Columbia Dividend Income Fund Class A | 922,645 | 78,853 | 366,036 | 406,065 | 10.94 | 0.3146 |

| 2022-08-15 | Susquehanna International Group, Llp | 876,800 | -642,900 | 670,796 | 376,989 | -43.8 | 0.2990 |

| 2022-08-15 | Nuveen Asset Management, LLC | 861,396 | -29,705 | 392,085 | 370,365 | -5.54 | 0.2937 |

| 2022-05-16 | Parametric Portfolio Associates Llc | 853,935 | 78,172 | 275,714 | 376,927 | 36.71 | 0.2912 |

| 2022-08-26 | FCNTX – Fidelity Contrafund | 831,697 | 370,824 | 203,429 | 357,596 | 75.78 | 0.2836 |

| 2022-08-15 | Citadel Advisors Llc | 788,900 | -482,500 | 561,196 | 339,195 | -39.56 | 0.2690 |

| 2022-08-25 | IWF – iShares Russell 1000 Growth ETF | 767,871 | 65,411 | 310,065 | 330,154 | 6.48 | 0.2618 |

| 2022-07-26 | Sumitomo Mitsui Trust Holdings, Inc. | 762,423 | 19,443 | 327,951 | 327,811 | -0.04 | 0.2600 |

| 2022-08-11 | Bank Of Montreal /can/ | 744,304 | 231,531 | 228,697 | 314,893 | 37.69 | 0.2538 |

| 2022-08-26 | ANCFX – AMERICAN FUNDS FUNDAMENTAL INVESTORS Class A | 724,929 | 0 | 319,983 | 311,690 | -2.59 | 0.2472 |

| 2022-09-27 | QUAL – iShares Edge MSCI USA Quality Factor ETF | 724,645 | -433,390 | 500,410 | 299,865 | -40.08 | 0.2471 |

| 2022-08-15 | Manufacturers Life Insurance Company, The | 716,791 | 56,844 | 291,301 | 308,191 | 5.8 | 0.2444 |

| 2022-08-12 | Pnc Financial Services Group, Inc. | 703,308 | 124,833 | 255,339 | 302,393 | 18.43 | 0.2398 |

| 2022-08-12 | American Century Companies Inc | 665,277 | 243,809 | 186,036 | 286,043 | 53.76 | 0.2268 |

| 2022-08-26 | AMERICAN FUNDS INSURANCE SERIES – Asset Allocation Fund Class 1 | 644,500 | -100,000 | 328,622 | 277,109 | -15.68 | 0.2198 |

| 2022-08-08 | Bahl & Gaynor Inc | 617,880 | 84,743 | 235,327 | 265,664 | 12.89 | 0.2107 |

| 2022-08-12 | First Trust Advisors Lp | 595,578 | 364,322 | 102,076 | 256,075 | 150.87 | 0.2031 |

| 2022-08-15 | Capital International Investors | 566,322 | -208,256 | 341,902 | 243,489 | -28.78 | 0.1931 |

| 2022-08-12 | Ubs Asset Management Americas Inc | 557,850 | -5,254 | 248,554 | 239,853 | -3.5 | 0.1902 |

| 2022-08-12 | Renaissance Technologies Llc | 541,600 | 172,100 | 163,097 | 232,866 | 42.78 | 0.1847 |

| 2022-07-29 | FSDAX – Defense and Aerospace Portfolio | 527,000 | 24,200 | 218,114 | 231,938 | 6.34 | 0.1797 |

| 2022-08-15 | Two Sigma Investments, Lp | 523,771 | 302,002 | 97,889 | 225,201 | 130.06 | 0.1786 |

| 2022-08-16 | First Republic Investment Management, Inc. | 512,143 | 16,629 | 218,720 | 220,201 | 0.68 | 0.1746 |

| 2022-08-15 | D. E. Shaw & Co., Inc. | 497,938 | -211,280 | 313,049 | 214,093 | -31.61 | 0.1698 |

| File Date | Investors for Lockheed Martin – Mutual Funds | Shares | Value Changed (%) | Allocation (Percent) |

| 2022-08-29 | VTSMX – Vanguard Total Stock Market Index Fund Investor Shares | 7,837,167 | -2.86 | 0.3038 |

| 2022-08-29 | VFINX – Vanguard 500 Index Fund Investor Shares | 5,241,947 | -3.73 | 0.3175 |

| 2022-09-27 | AMECX – INCOME FUND OF AMERICA Class A | 4,373,742 | -16.62 | 1.4954 |

| 2022-09-28 | AWSHX – WASHINGTON MUTUAL INVESTORS FUND Class A | 4,285,283 | -21.01 | 1.1633 |

| 2022-08-26 | ABALX – AMERICAN BALANCED FUND Class A | 2,768,614 | -17.26 | 0.6152 |

| 2022-07-29 | FXAIX – Fidelity 500 Index Fund | 2,555,318 | 3.14 | 0.3047 |

| 2022-08-29 | VIVAX – Vanguard Value Index Fund Investor Shares | 2,302,020 | -0.7 | 0.7113 |

| 2022-09-29 | VDIGX – Vanguard Dividend Growth Fund Investor Shares | 1,823,908 | -14.14 | 1.4228 |

| 2022-08-29 | VINIX – Vanguard Institutional Index Fund Institutional Shares | 1,754,599 | -5.92 | 0.3181 |

| 2022-07-28 | CWGIX – CAPITAL WORLD GROWTH & INCOME FUND Class A | 1,518,276 | 4.36 | 0.6073 |

| 2022-08-23 | FKINX – Franklin Income Fund Class A1 | 1,500,000 | -2.59 | 0.9301 |

| 2022-09-27 | AMRMX – AMERICAN MUTUAL FUND Class A | 1,252,256 | -4.24 | 0.6048 |

| 2022-09-28 | CAIBX – CAPITAL INCOME BUILDER Class A | 1,217,324 | -4.24 | 0.4893 |

| 2022-07-25 | LBSAX – Columbia Dividend Income Fund Class A | 922,645 | 10.94 | 1.0757 |

| 2022-08-26 | FCNTX – Fidelity Contrafund | 831,697 | 75.78 | 0.3685 |

| 2022-08-26 | ANCFX – AMERICAN FUNDS FUNDAMENTAL INVESTORS Class A | 724,929 | -2.59 | 0.3001 |

| 2022-07-29 | FSDAX – Defense and Aerospace Portfolio | 527,000 | 6.34 | 16.4801 |

| 2022-07-29 | FPURX – Fidelity Puritan Fund | 473,711 | 167.48 | 0.7011 |

| 2022-09-28 | IHGIX – THE HARTFORD DIVIDEND AND GROWTH FUND Class A | 467,936 | -2.81 | 1.2352 |

| 2022-09-23 | SWPPX – Schwab S&P 500 Index Fund | 436,178 | -4.88 | 0.2805 |

| 2022-09-23 | TWCGX – Growth Fund Investor Class | 408,881 | 31.37 | 1.4065 |

| 2022-08-23 | FKGRX – Franklin Growth Fund Class A | 395,654 | -2.59 | 1.0838 |

| 2022-07-25 | VAFAX – Invesco American Franchise Fund Class A | 394,193 | 1.422 | |

| 2022-07-29 | FSKAX – Fidelity Total Market Index Fund | 392,608 | 1.43 | 0.2568 |

| 2022-08-26 | AIVSX – INVESTMENT CO OF AMERICA Class A | 378,605 | -31.41 | 0.1621 |

| 2022-07-29 | FCTDX – Strategic Advisers Fidelity U.S. Total Stock Fund | 350,600 | 191.56 | 0.2242 |

| 2022-07-29 | FALCX – Strategic Advisers Large Cap Fund | 303,764 | 25.98 | 0.2398 |

| 2022-08-29 | VEIPX – Vanguard Equity Income Fund Investor Shares | 291,427 | 17.42 | 0.2502 |

| 2022-08-29 | VLACX – Vanguard Large-Cap Index Fund Investor Shares | 283,436 | -2.44 | 0.3494 |

| 2022-07-29 | FCFMX – Fidelity Series Total Market Index Fund | 270,365 | 4.71 | 0.2572 |

| 2022-09-27 | FSUVX – Fidelity SAI U.S. Low Volatility Index Fund | 263,389 | 11.14 | 1.2613 |

| 2022-08-01 | VINAX – Vanguard Industrials Index Fund Admiral Shares | 258,515 | -15.18 | 3.0092 |

| 2022-07-25 | MEIAX – MFS Value Fund A | 239,658 | -79.85 | 0.1705 |

| 2022-07-29 | FBALX – Fidelity Balanced Fund | 228,769 | -51.63 | 0.2418 |

| 2022-09-28 | TAGRX – Fundamental Large Cap Core Fund Class A | 216,744 | -7.62 | 1.6929 |

| 2022-08-29 | VBINX – Vanguard Balanced Index Fund Investor Shares | 205,400 | -3.53 | 0.1795 |

| 2022-09-28 | TIEIX – TIAA-CREF Equity Index Fund Institutional Class | 197,062 | -1.57 | 0.2355 |

| 2022-08-19 | YACKX – AMG Yacktman Fund Class I | 195,000 | -2.59 | 1.046 |

| 2022-08-26 | FLCNX – Fidelity Contrafund K6 | 189,050 | 101.17 | 0.4179 |

| 2022-09-28 | DFEOX – U.s. Core Equity 1 Portfolio – Institutional Class | 186,232 | -4.24 | 0.2602 |

| 2022-08-29 | VITNX – Vanguard Institutional Total Stock Market Index Fund Institutional Shares | 181,363 | -3.35 | 0.3042 |

| 2022-09-27 | FNKLX – Fidelity Series Value Discovery Fund | 173,500 | -6.18 | 0.8744 |

| 2022-08-24 | PREIX – T. Rowe Price Equity Index 500 Fund | 170,096 | -15.22 | 0.3181 |

| 2022-08-29 | BBVLX – Bridge Builder Large Cap Value Fund | 166,830 | -19.89 | 0.4235 |

| 2022-09-28 | DFQTX – U.s. Core Equity 2 Portfolio – Institutional Class | 161,715 | -4.24 | 0.2176 |

| 2022-07-29 | FAGAX – Fidelity Advisor Growth Opportunities Fund Class A | 157,900 | 0.4103 | |

| 2022-09-27 | IAUTX – INVESCO Dividend Income Fund Class A | 157,090 | -4.24 | 1.726 |

| 2022-09-28 | DURPX – U.S. High Relative Profitability Portfolio Institutional Class | 143,669 | -4.24 | 1.2167 |

| 2022-09-29 | OWLSX – Old Westbury Large Cap Strategies Fund | 138,317 | -1.79 | 0.2739 |

| 2022-08-29 | VQNPX – Vanguard Growth and Income Fund Investor Shares | 136,447 | 6.43 | 0.5431 |

| 2022-07-29 | FDGRX – Fidelity Growth Company Fund | 130,571 | 0.1263 |

Boeing. Total Shares = 544,594,399

| File Date | Investors for Boeing – All Institutional Owners | Prev Shares | Current Shares | Change | Current Value ($K) | % |

| 2022-08-09 | Newport Trust Co | 43,510,241 | 44,678,806 | 1,168,565 | 6,108,487 | 8.2041 |

| 2022-08-12 | Vanguard Group Inc | 43,355,912 | 44,529,543 | 1,173,631 | 6,088,080 | 8.1766 |

| 2022-08-12 | BlackRock Inc. | 31,674,287 | 32,695,447 | 1,021,160 | 4,470,120 | 6.0036 |

| 2022-08-15 | State Street Corp | 26,602,513 | 26,255,730 | -346,783 | 3,589,683 | 4.8212 |

| 2022-08-12 | Fmr Llc | 15,120,154 | 17,901,503 | 2,781,349 | 2,447,494 | 3.2871 |

| 2022-08-29 | VTSMX – Vanguard Total Stock Market Index Fund Investor Shares | 16,829,899 | 17,425,088 | 595,189 | 2,382,358 | 3.1996 |

| 2022-08-05 | Loomis Sayles & Co L P | 12,741,713 | 13,655,099 | 913,386 | 1,866,925 | 2.5074 |

| 2022-08-29 | VFINX – Vanguard 500 Index Fund Investor Shares | 11,993,605 | 12,310,117 | 316,512 | 1,683,039 | 2.2604 |

| 2022-08-12 | Geode Capital Management, Llc | 8,862,120 | 9,193,200 | 331,080 | 1,254,192 | 1.6881 |

| 2022-08-15 | Capital World Investors | 4,440,022 | 8,964,720 | 4,524,698 | 1,225,657 | 1.6461 |

| 2022-08-15 | Citadel Advisors Llc | 8,173,400 | 7,329,400 | -844,000 | 1,002,076 | 1.3458 |

| 2022-08-15 | Susquehanna International Group, Llp | 7,496,100 | 7,012,600 | -483,500 | 958,762 | 1.2877 |

| 2022-08-15 | Morgan Stanley | 6,213,784 | 6,958,973 | 745,189 | 951,431 | 1.2778 |

| 2022-08-15 | Susquehanna International Group, Llp | 6,492,000 | 6,322,000 | -170,000 | 864,344 | 1.1609 |

| 2022-08-12 | Bank Of America Corp /de/ | 6,271,171 | 6,207,722 | -63,449 | 848,720 | 1.1399 |

| 2022-08-26 | Spdr S&p 500 Etf Trust | 5,976,838 | 6,037,673 | 60,835 | 825,471 | 1.1087 |

| 2022-07-29 | FXAIX – Fidelity 500 Index Fund | 5,657,395 | 5,777,777 | 120,382 | 759,200 | 1.0609 |

| 2022-09-23 | Spdr Dow Jones Industrial Average Etf Trust | 5,676,543 | 5,706,213 | 29,670 | 909,057 | 1.0478 |

| 2022-08-15 | Citadel Advisors Llc | 5,765,700 | 5,482,100 | -283,600 | 749,513 | 1.0066 |

| 2022-08-12 | Northern Trust Corp | 4,957,841 | 5,082,330 | 124,489 | 694,855 | 0.9332 |

| 2022-08-25 | IVV – iShares Core S&P 500 ETF | 4,747,861 | 4,837,084 | 89,223 | 661,326 | 0.8882 |

| 2022-08-29 | VIGRX – Vanguard Growth Index Fund Investor Shares | 4,650,468 | 4,770,517 | 120,049 | 652,225 | 0.8760 |

| 2022-08-15 | Price T Rowe Associates Inc /md/ | 4,464,978 | 4,505,452 | 40,474 | 615,985 | 0.8273 |

| 2022-08-29 | VINIX – Vanguard Institutional Index Fund Institutional Shares | 4,107,698 | 4,120,129 | 12,431 | 563,304 | 0.7566 |

| 2022-08-15 | Nuveen Asset Management, LLC | 4,059,464 | 4,014,004 | -45,460 | 548,795 | 0.7371 |

| 2022-08-15 | Bank of New York Mellon Corp | 3,656,930 | 3,875,128 | 218,198 | 529,807 | 0.7116 |

| 2022-08-29 | LGRRX – Loomis Sayles Growth Fund Class A | 3,071,410 | 3,619,108 | 547,698 | 494,804 | 0.6646 |

| 2022-08-16 | Jane Street Group, Llc | 2,806,100 | 3,481,400 | 675,300 | 475,977 | 0.6393 |

| 2022-08-22 | Legal & General Group Plc | 2,801,791 | 2,992,486 | 190,695 | 409,134 | 0.5495 |

| 2022-08-15 | Charles Schwab Investment Management Inc | 2,814,461 | 2,907,541 | 93,080 | 397,520 | 0.5339 |

| 2022-08-11 | Bank Of Montreal /can/ | 4,953,461 | 2,883,128 | -2,070,333 | 994,131 | 0.5294 |

| 2022-08-26 | XLI – The Industrial Select Sector SPDR Fund | 2,938,617 | 2,849,798 | -88,819 | 389,624 | 0.5233 |

| 2022-08-26 | ANCFX – AMERICAN FUNDS FUNDAMENTAL INVESTORS Class A | 707,878 | 2,740,500 | 2,032,622 | 374,681 | 0.5032 |

| 2022-08-26 | ABALX – AMERICAN BALANCED FUND Class A | 1,323,715 | 2,701,218 | 1,377,503 | 369,311 | 0.4960 |

| 2022-08-12 | Wells Fargo & Company/mn | 2,903,705 | 2,651,764 | -251,941 | 362,550 | 0.4869 |

| 2022-08-15 | Capital International Investors | 0 | 2,482,390 | 2,482,390 | 339,392 | 0.4558 |

| 2022-08-16 | Jane Street Group, Llc | 3,521,600 | 2,441,600 | -1,080,000 | 333,816 | 0.4483 |

| 2022-08-09 | Swiss National Bank | 2,418,222 | 2,402,522 | -15,700 | 328,473 | 0.4412 |

| 2022-08-10 | UBS Group AG | 2,287,766 | 2,366,064 | 78,298 | 323,487 | 0.4345 |

| 2022-08-11 | Bank Of Montreal /can/ | 4,463,600 | 2,252,300 | -2,211,300 | 776,616 | 0.4136 |

| 2022-09-28 | AWSHX – WASHINGTON MUTUAL INVESTORS FUND Class A | 571,261 | 2,246,961 | 1,675,700 | 357,963 | 0.4126 |

| 2022-08-18 | Goldman Sachs Group Inc | 2,083,770 | 2,034,675 | -49,095 | 278,180 | 0.3736 |

| 2022-08-12 | PEAK6 Investments LLC | 1,503,300 | 1,919,600 | 416,300 | 262,448 | 0.3525 |

| 2022-07-26 | Sumitomo Mitsui Trust Holdings, Inc. | 1,789,740 | 1,855,301 | 65,561 | 253,657 | 0.3407 |

| 2022-08-15 | Invesco Ltd. | 1,603,989 | 1,834,456 | 230,467 | 250,806 | 0.3368 |

| 2022-08-05 | IMC-Chicago, LLC | 1,554,400 | 1,780,300 | 225,900 | 243,403 | 0.3269 |

| 2022-08-25 | ITA – iShares U.S. Aerospace & Defense ETF | 1,464,497 | 1,725,156 | 260,659 | 235,863 | 0.3168 |

| 2022-08-11 | Group One Trading, L.p. | 2,383,400 | 1,662,700 | -720,700 | 227,324 | 0.3053 |

| 2022-07-29 | FBALX – Fidelity Balanced Fund | 1,604,980 | 1,638,516 | 33,536 | 215,301 | 0.3009 |

| 2022-08-12 | Ubs Asset Management Americas Inc | 1,586,049 | 1,570,915 | -15,134 | 214,775 | 0.2885 |

| 2022-08-15 | Pentwater Capital Management LP | 1,965,000 | 1,562,000 | -403,000 | 213,557 | 0.2868 |

| 2022-08-12 | Barclays Plc | 1,448,795 | 1,516,184 | 67,389 | 207,292 | 0.2784 |

| 2022-08-15 | Susquehanna International Group, Llp | 580,566 | 1,477,538 | 896,972 | 202,009 | 0.2713 |

| 2022-08-17 | Parallax Volatility Advisers, L.P. | 851,000 | 1,476,900 | 625,900 | 201,917 | 0.2712 |

| 2022-08-15 | D. E. Shaw & Co., Inc. | 1,356,500 | 1,451,200 | 94,700 | 198,408 | 0.2665 |

| 2022-08-12 | Ensign Peak Advisors, Inc | 1,386,744 | 1,438,531 | 51,787 | 196,677 | 0.2641 |

| 2022-05-16 | Parametric Portfolio Associates Llc | 1,387,792 | 1,426,550 | 38,758 | 273,184 | 0.2619 |

| 2022-08-15 | Royal Bank Of Canada | 1,573,943 | 1,411,551 | -162,392 | 192,988 | 0.2592 |

| 2022-08-26 | FGLGX – Fidelity Series Large Cap Stock Fund | 1,087,191 | 1,392,891 | 305,700 | 190,436 | 0.2558 |

| 2022-08-15 | Viking Global Investors Lp | 305,347 | 1,391,238 | 1,085,891 | 190,210 | 0.2555 |

| 2022-08-03 | Simplex Trading, Llc | 1,331,400 | 1,382,600 | 51,200 | 189,029 | 0.2539 |

| 2022-08-25 | QCSTRX – Stock Account Class R1 | 1,330,330 | 1,372,876 | 42,546 | 187,700 | 0.2521 |

| 2022-07-29 | FSDAX – Defense and Aerospace Portfolio | 1,272,600 | 1,333,700 | 61,100 | 175,248 | 0.2449 |

| 2022-08-05 | IMC-Chicago, LLC | 1,407,200 | 1,328,900 | -78,300 | 181,687 | 0.2440 |

| 2022-08-15 | Balyasny Asset Management Llc | 293,631 | 1,306,557 | 1,012,926 | 178,632 | 0.2399 |

| 2022-08-15 | Millennium Management Llc | 1,808,900 | 1,295,800 | -513,100 | 177,162 | 0.2379 |

| 2022-08-11 | Jpmorgan Chase & Co | 1,325,280 | 1,295,770 | -29,510 | 177,158 | 0.2379 |

| 2022-08-03 | Simplex Trading, Llc | 1,545,500 | 1,266,400 | -279,100 | 173,142 | 0.2325 |

| 2022-08-11 | Group One Trading, L.p. | 1,670,500 | 1,218,100 | -452,400 | 166,539 | 0.2237 |

| 2022-08-15 | Wellington Management Group Llp | 1,139,143 | 1,203,339 | 64,196 | 164,520 | 0.2210 |

| File Date | Investors for Boeing – Mutual Funds | Avg Share Price | Shares | Report Value ($1000) | Value Changed (%) | % | |

| 2022-08-29 | VTSMX – Vanguard Total Stock Market Index Fund Investor Shares | 335.04 | 17,425,088 | 2,382,358 | -26.08 | 0.2148 | |

| 2022-08-29 | VFINX – Vanguard 500 Index Fund Investor Shares | 336.81 | 12,310,117 | 1,683,039 | -26.72 | 0.2371 | |

| 2022-07-29 | FXAIX – Fidelity 500 Index Fund | 337.22 | 5,777,777 | 759,200 | -34.65 | 0.2057 | |

| 2022-08-29 | VIGRX – Vanguard Growth Index Fund Investor Shares | 329.98 | 4,770,517 | 652,225 | -26.76 | 0.4878 | |

| 2022-08-29 | VINIX – Vanguard Institutional Index Fund Institutional Shares | 356.82 | 4,120,129 | 563,304 | -28.39 | 0.2375 | |

| 2022-08-29 | LGRRX – Loomis Sayles Growth Fund Class A | 191.23 | 3,619,108 | 494,804 | -15.87 | 4.8485 | |

| 2022-08-26 | ANCFX – AMERICAN FUNDS FUNDAMENTAL INVESTORS Class A | 202.8 | 2,740,500 | 374,681 | 176.4 | 0.3607 | |

| 2022-08-26 | ABALX – AMERICAN BALANCED FUND Class A | 251.12 | 2,701,218 | 369,311 | 45.69 | 0.1909 | |

| 2022-09-28 | AWSHX – WASHINGTON MUTUAL INVESTORS FUND Class A | 151.72 | 2,246,961 | 357,963 | 321 | 0.2348 | |

| 2022-07-29 | FBALX – Fidelity Balanced Fund | 234.71 | 1,638,516 | 215,301 | -34.67 | 0.5171 | |

| 2022-08-26 | FGLGX – Fidelity Series Large Cap Stock Fund | 209.14 | 1,392,891 | 190,436 | -8.53 | 1.5097 | |

| 2022-07-29 | FSDAX – Defense and Aerospace Portfolio | 288.28 | 1,333,700 | 175,248 | -32.94 | 12.4521 | |

| 2022-07-29 | FCTDX – Strategic Advisers Fidelity U.S. Total Stock Fund | 207.3 | 1,198,797 | 157,522 | -23.22 | 0.2289 | |

| 2022-09-23 | SWPPX – Schwab S&P 500 Index Fund | 1,024,316 | 163,184 | 10.43 | 0.2536 | ||

| 2022-07-29 | FALCX – Strategic Advisers Large Cap Fund | 182.65 | 918,988 | 120,755 | -34.49 | 0.2166 | |

| 2022-09-29 | VWNFX – Vanguard Windsor II Fund Investor Shares | 138.88 | 895,000 | 142,582 | 0.267 | ||

| 2022-07-29 | FSKAX – Fidelity Total Market Index Fund | 349.88 | 886,051 | 116,427 | -35.93 | 0.173 | |

| 2022-08-24 | PRFDX – T. Rowe Price Equity Income Fund | 350.35 | 880,000 | 120,314 | -26.09 | 0.7057 | |

| 2022-09-27 | FBLEX – Fidelity Series Stock Selector Large Cap Value Fund | 200.01 | 778,215 | 123,977 | -6.02 | 1.2741 | |

| 2022-09-29 | VWNDX – Vanguard Windsor Fund Investor Shares | 207.9 | 672,223 | 107,092 | 4.82 | 0.4699 | |

| 2022-07-28 | AGTHX – GROWTH FUND OF AMERICA Class A | 365.75 | 659,470 | 86,654 | -48.1 | 0.0389 | |

| 2022-08-29 | VLACX – Vanguard Large-Cap Index Fund Investor Shares | 326.36 | 630,075 | 86,144 | -25.76 | 0.247 | |

| 2022-09-27 | FBGRX – Fidelity Blue Chip Growth Fund | 197.62 | 628,270 | 100,090 | 14.52 | 0.2435 | |

| 2022-07-29 | FCFMX – Fidelity Series Total Market Index Fund | 304.23 | 610,897 | 80,272 | -33.92 | 0.1735 | |

| 2022-09-27 | FGRIX – Fidelity Growth & Income Portfolio | 209.6 | 607,720 | 96,816 | 17.52 | 1.2599 | |

| 2022-08-26 | ANWPX – NEW PERSPECTIVE FUND Class A | 357.45 | 601,236 | 82,201 | -28.61 | 0.0774 | |

| 2022-08-01 | VINAX – Vanguard Industrials Index Fund Admiral Shares | 365.34 | 581,650 | 76,429 | -46.12 | 2.0215 | |

| 2022-09-27 | FNKLX – Fidelity Series Value Discovery Fund | 464,400 | 73,984 | 0.901 | |||

| 2022-08-26 | MBCGX – MassMutual Select Blue Chip Growth Fund Class A | 226.2 | 463,478 | 63,367 | -18.42 | 2.3083 | |

| 2022-09-27 | FEQIX – Fidelity Equity-Income Fund | 223.71 | 460,424 | 73,350 | 5.68 | 1.0241 | |

| 2022-09-28 | TIEIX – TIAA-CREF Equity Index Fund Institutional Class | 331.75 | 459,453 | 73,195 | 16.15 | 0.2114 | |

| 2022-08-29 | VBINX – Vanguard Balanced Index Fund Investor Shares | 352.47 | 456,411 | 62,401 | -26.86 | 0.1268 | |

| 2022-08-24 | CZMGX – Multi-Manager Growth Strategies Fund Institutional Class | 162.79 | 442,856 | 60,547 | 2.75 | 1.6163 | |

| 2022-08-01 | VMGAX – Vanguard Mega Cap Growth Index Fund Institutional Shares | 292.2 | 430,623 | 56,584 | -35.91 | 0.5082 | |

| 2022-08-29 | VITNX – Vanguard Institutional Total Stock Market Index Fund Institutional Shares | 351.02 | 404,056 | 55,243 | -26.33 | 0.2155 | |

| 2022-08-24 | PREIX – T. Rowe Price Equity Index 500 Fund | 357.45 | 399,420 | 54,609 | -35.15 | 0.2375 | |

| 2022-08-26 | FDETX – Fidelity Advisor Capital Development Fund Class O | 212.7 | 367,700 | 50,272 | -14.32 | 1.4954 | |

| 2022-09-28 | NEWFX – NEW WORLD FUND INC Class A | 244.71 | 350,700 | 55,870 | 21.67 | 0.116 | |

| 2022-09-28 | USAAX – Growth Fund Shares | 204.76 | 310,740 | 49,504 | 18.56 | 1.7635 | |

| 2022-08-26 | QVG2Q – Growth Portfolio Investor Class | 308,400 | 42,164 | 0.622 | |||

| 2022-09-28 | DFEOX – U.s. Core Equity 1 Portfolio – Institutional Class | 357.79 | 293,933 | 46,826 | 7.04 | 0.1581 | |

| 2022-08-24 | PRCOX – T. Rowe Price U.S. Equity Research Fund | 249.38 | 290,989 | 39,784 | -18.8 | 0.3484 | |

| 2022-09-27 | FDCAX – Fidelity Capital Appreciation Fund | 287,700 | 45,833 | 0.7584 | |||

| 2022-09-27 | FLCSX – Fidelity Large Cap Stock Fund | 207.27 | 283,133 | 45,106 | 14.78 | 1.6261 | |

| 2022-08-26 | FNIAX – Fidelity Advisor New Insights Fund Class A | 254.26 | 278,000 | 38,008 | -39.32 | 0.2177 | |

| 2022-07-29 | FABLX – Fidelity Advisor Balanced Fund Class A | 227.35 | 270,943 | 35,602 | -31.62 | 0.5288 | |

| 2022-07-28 | NPRTX – Neuberger Berman Large Cap Value Fund Investor Class | 205.6 | 269,176 | 35,370 | -45.82 | 0.3323 | |

| 2022-08-26 | QBA2Q – Balanced Portfolio Initial Class | 217.23 | 253,000 | 34,590 | -27.55 | 0.5764 | |

| 2022-09-27 | TIGRX – TIAA-CREF Growth & Income Fund Institutional Class | 138.88 | 244,974 | 39,027 | 25.44 | 0.6943 | |

| 2022-08-01 | VRVIX – Vanguard Russell 1000 Value Index Fund Institutional Shares | 198.24 | 240,793 | 31,640 | -35.25 | 0.3524 | |

| 2022-09-27 | TIRTX – TIAA-CREF Large-Cap Growth Fund Retail Class | 207.14 | 233,586 | 37,213 | 2.32 | 0.6956 | |

| 2022-05-27 | HLQVX – JPMorgan Large Cap Value Fund Class I | 217.65 | 230,200 | 44,083 | 20.51 | 1.303 | |

Northrop Grumman. Total shares = 202,959,137

| File Date | Investors for Northrop Grumman – All Institutional Owners | Current Shares | Change | Prev Value ($K) | Current Value ($K) | % |

| 2022-08-15 | State Street Corp | 14,243,422 | -177,597 | 6,449,368 | 6,816,474 | 7.0179 |

| 2022-08-15 | Capital International Investors | 12,280,616 | -167,880 | 5,568,059 | 5,874,905 | 6.0508 |

| 2022-08-12 | Vanguard Group Inc | 12,031,374 | 119,962 | 5,327,021 | 5,757,854 | 5.9280 |

| 2022-08-12 | BlackRock Inc. | 9,171,587 | 509,659 | 3,873,788 | 4,389,247 | 4.5189 |

| 2022-08-15 | Wellington Management Group Llp | 7,974,522 | -701,186 | 3,879,950 | 3,816,368 | 3.9291 |

| 2022-08-12 | Fmr Llc | 6,562,706 | 339,889 | 2,782,968 | 3,140,714 | 3.2335 |

| 2022-08-09 | Massachusetts Financial Services Co /ma/ | 5,434,390 | -138,583 | 2,492,346 | 2,600,736 | 2.6776 |

| 2022-09-28 | AWSHX – WASHINGTON MUTUAL INVESTORS FUND Class A | 5,177,097 | 1,074,041 | 1,802,882 | 2,479,312 | 2.5508 |

| 2022-08-11 | Jpmorgan Chase & Co | 4,218,841 | -1,023,065 | 2,344,285 | 2,019,009 | 2.0787 |

| 2022-08-29 | VTSMX – Vanguard Total Stock Market Index Fund Investor Shares | 4,120,790 | 68,881 | 1,812,094 | 1,972,086 | 2.0304 |

| 2022-09-29 | VDIGX – Vanguard Dividend Growth Fund Investor Shares | 3,666,984 | 20,322 | 1,602,343 | 1,756,119 | 1.8068 |

| 2022-07-25 | MEIAX – MFS Value Fund A | 3,415,462 | -243,226 | 1,617,652 | 1,598,334 | 1.6828 |

| 2022-08-29 | VFINX – Vanguard 500 Index Fund Investor Shares | 3,234,195 | 23,000 | 1,436,110 | 1,547,789 | 1.5935 |

| 2022-08-12 | Bank Of America Corp /de/ | 3,148,284 | 60,553 | 1,380,895 | 1,506,676 | 1.5512 |

| 2022-08-12 | Sanders Capital, LLC | 3,134,834 | -190,626 | 1,487,212 | 1,490,833 | 1.5446 |

| 2022-08-15 | Morgan Stanley | 3,057,744 | 775,329 | 1,020,742 | 1,463,345 | 1.5066 |

| 2022-08-12 | Geode Capital Management, Llc | 2,668,711 | 141,963 | 1,126,952 | 1,274,654 | 1.3149 |

| 2022-08-26 | ABALX – AMERICAN BALANCED FUND Class A | 2,470,885 | 25,000 | 1,093,848 | 1,182,491 | 1.2174 |

| 2022-08-15 | Capital World Investors | 2,357,116 | 1,623,944 | 327,889 | 1,128,045 | 1.1614 |

| 2022-08-15 | Ameriprise Financial Inc | 2,194,795 | -102,069 | 1,026,512 | 1,050,041 | 1.0814 |

| 2022-08-15 | Putnam Investments Llc | 1,746,963 | -8,918 | 785,265 | 836,044 | 0.8607 |

| 2022-09-27 | AMRMX – AMERICAN MUTUAL FUND Class A | 1,654,442 | 88,840 | 687,925 | 792,312 | 0.8152 |

| 2022-08-26 | Spdr S&p 500 Etf Trust | 1,588,637 | -9,165 | 714,569 | 760,274 | 0.7827 |

| 2022-07-29 | FXAIX – Fidelity 500 Index Fund | 1,547,037 | 20,895 | 674,768 | 723,967 | 0.7622 |

| 2022-08-26 | AIVSX – INVESTMENT CO OF AMERICA Class A | 1,523,090 | -53,500 | 705,082 | 728,905 | 0.7504 |

| 2022-08-01 | VWELX – VANGUARD WELLINGTON FUND Investor Shares | 1,487,693 | 0 | 657,768 | 696,196 | 0.7330 |

| 2022-08-15 | Bank of New York Mellon Corp | 1,380,421 | 43,094 | 598,080 | 660,628 | 0.6801 |

| 2022-07-25 | LBSAX – Columbia Dividend Income Fund Class A | 1,376,096 | -90,071 | 648,251 | 643,972 | 0.6780 |

| 2022-08-12 | Northern Trust Corp | 1,304,888 | 15,545 | 576,620 | 624,481 | 0.6429 |

| 2022-08-15 | Price T Rowe Associates Inc /md/ | 1,290,934 | 567,520 | 323,525 | 617,802 | 0.6361 |

| 2022-08-25 | IVV – iShares Core S&P 500 ETF | 1,265,157 | -5,731 | 568,366 | 605,466 | 0.6234 |

| 2022-08-17 | Macquarie Group Ltd | 1,247,547 | -329,212 | 705,158 | 597,039 | 0.6147 |

| 2022-08-26 | HLIEX – JPMorgan Equity Income Fund Class I | 1,211,552 | -371,561 | 707,999 | 579,812 | 0.5969 |

| 2022-08-29 | VIVAX – Vanguard Value Index Fund Investor Shares | 1,209,419 | 43,401 | 521,466 | 578,792 | 0.5959 |

| 2022-08-29 | VINIX – Vanguard Institutional Index Fund Institutional Shares | 1,082,582 | -17,280 | 491,880 | 518,091 | 0.5334 |

| 2022-08-26 | FCNTX – Fidelity Contrafund | 1,068,459 | 333,355 | 328,753 | 511,332 | 0.5264 |

| 2022-09-26 | PEYAX – PUTNAM EQUITY INCOME FUND Class A Shares | 1,037,631 | 0 | 455,935 | 496,921 | 0.5113 |

| 2022-09-29 | VWNFX – Vanguard Windsor II Fund Investor Shares | 1,014,374 | 0 | 445,715 | 485,784 | 0.4998 |

| 2022-08-15 | Invesco Ltd. | 952,722 | -233,814 | 530,644 | 455,943 | 0.4694 |

| 2022-08-11 | Clearbridge Investments, LLC | 932,135 | 2,471 | 415,765 | 446,092 | 0.4593 |

| 2022-09-29 | VIG – Vanguard Dividend Appreciation Index Fund ETF Shares | 920,309 | 8,011 | 400,863 | 440,736 | 0.4534 |

| 2022-08-10 | Bessemer Group Inc | 899,026 | 3,825 | 400,351 | 430,246 | 0.4430 |

| 2022-08-22 | Legal & General Group Plc | 884,022 | 85,911 | 356,931 | 423,067 | 0.4356 |

| 2022-08-11 | Franklin Resources Inc | 866,067 | -51,394 | 410,307 | 414,474 | 0.4267 |

| 2022-08-26 | AMERICAN FUNDS INSURANCE SERIES – Asset Allocation Fund Class 1 | 860,568 | 57,015 | 359,364 | 411,842 | 0.4240 |

| 2022-08-26 | JUEAX – JPMorgan U.S. Equity Fund Class A | 805,472 | -19,056 | 368,745 | 385,475 | 0.3969 |

| 2022-08-26 | ANCFX – AMERICAN FUNDS FUNDAMENTAL INVESTORS Class A | 766,401 | 0 | 342,749 | 366,777 | 0.3776 |

| 2022-08-15 | Nuveen Asset Management, LLC | 766,176 | -10,523 | 346,873 | 366,669 | 0.3775 |

| 2022-08-23 | FKGRX – Franklin Growth Fund Class A | 760,508 | -45,800 | 360,597 | 363,956 | 0.3747 |

| 2022-08-26 | XLI – The Industrial Select Sector SPDR Fund | 748,719 | -37,842 | 351,765 | 358,314 | 0.3689 |

| 2022-08-15 | Royal Bank Of Canada | 748,095 | 25,606 | 323,109 | 358,015 | 0.3686 |

| 2022-08-15 | Charles Schwab Investment Management Inc | 737,264 | -2,167 | 330,689 | 352,833 | 0.3633 |

| 2022-08-12 | Dimensional Fund Advisors Lp | 676,254 | -16,124 | 309,645 | 323,635 | 0.3332 |

| 2022-08-08 | Allen Investment Management LLC | 664,870 | -118,858 | 350,499 | 318,187 | 0.3276 |

| 2022-05-16 | Parametric Portfolio Associates Llc | 642,858 | 38,979 | 233,743 | 287,499 | 0.3167 |

| 2022-08-10 | Lsv Asset Management | 641,204 | -70,257 | 318,180 | 306,861 | 0.3159 |

| 2022-08-26 | AMERICAN FUNDS INSURANCE SERIES – Growth-Income Fund Class 1 | 633,267 | -33,434 | 298,162 | 303,063 | 0.3120 |

| 2022-07-13 | AustralianSuper Pty Ltd | 628,163 | -116,004 | 332,806 | 300,620 | 0.3095 |

| 2022-08-15 | Alliancebernstein L.p. | 620,220 | -59,102 | 303,806 | 296,819 | 0.3056 |

| 2022-08-15 | 1832 Asset Management L.P. | 591,215 | 143,229 | 197,597 | 282,938 | 0.2913 |

| 2022-08-29 | VEIPX – Vanguard Equity Income Fund Investor Shares | 549,273 | -197,047 | 333,769 | 262,866 | 0.2706 |

| 2022-08-12 | Lord, Abbett & Co. Llc | 547,084 | 5,127 | 242,374 | 261,818 | 0.2696 |

| 2022-08-29 | BBVLX – Bridge Builder Large Cap Value Fund | 539,868 | -15,911 | 248,555 | 258,365 | 0.2660 |

| 2022-07-29 | FPURX – Fidelity Puritan Fund | 531,467 | 17,117 | 227,414 | 248,711 | 0.2619 |

| 2022-07-25 | DDVAX – Delaware Value Fund Class A | 523,462 | -162,100 | 303,114 | 244,965 | 0.2579 |

| 2022-08-18 | Goldman Sachs Group Inc | 513,604 | 6,683 | 226,705 | 245,795 | 0.2531 |

| 2022-08-12 | Artisan Partners Limited Partnership | 490,882 | 266,487 | 100,354 | 234,921 | 0.2419 |

| 2022-07-29 | FALCX – Strategic Advisers Large Cap Fund | 478,854 | 112,441 | 162,005 | 224,089 | 0.2359 |

| 2022-05-26 | FTCS – First Trust Capital Strength ETF | 437,853 | -4,607 | 171,262 | 195,817 | 0.2157 |

| 2022-08-12 | Wells Fargo & Company/mn | 435,713 | -78,855 | 230,126 | 208,519 | 0.2147 |

| 2022-08-04 | Yacktman Asset Management Lp | 435,481 | 322 | 194,612 | 208,408 | 0.2146 |

| 2022-07-26 | Sumitomo Mitsui Trust Holdings, Inc. | 435,020 | 19,502 | 185,828 | 208,188 | 0.2143 |

| File Date | Investors for Northrop Grumman – Mutual Fund | Shares | Report Value ($k) | Value Changed (Percent) | Allocation (%) | ||

| 2022-09-28 | AWSHX – WASHINGTON MUTUAL INVESTORS FUND Class A | 5,177,097 | 2,479,312 | 37.52 | 1.6264 | ||

| 2022-08-29 | VTSMX – Vanguard Total Stock Market Index Fund Investor Shares | 4,120,790 | 1,972,086 | 8.83 | 0.1778 | ||

| 2022-09-29 | VDIGX – Vanguard Dividend Growth Fund Investor Shares | 3,666,984 | 1,756,119 | 9.6 | 3.3105 | ||

| 2022-07-25 | MEIAX – MFS Value Fund A | 3,415,462 | 1,598,334 | -1.19 | 2.5829 | ||

| 2022-08-29 | VFINX – Vanguard 500 Index Fund Investor Shares | 3,234,195 | 1,547,789 | 7.78 | 0.2181 | ||

| 2022-08-26 | ABALX – AMERICAN BALANCED FUND Class A | 2,470,885 | 1,182,491 | 8.1 | 0.6111 | ||

| 2022-09-27 | AMRMX – AMERICAN MUTUAL FUND Class A | 1,654,442 | 792,312 | 15.17 | 0.9248 | ||

| 2022-07-29 | FXAIX – Fidelity 500 Index Fund | 1,547,037 | 723,967 | 7.29 | 0.1962 | ||

| 2022-08-26 | AIVSX – INVESTMENT CO OF AMERICA Class A | 1,523,090 | 728,905 | 3.38 | 0.726 | ||

| 2022-08-01 | VWELX – VANGUARD WELLINGTON FUND Investor Shares | 1,487,693 | 696,196 | 5.84 | 0.6291 | ||

| 2022-07-25 | LBSAX – Columbia Dividend Income Fund Class A | 1,376,096 | 643,972 | -0.66 | 1.7059 | ||

| 2022-08-26 | HLIEX – JPMorgan Equity Income Fund Class I | 1,211,552 | 579,812 | -18.11 | 1.2609 | ||

| 2022-08-29 | VIVAX – Vanguard Value Index Fund Investor Shares | 1,209,419 | 578,792 | 10.99 | 0.4159 | ||

| 2022-08-29 | VINIX – Vanguard Institutional Index Fund Institutional Shares | 1,082,582 | 518,091 | 5.33 | 0.2185 | ||

| 2022-08-26 | FCNTX – Fidelity Contrafund | 1,068,459 | 511,332 | 55.54 | 0.5269 | ||

| 2022-09-26 | PEYAX – PUTNAM EQUITY INCOME FUND Class A Shares | 1,037,631 | 496,921 | 8.99 | 2.7965 | ||

| 2022-09-29 | VWNFX – Vanguard Windsor II Fund Investor Shares | 1,014,374 | 485,784 | 8.99 | 0.9097 | ||

| 2022-08-26 | JUEAX – JPMorgan U.S. Equity Fund Class A | 805,472 | 385,475 | 4.54 | 2.0718 | ||

| 2022-08-26 | ANCFX – AMERICAN FUNDS FUNDAMENTAL INVESTORS Class A | 766,401 | 366,777 | 7.01 | 0.3531 | ||

| 2022-08-23 | FKGRX – Franklin Growth Fund Class A | 760,508 | 363,956 | 0.93 | 2.3187 | ||

| 2022-08-29 | VEIPX – Vanguard Equity Income Fund Investor Shares | 549,273 | 262,866 | -21.24 | 0.525 | ||

| 2022-08-29 | BBVLX – Bridge Builder Large Cap Value Fund | 539,868 | 258,365 | 3.95 | 1.5254 | ||

| 2022-07-29 | FPURX – Fidelity Puritan Fund | 531,467 | 248,711 | 9.36 | 0.8364 | ||

| 2022-07-25 | DDVAX – Delaware Value Fund Class A | 523,462 | 244,965 | -19.18 | 3.1229 | ||

| 2022-07-29 | FALCX – Strategic Advisers Large Cap Fund | 478,854 | 224,089 | 38.32 | 0.402 | ||

| 2022-08-24 | PRDGX – T. Rowe Price Dividend Growth Fund, Inc. | 410,080 | 196,252 | 7.01 | 1.0369 | ||

| 2022-09-29 | OWLSX – Old Westbury Large Cap Strategies Fund | 366,666 | 175,596 | 9.3 | 0.8404 | ||

| 2022-09-28 | LAFFX – LORD ABBETT AFFILIATED FUND INC Class A | 356,100 | 170,536 | 8.99 | 2.9669 | ||

| 2022-08-26 | FNIAX – Fidelity Advisor New Insights Fund Class A | 344,586 | 164,909 | 19.73 | 0.9447 | ||

| 2022-09-27 | FNKLX – Fidelity Series Value Discovery Fund | 302,900 | 145,059 | 6.01 | 1.7667 | ||

| 2022-09-23 | SWPPX – Schwab S&P 500 Index Fund | 269,145 | 128,894 | 10.33 | 0.2003 | ||

| 2022-08-26 | FLCNX – Fidelity Contrafund K6 | 241,391 | 115,522 | 76.26 | 0.594 | ||

| 2022-07-29 | FSKAX – Fidelity Total Market Index Fund | 237,357 | 111,076 | 5.4 | 0.1651 | ||

| 2022-08-19 | SOPAX – ClearBridge Dividend Strategy Fund Class A | 228,800 | 109,497 | 7.01 | 1.6284 | ||

| 2022-08-19 | YACKX – AMG Yacktman Fund Class I | 225,000 | 107,678 | 7.01 | 1.3434 | ||

| 2022-07-29 | FCTDX – Strategic Advisers Fidelity U.S. Total Stock Fund | 222,500 | 104,123 | -5 | 0.1513 | ||

| 2022-08-24 | TRVLX – T. Rowe Price Value Fund, Inc. | 208,500 | 99,782 | 0.3198 | |||

| 2022-08-01 | VWUSX – Vanguard U.S. Growth Fund Investor Shares | 188,432 | 88,181 | 52.07 | 0.2492 | ||

| 2022-07-29 | FBALX – Fidelity Balanced Fund | 188,016 | 87,986 | -55.66 | 0.2113 | ||

| 2022-07-29 | FSDAX – Defense and Aerospace Portfolio | 174,500 | 81,661 | 6.21 | 5.8023 | ||