TIBET-CHINA IS THE ABSOLUTE LEADER OF THE WORLD

The sign of Tibet is the eye. This sign comes from the point painted in the middle of the forehead.

Tibet – China it is hidden behind the following five countries: India, Iran, Israel, SRI Lanka, Pakistan (Punjab).

Tibet – China is the master of these five shield countries.

Tibet- China coordinates, Iran, India and Israel in order to accomplish it’s financial purposes

China = God – and rules over:

God Father = Iran

God Holly Spirit = India

God Son = Israel

In cabala, G = C, because they have the same shape.

The translation is: IN CHINA WE MAKE THE FINANCIAL TRUST

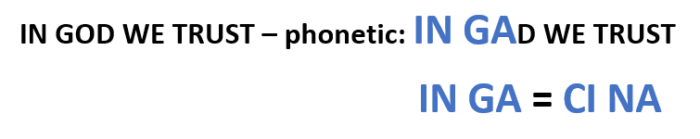

The Kabbala representation for the Sephirot Tree is a pyramid from the 1$ banknote.

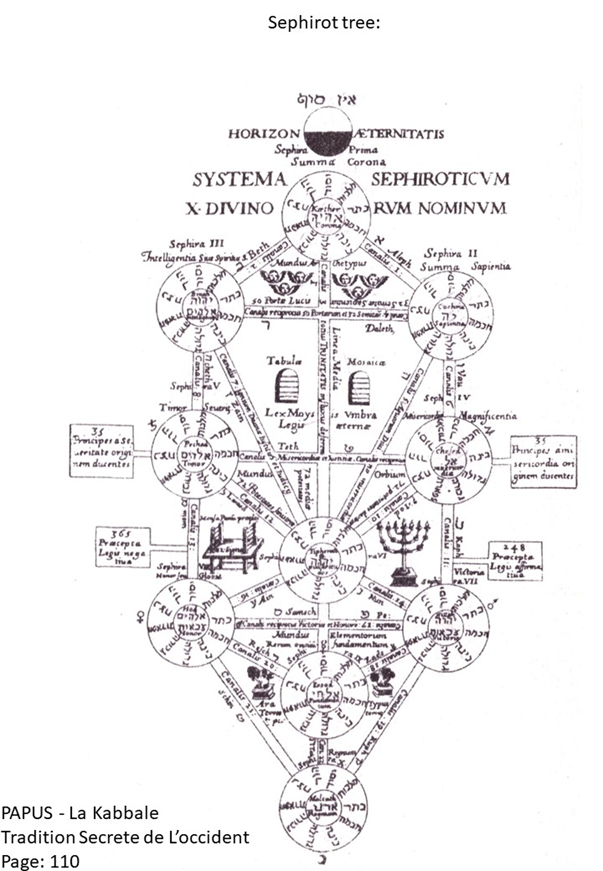

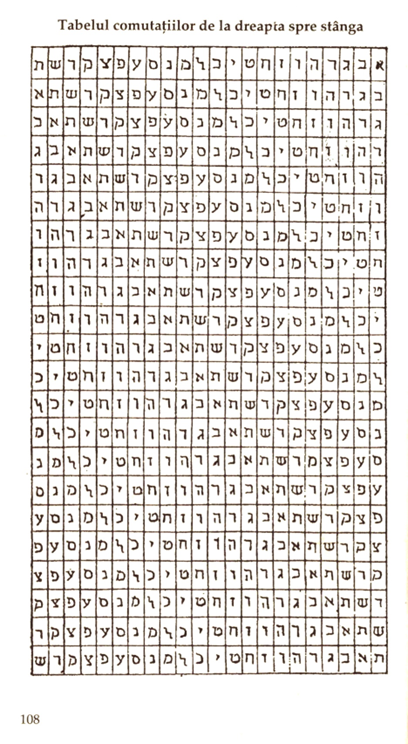

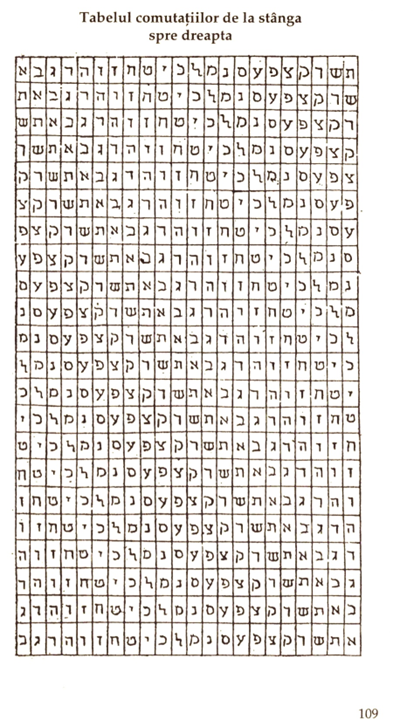

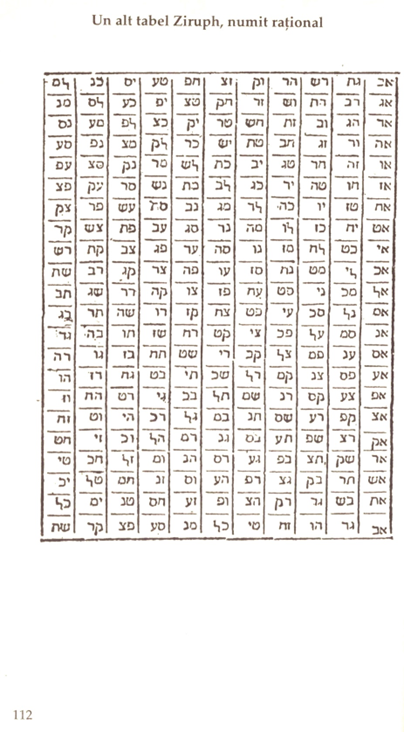

Table from page 107 from Book “Magia Ceremoniala” – Filosofia occulta sau magia ( Cartea III), Cornelius Agrippa von Nettsheim.

The above table contains secret 72 keywords, (passwords, parola) that are used to encrypt the exchange rates and assets value in the stock exchange. (London Stock exchange, New York Stock exchange, Paris Stock exchange, New Delhi Stock exchange, Singapore Stock exchange, Hong Kong Stock exchange).

Very Important:

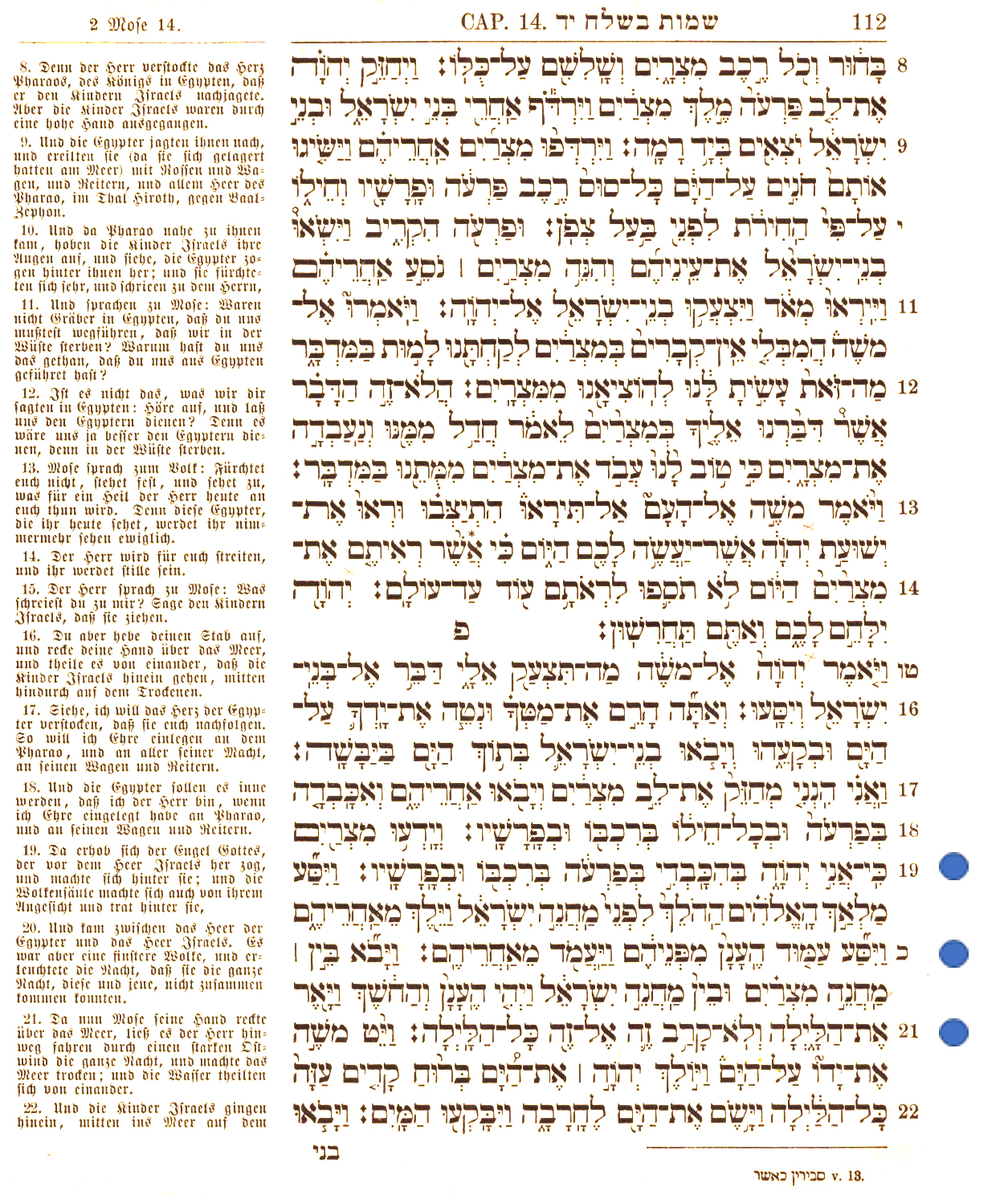

The 72 ciphers are extracted from Book Exodus, chapter 14 ,verse 19, 20 and 21. Every verse has 72 letters. All the details on how to construct the 72 keywords can be found in the book “Kabbala” – Traditia secreta a Occidentului / Stiinta Secreta – PAPUS, Editura Herlad. Page 57-58, and book “Magia Ceremoniala”- Filosofia Oculta sau Magia, page 106 – Corenelius Agrippa.

We present the original page from Exodus, Cap 14, verse 19,20 and 21:

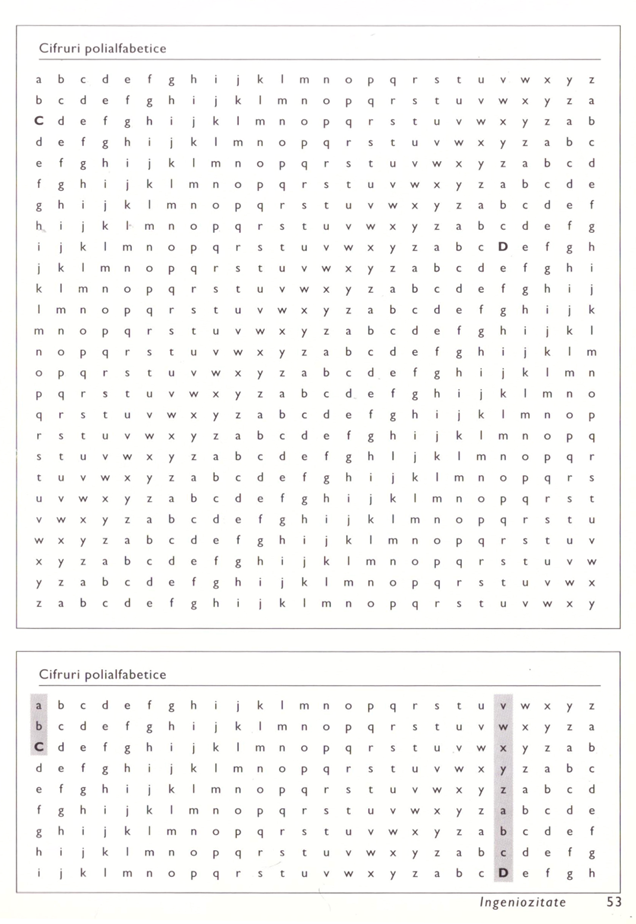

These cipher (keywords) are used together with the following tables,

Ziruph means Siruph = Ziphru = means tzifru. (in Romanian cifru = cipher )

In Cabala, Z = S = C

The usage model for the cipher and the tables are presented in the book “Coduri – O istorie a comunicarii secrete”, page 52-53, by Stephen Pincock and Mark Frary.

The method is known by secret services as the Polyalphabetic Ciphers .

Schemhamphoras, means schema-amphora.

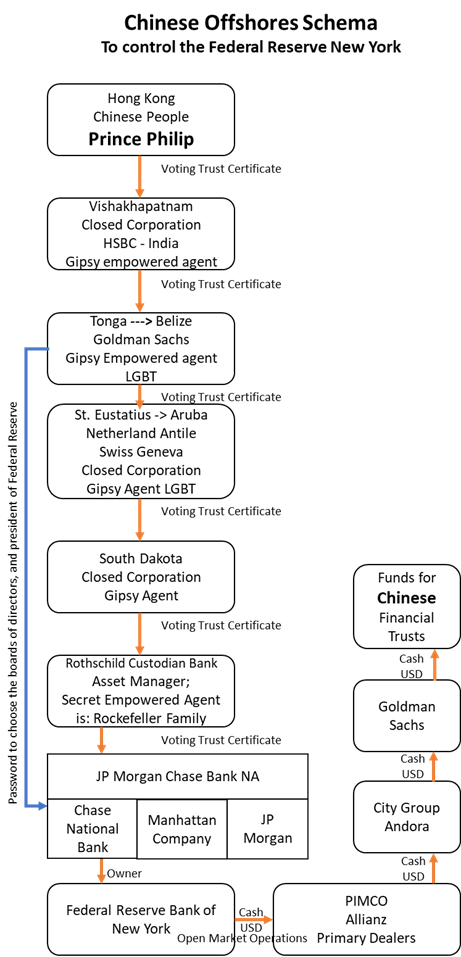

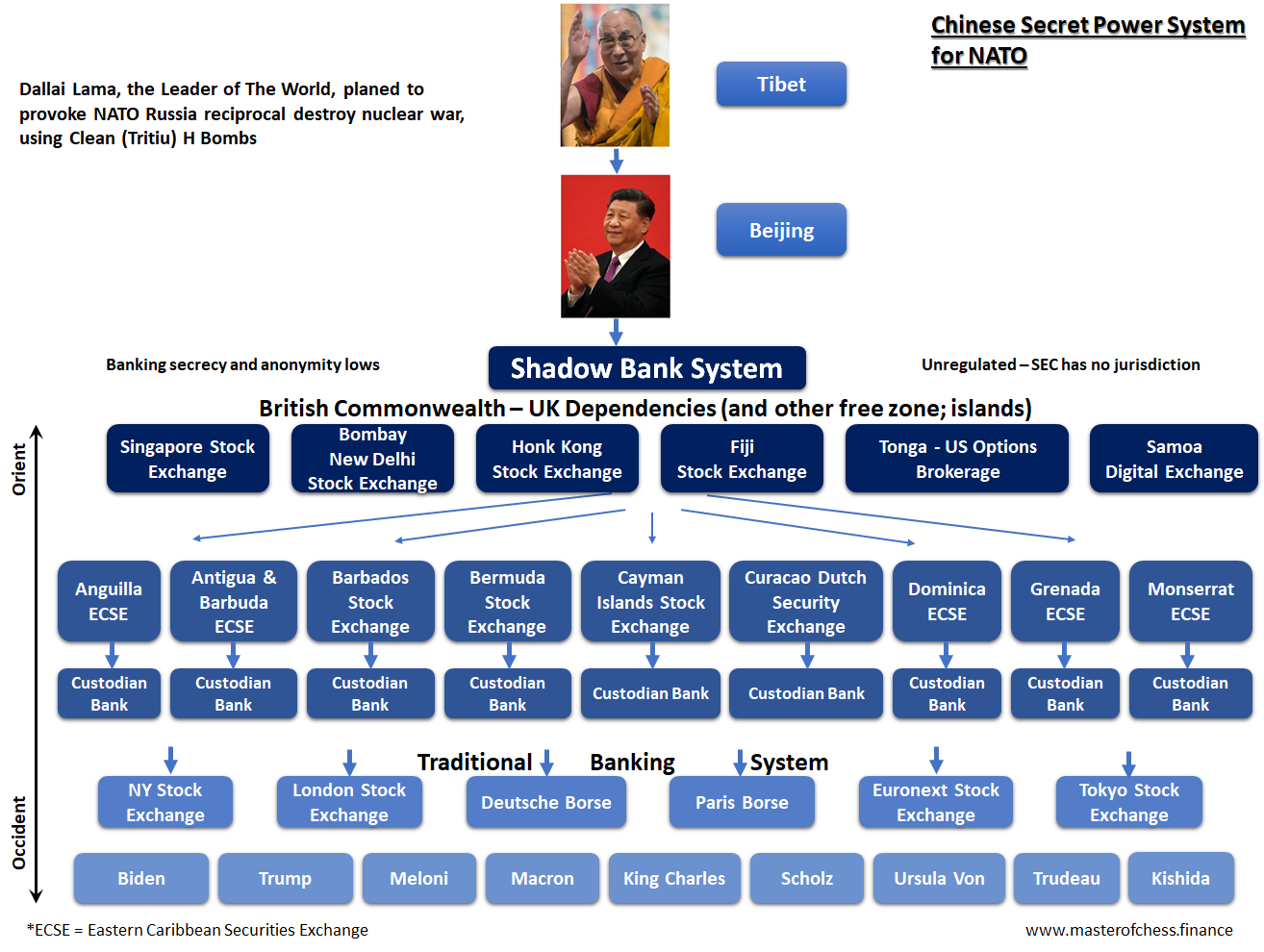

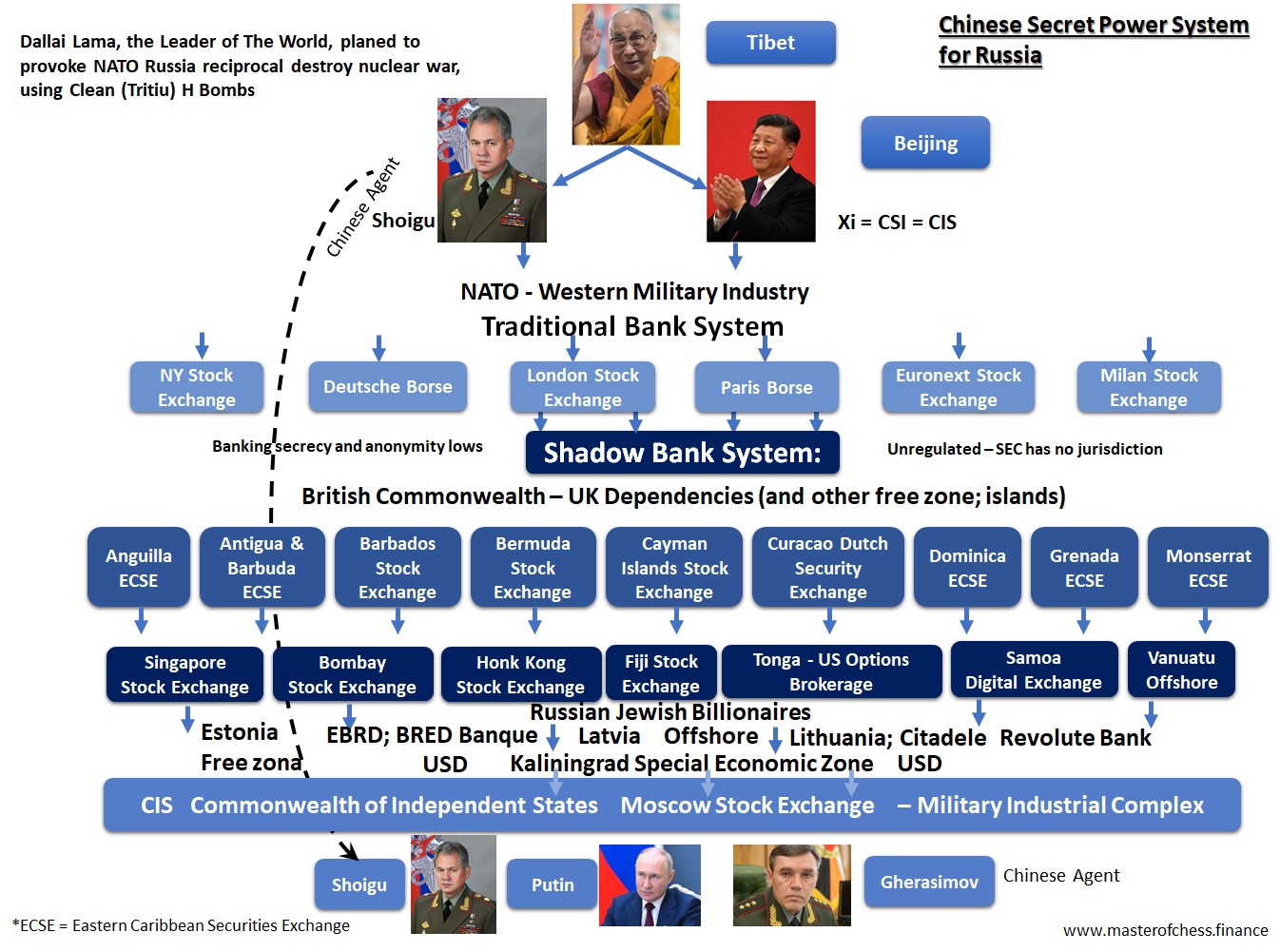

China Controls Federal Reserve Bank of New York using as protecting shield, Rothschild’s Family custodian Bank (asset manager)

Rothschild Custodian Banks has the role to hide Prince Philip as Federal Reserve New York Shareholder

Using the following schema, China intend to convince US president and US top politicians that Federal Reserve Bank of New York is owned and ruled by white people

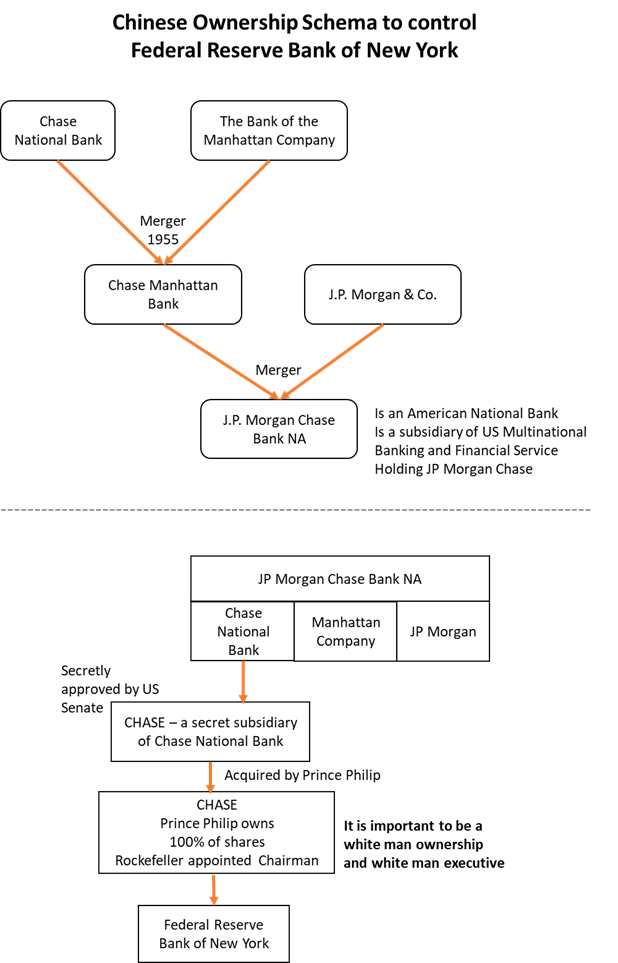

The owner of Federal Reserve Bank of New York is Chase (Manhattan) Bank. The controlling shareholder of Chase Manhattan is in conformity with shareholders register Rockefeller Family. The write to vote in Shareholder meeting belongs to Rockefeller Family.

Rockefeller Family is not the real controlling shareholder of Chase Manhattan, so nether to Federal Reserve Bank New York. The real and only secret shareholder of federal Reserve Bank of New York is Principe Consort Philip, the husband of queen Elisabeth.

The Rothschild Asset Manager Witch is also Custodian Bank or Clearing Bank, keep in custody the shares of Federal Reserve New York Bank and Chase Manhattan Bank.

In the Shareholders register of the Rothschild Asset Manager (Custodian Bank, Clearing Bank) is recorded as shareholders Rockefeller Family. But Rockefeller is empowered (in secret) to vote by some other entity, a closed corporation.

This closed corporation, at his turn, is empowered to vote, using a voting trust certificate, (vote mandate; prokura) by another closed corporation, to exercise the right to vote and so one.

In the end, the real secret shareholder of Federal Reserve Bank of New York is Price Philip.

The Rockefeller Family is not the real owner of federal reserve and this is kept strictly secret by Rothschild Custodian Bank (Asset Manager, Register).

For the United States elites is known that Rockefeller is the real owner of Federal Reserve.

Prince Philip was manipulated by Rothschild Family (at Tibet-China orders) to buy the Shares (Syndicated shares) of Federal Reserve Bank of New York.

Prince Philip and his Royal Family was in the situation to avoid a financial bankruptcy and was helped by Rockefeller Family and Rothschild Family. Past chairman Sir Evelin Robert de Rothschild was the personal financial advisor of Queen Elisabeth II, and knighted him in 1989.

Prince Philip was convinced to promote a network of Free Zone – Tax Heaven in the British Dependencies (Common wealth) – British Island for some reasons.

- To avoid the taxes

- To hide the route of voting trust certificates used by agents.

- To hide his dividends benefits.

In this Tax Heaven, the government agencies must not have jurisdictions.

Also Bank Secrecy Lows protecting the identity of the owners of offshore capital must be promoted by Prince Philip. This can be done using his influence in politics and Masonry.

Rockefeller family was many times under bankruptcy.

Rothschild family sustained Rockefeller family with financial resources and financial expertise, in order build a white people (artificial) financial empire.

Is very important the US Elites to know Rockefeller family controls Chase Manhattan Bank, and that Chase (Manhattan) Bank is the owner of the Federal Reserve Bank of New York.

Rockefeller Family Wealth:

Much of the wealth has been locked up in the family trust in 1934 and the trust of 1952, bot administrated by Chase Bank the corporate successor to Chase Manhattan Bank.

This trust consisted of shares in the successor companies to Standard Oil and other diversified investment as well as family considerable real estate holdings.

The combined wealth of the family, their total assets and investments has never been known with any precision. The records of the family are hidden related to both of the family and the individual members net worth are closed to researchers.

Rothschild Investment Trust, now RIT Capital Partners buy in 2012 37% stake in Rockefeller family. Wealth Advisory and Assets Management Group.

David Rockefeller said: “The connection between our two families remain very strong”.

Chase Manhattan

Chase is closely associate with and has financed the oil industry having longstanding connections with its board of directors to the successor companies of Standard Oil, especially Exxon Mobile witch are also part of Rockefeller holdings.

In 1969 under leadership of David Rockefeller the bank has reorganized as bank holding company the Chase Manhattan Corporation.

In 1979 a study titled “The significance of Bank control over Large Corporations found that: The Rockefeller controlled Chase Manhattan Bank tops the list, controlling 16 companies”.

Chinese actors for Federal Reserve New York ownership

- Prince Philip

- Rothschild Family

- Rockefeller Family

- Chase Manhattan Bank

Rothschilds Financial Companies:

Rothschild Concordia SAS

Paris Orleans SA – France

Concordia BV – Master Holding – Dutch Registered

Rothschilds Continuation Holding – Swiss Registered

Rothschild & Cie Banque – France

Rothschild Continuation Holding AG

N M Rothschild & Sons.

Jardine Strategic – has 20% Rothschild Continuation Holding AG

Jardine Strategic is a subsidiary of Jardine Matheson and Co of HongKong

RaboBank Group – Private Bank Netherland acquired 7.5% of Rothschild Continuation Holding AG

RaboBank and Rothschild entered into a cooperation agreement in the field of mergers and acquisitions ( to help Rothschild Continuation Holdings AG gain access to a wider capital pool enlarging presents in East Asian markets)

Paris Orleans SA is a financial holding company listed under EURONEXT Paris, and controlled by French an English Branches of Rothschild family.

Paris Orleans controls Rothschild Group’s Banking activity including N M Rothschild & Sons and Rothschild & Cie Banque.

Edmond de Rothschild Group – Based in Geneva specialised in Asset Management and Private Banking.

RIT Capital stored a significant proportion of its assets in physical gold

The China trick is as follows: A subsidiary of Chase National Bank was created and sold to Price Philip keeping the name of Chase, (without consent of the other Chase National Bank shareholders). Prince Philip as a singular shareholder, remain anonyme.

Chase is a singular shareholder of the Federal Reserve Bank of New York. Prince Philip appoints a Rockefeller Family member as chairman of Chase Bank. The fact that Rockefeller is Chairman to Chase Bank and also Chase is owner of Federal Reserve New York is known by the US President and some top people of Washington establishment.

The US president and other top politicians does not know that:

– Rockefeller is not the real owner of Federal Reserve of New York

– he is empowered to vote the board of directors to Fed New York (using a voting trust certificate, prokura, mandate) by Prince Philip (through some intermediaries) and to appoint the chairman of Fed New York.

The fact that Rockefeller is empowered to vote using voting trust certificate (mandate) by Prince Philip is known only by 8 Rothschild’s custodian banks (bank syndicate) asset manager linked each other (attached to several stock exchanges).

The custodian Banks keeps also the Shareholders Register.

There is no other information about King’s Charles intentions as owner at the Federal Reserve Bank of New York, after Prince Philip death.

The dividend benefit receive by Price Philip is the legal dividend in conformity of the balance sheet for the Federal Reserve Bank of New York.

This amount of money is sent to Philip’s Account via a chain of tax haven companies (Aruba, Antigua, Belize, Geneva, Monaco-Rothschild Bank). This amount is tiny compared with the “open market operation” (hundreds of million USD on one Giant Bronze bill of exchange – promissory note; check), cashed in by Allianz – PIMCO primary dealers. (trillions USD / year)

PIMCO = Pacific Investment Management Company

Piața derivatelor condusă din India la ordinul tibetanilor

Piața mondială de produse derivate OTC (over the counter) este o piață de negocieri directe între vânzătorii și cumpărătorii acestor produse financiare foarte sofisticate. Pentru aceste produse nu există burse obișnuite care să funcționeze la un sediu cu ring bursier. Pe această piață se vând produse care au ca suport acțiunile companiilor americane, precum și titlurile de credit emise de aceste-companii

Aceste produse, în ordinea complexității lor, sunt:

- acțiuni, obligațiuni convertibile în acțiuni, warante etc.;

- contracte futures pe acțiuni ale unor companii din Occident;

- contracte futures cu optiuni având ca suport acțiunile și obligațiunile companiilor din S&P 500;

- strategii cu opțiuni care combină diverse tipuri de opțiuni. Aceste strategii cu opțiuni sunt: – straddle;

- strangle;

- butterfly;

- condor.

- Exchange Traded Funds – ETF. Aceste tipuri de active (foarte ermetice pentru publicul larg și pentru finanțiștii americani) au la bază un portofoliu de “Strategii cu Opțiuni”, care și ele au la bază acțiuni, obligațiuni convertibile, warante și altele care se convertesc în acțiuni.

Pentru a regla și mai bine prețul activelor care se convertesc în acțiuni, precum și titlurile de credit care se convertesc în acțiuni.

În afara de acestea, mai există și coeficienții de sensibilitate Delta, Vega, Gama, cu care se corijează valoarea contractelor de opțiuni. Toate aceste produse întortocheate nu au nicio semnificație economică pentru industria americană.

Aceste produse vândute pe piața OTC conduc opțiunile la acea valoare de piață — punct de declanșare (trigger point – punct mort) — în care toate activele legate de acțiuni sau bazate pe acțiuni se transformă în acțiuni la firma care urmează să se voteze în Adunarea Generală a Acționarilor.

Piața mondială de produse derivate OTC (over the counter) este o piață de negocieri directe între vânzătorii și cumpărătorii acestor produse financiare foarte sofisticate. Pentru aceste produse nu există burse obișnuite care să funcționeze la un sediu cu ring bursier. Pe această piață se vând produse care au ca suport acțiunile companiilor americane, precum și titlurile de credit emise de aceste-companii

Aceste produse, în ordinea complexității lor, sunt:

- acțiuni, obligațiuni convertibile în acțiuni, warante etc.;

- contracte futures pe acțiuni ale unor companii din Occident;

- contracte futures cu optiuni având ca suport acțiunile și obligațiunile companiilor din S&P 500;

- strategii cu opțiuni care combină diverse tipuri de opțiuni. Aceste strategii cu opțiuni sunt: – straddle;

- strangle;

- butterfly;

- condor.

- Exchange Traded Funds – ETF. Aceste tipuri de active (foarte ermetice pentru publicul larg și pentru finanțiștii americani) au la bază un portofoliu de “Strategii cu Opțiuni”, care și ele au la bază acțiuni, obligațiuni convertibile, warante și altele care se convertesc în acțiuni.

Pentru a regla și mai bine prețul activelor care se convertesc în acțiuni, precum și titlurile de credit care se convertesc în acțiuni.

În afara de acestea, mai există și coeficienții de sensibilitate Delta, Vega, Gama, cu care se corijează valoarea contractelor de opțiuni. Toate aceste produse întortocheate nu au nicio semnificație economică pentru industria americană.

Aceste produse vândute pe piața OTC conduc opțiunile la acea valoare de piață — punct de declanșare (trigger point – punct mort) — în care toate activele legate de acțiuni sau bazate pe acțiuni se transformă în acțiuni la firma care urmează să se voteze în Adunarea Generală a Acționarilor.

Mentiune!!! – accesul pe o prarte din piata NASDAQ se face numai cu parola transmisa din Tibet.

Schema traseului de produse OTC condusă de Citigroup

India are o platformă electronică de tranzacționare a produselor sofisticate OTC (over the counter). Aceste platforme sunt deținute de Hedge Funds care sunt organizate sub forma unor societăți închise anonime (closed corporations). Aceste societăți închise se află în India, în locații precum:

- Gurgaon;

- Bangalore;

- Vishakhapatnam;

- Hyderabad;

- Pune;

- New Delhi;

- Kolkata.

- Chennai

Toate aceste societati inchise din India primesc parolele secrete prin intermediul agentilor rromi din Guangzhou – China.

Aceste companii secrete au acces, pe baza unei parole, la piața OTC americană NASDAQ – Amex. Aceasta este o piață a piețelor care foloseste doua sisteme:

- Sistem de Comunicare Electronică (Electronic Communication Network – ECN)

- Sistem Electronic de Transfer de produse financiare (Electronic Funds Transfer – EFT).

Indienii din aceste locații, care sunt sucursale ale firmei HSBC, se conectează in secret la piața NASDAQ prin doua softuri specializate ale lor:

- Data Processing & Customer Service

- Internal Software Engineering

Astfel se organizată confecționarea pachetelor (cosuri) de active care au ca suport acțiuni americane, obligațiuni, contracte futures cu optiuni si strategii cu optiuni. Toate acestea se pot converti în acțiuni americane (occidentale in general).

- De aici, se organizează și momentul în care aceste pachete de active ajung în punctul de declanșare (trigger point) în care se convertesc în acțiuni. Apoi, aceste pachete trec prin bursa din Singapore care este legată la DTCC – Depository Trust & Clearing Corporation din SUA prin DTCC Data Repository – Singapore PTE. Astfel, din Singapore, coșurile de active se vând pe piața din Caraibe.

Toate produsele de pe piața OTC din lume sunt concepute și organizate de Citigroup, deținut în secret de India la comanda Tibet-China.

Atentie!!! Deriv/SERV este o filiala a lui DTCC care face clearing(compensari) automat este cel mai mare serviciu de clearing (transfer de active finaciare) pentru piata OTC din lume. La aceasta are acces, in afara de Occident si Singapore (prin care intra indienii).