Cum se construieste monopolul

I. Instrumentele cu care se construieste majoritatea de vot

a) Actiunile

Actiuni preferentiale: asigura o rentabilitate mai mare pe baza unui dividend prioritar care se plateste inaintea dividendelor actiunilor ordinare; dar nu are drept de vot.

Actiuni ordinare: nu au prioritate la profit, la dividend, dar au drept de vot.

Actiuni privilegiate: (voting right shares) – sunt emise cu privilegiul de a avea un vot, doua voturi sau mai multe voturi pentru o singura actiune.

Actiuni preferentiale participative: actiuni rascumparabile – la care emitentul poate pervedea o clauza de rascumparare daca considera ca rata dividentului va scadea in viitorul nu prea indepartat.

Actiuni cumulative: dividende se acumuleaza pentru o perioada de mai multi ani. Dividentul cuvenit se cumleaza in toti anii in care s-au inregistrat pierderi si se plateste cu prioritate in primul an in care se inregistreaza profit.

Actiuni convertibile: permite detinatorilor de actiuni preferentiale sa le converteasca in actiuni ordinare, (cu drept de vot). Convertibilitatea este exprimata de rata de conversie. In functie de cate actiuni ordinare pot fi obtinute pentru fiecare actiune preferentiala. Daca rata de conversie este 2 la 1, atunci fiecare actiune preferentiala poate fi convertia in 2 actiuni ordinare.

Actiuni de trezorerie: sunt actiuni proprii pe care societate si le rascumpara de pe piata din diverse motive. Cate vreme sunt in trezorerie, actiunile nu poarta dividente.

b) Obligatiuni care se pot transforma in actiuni

Imprumuturi (sau datorii) care se pot converti in actiuni – obligatiuni de imprumut convertibile in actiuni. Detinatorul obligatiunii are dreptul sa primeasca actiuni la companie in locul banilor cu care a imprumutat compania.

Obligatiuni de imprumut cu bonuri de subscriere – aceste titluri de imprumut dau dreptul detinatorului sa achizitioneze ulterior la un pret fixat inaite actiuni la societatea emitenta.

Obligatiuni indexate: emitentul isi asuma obligatia de a actualiza valoarea acestor titluri in functie de un indice. (acesta poate fi si un indice bursier)

Drepturi de preferinta – intervine in cazul majorarii capitalului social prin emisiunea de noi actiuni. Actiunile nou emise vor fi oferite spre cumparare in primul rand acelor actionari care detin drepturile de preferinta.

Drepturi de atribuire – constau in participarea tuturor posesorilor de actiuni ordinare la majprarea capitalului social prin incorporarea de reserve. Practic, majorarea de capital social genereaza o distribuire gratuita de actiuni. In plus, se poate distribui dividendul sub forma de actiuni. Drepturile de atribuire se pot vinde pe piata.

Warantul – este o valoare mobiliara care indreptateste pe detinator sa cumpere actiuni la societatea care i-a emis la un pret fixat prin warrant. Pe piata apar ca:

– actiuni cu warrant;

– obligatiuni de imprumut cu warrant.

Toate aceste obligatiuni de imprumut permit ca banii imprumutati unei societati sa se transforme in actiuni cu drept de vot la acea societate. Aceste Obligatiuni si Drepturi care se convertesc in actiuni se vand pe bursa. Astfel ele pot fi cumparate de actionarii unei companii inaintea Adunarii generale a actionarilor pentru a avea un aflux mare de actiuni cu drept de vot.

Asa se construieste o majoritate de voturi pentru a numi in functie pe directorul companiei.

Aceste tipuri de actiuni si obligatiuni convertibile in actiuni au fost inventate si legiferate de “Secta Bancara Tibetana” condusa de Dalai Lama pentru a stapani prin majoritate de actiuni (voturi) toate companiile si corporatiile multinationale inregistrate in Occident.

Atentie!! – aceste companii mama , sunt doar inregistrate pe teritoriul American si European dar proprietarii, stapanii lor sunt in Tibet – China (cu aportul subsidiarelor Orientale).

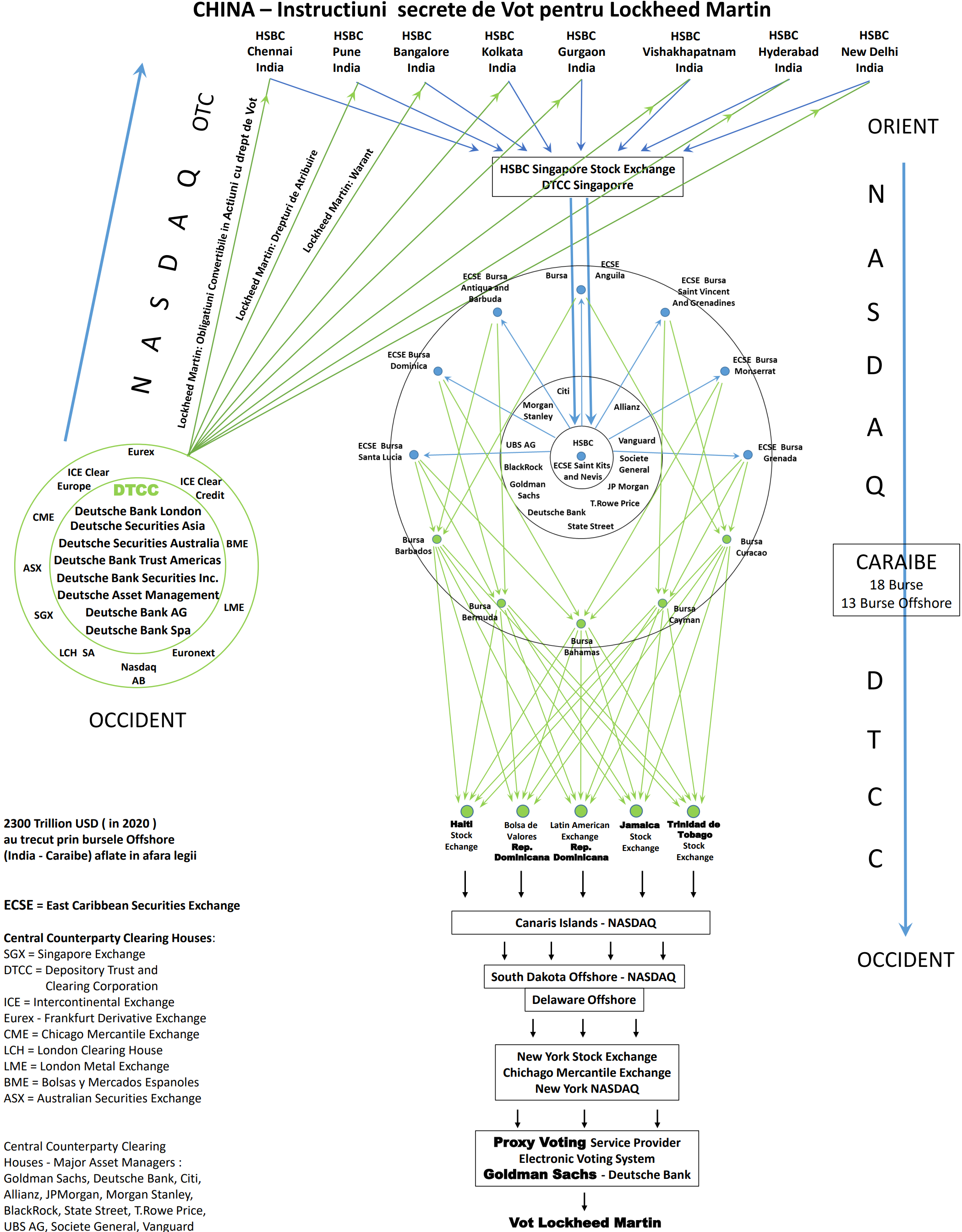

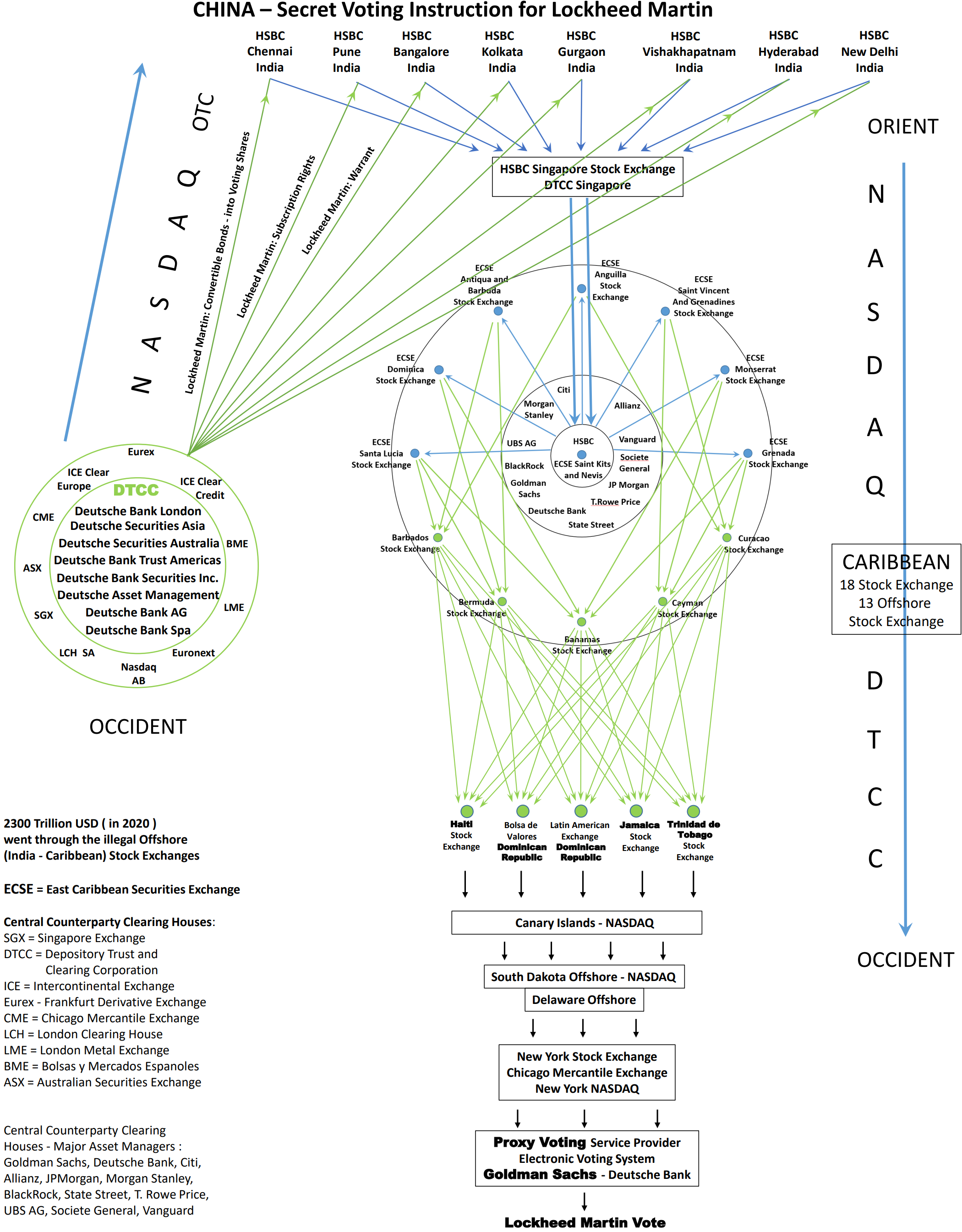

Agentii chinezi din Chinatown (vezi tabel, pag. 26) care sunt raspandite in marile orase centre financiare ale lumii dau instructiuni catre dealeri agentii secreti rromi cum sa concentreze obligatiunile convertibile in actiuni (warante , drepturi de atribuire etc.) in Ofhsor–urile indiene din : Chennai , Pune , Bangalore , Kolkata , Gurgaon , Vishakhapatnam , Hyderabad , New Delhi.

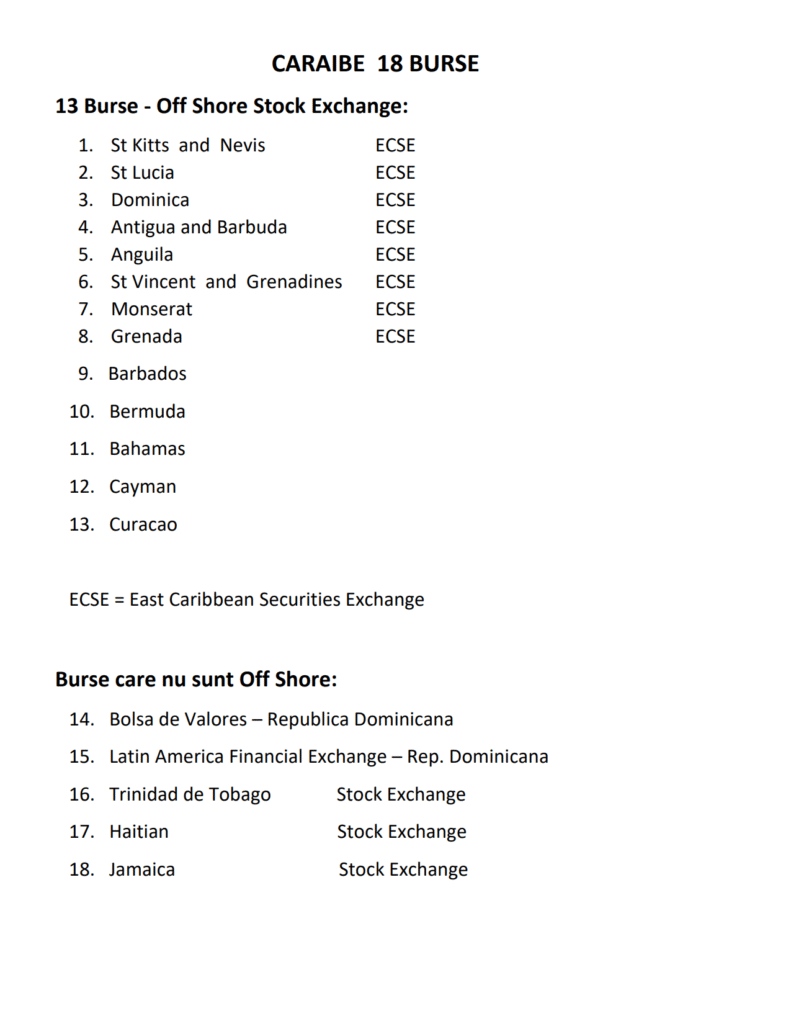

Din India aceste active tinute in evidenta si coordonate de HSBC sun vandute pe piata OTC nereglementata ( NASDAQ ) prin bursa din Singapore si apoi prin cele 18 burse din Caraibe (vezi schema, pag. 24) catre bursele americane.

Bancile Custode, care se afla in Singapore, au acces si vizibilitate totala la actiunile si obligatiunile care se pot converti in actiuni aflate in posesia tuturor companiilor care fac tranzactii la acea bursa. Tot ele sunt atasate la o bursa de valori si tin in evidenta actiunile si obligatiunile si cosurile de contracte futures care au suport obligatiuni corporatiste (care se pot transforma in actiuni) aflate in posesia celor care cumpara sau vand pe acea bursa.

Exemplu

Sa presupunem ca pe bursa din Saint Lucia Securities Exchange din Caraibbe s-au cumparat cosuri de active care se pot schimba in actiuni la firma Boeing de catre un cumparator – fond mutual al lui JP Morgan de la un vanzator din Singapore. Atunci cosurile (pachete) de active financiare care se pot transforma in actiuni Boeing sunt transferate de la banca custode din Singapore care deserveste bursa din Singapore, catre banca custode din Saint Lucia din Caraibbe.

Sa presupunem ca si alte cosuri de contracte de optiuni care se pot transforma in actiuni ale firmei Boeing au fost cumparate de o firma – de exemplu Vanguard, de pe bursa din Grenada (Grenada Securities Exchange), tot din Caraibbe, de la un dealer aflat in Singapore. Si in acest caz, cosul de contracte futures cu optuiuni din banca custode din Singapore, atasata la bursa din Singapore sunt transferate in custodie in banca custode din Grenada (din Caraibbe) atasata la bursa din Grenada care face parte din “ Eastern Caribbean Securities Exchange” (ECSE).

In continuare, consideram ca alte cosuri de strategii de optiuni bazate pe obligatiuni convertibile in actiuni ale firmei Boeing au fost cumparate de un dealer spre exemplu Black Rock, pe bursa din Dominica numita Dominica Eastern Caribbean Securities Exchange de la un dealer, sa presupunem Goldman Sachs tot din Singapore.

Atunci aceste pachete de strategii cu optiuni bazate pe obligatiuni convertibile in actiuni, pe warante si pe “drepturi de atribuire” ale unor actiuni noi emise, ale firmei Boeing sunt transferate de la banca custode din Singapore care deserveste Singapore Stock Exchange catre banca custode din Dominica atasata la bursa din Dominica.

In realitate, aceste pachete de produse finaciare sunt confectionate in India si trec prin Singapore, apoi prin bursele din Caraibbe (18 burse) (schema, pag. 24) care reprezinta veriga de legatura intre Orient = India si Occident = SUA, Europa, Canada. Ulterior, pachetele de obligatiuni convertibile in actiuni Boeing trec in posesia celor 8 Banci Custode din cadrul Eastern Caribbean Securities Exchange (ECSE), repartizate cat mai uniform, acestea asteapta termenul pentru ca toate instrumentele derivate de pe piata OTC care au ca suport obligatiuni convertibile in actiuni ale companiei Boeing sa se converteasca in actiuni la Compania Boeing.

La contractele futures si futures cu optiuni care au ca suport obligatiuni convertibile in actiuni, warante, “drepturi” emise de Boeing – mentionate la inceput, exista un punct mort (trigger point) la care nu mai aduc profitul scontat si sub acest pretext artificial ele se convertesc in actiuni la firma Boeing.

Dealerii/vanzatori si dealerii/cumparatori de la Bursele din India fac intentionat ordine de cumparare si vanzare care conduc intentionat produsele financiare catre acea valoare de “piata” numita punct de declansare – trigger point (sau punct mort). La aceasta manevra foarte subtila participa si brokerul bursei care in intelegere cu dealerii conduc un cos mare de active financiare in punctul mort – trigger point, la care acestea se schimba in actiuni (cand profitul din dividendul actiunii devine mai atragator decat profitul din dobanda obligatiunii).

Mentionam ca la momentul la care se declanseaza conventirea in actiuni, acele produse financiare nu se mai afla in Bancile custode din India si Singapore si in Bursele din Offshor-rurile din Caraibbe, ci se aflau deja in Bursele electronice din offshore-ul din Delaware si mai departe in New York Stock Exchange, New York NASDAQ, Chicago Mercantille Exchange.

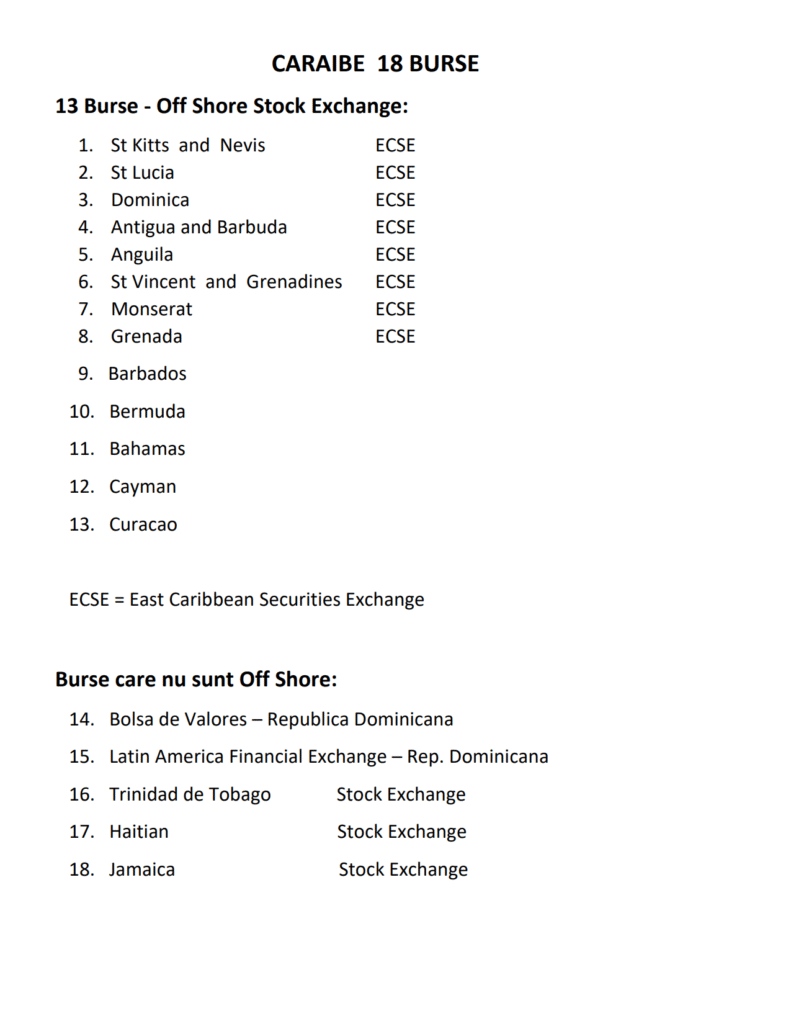

Aceste burse din offshore-rurile din Caraibbe sunt:

– Montserat

– Anguila

– Saint Lucia

– Grenada

– Dominica

– Saint Kitts and Nevis

– Saint Vincent and Grenadines

– Antigua and Barbuda

Si formeaza grupul celor 8 Eastern Caribbean Securities Exchange (ECSE).

La acestea se adauga bursele offshore Barbados, Bermuda, Bahamas, Cayman, Curacao.

Atentie!! – obligatiunile convertibile in actiuni se afla in pastrare la Banca Custode care deserveste bursa unde ele au fost cumparate ultima data.

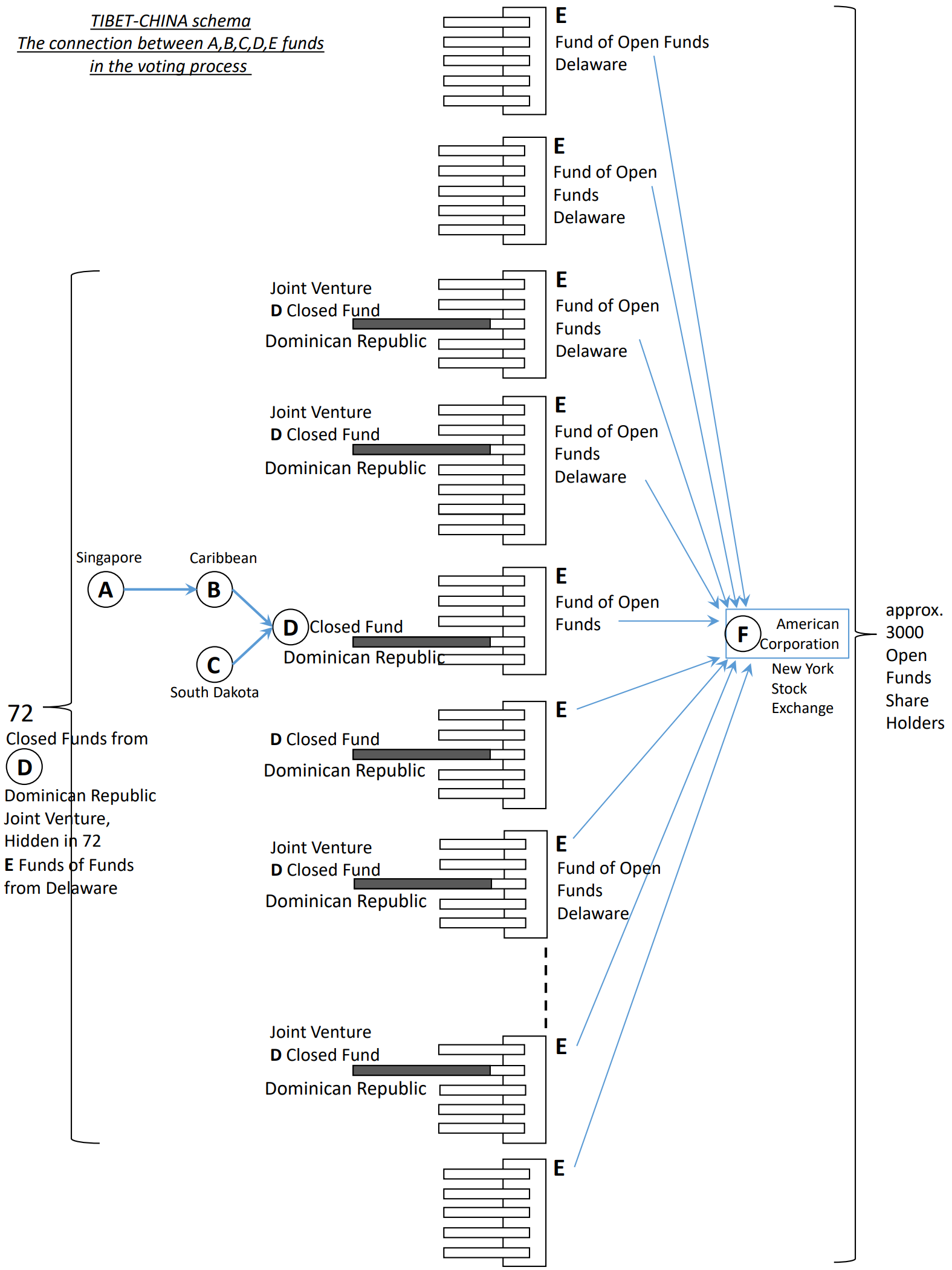

Dupa aceata faza arhitectii financiari din China/Tibet pregatesc pachete de active (cosuri de active financiare) ce urmeaza sa se preschimbe in actiuni si pregatesc si cele 72 de companii din cele 2500 (care formeaza Trustul Bancar Tibetan) care sunt cele mai potrivite pentru a intra in posesia acestor active (pentru a le folosi la vot).

Atentie!!- Cele 72 de companii care acumuleaza actiunile pentru votare se aleg prin rotatie dintre cele 2500 de companii financiare, care formeaza Trustul Secret Chinez.

Aceste 72 de companii financiare vor fii mereu altele care numesc conducerea la fiecare Corporatie Industriala Multinationala din indicii : S&P 500 si din Dow Jones.

Aceste 72 de companii, toate cu procente de sub 1% vor avea o putere de vot (votting power) de 37% – 40%, suficienta pentru a numi conducerea firmei.

Pentru a strange actiuni se confectioneaza blocuri sau cosuri cu active care se pot converti in actiuni.

Aceste cosuri contin:

– obligatiuni convertibile in actiuni;

– obligatiuni cu warante convertibile in actiuni;

– obligatiuni de imprumut cu bonuri de subscriere (care permit sa subscri la actiuni noi emise);

China a ales bursele Indiei sa fie in varful lantului de burse fuzionate intre ele (din Europa, SUA si Canada).

Bursa NASDAQ este o bursa a burselor din lume si din cauza ca se afla in varful piramidei de burse fuzionate intre ele are posibilitatea sa vada toate tipurile de actiuni si obligatiuni, cine este proprietarul lor, sa faca pachetul de active si sa le aduca in punctul de declansare – punctul mort (trigger point). La acest punct de declansare pachetele de active se transforma in actiuni.

La fel si DTCC – Depositary Trust and Clearing Corporation care este cel mai mare conglomerat de banci custode interconectate intre ele si are dreptul si posibilitatea de a vedea toate actiunile si obligatiunile, cine le detine si cum sa formeze cosul de active care se pot transforma in actiuni. Aceste active OTC bazate pe obligatiuni convertibile in actiuni sunt cumparate de pe bursele din Caraibbe, ajung in Bancile custode offshore din Caraibbe. Apoi se vand cate o portiune catre:

1. bursa din Trinidad de Tobago.

2. bursa – Latin America International Financial Exchange din Republica Domnicana.

3. Bolsa de Valores de la Republica Dominicana.

4. Haiti Stock Exchange.

5. Jamaica Stock Exchange.

Si, in final, ajung la Banca Custode a acestor burse.

Este foarte important de precizat ca aceste ultime cinci burse nu sunt offshore-uri si nu trezesc suspiciuni.

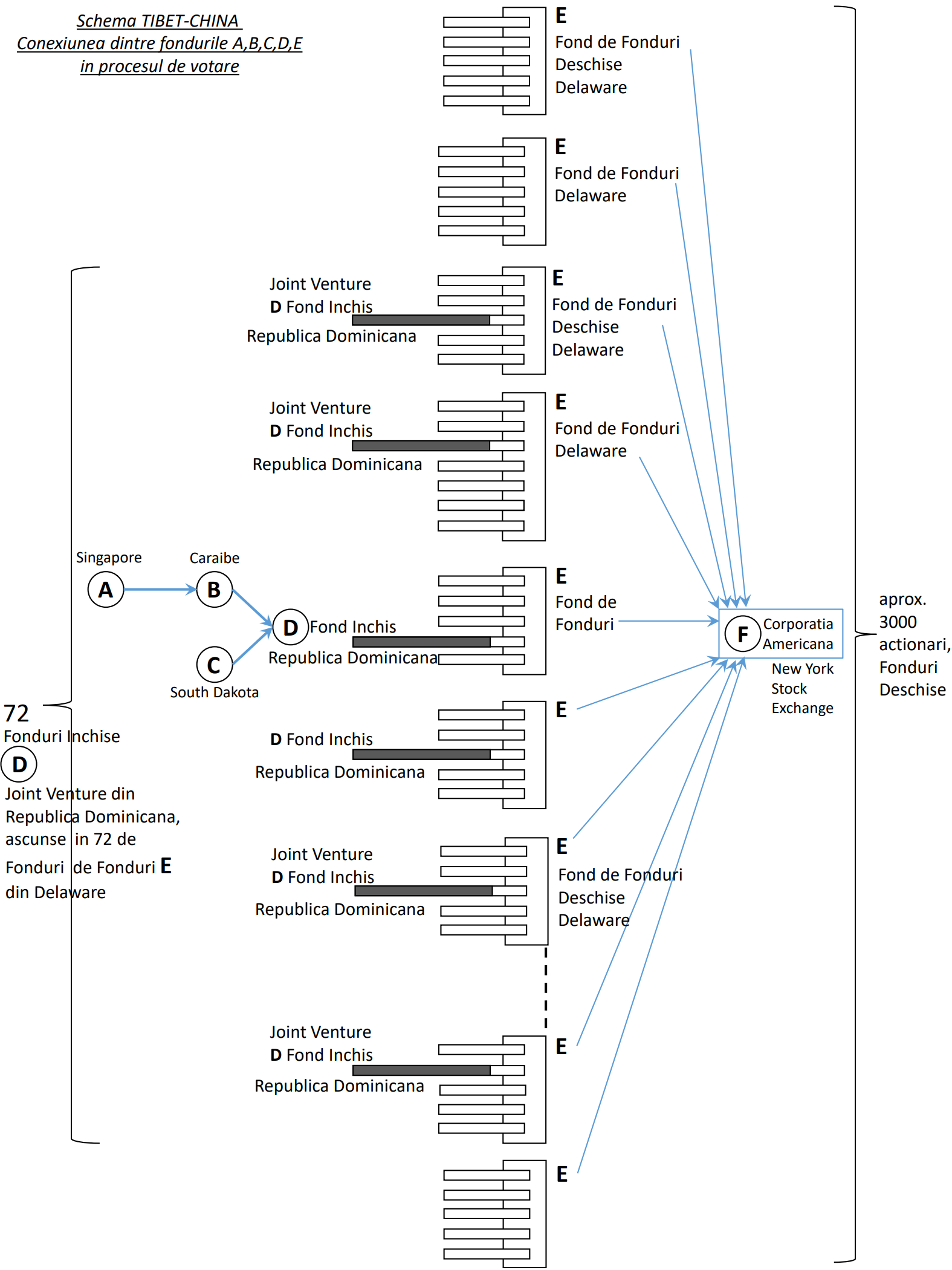

Din Caraibe instructiunile de votare date de anumite fonduri inchise joint venture pleaca mascat (secret) catre un numar de Fonduri de Fonduri din Delaware (vezi schema, pag. 22; cercul 3, pag. 21). Registrul Fondurilor de Fonduri din Delaware se afla in bancile custode din New York Stock Exchange (NYSE).

In Delaware cosurile obligatiunilor convertibile, warante, drepturi de subscriptie (la actiuni noi emise), detinute de dealerul rrom II (asociat in joint venture) sunt deja transformate in actiuni.

Delaware este un gigant financiar offshore unde isi au sediul mii de fonduri mutuale.

Prin bancile custode din Caraibe si din New York Stock Exchange (NYSE), o banca specializata in procesul de votare – “Proxy Voting Service Provider” este insarcinata sa execute procesul de votare. Ea creaza in secret majoritatea de voturi pentru a numi consiliul de administrare si directorul (CEO).

II Metode pentru a obtine majoritatea de voturi

Pentru a pregati o majoritate de voturi in posesia companiilor financiare care formeaza Trustul Bancar Tibetan, expertii lor finaciari se folosesc de mai multe procedee.

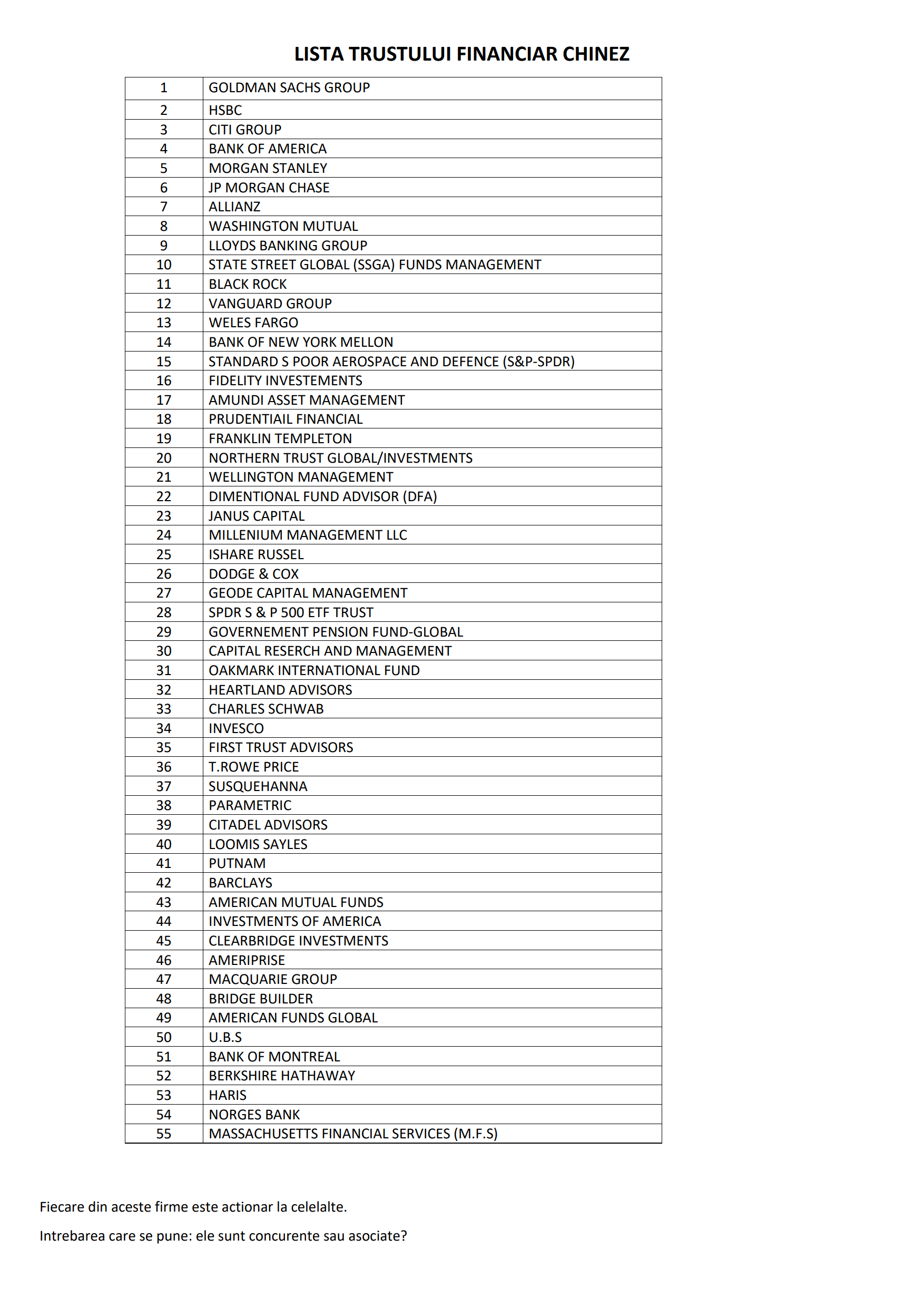

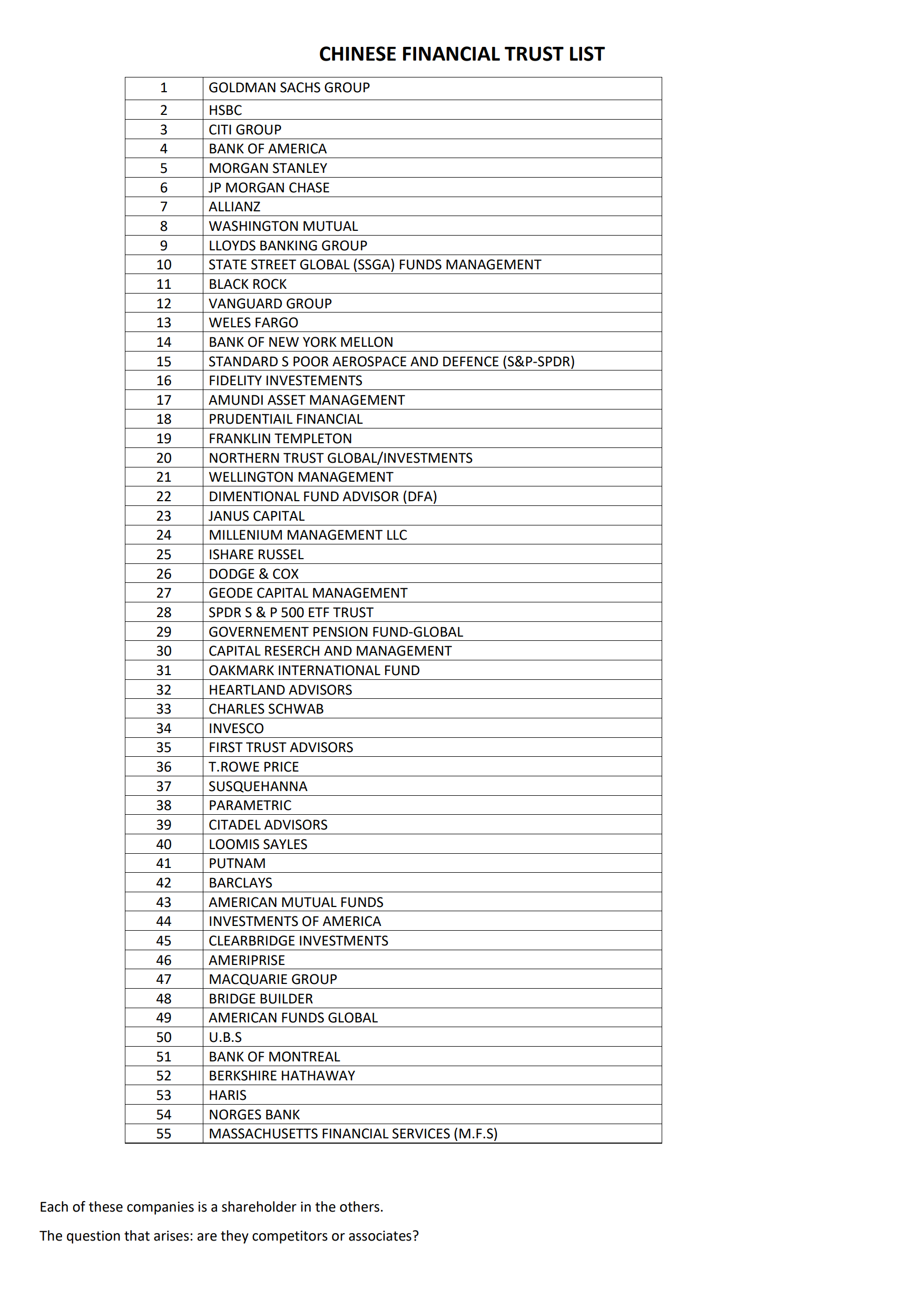

Sa presupunem ca numarul companiilor mama din Trustul Bancar Tibetan este de aproximativ 55 (vezi tabelul pag. 25 – Lista Trustului Financiar Chinez – Firme Mama). Fiecare companie mama are aproximativ 90 subsidiare care sunt alte companii (pretinse) din acelasi grup care poarta numele companiei mama: banca comerciala; banca de investitii; multe fonduri mutuale; hedge fonduri (fonduri cu capital de risc); broker dealeri (adica burse); firme de asigurari; asset manager – adica banca custode sau clearing bank; societate inchisa (closed corporation).

Din totalul de 90 de subsidiare:

- 45 de subsidiare au sediul in SUA, deci au nationalitatea Americana

- Alte 45 de subsidiare au sediul (Head Office) in Orient sau in Caraibe, deci au nationalitate preponderent Orientala

In total filialele din India, Singapore, Mauritius si Caraibe au:

45×55=2500 de fonduri (aprox.) care nu au nationalitate Americana

Din aceste companii arhitectii financiari din China trebuie sa aleaga 72 de companii care sa intruneasca o majoritate de 37-40% din drepturile de vot ale firmei pentru a vota in adunarea generala a actionarilor si a alege un director. Directorul trebuie sa fie de origine evreiasca pentru a arata ostentativ ca evreii conduc toate companiile si finantele lumii(ceea ce este complet fals).

Trebuie mentionat ca 10-20% din actiunile emise nu au drept de vot (actiuni preferentiale).

De asemenea, companiile care au participatii mari de 2% – 3% din actiuni nu au drept de vot pentru ca legile finaciare internationale nu permit acest lucru. Aceasta pentru ca obiectul lor de activitate este chiar detinerea de actiuni la alte companii in scopul tranzactionarii. Astfel se presupune ca ar fi tentati sa faca monopol pe piata.

Aceasta doar de fatada pentru ca agentiile guvernamentale sa-si focuseze vigilenta pe actionarii mari.

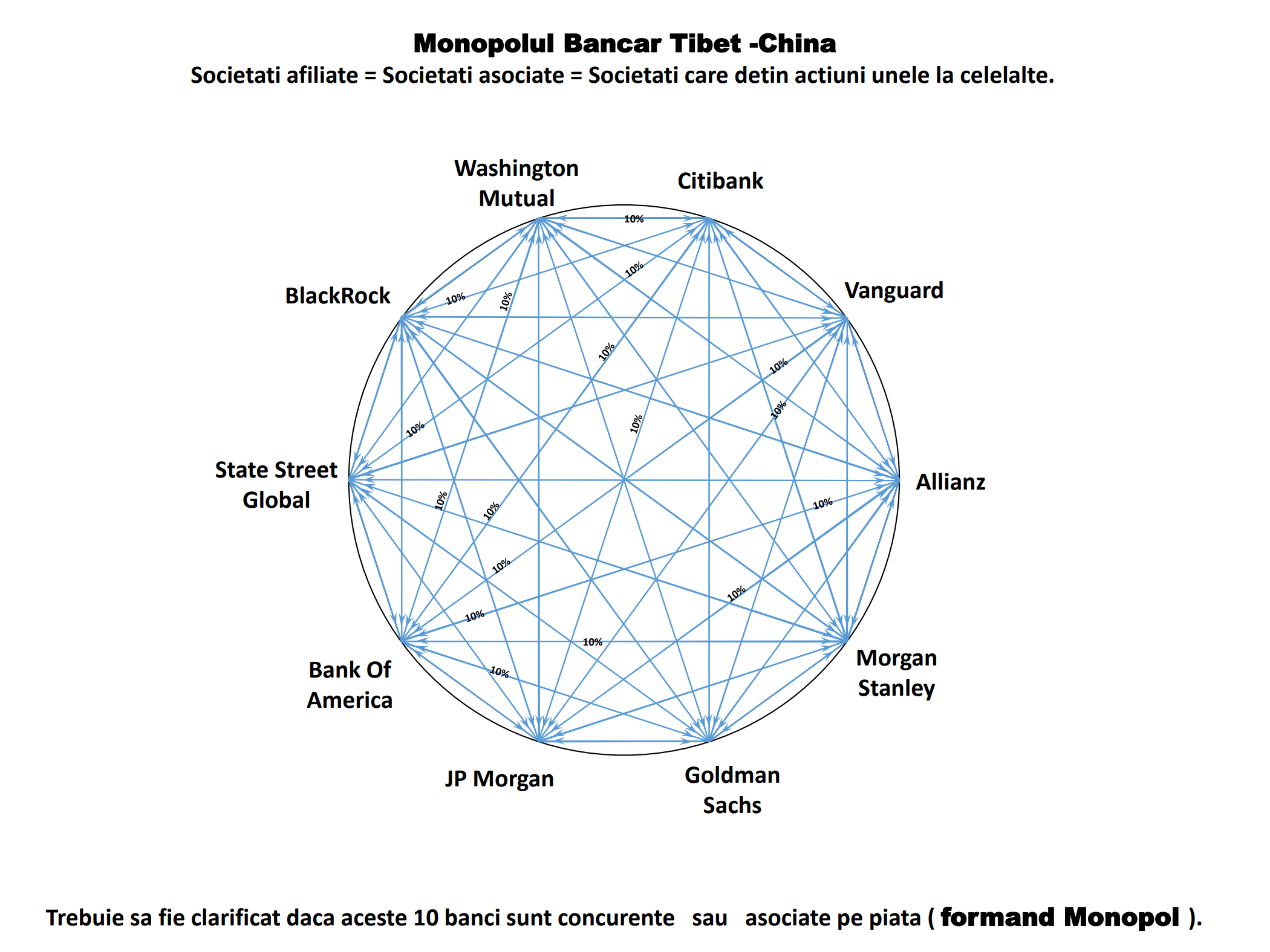

In timp ce agentiile antimonopol din occident supravegheaza actionarii de top, chinezii formeaza, in ascuns, o majoritate de voturi cu actionari (filiale orientale) multi dar cu procente mici care detin sub 1% din voturi. Acestia nu atrag atentia dar voteaza organizat acelasi candidat la functia de director – CEO pe baza unui cod secret.

72 actionari x 0,527% = 38%

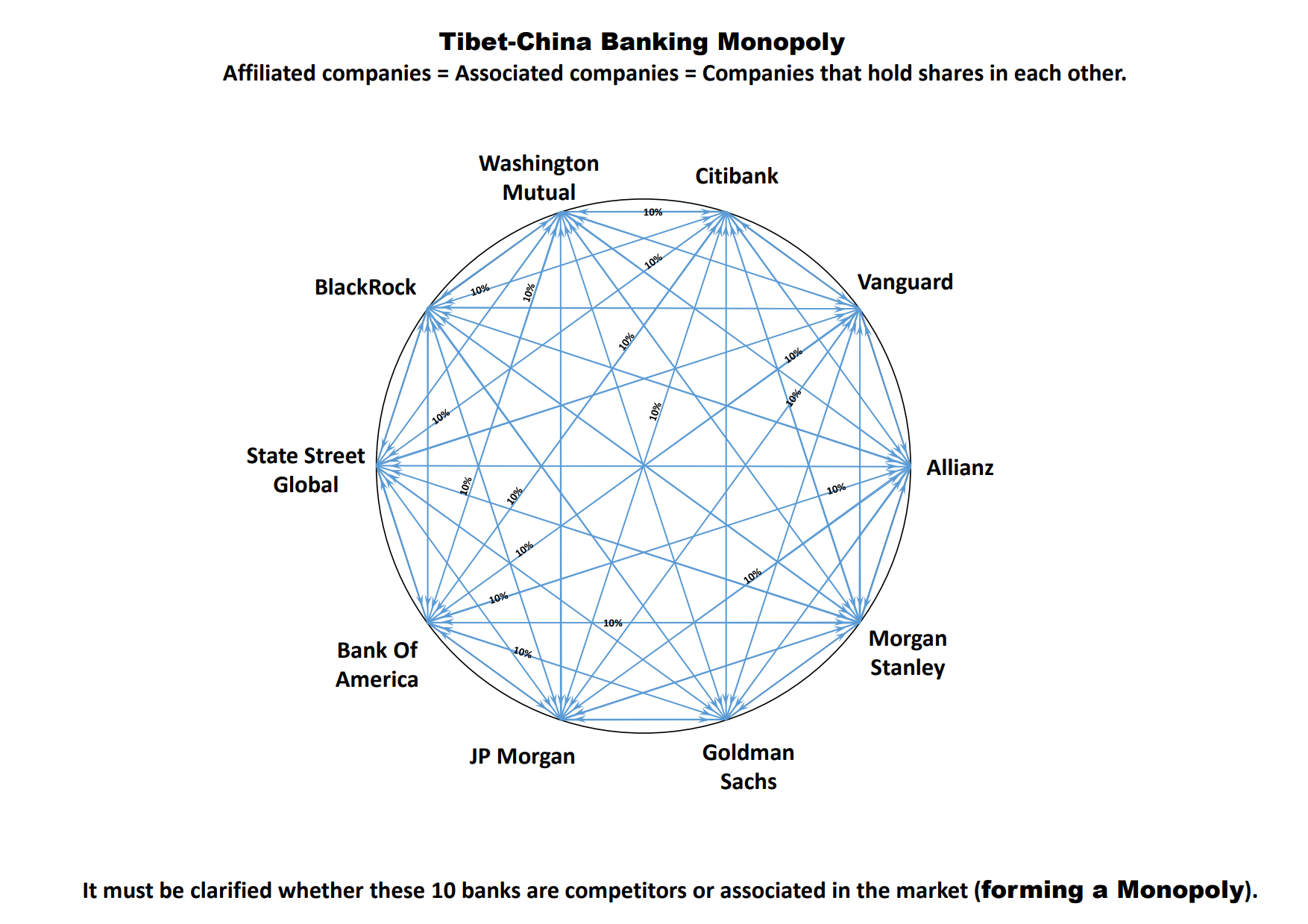

Deci, cu un procent mediu de 0.527% se poate obtine 38% daca toti cei 72 voteaza aceeasi membri in consiliul de administratie. Aceasta presupunand ca din 100% actiuni doar 80% au drept de vot. Astfel cele 2500 de companii (filiale orientale), cumparand actiuni unii la altii, si intrunind majoritate de voturi unii la altii, practic au fuzionat.

Legal, fuziunea traditionala a doua companii se petrece cu totul altfel, este foarte vizibila, dezbatuta in massmedia si este anuntata public. Doua companii pot fuziona prin schimb de actiuni sau prin emisiunea de actiuni noi la noua firma rezultata prin fuziune, astfel incat valoarea actiunilor unui actionar sa fie echivalenta cu valoarea actiunilor acelui actionar inainte de fuziune.

In cazul trustului de 2500 de companii financiare Tibet – China fuzionarea lor nu este sesizata public pentru ca ele au fuzionat in secret pe bursa. Ele au fost de acord tacit sa cumpere actiuni unele la altele, sa voteze unele la altele si sa numeasca consiliul de administratie unele la altele. Acum ele formeaza o singura companie, adica un conglomerate format prin fuziunea nevizibila a 2500 de firme financiare. Dupa ce s-a infiintat monopolul de 2500 de firme financiare orientale, acesta voteaza la firmele industriale americane prin rotatie. Aceasta fuziune nu este observata de societatea democratica occidentala sau de agentiile guvernamentale antimonopol. Nimeni nu isi imagineaza mecanismul prin care 2500 de companii ar putea sa fie intelese intre ele pentru a vota acelasi canditat la functia de CEO (director).

Fuzionarea aceasta ilegala este condusa din Tibet din vechime, foarte precis, pe baza unor parole si a unor tabele de cifrare numite cifruri polialfabetice. Tabelele sunt foarte bine explicate in Kabala – Magia Ceremoniala (pag 109).

Parolele se transmit direct din CHINA TOWN, din orasele americane unde sunt bursele, prin intermediul unor agenti de etnie roma catre indienii care controleaza bursele si catre iranienii care controleaza Bancile Custode si Clearing House.

Nici iranienii si nici indienii nu stiu ca cifrurile vin din Tibet prin China Town raspandite in tot occidentul. Mai mult, nici guvernele iranian si indian nu cunosc faptul ca participa in activitatea unei secte bancare Chineze.

Doar un grup mic de 500 – 1000 de iranieni condusi de Ayatolah si un grup de 500 – 1000 de indieni condusi de liderii religiosi hindusi (din zona Taj Mahal) si brahmani sunt implicati in aceasta activitatea bancara oculta.

Inputernicirea de vot transmisa in secret contine:

a) numele companiei finaciare care detine actiunile, numarul de actiuni detinute si numarul de voturi corespunzatoare pe care are dreptul sa si le exprime in adunarea generala a actionarilor,

b) numarul de voturi acordat fiecarei din cele 9 persoane candidate din care 5 vor fi alesi in consiliul de administratie.

Apoi cei 5 alesi il vor alege cu majoritatea de voturi pe managerul companiei.

Agentul imputernicit sa transmita parolele si numele canditatului caruia sa ii aloce voturile este protejat de legea anonimitatii si legea secretului burselor din Offshore. El face parte dintr-o societate financiara inchisa- care nu este deschisa publicului (closed corporation) si care se afla in offshore-urile din India, Singapore si Caraibe.

Schema de Vot – Companiile

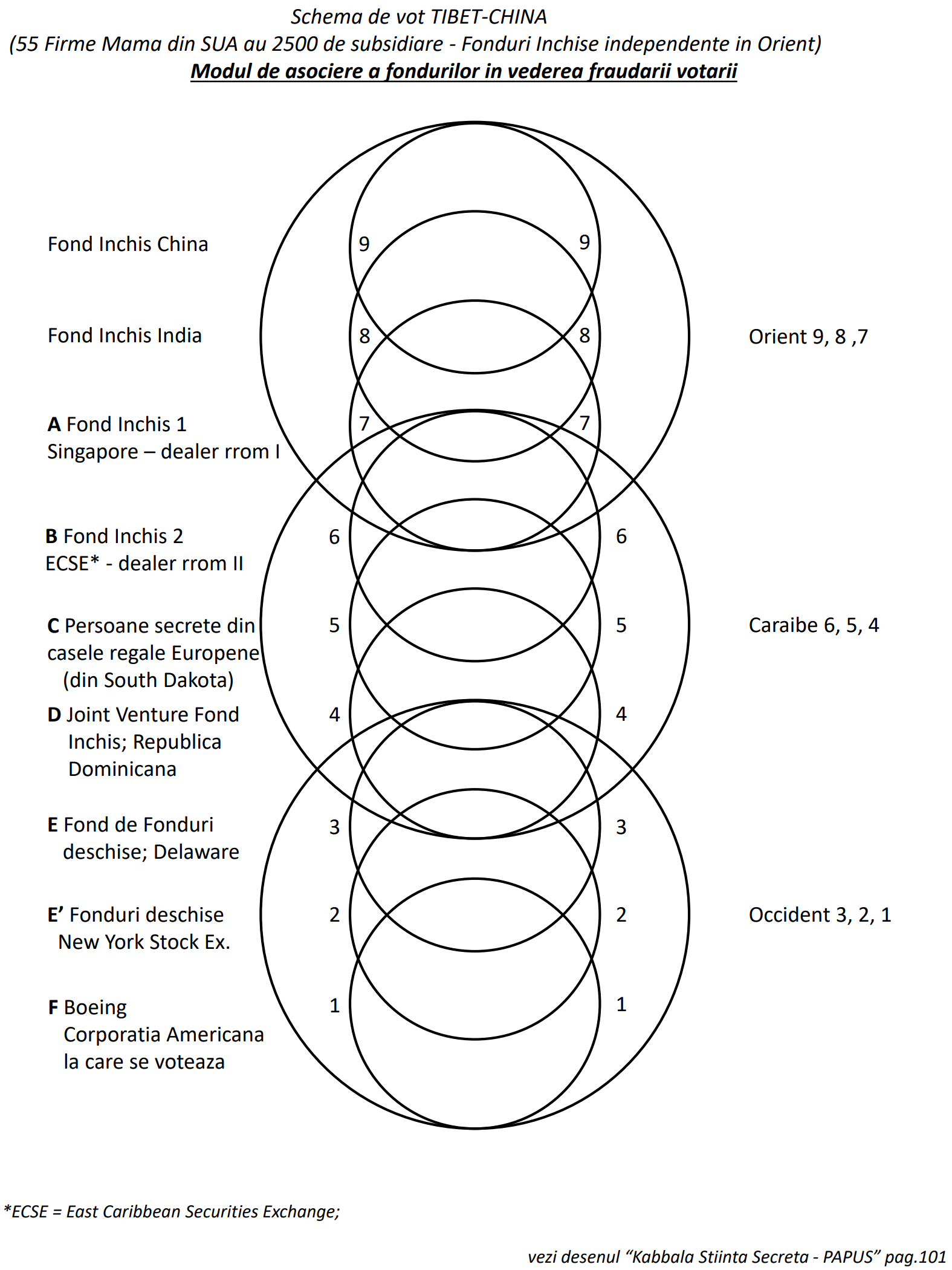

Exista sase tipuri de firme care intra in joc:

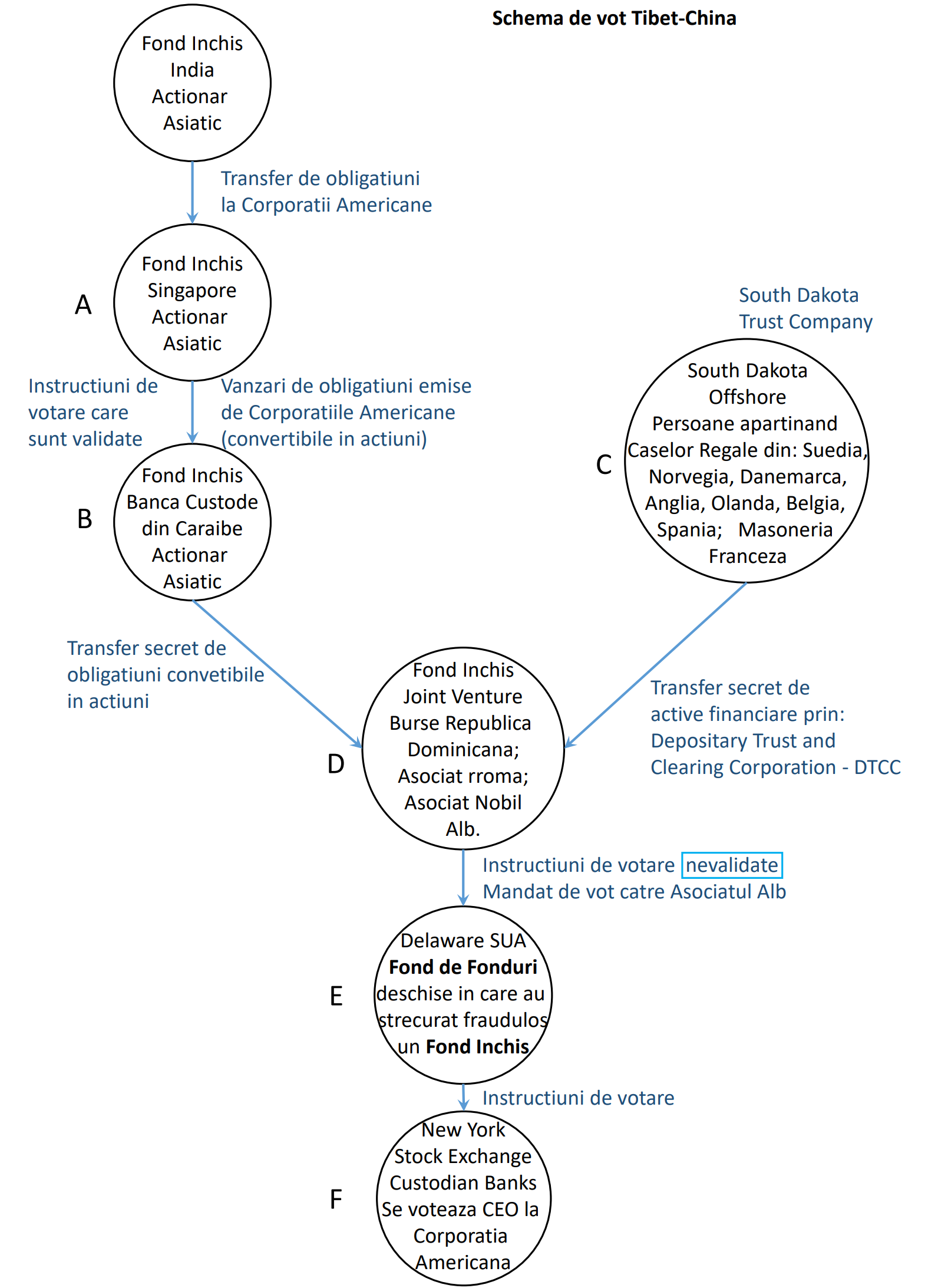

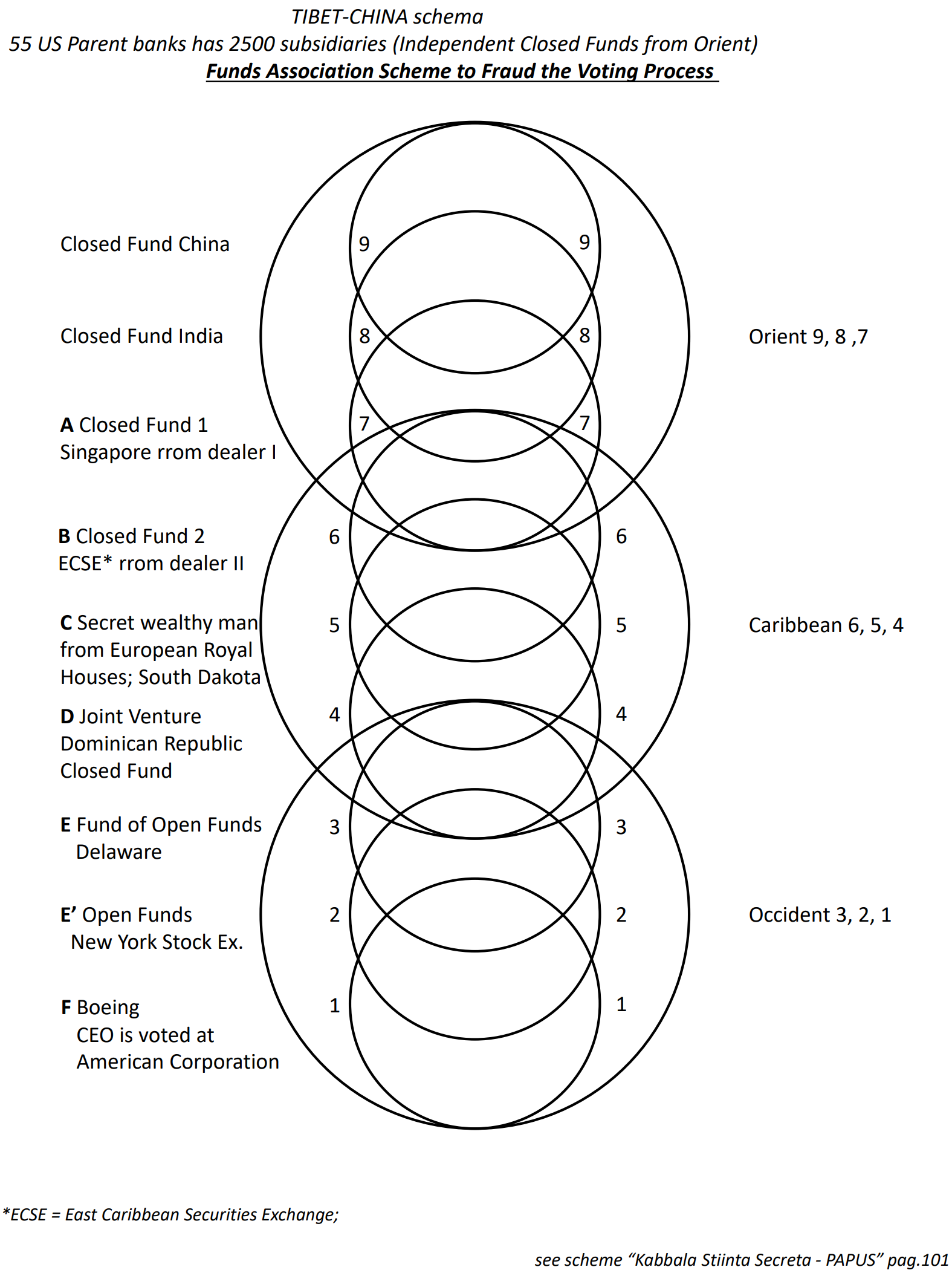

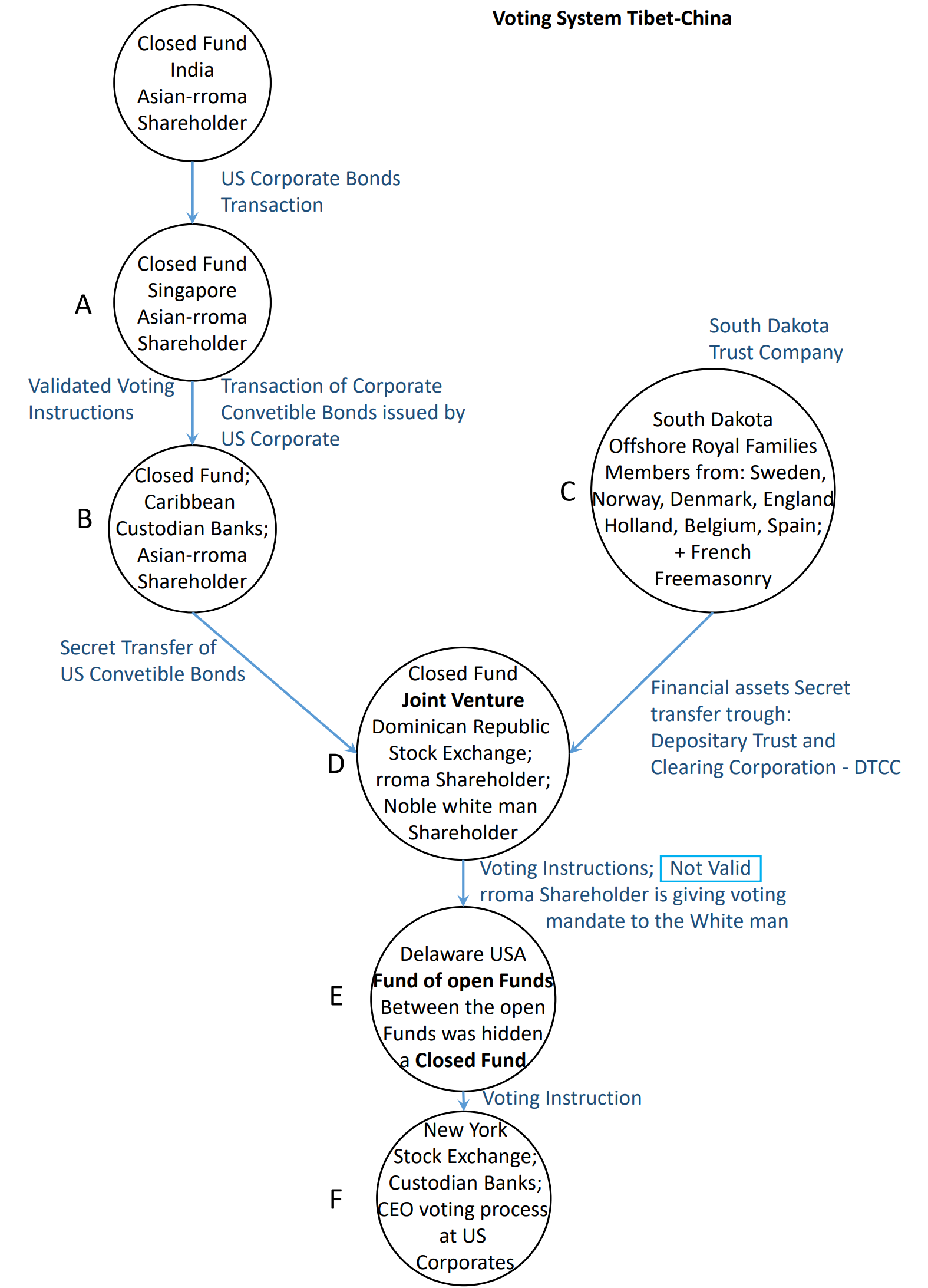

A. Fonduri mutuale inchise orientale cu sediul in Singapore (dar organizate din India) detinute de dealeri rromi I aflati sub comanda Chinei (vezi cercul 7 in desen pag. 21).

Legea precizeaza ca fondurile de investitii au nationalitatea tarii unde isi au sediul central ( head office). Prin urmare subsidiarele ( puii firmelor mama americane ) au nationalitate Indiana , Singaporeza , Mauritius . Doar denumirea o au americana pentru a deruta organele de control financiar SUA.

Dupa legile din India , Singapore , chiar si Caraibe fondurile inchise nu sunt obligate sa publice lista acionarilor.

B. Fonduri mutuale inchise cu sediul in Caraibe detinute de alti dealeri rromi II (agenti chinezi) (vezi cercul 6 in desen pag. 21).

Deoarece au sediul in caraibe ele au nationalitatea acelor teritorii din Caraibe ( multe independente ; semiindependente

C. Persone particulare (cercul 5 desen, pag.21) care fac parte din:

– Familia Regala din Suedia

– Familia Regala din Danemarca

– Familia Regala din Norvegia

– Familia Regala din Anglia

– Familia Regala din Olanda

– Familia Regala din Belgia

– Familia Regala din Spania

– Familia Regala din Portugalia

– organizatiile masonice de rang inalt din Franta

Acesti Nobili din familiile Regale Europene detin actiuni la purtator tiparite la firmele de armament Americane.

Actiunile la purtator se afla in seifurile Bancii Centrale din Stockholm, Suedia (sau Danemarca, Norvegia). Aceste actiuni la purtator sunt inregistrate in registrele secrete ale Bancilor Custode din South Dakota Offshore SUA (South Dakota Trust Company).

Bancile Custode fac parte din reteaua Depositary Trust and Clearing Corporation (DTCC).

South Dakota Offshore este pentru persoane particulare foarte bogate care vor sa isi tina secreta averea. Averea lor este perpetua de-a lungul secolelor. Inainte sa le aduca in SUA, averile se tineau in bancile mari de pe Lombard Street Londra.

D. Societati mixte (cercul 4, pag. 21) ( joint venture ) inchise, formate cu participarea fondurilor B si C.

E. Este un Fond de Fonduri deschise American (cercul 3, pag. 21; schema, pag. 22) cu baza in Delaware Offshore SUA.

Acesta este un fond de fonduri deschise reglementate de legea americana

Fondul inchis D este ( ilegal ) unul din fondurile detinute de Fondul de Fonduri E

E’. Fonduri deschise din New York Stock Exchange (cercul 2, pag. 21; pag. 22)

F. Companie americana la care se organizeaza alegerile (se trucheaza alegerile), banci, corporatii industriale (cercul 1 desen, pag. 21).

In continuare se detaliaza fiecare tip de firma in parte.

A. Fondurile mutuale inchise ( closed corporation ) din Singapore fac parte din Trustul Bancar Tibetan secret.

La aceste fonduri inchise nu poate detine actiuni publicul larg , deci nu sunt deschise pentru subscriptie publica , actionari lor sunt cetateni rromi sunt protejati de legea anonimitatii si se afla sub comanda Tibet-China.

Ei nu sunt proprietarii reali ai capitalului de lucru. Acest capital este detinut de agentii chinezi care isi au companiile ( alte fonduri inchise ) in offshor-uri din India , Chennai , Pune , Bangalore , Kolkata , Gurgaon , Vishakhapatnam , Hyderabad , New Delhi.

Aceste fonduri inchise au rolul sa stranga de pe piata OTC pachete de produse derivate – contracte de optiuni care au ca suport obligatiuni de imprumut convertibile in actiuni la corporatiile americane ( banci si industrie ).

In afara de obligatiuni convertibile ( covertible bonds ) mai exista si alte active financiare care formeaza suport pentru contractele de optiuni :

-warante

-drepturi de atribuire ale unor actiuni

-drepturi de subscriere a unor noi actiuni

care se pot converti in actiuni la firmele americane la care se vor organiza alegeri pentru numirea CEO.

Aceste tipuri de produse financiare care se pot converti in actiuni se emit de catre directorul adjunct maghiar de la firma emitenta. Directorului General i se explica ca a dat aceste produse catre anumite banci alese de el din cauza faptului ca le-a oferit dobanzi preferentiale (mai reduse) la imprumuturile efectuate. Foarte important de mentionat este ca directorul adjunct maghiar conduce cu adevarat firma emitenta(multinationale) si nu Directorul General (care poate fii evreu). Toate companiile multinationale occidentale sunt conduse de Directorul Adjunct (Deputy Chairman) care este de etnie maghiara. China a convins etnia maghiara(pe Grofi) ca au origini comune asiatice deoarece Hunii erau vecini cu China.

B . Fondurile mutuale inchise cu sediul in Caraibe

Acestea se prezinta ca subsidiare ( filiale ) ale unor firme financiare americane doar pentru a deruta agentiile antimonopol occidentale cu numele lor.

In total fondurile inchise A si B ( closed corporation ) sunt in numar de aproximativ 2500 si au sediile in India , Mauritius , Singapore , Caraibe . Desi au nationalitatea tarii unde au sediul, adica indiana, singaporeza , caraibiana ele au denumiri americane : JP Morgan , Goldman Sachs , Allianz , Morgan Stanley , State Street Global , Washington Mutual , Blackrock , Vanguard , Fidelity , Citigroup , Wells Fargo , BNY Mellon , Dimentional , etc.

Bancile mama care fac parte din Trustul Bancar Tibet – China sunt in numar de aprox. 55 ( vezi tabelul cu Trustul Bancat Tibet –China vezi pag. 25) si au sediul in SUA deci au nationalitate americana. Dar asa zisele filiale ale lor , fonduri mutuale inchise din Orient si Caraibe sunt aproximativ 45 pentru fiecare firma mama.

In total 55 x 45 = 2500 aprox. filiale Orientale si Caraibe cum am precizat anterior Aceste filiale Orientale si din Caraibe ajung sa formeze majoritatea de vot si la firmele mama din SUA prin schema descrisa acum:

Aceste 2500 de firme inchise ( closed corporation ) sunt actionare unele la celelalte si voteaza conducerea unele la celelalte formand un MONOPOL bancar.

Fondurile mutuale din Caraibe au rolul de a forma societati mixte ( joint venture ) cu fondurile de tip C , detinute de membri din familiile Regale Europene ( Suedia , Danemarca , Norvegia , Anglia , Olanda , Belgia , Portugalia c. ) tinuti secret in Offshore South Dakota. Averea albilor din South Dakota offshore este administrata de bancile custode din South Dakota. Practic vor folosi membri ai familiilor Regale Europene ca paravan pentru a truca procesul de votare lasand sa se inteleaga pentru elitele politice ca albii voteaza. Faptul ca albii voteaza este complet fals (votul lor este anulat).

C . Persone fizice anonime care fac parte din familiile Regale Europene ( Suedia , Norvegia , Danemarca , Olanda , Anglia , Spania , Belgia , Portugalia ) si din organizatiile masonice de rang inalt din Franta cu sediul secret in South Dakota offshore SUA au rolul de a masca aportul de capital al asociatului sau rrom II (care detine fondul inchis B ) cu care s-a asociat intr-o societate mixta.Totodata dealerul alb mascheaza si votul dat la “Record date “ de firma de tip A din Singapore. Aceasta pentru ca elitele conducatoare americane trebuie sa creada (in mod eronat) ca instructiunile de vot au fost date de dealerul alb si ca ele au fost luate in considerare.

Bancile custode tin secret faptul ca:

– dealerul alb a votat prin mandat de vot fiind imputernicit de asociatul sau rrom

– capitalul Nobilului alb este de 50% din capitalul joint venture

– votul asociatului alb nu a fost luat in calcul la votare

Legea americana interzice ca actiunile de la corporatiile americane (si de armament) sa fie tranzactionate pe piata Over The Counter ( OTC ) nereglementata. Astfel a aparut necesitatea inventarii unor produse financiare sofisticate greu de inteles pentru nativii albi dar care nu au nici o semnificatie economica. Acestea nu sunt actiuni dar se pot transforma in actiuni inseland vigilenta agentiilor guvernamentale antimonopol americane. Aceste produse financiare sunt contracte futures cu optiuni avand ca suport obligatiuni (de imprumut) convertibile in actiuni ale corporatiilor americane. Convertirea apare la “Trigger point “ numit si punct de declansare sau punct mort.

Acest “Trigger point “ este acea valoare de piata la bursa a obligatiunilor emise de corporatiile americane la care dobanda plus valoarea de piata a obligatiunii este mai mica decat dividendul plus valoarea de piata a actiunii.

In acest punct “Trigger point “ investitorul isi converteste obigatiunile in actiuni pretinzand ca se mareste profitul. Motivul real al convertirii este afluxul mare de actiuni cu drept de vot obtinut de dealerul rrom II (care este sub comanda ingineriilor financiari chinezi).

Valoarea de piata a obligatiunilor si actiunilor este manipulata cu abilitate pe marile burse si conduse catre “ Trigger point “(vezi capitolul Instrumente Financiare – Detalii). In cazul unui control mai riguros se poate pretexta ca investitorul din joint venture a preferat actiunile si nu obligatiunile. Acest lucru aparent il urmaresc dealerii rromi II aflati in slujba chinezilor (dar fara sa stie pentru cine lucreaza).

Astfel joint venture-ul chiar daca este descoperit ramane foarte util si pentru a se mai obtine o amanare a anchetei. Intre timp organul financiar de control poate fii impedicat intr-un fel sa isi faca misiunea. Mentiune: Joint Venture apare doar in registrul secret. Oficial el nu exista.

Fondurile orientale nu au voie sa detina actiuni la firmele de armament americane dar au voie sa detina obligatiuni convertibile in actiuni emise de firmele industriale americane si de armament.

D. Societati mixte ( joint venture ) formate cu participarea fondurilor B si C

Societatea mixta formata va avea sediul in Republica Dominicana offshore si va avea urmatoarea distributie a capitalului cu care participa fiecare :

-fond mutual inchis cu sediul in Caraibe ( tip B ) detinuta de un etnic rrom II – 50%

-persoane particulare anonime de tip C membre a Familiilor Regale Europene ( Suedia , Norvegia , Danemarca , Anglia, Belgia, Portugalia, Spania si altele) si Francmasoni de rang inalt francezi care au contul in South Dakota – 50%

Nobilii Europeni sunt reprezentati printr-un delegat Stewart Regal. Acesta poate fii gay ca si asociatul sau din Joint Venture. Intre cei doi parteneri sexuali gay se stabileste o relatie de mare incredere.

Societatea mixta cu sediul in Caraibe are rolul de a aduna numarul de contracte de optiuni care au ca suport obligatiunile convertibile ale firmelor americane ( bancare si industriale ).

Prin intermediul celor 18 burse din Caraibe ( din care 13 sunt in offshore ) si cele 12 banci de clearing ( banci custode care tin si registrul actionarilor si le deservesc pe toate cele 18 burse) activele financiare se preiau din toate bursele lumii si se distribuie cat mai uniform catre cele 72 de societati mixte .

Aceste societati mixte trebuie sa detina impreuna aproximativ 38% din drepturile de vot.

Nimeni nu s-a gandit ca aceste 72 de societati mixte vor vota organizat cu ajutorul unor mesaje secrete si a unor parole , acelasi candidat la functia de CEO al firmei americane.

Agentul rrom din firma mixta D asteapta o perioada, cand pretul actiunilor vor creste si obligatiunile se vor converti in actiuni.

Intr-adevar dupa o perioada se ajunge la “trigger point” si actiunile devin mai rentabile decat obligatiunile.

Deoarece obligatiunile se convertesc in actiuni apare un aflux mare de voturi.

Dealerul rrom II da un mandat de vot catre partenerul sau alb sa voteze cu cine doreste ( voturile albului nu vor fi luate in calcul pretextand ca actiunile au fost inregistrate dupa Record Date ).

Acesta da instructiunile de vot catre banca custode din reteaua DTCC South Dakota offshore care face clearingul pe piata NASDAQ si banca custode da instructiunile de vot mai departe catre “Proxi Voting Service Provider “.Aceasta este o institutie specializata doar in procesul de votare la companii.

DTCC ( Depository Thrust and Clearing Corporation) este cea mai mare retea de banci de clearing si banci depozitare ( care tin evidenta actionarilor la companii ,distribuie dividendele si executa instructiunile de votare ).Are reprezentante in SUA – South Dakota offshore , Anglia , Singapore si opereaza clearing pe piata nereglementata NASDAQ.

E. Compania E este un Fond de Fonduri deschise cu sediul in Delaware offshore.Fondul de fonduri E poate cumpara o parte ( un procent ) din alte fonduri deschise.Fondul de fonduri poate investi (ilegal) intr-un fond inchis ( joint venture) din Republica Dominicana. Investitia se face doar in actiuni.

Instructiunile de votare date prin registrul din Republica Dominicana de catre societatea mixta (joint venture) se transmit prin registrul Fondului de fonduri aflat in bancile custode de la New York Stock Exchange. La vedere apare Fondul de Fonduri si societatea mixta (joint venture) ramane nevazuta. Ascunderea s-a facut cu complicitatea bancii custode condusa de agentul maghiar.

Concluzie: Printre aceste fonduri deschise se ascunde cu complicitatea bancii custode condusa de un maghiar cu nume american si fondul inchis D, care are actionar si pe asociatul rrom. Acest asociat rrom nu trebuie sa fie la vedere. La vedere, pentru un grup mic de masoni de rang inalt apare un fond mutual detinut de un membru al Caselor Regale Europene.

Banca Custode Centralizatoare, condusa de un maghiar, a inlocuit ilegal in registru, contul (indicativul) de Joint Venture cu un cont (indicativ) de fond mutual pe care Nobilul European il detine singur.

F. Aceste companii sunt corporatiile americane, banci sau corporatii industriale la care trebuiesc organizate (trucate) alegerile.

Fondul de Fonduri deschise E (cercul 3, pag.21) preia instructiunile de vot de la fondul mixt D, le preda catre registrul E’ de la New York Stock Exchange (cercul 2, pag. 21) si apoi mai departe catre Proxy Voting Service Provider.

Acest ultim intermediar imputernicit verifica in secret daca s-a facut o majoritate de voturi de catre candidatii indicati din China.

Exemplu:

1. Sa presupunem ca o firma oarecare multinationala occidentala are aproximativ 2700 de actionari.

2. Din aceste 2700 firme, 500 fac parte din trustul bancar secret Tibet – China.Cele 500 fac parte din cele 2500 de fonduri anonime inchise A si B, din Orient si Caraibe, analizate anterior.

Cele 500 de firme alese sa faca parte din actionariat sunt mereu altele prin rotatie din cele 2500 de fonduri orientale.

3. Din cele 500 doar 72 de fonduri societati mixte formeaza majoritatea de vot. De fiecare data cand se organizeaza alegeri , cele 72 de fonduri inchise se selecteaza mereu altele , prin rotatie din cele 2500 de fonduri inchise orientale. Aceste 72 de fonduri inchise, mereu altele, vor forma 72 de joint venture cu asociatul alb.

4. Restul actionarilor de la punctul 1 sunt : 2700 – 500 = 2200 sunt fonduri deschise publicului larg sau persoane fizice din Occident. Oricine poate cumpara actiuni la aceste fonduri. Dar aceste fonduri deschise publicului chiar daca pot intruni in total 25%-30% din voturi ele nu voteaza organizat un anumit candidat in functia de conducere a Companiei Multinationale Americane in cauza.

Rolul acestor 2200 de fonduri deschise publicului sau persoane fizice este foarte important intrucat cele 72 de societati mixte in care sunt concentrate in secret drepturile de vot, se pierd printre ele.

PRECIZARI 24.10.2025

Persoanele pe numele carora sunt trecute actiunile la purtator ale

firmelor de armament Americane

I. Nobilul European, membru al caselor regale Europene – este proprietarul actiunilor la purtator ( tiparite)

II. Steward Regal (sau un alt official Regal) – Actiunile sunt trecute pe numele unui Steward Regal sau alt official Regal in bancile custode din South Dakota Offshore.

Pentru aceasta Nobilul European (Duke, Lord, Prince,…) a dat o procura catre delegatul sau Steward-ul Regal

III. Steward-ul Regal este insotit de un Martor Mason care este sub autoritatea celul de-al 33-lea grad Franc Masonic de Rit Scotian

IV. Al 33-lea grad Franc Masonic de Rit Scotian da marturie prin Martor unui alt Mason American care apartine Consiliului Suprem de la Charleston ca:

-actiunile la purtator ale Nobilului European sunt reale

-aceste actiuni se afla in seifurile Bancii Centrale din Stockholm Suedia (sau in Danemarca)

V. In aceste conditii Masonul American, Membrul Consiliului Suprem din Charleston este de acord sa se treaca actiunile la purtator in registrul din South Dakota Trust Company pe numele sau. Aceasta se face la cererea Masonului European. La fel, se pot trece actiunile pe numele unor Endownment Fund detinute de Consiliul Suprem de la Charleston.

Registrele din South Dakota (Offshore Strict Secret) sunt tinute de Bancile Custode din reteaua international Depository Trust and Clearing Corporation – DTCC.

VI. In final Masonul American (sau Endownment Fund masonic) este indrumat sa treaca actiunile si el la randul lui pe numele Bancii Custode care deservesc bursele din Republica Dominicana:

-Bolsa de Valores de la Republica Dominicana

-Latin American International Financial Exchange – Republica Dominicana

Acest lucru se face folosind o procura “Power of Attorney”. Deci in registru apare numele Bancii Custode.

Bancile Custode care deservesc bursele din Republica Dominicana se folosesc de faptul ca actiunile la purtator nu sunt legate de numele unui proprietar anume. Astfel pot muta illegal actiunile dintr-un cont de societate mixta intr-un cont de Fond Mutual.

Schema de fraudare a votului de catre Tibet-China

-Fondul A din Singapore detinut de dealerul rrom I (cercul 7 in desen, pag. 21) isi inregistreaza activele financiare si da instructiunile de votare la record date (cu 60 de zile inainte de votarea efectiva).

-La un minut dupa inregistrare, vinde activele financiare (valorile mobiliare care au potentialul de a se schimba in actiuni) catre Fondul B (cercul 6 din desen, pag. 21) detinut de dealerul rrom II (aflat in bancile custode care deservesc East Caribbean Securities Exchange.

-Tot o trucare asemanatoare se face folosind diferenta de fus orar intre diferite zone din SUA.

-Dar aceasta intra in asociere cu Nobilul European intr-un joint venture D (cercul 4 din desen, pag. 21) in Republica Dominicana.

-Nobilul European intra in acest joint venture cu actiunile la purtator care erau inregistrate in bancile custode din South Dakota Offshore (DTCC)

-Dupa ce a cumparat cosurile de active financiare, joint venture-ul D (cercul 4 din desen pag. 21) inregistreaza si el activele financiare si da instructiunile de votare la un minut dupa record date. Acestea vor fi anulate in secret.

Vor fi anulate pentru ca legea Americana spune ca cel care a inregistrat activele financiare eligibile pentru votare la record date are dreptul de a vota, chiar daca a vandut activele dupa aceasta data.

Iar cel care a cumparat activele dupa record date nu are dreptul de a vota cu actiunile ce provin din aceste active financiare. Nu pot vota cu aceleasi active financiare si cel care a vandut si cel care a cumparat.

Inregistrarea valorilor mobiliare la record date are loc cu 60 de zile inaintea votului in Adunarea Generala a Actionarilor. Asocierea in joint venture se face in procent de 50%/50%.

Adica asociatul dealerul rrom II vine in participatie cu valori mobiliare care se convertesc intr-un numar egal de actiuni cu cel al asociatului sau, Nobilul European.

In aceste conditii asociatul dealerul rrom II trebuie sa-l consilieze oe Nobilul European- mai precis pe delegatul acestuia Stewardul Regal sa isi converteasca actiunile la purtator preferentiale in actiuni ordinare.

Rata de conversie este de 6 actiuni ordinare pentru o actiune la purtator. Fiecare actiune ordinara are un vot. Astfel asociatul dealerul rrom II il convinge ca va avea un profit dupa vanzarea lor. Cu banii obtinuti din vanzare isi va rascumpara actiunile la purtator si va ramane si cu un profit.

Actiunile preferentiale la purtator (tiparite) au clauza de:

-actiuni convertibile

-actiuni rascumparabile

Deci, actiunile la purtator nu se vor misca din seifurile Bancii Centrale din Stockholm, Suedia.

Convertirea in actiuni ordinare (fiecare cu cate un drept de vot) se face in bancile custode din South Dakota (DTCC)-Depositary Trust and Clearing Corporation.

Dupa convertirea in actiuni ordinare Nobilul muta aceste actiuni intr-un fond mutual ( in o banca custode ) din Republica Dominicana

Bancile custode care deservesc bursele din Republica Dominicana muta fraudulos fonduri joint venture (fond mixt) din contul indicativul de joint venture D (cercul 4 in desen, pag. 21) in cont indicativ de fond mutualdin South Dakota (fondul C, cercul 5, pag. 21), al carui singur actionar este Nobilul European (prin delegatul sau, Steward Regal.

Practic asociatu dealerul rrom II devine nevizibil.

Oficial nici fondul joint venture nu exista. Aceste Joint venture exista doar in registrele secrete ale bancilor custode din Republica Dominicana.

Aceasta le este necesar pentru ca masonii americani nu accepta ca rromii (gipsy) sa fie actionari la firmele de armament americane.

Din aceasta rezulta ca nu votul joint venture va fi anulat ci votul Nobilului European va fii anulat.

Confuzia vine din faptul ca:

-In registrul valorilor mobiliare s-a facut prin frauda inlocuirea fondului joint venture cu fondul mutual al Nobilului. Inlocuirea s-a facut in secret de catre administratorul maghiar al Registrul Centralizator.

-Ca cele doua fonduri au un numar identic de drepturi de vot dar pentru canditati diferiti. Pentru a face ca numarul de voturi sa fie identice dealerul rrom II completeaza instructiunile de votare si in blanc (necompletate) (aprox. 20% din voturie lui). Cand un actionar da instructiuni de votare in blanc se intelege ca lasa banca custode sau un Proxy Voting Service Provider (condusa de un maghiar) sa acorde voturile cum crede in locul lui.

Ambele categorii de actiuni provin prin convertirea altor tipuri de valori mobiliare

Voturile lor provin din surse diferite dar tot printr-o operatiune de convertire.

Voturile asociatului dealer rrom I – Singapore provin din convertirea:

– obligatiuni corporate convertibile in actiuni

– convertirea warrantelor in actiuni

– convertirea drepturilor de subscriptie in actiuni

Convertirea a avut loc pentru ca aceste active au ajuns la Trigger Point.

Aceste convertiri au loc in bancile custode care deservesc East Carribean Securities Exchange – ECSE:

St. Kitts and Nevis

St. Lucia

Dominica

Antigua and Barbuda

Anguilla

St. Vincent and Grenadines

Monserrat

Grenada

Si apoi prin bursele din: Caiman, Curacao, Barbados, Bermuda si Bahamas

Voturile Nobilului European provin din convertirea actiunilor preferentiale la purtator (tiparite = Bearer Shares) in actiuni ordinare cu rata de conversie de sase actiuni ordinare pentru o actiune la purtator.

Fiecare actiune odinara are cate un drept de vot.

Convertirea are loc in South Dakota Custodian Bank.

Voturile provenite de la Joint Venture aflate intr-un cont modificat (intentionat) de fond mutual au anumite instructiuni de vot (hotarate de agentii Chinezi). Aceasta modificare ilegala a fost facuta de agentul secret maghiar care administreaza Proxy Voting Service Provider..

Voturile detinute de delegatul Nobilului au alte intructiuni de votare (hotarate de Nobil).

Dupa cum am vazut instructiunile de votare ale Nobilului vor fi anulate in secret de agentul maghiar care tine registrul Proxy Voting Service Provider.

Pentru a mari si mai mult confuzia, fondul Nobilului a fost cumparat partial (presupunem 40%) de un Fond de Fonduri din Delaware (fondul E, cercul 3, pag. 21; pag. 22).

Fondul Nobilului (din rep. Dominicana) este ascuns printre alte sute de fonduri deschise care apartin Fondurilor de Fonduri (schema, pag. 22). Aceste sute de fonduri deschise au sediul in Delaware si sunt inregistrate in NYSE.

Fondul de Fonduri (fondul E, cercul 3, pag. 21) a cumparat doar partea de actiuni si alte valori mobiliare care se pot converti in actiuni (nu si bondurile de Trezorerie).

Atunci voturile aferente actiunilor inregistrate in Registrul apartinand fondurilor inchise din Republica Dominicana se va face prin Registrul Fondurilor de Fonduri (fondul E, cercul 3, pag. 21) din Delaware, care este foarte incurcat. Urmarirea fondurilor care fac majoritatea in alegeri este foarte greoaie.

Este foarte incurcat pentru ca valorile mobiliare se muta dintr-un cont in altul dupa cum anumite tipuri de valori mobiliare s-au transformat in alte valori mobiliare (in actiuni).

Exemplu de transformari ale valorilor mobiliare:

Asociatul dealerul rrom II din Caraibe,cercul 6) a cumparat de la dealerul rrom I (din Singapore) fondul A (cercul 7 din desen, pag. 21) mai multe tipuri de valori:

– Obligatiuni Corporate convertibile in Actiuni

– Warrants

– Drepturi de subscriptie (Subscription Rights)

In registrul actionarilor de la Bancile Custode ele sunt tinute in contul investitorului (Client Account) fiecare in conturi separate.

Daca Obligatiunile convertibile s-au convertit in actiuni ele sunt mutate din conturile de Obligatiuni in conturile de actiuni.

Daca Warrant-ele s-au convertit in actiuni la cererea posesorului atunci ele sunt mutate din conturile de Warrante in conturile de actiuni.

La fel se muta si “drepturile de subscriptie” din contul de “drepturi” in contul de actiuni.

Doar agentul secret care tine Registrul Valorilor mobiliare stie precis ce operatiuni s-au efectuat.Acest agent, care conduce Banca Custode este de etnie maghiara si este agent secret in slujba Chinei.

Registrul Fondurilor de Fonduri (schema, pag.22 si cercul 3, pag.21) din Delaware este tinut de bancile custode de la New York Stock Exchange (E’, cercul 2).

Astfel instructiunile de votare date de China-Tibet vor ajunge din Asia (Singapore, cercul 7), la New York Stock Exchange (cercul 2).

Anularea votului nobilului European nu apare la vedere pentru ca in SUA nu exista o procedura standard care sa confirme actionarilor ca votul lor a fost numarat la votarea din Adunarea Generala a Actionarilor.

Inspectorii financiari americani au dreptul de control in bancile custode care deservesc bursele din Republica Dominicana, pentru ca nu este offshore. In realitate este un semi-offshore la care au acces doar anumite organe de control.

Pentru a evita riscurile unui asemenea control delegatul Nobilului da un mandat catre un mason American din Consiliul Suprem de la Charleston sa treaca actiunile la purtator pe numele lui.

La fel, poate da mandat catre un Endowment Fund detinut de Consiliul Suprem de la Charleston sa treaca actiunile regale pe numele acestor Endowment Funds.

Endowment Funds (detinute de societatile secrete masonice) dau mandat mai departe catre bancile custode sa inregistreze actiunile pe numele bancii custode.

Banca custode care este tinuta tot de un agent secret rrom la comanda Chinei poate sa mute activele financiare dintr-un cont in altul si fondurile mutuale dintr-un cont in altul pentru a-l ascunde pe dealerul rrom II (cercul 6).

Inspectorii financiari americani care sunt si ei masoni si sunt girati de Consiliul Suprem de la Charleston nu au foarte mare vigilenta in a controla ce fonduri inchise din Republica Dominicana fac pac parte din Fondurile de Fonduri deschise din Delaware (cercul 3; E).

Pentru a avea o colaborare stransa cu Consiliul Suprem de la Charleston, Stewardul Regal este insotit de un Martor Mason European imputernicit de al 33-lea Grad Francmasonic de rit Scotian.

Acest Martor European Mason depune marturie ca actiunile la purtator (tiparite ale Nobililor) sunt reale si se afla in seifurile Bancii Centrale din Stockholm Suedia (sau Danemarca). Reamintim ca actiunile la purtator nu sunt legate de numele unui actionar. Proprietarul este cel care le detine.

In final voturile se centralizeaza la Proxy Voting Service Provider, care este conceputa si controlata de China-Tibet printr-un etnic maghiar. Aceasta are misiunea secreta ca 72 de joint venture compuse din 72 de Nobili Regali Europeni si 72 de rromi sa formeze o majoritate de vot de 38% la firmele de armament americane. Cele 72 de joint venture se pierd printre cele aproximativ 3000 de fonduri deschise actionare la o firma Americana.

Proxy Voting Service Provider este o banca specializata doar pentru procesul de votare si este condusa de un singur etnic maghiar.

Acest etnic maghiar schimba intentionat instructiunile de vot ale nobilului European cu instructiunile de vot ale romului din “joint-venture-ul” din Republica Dominicana.Nobilii Europeni sunt mintiti ca voteaza. Numai Proxy Voting Service Provider stiu ca instructiunile de vot ale dealerului rrom I din Singapore s-au trecut ilegal pe numele Nobilului. Iar votul Nobilului s-a anulat.

Masoneria si Nobilii cred in mod eronat faptul ca votul Nobilului Regal a fost dat correct la record date si ca el va fi luat in calcul la numaratoarea voturilor in Adunarea Generala. Dar din cauza ca la formarea majoritatii participa 72 de fonduri mutuale inchise detinute de 72 de rromi din Singapore, procentul necesar pentru fiecare este de doar 0.52% din vot (72×0.52%=38%).

Aceste 0.52% din voturi cu instructiuni de votare date de rromi se atribuie in mod fals celor 72 de Nobili Europeni care participa la o votare. Deci Nobilul nu este surprins ca nu a castigat candidatul votat de el pentru ca el detine doar 0.52% din voturi

0.52% din voturi provin din 0.088% din total actiuni (fiecare actiune are in medie 6 voturi) ( 0,088 % x 6 voturi = 0,52 % )

Nobilul poate sa creada ca alti actionari au votat altceva si ca el avand foarte putine actiuni crede ca votul lui nu influenteaza prea mult.

Fiecare nobil nu stie ca voteaza si alti nobili. Ei nu voteaza organizat.

Pe cand cei 72 de dealeri rromi I voteaza toti acelasi candidat (din cei 9 candidati).

Asa au fost instruiti de chinezi.

Pe baza unor parole secrete primesc numele candidatului de origine evreiasca care trebuie sa castige alegerile.

Mentiune: toata conducerea financiara a lumii este condusa de China prin intermediul agentilor secreti de etnie rroma (gipsy).

Chinezii pun la conducerea companiilor multinationale CEO de origine evreiasca in mod ostentativ pentru a lasa impresia ca evreii conduc sistemul financiar-industrial. In realitate evreii nu detin nicio putere bancara sau industriala. Ei sunt simpli angajati (nu proprietari) care formeaza un paravan pentru acoperirea trustului bancar chinez. In spatele directorilor evrei sunt adjuncti de origine asiatica care conduc cu adevarat firma.

La conspiratie participa pe langa agentii rromi si Stewardul Regal, care este si el metis rrom.

Masonii sunt inselati si ei. Ei intentioneaza doar sa ascunda publicului American si presei faptul ca Nobilii Europeni din familiile regale sunt proprietarii firmelor de armament americane. Dar fara sa stie, masonii de fapt au rolul sa ascunda votul agentilor secreti rromi aflati sub comanda Chinei.

Inspectorilor financiari americani li se cere de catre superiorul lor Francmason Grad 33 rit Scotian European sa nu dezvaluie publicului American ca Nobilii din familiile Regale Europene sunt actionari la companiiloe americane. Si sa nu dezvaluie nici numele delegatului (Steward Regal sau alt oficial Regal).

Nota:

Nobilii din Familiile Regale mostenesc (probabil primul nascut-primogenii) actiunile la purtator de secole (perpetuity).

Pentru a fi la dispozitia Trustului Bancar Chinez, Nobilii Europeni sunt imbolnaviti intentionat de:

Alienare mintala

Dementa

-Schizofrenie

-Motivul inventat ar fi relatiile incestuase intre membri familiilor regale Europene. Rudelor lor li se spune ca fac tratament pentru insanatosire.

-Medicatia care induce boala este intrerupta doar cand semneaza instructiunile de votare sau cand da procura catre Stewardul Regal.

Uneori in scrierea secreta se semnaleaza ca Nobilii ar fi captivi in azile sau ospicii private.

Kabala – Traditia Secreta a Occidentului

Piața derivatelor condusă din India la ordinul tibetanilor

Piața mondială de produse derivate OTC (over the counter) este o piață nereglementata de negocieri directe între vânzătorii și cumpărătorii acestor produse financiare foarte sofisticate. Pentru aceste produse nu există burse obișnuite care să funcționeze la un sediu cu ring bursier. Pe această piață se vând produse care au ca suport acțiunile companiilor americane, precum și titlurile de credit emise de aceste companii.

Aceste produse, în ordinea complexității lor, sunt:

- acțiuni, obligațiuni convertibile în acțiuni, warante etc.;

- contracte futures pe acțiuni ale unor companii din Occident;

- contracte futures cu optiuni având ca suport acțiunile și obligațiunile companiilor din S&P 500;

- strategii cu opțiuni care combină diverse tipuri de opțiuni. Aceste strategii cu opțiuni sunt:

– straddle

– strangle;

– butterfly;

– condor. - Exchange Traded Funds – ETF. Aceste tipuri de active (foarte ermetice pentru publicul larg și pentru finanțiștii americani) au la bază un portofoliu de “Strategii cu Opțiuni”, care și ele au la bază acțiuni, obligațiuni convertibile, warante și altele care se convertesc în acțiuni.

Pentru a regla și mai bine prețul activelor care se convertesc în acțiuni, precum și a altor titluri de credit care se convertesc în acțiuni, se mai folosesc și coeficienții de sensibilitate Delta, Vega, Gama, Rho, Theta cu care se corijează valoarea contractelor de opțiuni. Toate aceste produse întortocheate nu au nicio semnificație economică pentru industria americană.

Aceste produse vândute pe piața OTC conduc opțiunile la acea valoare de piață — punct de declanșare (trigger point – punct mort) — în care toate activele legate de acțiuni sau bazate pe acțiuni se transformă în acțiuni la firma care urmează să se voteze în Adunarea Generală a Acționarilor.

Astfel, deși prețul acestor active este condus din India (de dealeri rromi), afluxul de acțiuni provenit din aceste active apare în băncile custode din Caraibe, Canare, (pe bursa nevazută NASDAQ – OTC – Electronic Communication Network, Electronic Funds Transfer), Delaware off-shore, New York Stock Exchange și Chicago Mercantile Exchange.

Mentiune!!! – accesul pe o prarte din piata NASDAQ se face numai cu parola transmisa din Tibet.

Schema traseului de produse OTC condusă de Citigroup

India are o platformă electronică de tranzacționare a produselor sofisticate OTC (over the counter). Aceste platforme sunt deținute de Hedge Funds care sunt organizate sub forma unor societăți închise anonime (closed corporations). Aceste societăți închise se află în India, în locații precum:

- Gurgaon;

- Bangalore;

- Vishakhapatnam;

- Hyderabad;

- Pune;

- New Delhi;

- Kolkata.

- Chennai

Toate aceste societati inchise din India primesc parolele secrete din Guangzhou – China, prin intermediul agentilor secreti asiatici.

Aceste companii secrete au acces, pe baza unei parole, la piața OTC americană NASDAQ – Amex. Aceasta este o piață a piețelor care foloseste doua sisteme:

- Sistem de Comunicare Electronică (Electronic Communication Network – ECN)

- Sistem Electronic de Transfer de produse financiare (Electronic Funds Transfer – EFT).

Indienii din aceste locații, care sunt sucursale ale firmei HSBC, se conectează in secret la piața NASDAQ Amex prin doua softuri specializate ale lor:

- Data Processing & Customer Service

- Internal Software Engineering

Astfel se organizată confecționarea pachetelor (cosuri) de active care au ca suport acțiuni americane, obligațiuni, contracte futures cu optiuni si strategii cu optiuni. Toate acestea se pot converti în acțiuni americane (occidentale in general).

- De aici, se organizează și momentul în care aceste pachete de active ajung în punctul de declanșare (trigger point) în care se convertesc în acțiuni. Apoi, aceste pachete trec prin bursa din Singapore care este legată la DTCC – Depository Trust & Clearing Corporation din SUA prin DTCC Data Repository – Singapore PTE. Astfel, din Singapore, coșurile de active se vând pe piața din Caraibe.

Toate produsele de pe piața OTC din lume sunt concepute și organizate de Citigroup, deținut în secret de India la comanda Tibet-China.

Atentie!!! Deriv/SERV este o filiala a lui DTCC care face clearing(compensari) automat este cel mai mare serviciu de clearing (transfer de active finaciare) pentru piata OTC din lume. La aceasta are acces, in afara de Occident si Singapore. Prn Singapore intra si dealeri indieni pe piata Deriv/Serv.

Detalii Asupra Instrumentelor Financiare

Un contact futures cu optiuni contine ca elemente definitorii:

- Pretul de exercitare al obtiunii

- Prima optiunii – este platita la semnarea contractului

- Durata contractului

- Pretul de bursa din momentul exercitarii optiunii.

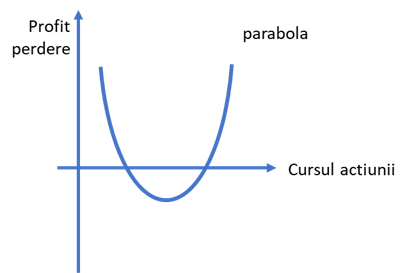

Punctul mort este atins cand pretul bursei este egal cu pretul de exercitare plus prima optiunii.

La punctul mort, (punct de declansare; trigger point, nici nu se pierde nici nu se castiga)

Cu ajutorul contractelor de optiuni care are ca active suport obligatiuni de imprumut ale firmei Boeing ( convertibile in actiuni) dealerii de la bursa controleaza “valoarea de piata “ a obligatiunilor adica chiar a activului suport.

Preturile de piata ale obligatiunilor sunt confectionate artificial cu ajutorul optiunilor.

De altfel mai exista un punct mort si pentru obligatiuni, (trigger point) care este atins atunci cand valoarea de piata a obligatiunii (create artificial) plus dobanda anuala este egala cu profitul obtinut din dividend plus valaorea de piata a actiunii.

Cand profitul provenit din obligatiuni este depasit de profitul provenit din actiuni , in mod normal obligatiunile se convertesc in actiuni. Acesta este pretextul pentru care cu mai putin de o luna inainte de votul in adunarea generala a actionarilor, obligatiunile se convertesc in actiuni.

Strategiile cu optiunie:

Straddle:

Este o combinatie Call-Put, pretul de exercitare si scadentele sunt identice.

Intr-un Straddle la cumparare se efectueaza o:

- O cumparare de Call combinata cu o cumparare de Put

Intr-un Straddle la vanzare se combina :

- O vanzare ca Call si o vanzare de Put

Alte tipuri de combinari de optiuni se numesc, Butterfly, Condor, Strangle;….

Aceste strategii se folosesc pentru a conduce in mod intentionat dar artificial valoarea activului suport intr-o anumita directie: de crestere sau de scadere.

Aceste tipuri de manipulare a pretului la obligatiuni, tibetanii le-au lasat in sarcina dealearilor indieni.

Dar totusi indienii, chiar daca sunt aliatii Chinei, sunt in acelas timp si rivalii Chinei pentru controlul finantelor globale.

Deoarece India nu are la dispozitie bani de la bancile centrale occidentale decat pe termen scurt si nu sume mari, ei nu au suficiente fonduri pentru a da trendul crescator sau descrescator accentuat pentru activele financiare . Astfel miscare in sus sau in jos a valorii activelor facute de brokerii indieni este doar liniara.

Pe cand trendul crescator sau descrescator care este dat de dealerii controlati de tibetani este exponential de tipul X2 (adica puterea a doua sau patratica) cu graficul in forma de parabola.

Aceasta este posibil pentru ca Tibetanii au access la Federal Reserve Banks , la credite petermen lung cu dobanda zero. La aceste credite se cere o grantie in aur de 10% din valoarea creditului .

Astfel au access la sufficient de multa finantare pentru a imprumuta cu levier (Leverage) toti dealerii controlati de ei. Firma controlata din Tibet care da imprumut cu levier la toti celalti dealeri cu cea mai mica dobanda este Goldman Sachs. .

Goldman Sachs controleaza toti Primary Dealears ( dealerii primari) de pe piata financiara pe termen lung, Americana si Ocidentala in General.

Acesti Primary Dealears imprumuta trezoreriile SUA si ale statelor occidentale pe termen lung . 1-3-5-10-30 ani.

Tot acesti Primary Dealers se duc cu titlurile de stat (luate de la trezorerii ) la bancile centrale americane si occidentale ca si garantie pentru a lua noi credite.

La creditele pe termen lung pe care le ofera Federal Reserve catre Primary Dealers se cere si o garantie in aur (10% din valoarea creditului).

Aceste lingouri de aur au fost luate de Primary Dealears (controlati de Tibet) de la Department of Treasury SUA drept graj pentru creditele cu termen lung.

Indienii nu pot sa respecte aceste cerinte si nu pot da un trend pietelor cu o crestere parabolica. (patratica)

In plus, Chiana controleaza si comunitatea gay si masoneria, adica puterea politica si legislative din occident.

In englezam mason – zidar

Deci cea mai mare asociatie de zidari din lume, Massoneria, nu poate sa zideasca decat cel mai mare zid din lume, adica Marele zid Chinezesc. (Zid = Bursa= Wall = Wall Street)

In Kabala, ZID este BURSA.

O alta metoda folosita de tibetani pentru a influenta pretul obligatiunilor sau actiunilor este metoda coeficientilor de sensibiltate – la care brokeri dealeri indieni nu au access. Acesti coeficienti dau sensul crescator sau descrescator al activului suport.

Delta – coefficient care exprima variatia primei optiunii la variaitia pretului cu o unitate a actvilui suport.

Delta aproximeaza probabilitatea ca optiunea sa fie exercita si se determina cu formula derivatei de gradul 1 a valorii curente a optiunii ( a primei optiunii) in raport cu cea a instrumentului de referinta.

De aici provine si denumirea de produse derivatei ( pe piata OTC) .

Gamma – este coefficient care reprezinta rata de modificare a coeficientului Delta.

Vega – coefficient care pune in evidenta modificarea primei unei optiuni la modificarea de 1% in volatilitatea pretului activului suport.

Rho – reflecta variatia pretului primei optiunii la o modificare de 1% a ratei dobanzii.

Daca se doreste marirea valorii de piata a actiunilor companiilor ce compun indicele S&P500 atunci se folosesc produse sintetice comandate doar de tibetani si pe care brokeri indieni nu le pot influenta. Valoarea actiunilor companiilor care formeaza indicele se mareste pentru ca au loc alegeri in mai multe companii in aceleas perioada si trebuie creat trendul.

Valoarea unui portofoliu (P) de actiuni este data de expresia

P= N(Ip x M) / Delta =~ 5 000 000$

N = 6 -numarul de contracte

Ip = 1900 , valoarea in puncte al indicelui S&P500 la acea data

M = Multiplicatorul pietei americane. M = 500$ pentru fiecare punct de indice.

Delta = 1.15 coeficientul de sensiblilitatea al portofoliului detinut in raport cu indicele.

Coeficientii de sensibilitate sunt inventati de Goldman Sachs pentru contractile futures si optiuni.

Casele de compensare – Clearing House, actioneaza ca intermediar in tranzactii.

Clearing House este vanzator pentru oricare cumparator, si cumparator pentru orice vanzator de contracte futures si optiuni.

Toate produsele sintetice – Optiuni pe indici bursieri sunt vandute de Goldman Sachs Clearing House in colaborare cu Deutsche Bank, Morgan Stanley , JP Morgan, HSBC – Clearing House. Din aceasta cauza Goldman Sachs este considerat o bursa a burselor.

Goldman Sachs Clearing House, coordoneaza activitatea DTCC (Depository Trust and Clearing Corporation), CCPS ( Central Counterparty Clearing House) si ICE Clear ( Intercontinal Exchange – Clear)

Goldman Sachs se afla in varful trustului bancar Tibetan.

How elections for administration councils of all the multinational corporations of the world are organized by Tibet-China

How to build a monopole

I. The tools to build the majority of votes

a) Shares

Preference shares: provide a higher return based on a priority dividend that is paid before the dividends on ordinary shares; but have no voting right.

Ordinary shares: they do not have priority profit or dividend, but have voting rights.

Voting right shares: – are issued with the privilege of having one vote, two or more votes for a single share.

Participating preference shares: redeemable shares – where the investor can add a redemption clause if the dividend rate is known to fall in the not-too-distant future.

Cumulative shares: dividends accumulate over a period of several years. The dividend due is cumulated in all years in which losses have been incurred and will be tested first in the first year in which a profit is made.

Convertible preference shares: allows holders of preference shares to convert them into ordinary shares (with voting rights). Convertibility is expressed by the conversion rate. It depends on how many ordinary shares can be obtained for each preference share. If the conversion ratio is 2 to 1, then each preference share can be converted into 2 ordinary shares.

Treasury stocks: these are own shares that the issuing company repurchases from the market for various reasons. As long as they are in the treasury, the shares do not carry dividends.

b) Convertible bonds

Loans (or debts) convertible into shares – loan bonds convertible into shares. The holder of the bond is entitled to receive shares in the company in lieu of the money the company borrowed.

Bonds with warrants – these securities give the holder the right to subsequently acquire shares in the issuing company at a fixed price.

Index-linked bonds: the issuer assumes the obligation to update the value of these securities in relation to an index (this can also be a stock market index).

Preferential subscription rights – in case of a capital increase through the issue of new shares. The newly issued shares will be offered for subscription in the first instance to shareholders who hold pre-emption rights.

Subscription rights –equity warrant – consist in the participation of all holders of ordinary shares in the share capital increase by incorporation of reserves. So, the increase of the capital generates a free distribution of shares. In addition, the dividend may be distributed in the form of shares. The subscription rights can be sold on the market.

Warrant – is a security which entitles the holder to buy shares in the issuing company at a price fixed by the warrant. On the market they appear as:

– warrant shares;

– warrant-linked bonds.

All these loan bonds allow the money lent to a company to be converted into voting shares in that company. These Bonds and Rights that convert into shares are sold on the stock exchange. Thus, they can be bought by the shareholders of a company before the General Meeting of Shareholders in order to have a large number of voting shares.

That’s how you build a majority of votes to appoint the company’s first director.

These types of shares and bonds convertible into shares were invented and legislated by the “Tibetan Banking Sect” led by Dalai Lama to control by a majority of shareholders (voting shareholders) all the companies and multinational corporations registered in the West.

Attention!!! – these parent companies are only registered on American and European Territories, but their owners, their masters, are in Tibet – China.

Chinese agents from all Chinatowns (see table pag.27)that are spread in the big financial centers of the world are giving secret instruction to the rromani dealer agents. This instructions contains information how to concentrate the convertible bonds (bond warrants, equity warrants, subscription rights) in the Indian Offshores: Chennai, Pune, Bangalore, Kolkata, Gurgaon, Vishakhapatnam, Hyderabad, New Delhi.

From India, this financial assets are sold on unregulated OTC market (NASDAQ) trough Singapore Stock Exchange, the 18 Caribbean Stock Exchange and finally reaching the US Stock Market. The financial assets transactions on this chain of Offshore Stock Exchanges are monitored and coordinated by HSBC.

Custodian Banks, which is based in Singapore, has full access and visibility to the shares and convertible bonds held by all the companies which trade on that exchange. It is linked to a stock exchange and keeps track of the stocks and bonds and the futures contracts that are backed by bonds (convertible into shares) held by those who buy or sell on that exchange.

Example

Suppose that on the St. Lucia Securities Exchange in the Caribbean, baskets of assets (option contracts), exchangeable into shares, have been bought on the Boeing firm by a buyer – JP Morgan’s mutual fund – from a seller in Singapore. Then the baskets (packs) of financial assets convertible into Boeing shares are transferred from the Singapore Custodian bank servicing the Singapore stock exchange to the Custodian bank in St. Lucia in the Caribbean.

Let’s assume that other baskets of options contracts that can be converted into Boeing shares have also been bought by a firm – Vanguard, for example, on the Grenada (Grenada Securities Exchange), also in the Caribbean, from a dealer in Singapore. In this case, too, the basket of futures contracts with options from the Singapore Custodian Bank, attached to the Singapore Stock Exchange, are transferred into custody in the Grenada (Caribbean) Custodian Bank, attached to Grenada Stock Exchange, part of the “Eastern Caribbean Securities Exchange” (ECSE).

Further, let’s presume that other baskets of strategies and options based on convertible bonds from Boeing company have been purchased by a dealer, such as Black Rock, on the Dominica Stock Exchange, called Dominica Eastern Caribbean Securities Exchange, from a dealer, let’s say Goldman Sachs, also from Singapore.

Then, these option strategies packs, based on convertible bonds, warrants and “attribution rights” of newly issued Boeing shares are transferred from the Singapore Custodian Bank servicing the Singapore Stock Exchange to the Dominica Custodian Bank attached to the Dominica Stock Exchange.

In reality, these packs of financial products are made in India and pass through Singapore, then on through the Caribbean Stock Exchanges (18 stock exchanges) which are the link between the East = India and the West = USA, Europe, Canada. Subsequently, the packages of bonds convertible into Boeing shares are in the possession of the 8 Custodian Banks from the Eastern Caribbean Securities Exchange (LCSE), distributed as evenly as possible, they are waiting for the deadline, so all the OTC derivatives that are backed by bonds convertible into Boeing Company shares of to convert into shares of The Boeing Company.

In the futures and futures with options contracts that are backed by bonds convertible into shares, warrants, “rights” issued by Boeing – mentioned at the beginning, there is a trigger point at which they no longer bring the expected profit and under this artificial pretext they convert into shares of Boeing.

Dealers/sellers and dealers/buyers on Indian stock exchanges intentionally place buy and sell orders that intentionally drive financial products through that “market” value called the trigger point. In this very subtle maneuver, the stock exchange broker also participates, together with the dealers and they all drive the financial assets to the trigger point and thus they change into shares (when the profit from the dividend of the share becomes more attractive than the profit from the bond interest).

We mention that at the time of the triggering the conversion of financial assets into shares, those financial products are no longer in the Custodian Banks in India and Singapore and in the Caribbean Offshores, but they are already in the Electronic Stock Exchanges from Delaware Offshores Offices, and further on in the New York Stock Exchange, New York NASDAQ, Chicago Mercantile Exchange.

These Stock Exchenges in the Caribbeans are:

– Montserat

– Anguilla

– Saint Lucia

– Grenada

– Dominica

– Saint Kitts and Nevis

– Saint Vincent and Grenadines

– Antigua and Barbuda

And they form the group of the 8 Eastern Caribbean Securities Exchange (ECSE).

Beside the above Stock Exchanges there are added the following Offshore Stock Exchanges: Barbados, Bermuda, Bahamas, Curacao, Cayman.

Attention!! – bonds convertible into shares are held in custody at the Custodian Bank serving the Stock Exchange where these were bought last time.

After this phase, the financial architects from China/ Tibet prepare the asset bundles (baskets of financial assets) to be converted into shares and they prepare the 72 companies out of 2500 companies (forming the Tibetan Banking Trust) which are the most suitable to take possession of these assets (to use them for voting).

Attention! – The 72 companies that accumulate shares for voting are designated in turn from the 2500 financial companies which form the Chinese Secret Trust.

These 72 financial companies will always be different, that appoint the management of every Multinational Industrial Corporation using the following indices: S&P 500 and Dow Jones.

These 72 companies, all with percentages below 1% will have a voting power of 37% – 40%, enough to appoint the management.

In order to collect shares, there will be created pools (baskets) of assets that can be converted into shares.

These baskets contain:

– bonds convertible into shares;

– bonds with warrants convertible into shares;

– bonds with subscription warrants (which allow you to subscribe for newly issued shares);

China has chosen the Indian stock exchanges to be at the top of the chain of merged exchanges (from Europe, the US and Canada).

NASDAQ is an exchange of the world’s stock exchanges and because it sits at the top of the pyramid of merged stock exchanges, it is able to see all types of stocks and bonds, to see who is their owner, to create the package of assets and bring them to the trigger point. At this trigger point, the baskets of assets are converted into shares.

As well as the DTCC – Depository Trust and Clearing Corporation which is the largest conglomerate of interconnected custodian banks and has the right and ability to see all the stocks and bonds, who owns them and how to form the basket of assets that can be converted into shares. These OTC assets, based on bonds convertible into shares are traded on the Caribbean Stock Exchanges and arrive in the Caribbean Custodian Banks. The, they are sold, in portions, to:

1. Stock Exchange in the Trinidad and Tobago.

2. Stock Exchange – Latin America International Financial Exchange in the Dominican Republic.

3. Bolsa de Valores de la Republica Dominicana.

4. Haiti Stock Exchange.

5. Jamaica Stock Exchange.

And, immediately, they arrive at the Custodian Bank of these stock exchanges.

It is very important to mention that these five stock exchanges are not offshores and, thus, they do not arise suspicions.

From the Caribbean custodian banks, voting instructions given by certain closed joint venture funds are sent in secret to a number of Delaware Funds of Funds (see diagram, page 23; circle 3, page 22). The Delaware Funds of Funds shareholder register is located in the custodian banks of the New York Stock Exchange.

In Delaware, the baskets of convertible bonds, warrants, subscription rights (for newly issued shares), held by the dealer rrom II (joint venture partner) are already converted into shares.

Delaware is an offshore financial giant where thousands of mutual funds are headquartered.

Through the Custodian Banks from Caribbean and the Custodian Banks attached to New York Stock Exchange, a bank specialized in the voting process – “Proxy Voting Service Provider” is tasked with executing the voting process. It secretly creates the majority of votes to appoint the board of directors and the director (CEO).

II. Ways to get the majority of votes

In order to prepare a majority of the votes in the possession of the financial companies that form the Tibetan Banking Trust, their financial experts use several methods.

Let us assume that the number of parent companies in the Tibetan Banking Trust is approximately 55 (see table p. 26 – List of Chinese Financial Trusts – Parent Companies). Each parent company has approximately 90 subsidiaries which are other (alleged) companies in the same group that bear the name of the parent company: commercial bank; investment bank; many mutual funds; hedge funds (venture capital funds); broker dealers (i.e. stock exchanges); insurance companies; asset manager; closed corporation.

Of the total of 90 subsidiaries:

– 45 subsidiaries are headquartered in the USA, so they have American nationality

– another 45 subsidiaries are headquartered (Head Office) in the Orient or in the Caribbean, so they have predominantly Oriental nationality

In total the subsidiaries in India, Singapore, Mauritius and the Caribbean have:

45×55=2500 closed mutual funds (approx.) that do not have American nationality

Out of these companies, the Chinese financial architects have to choose 72 companies that hold a majority of 37-40% from company’s voting rights in order to vote at the General Assembly of Shareholders and elect a director. The director has to be of Jewish origin to falsely claim that Jews run all the world’s companies and finances (which is completely false).

It should be mentioned that 10-20% of the issued shares do not have voting rights.

Also, companies that have large shareholdings of 2% – 3% of the shares do not have voting rights because international financial laws do not allow this. This is because the very object of their business is to own shares in other companies for the purpose of trading shares. Thus, it is assumed that they would be tempted to monopolize the market.

This is just a front for government agencies to focus their vigilance on the big shareholders.

While anti-trust agencies in the West keep an eye on the top shareholders, the Chinese are secretly scrutinizing a voting majority with many small shareholders holding less than 1% of the votes. They do not attract any attention, but they vote, in an organized way, the same candidate for the CEO – director position, based on a secret code.

72 shareholders x 0.527%= 38%

So with an average percentage of 0.527%, you can get 38% if all the 72 members vote the same members in the Administration Council. This assumes that out of 100% shares only 80% have the right to vote. Thus, the 2500 companies, by buying shares from each other, and by making a majority of votes from each other, have practically merged.

Legally, the traditional merger of two companies happens quite differently, it is highly visible, debated in the media and it is publicly announced. Two companies can merge by exchanging shares or by issuing new shares to the newly created company. So the value of a shareholder’s shares after merger is equivalent to the value of that shareholder’s shares before the merger.

In the case of the trust of 2500 Tibet – China financial companies, their merger is not publicized because they merged secretly on the stock exchange. They tacitly agreed to buy each other’s shares, to vote for each other and to appoint each other’s administration boards. Now, they are forming a single company, in fact a conglomerate formed by the invisible merger of 2500 financial companies. After the monopoly of these 2500 oriental financial companies was formed, it votes on American industrial companies by rotation. This merger goes unnoticed by Western democratic society or anti-monopoly government agencies. No one can imagine the mechanism through which some of the 2500 companies might agreed among themselves (illegally) to vote for the same candidate for CEO.